India Kitchen Hood Market Size, Share, Trends, and Forecast by Product Type, Suction Power, Sales Channel, and Region, 2025-2033

India Kitchen Hood Market Size and Share:

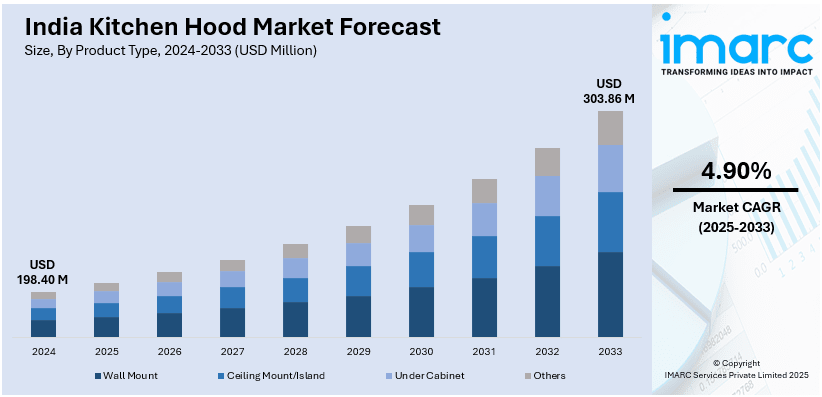

The India kitchen hood market size reached USD 198.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 303.86 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The market is witnessing significant growth, driven by the rising demand for smart and IoT enabled kitchen hoods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 198.40 Million |

| Market Forecast in 2033 | USD 303.86 Million |

| Market Growth Rate (2025-2033) | 4.90% |

India Kitchen Hood Market Trends:

Rising Demand for Smart and IoT-Enabled Kitchen Hoods

The India kitchen hood market is experiencing a transition to smart and Internet of Things-enabled appliances. Consumer interest in highly advanced home automation has made urban households define the use of urban kitchens with very convenient, energy-efficient, and remotely controlled use through intelligent kitchen hoods that have Wi-Fi, infrared motion sensors, and voice-control features. There are real-time air quality monitoring and auto-cleaning systems that tie with smart home ecosystems, such as Amazon Alexa and Google Assistant, which are now added to further enhance users' experience. Furthermore, modular kitchen penetration is always urbanized. Real estate developers are getting smart home appliances installed, even in the exclusive projects of premium residential setups. For instance, in March 2025, Havells India announced its plans to expand into kitchen appliances, including cooktops, hobs, chimneys, and built-ins, leveraging synergies with small appliances. It aims to be a top-three player within three years. Additionally, government initiatives such as the Smart Cities Mission are accelerating the adoption of technology-driven household appliances. Consumers are also becoming more aware of the benefits of smart ventilation systems in improving indoor air quality, especially in urban settings where air pollution is a concern. Leading brands, including Faber, Elica, and Hindware, are expanding their smart kitchen hood offerings to cater to this demand. As disposable income continues to rise, the Indian market is expected to see sustained growth in the adoption of smart kitchen hoods over the next decade.

To get more information of this market, Request Sample

Increasing Popularity of Ductless and Low-Noise Kitchen Hoods

The Indian kitchen hood market is experiencing a surge in demand for ductless and low-noise models, particularly in compact urban homes and apartments where space constraints and noise levels are major considerations. Traditional ducted hoods require extensive installation and maintenance, making ductless alternatives more attractive for modern households seeking hassle-free solutions. These models utilize advanced carbon filters to effectively remove smoke, grease, and odors without requiring external ventilation, making them ideal for Indian cooking, which involves high oil and spice usage. Manufacturers are focusing on developing quieter kitchen hoods to address consumer concerns regarding noise levels, especially in open-concept kitchen layouts. Innovations such as brushless DC motors, soundproofing insulation, and aerodynamic designs are enabling the production of ultra-quiet hoods without compromising performance. For instance, in January 2024, Panasonic Homes & Living, known for L-Class and I-Class kitchens, declared itself to be a silver sponsor at India Kitchen Congress 2024. It operates 30 modular kitchen outlets across 25+ Indian cities through channel partners. Furthermore, increasing health awareness and consumer preference for a clean cooking environment are driving demand for energy-efficient models with improved suction power and air purification capabilities. Brands like Glen, Kaff, and Bosch are expanding their product portfolios with silent and efficient ductless kitchen hoods to cater to evolving consumer preferences. The market is expected to continue growing as more households prioritize convenience, aesthetics, and enhanced indoor air quality.

India Kitchen Hood Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, suction power, and sales channel.

Product Type Insights:

- Wall Mount

- Ceiling Mount/Island

- Under Cabinet

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wall mount, ceiling mount/island, under cabinet, and others.

Suction Power Insights:

- Less than or equals to 1200 m3/h

- More than 1200 m3/h

A detailed breakup and analysis of the market based on the suction power have also been provided in the report. This includes less than or equals to 1200 m3/h and more than 1200 m3/h.

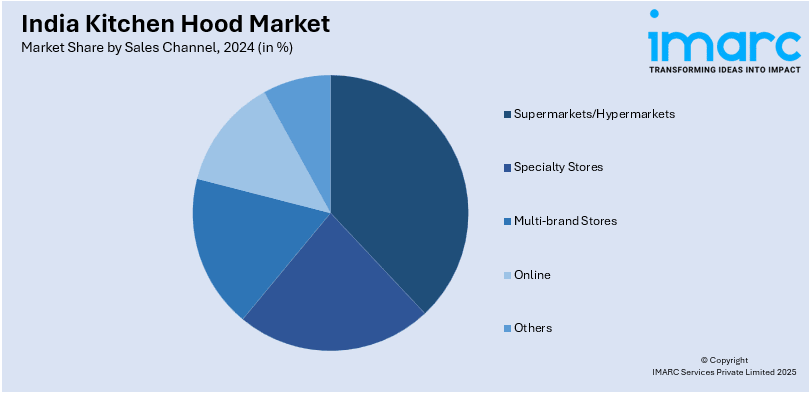

Sales Channel Insights:

- Supermarkets/Hypermarkets

- Specialty Stores

- Multi-brand Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets/hypermarkets, specialty stores, multi-brand stores, online, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Kitchen Hood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Wall Mount, Ceiling Mount/Island, Under Cabinet, Others |

| Suction Powers Covered | Less than or equals to 1200 m3/h, More than 1200 m3/h |

| Sales Channels Covered | Supermarkets/Hypermarkets, Specialty Stores, Multi-brand Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India kitchen hood market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India kitchen hood market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India kitchen hood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kitchen hood market in India was valued at USD 198.40 Million in 2024.

The kitchen hood market in India is projected to exhibit a CAGR of 4.90% during 2025-2033, reaching a value of USD 303.86 Million by 2033.

The growth of the India kitchen hood market is driven by increasing urbanization, rising consumer preference for modular kitchens, and growing awareness of indoor air quality. Higher disposable incomes, lifestyle upgrades, and the influence of cooking shows and social media are also pushing demand. Additionally, product availability through online channels and improved designs with smart features are contributing to market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)