India Kidney Function Test Market Size, Share, Trends and Forecast by Product, End Use, and Region, 2025-2033

India Kidney Function Test Market Overview:

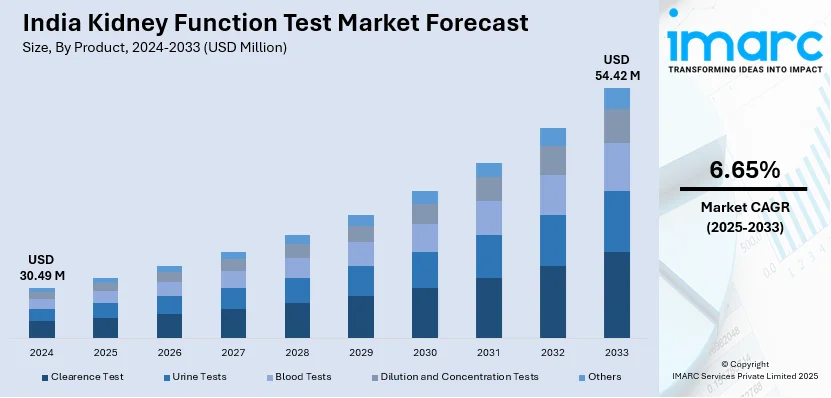

The India kidney function test market size reached USD 30.49 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 54.42 Million by 2033, exhibiting a growth rate (CAGR) of 6.65% during 2025-2033. The market is driven by the rising prevalence of chronic kidney diseases, growing elderly population, increasing awareness about early diagnosis, and expanding healthcare infrastructure. Technological advancements in diagnostic tools and several government health initiatives are also contributing significantly to the India kidney function test market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.49 Million |

| Market Forecast in 2033 | USD 54.42 Million |

| Market Growth Rate 2025-2033 | 6.65% |

India Kidney Function Test Market Trends:

Rising Prevalence of Chronic Kidney Diseases (CKD)

The increasing incidence of chronic kidney diseases due to lifestyle disorders like diabetes and hypertension is a major driver of the kidney function test market in India. As these conditions damage kidney function over time, regular testing becomes essential for early detection and management. Health data shows that millions of Indians have kidney impairment, yet many remain unaware until the disease becomes advanced. This growing patient base has significantly boosted the demand for diagnostic services, including serum creatinine, glomerular filtration rate (GFR) tests, and blood urea nitrogen (BUN), across hospitals, clinics, and diagnostic centers, which is creating a positive India kidney function test market outlook. According to industry reports, more than 10% of the Indian populace suffers from chronic kidney diseases, with over one hundred thousand patients experiencing renal failure annually. While CKD is typically associated with adults, infants, and children under five years old are also at risk of developing CKD, with 60% resulting from structural abnormalities identified during prenatal ultrasounds.

To get more information of this market, Request Sample

Growing Geriatric Population

India's aging population is another key factor fueling the kidney function test market. According to industry reports, in India, the percentage of individuals who are 60 years old and above was 7% in 2009 (88 million) and is anticipated to rise to 20% (315 million) by the year 2050. Older adults are more susceptible to kidney-related issues, as kidney function naturally declines with age. With increasing life expectancy, the number of elderly individuals requiring regular health monitoring is rising. Kidney function tests are routinely recommended for aging individuals to assess early signs of renal impairment. This demographic shift is prompting healthcare providers to expand geriatric care and diagnostics, creating a steady demand for kidney function testing. The trend is especially evident in urban centers where preventive healthcare awareness among seniors is gaining traction, fueling the India kidney function test market share.

Technological Advancements and Test Innovation

Technological progress in diagnostic tools has significantly improved the speed, accuracy, and affordability of kidney function tests in India. Automated analyzers, portable testing kits, and integrated laboratory information systems (LIS) are enabling quicker turnaround times and better patient outcomes. Advanced biomarkers and point-of-care testing are also being introduced to detect kidney issues earlier and more precisely. These innovations are particularly beneficial in rural and underserved areas where access to specialized nephrology services is limited. As awareness of kidney health grows, innovation continues to play a pivotal role in increasing test adoption across diverse healthcare settings. For instance, in February 2025, Renowned nephrologists and healthcare researchers globally were astonished upon witnessing the impressive results achieved by an AI-driven kidney disease screening model created by an Indian nephrologist. Leading medical experts, including representatives from the World Health Organization (WHO), who participated in the World Congress of Nephrology (WCN) in New Delhi, recognized HelloKidney.ai as a promising AI tool aimed at tackling the growing challenge of kidney diseases worldwide. The platform is effective in providing standard care to millions of kidney patients who might otherwise be at risk of kidney failure.

India Kidney Function Test Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product and end use.

Product Insights:

- Clearence Test

- Urine Tests

- Blood Tests

- Dilution and Concentration Tests

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes clearence test, urine tests, blood tests, dilution and concentration tests, and others.

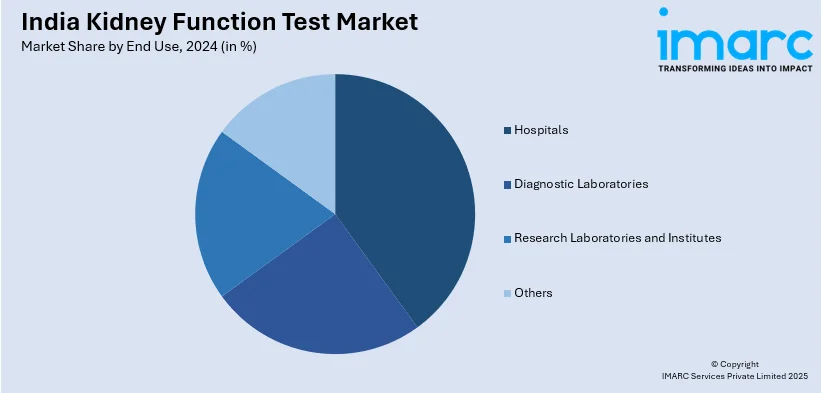

End Use Insights:

- Hospitals

- Diagnostic Laboratories

- Research Laboratories and Institutes

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes hospitals, diagnostic laboratories, research laboratories and institutes, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Kidney Function Test Market News:

- In March 2025, India aimed to break the previous record of one lakh uACR tests using NeoDocs Kit in patients with type 2 diabetes nationally on World Kidney Day. This is part of a national initiative to detect kidney disease early. Union Minister Jitendra Singh, Diabetes India, Bayer, and NeoDocs, an IIT Bombay alumnus startup, are supporting this project.

- In March 2025, Manipal Hospitals started a provocative campaign called 'Kidneys Across the Country Are Resigning' to draw attention to the growing kidney disease epidemic on World Kidney Day. Since kidney illness frequently shows no symptoms until it has progressed, early identification and routine screening are crucial to avoiding serious consequences.

India Kidney Function Test Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Clearence Tests, Urine Tests, Blood Tests, Dilution, Concentration Tests, Others |

| End Uses Covered | Hospitals, Diagnostic Laboratories, Research Laboratories, Institutes, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India kidney function test market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India kidney function test market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India kidney function test industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kidney function test market in India was valued at USD 30.49 Million in 2024.

The kidney function test market in India is projected to exhibit a CAGR of 6.65% during 2025-2033, reaching a value of USD 54.42 Million by 2033.

The kidney function test market in India is driven by the rising prevalence of chronic kidney diseases, increasing awareness about early diagnosis, and a growing aging population. Lifestyle-related conditions like diabetes and hypertension further contribute to demand. Advancements in diagnostic technology, improved healthcare infrastructure, and government health initiatives also support market growth across urban and rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)