India Kitchen Chimney Market Size, Share, Trends and Forecast by Product Type, Duct Type, Application, Distribution Channel, and Region, 2025-2033

India Kitchen Chimney Market Overview:

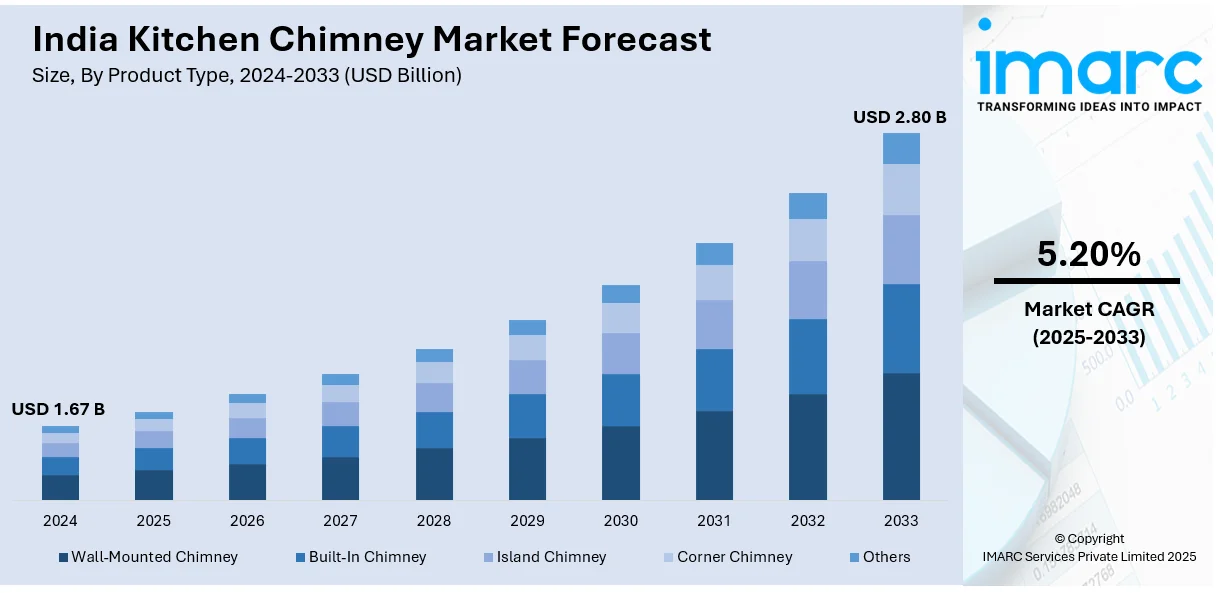

The India kitchen chimney market size reached USD 1.67 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.80 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by rising urbanization, increasing disposable incomes, widespread awareness of kitchen hygiene, and surging demand for advanced, energy-efficient, and aesthetically appealing models, particularly in premium and modular kitchen segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.67 Billion |

| Market Forecast in 2033 | USD 2.80 Billion |

| Market Growth Rate (2025-2033) | 5.20% |

India Kitchen Chimney Market Trends:

Rising Demand for Smart and Auto-Clean Chimneys

The rising demand for smart and auto-clean chimneys is boosting the India kitchen chimney market share, as consumers now favor auto-clean appliances with smart features. Traditional chimneys force users to spend unnecessary time cleaning them manually since they operate in strong spices and high oil in Indian kitchens. The heat and water-based auto-clean technology reduces grease accumulation in chimneys and enhances their durability to make them the preferred option. For instance, Crompton introduced chimneys with Intelli-autoclean technology, reducing the need for professional cleaning interventions. These products also offer a 50% reduction in perceptible noise and increased suction power, enhancing kitchen air quality and user comfort. Additionally, people living in urban areas are turning towards smart chimneys due to their features, including motion sensors, touch controls, and voice command functionalities that provide them with updated modern kitchen solutions. Moreover, the increasing popularity of modular kitchens in metro cities has driven homeowners to buy advanced kitchen appliances which give them easy operation alongside energy efficiency and better air quality. As a result, the manufacturers create new innovative products, aligning with the cooking habits of Indians, thereby driving the India kitchen chimney market growth.

To get more information of this market, Request Sample

Increasing Preference for Aesthetic and Space-Saving Designs

The Indian consumer demand for premium and compact living spaces has led to an increase in purchases of both design-oriented and space-saving kitchen chimneys. People seek wall-mounted and island chimneys with elegant black glass and stainless steel and matte finish coatings that match contemporary kitchen designs. In line with this, the rise of modular kitchens has intensified the market need for ventilation systems, which both enhance kitchen aesthetics and deliver strong suction power. For example, Elica introduced the iSMART model featuring inverter technology and adjustable motion sensors, ensuring efficient ventilation and aligning with contemporary kitchen designs. Moreover, brand manufacturers concentrate on creating modern chimney designs which integrate light emitting diode (LED) lighting and hidden ducts to produce aesthetically pleasing kitchen spaces. Concurrently, the market for compact and downdraft chimneys is expanding among urban homeowners who live in apartments because they have limited available space. Furthermore, the rise of aesthetic demands by consumers prompts manufacturers to introduce multiple design choices, which allows people to customize their kitchens while achieving efficient smoke and odor extraction, thus enhancing the India kitchen chimney market outlook.

India Kitchen Chimney Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, duct type, application, and distribution channel.

Product Type Insights:

- Wall-Mounted Chimney

- Built-In Chimney

- Island Chimney

- Corner Chimney

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wall-mounted chimney, built-in chimney, island chimney, corner chimney, and others.

Duct Type Insights:

- Ducted

- Ductless

A detailed breakup and analysis of the market based on the duct type have also been provided in the report. This includes ducted and ductless.

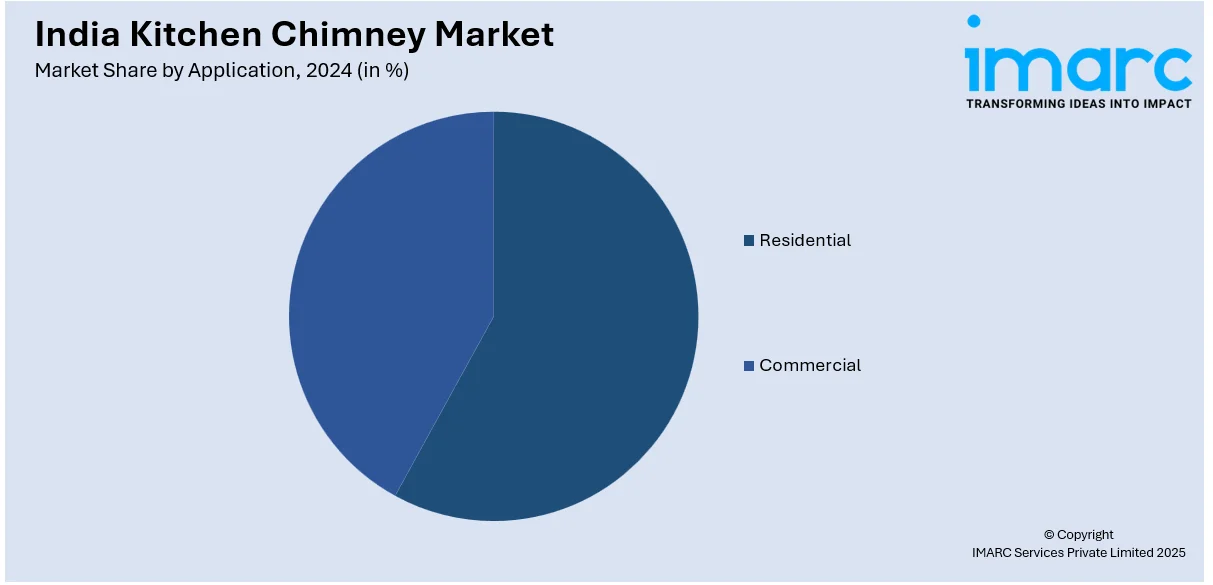

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Kitchen Chimney Market News:

- In November 2024, Stove Kraft introduced the Pigeon Black Diamond and Atmos Chimneys, featuring advanced heat auto-clean technology, high-efficiency filterless systems, and low noise levels. These innovations address common kitchen issues like smoke and grease, enhancing user convenience and promoting a cleaner cooking environment.

- In March 2024, Livpure collaborated with Inflame Appliances to strengthen its presence in South India. This partnership aims to meet the region's growing demand for chimneys, combining Livpure's commitment to quality with Inflame's manufacturing expertise, thereby expanding their market reach.

India Kitchen Chimney Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wall-Mounted Chimney, Built-In Chimney, Island Chimney, Corner Chimney, Others |

| Duct Types Covered | Ducted, Ductless |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, South India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India kitchen chimney market performed so far and how will it perform in the coming years?

- What is the breakup of the India kitchen chimney market on the basis of product type?

- What is the breakup of the India kitchen chimney market on the basis of duct type?

- What is the breakup of the India kitchen chimney market on the basis of application?

- What is the breakup of the India kitchen chimney market on the basis of distribution channel?

- What is the breakup of the India kitchen chimney market on the basis of region?

- What are the various stages in the value chain of the India kitchen chimney market?

- What are the key driving factors and challenges in the India kitchen chimney?

- What is the structure of the India kitchen chimney market and who are the key players?

- What is the degree of competition in the India kitchen chimney market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India kitchen chimney market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India kitchen chimney market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India kitchen chimney industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)