India Kombucha Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

India Kombucha Market Summary:

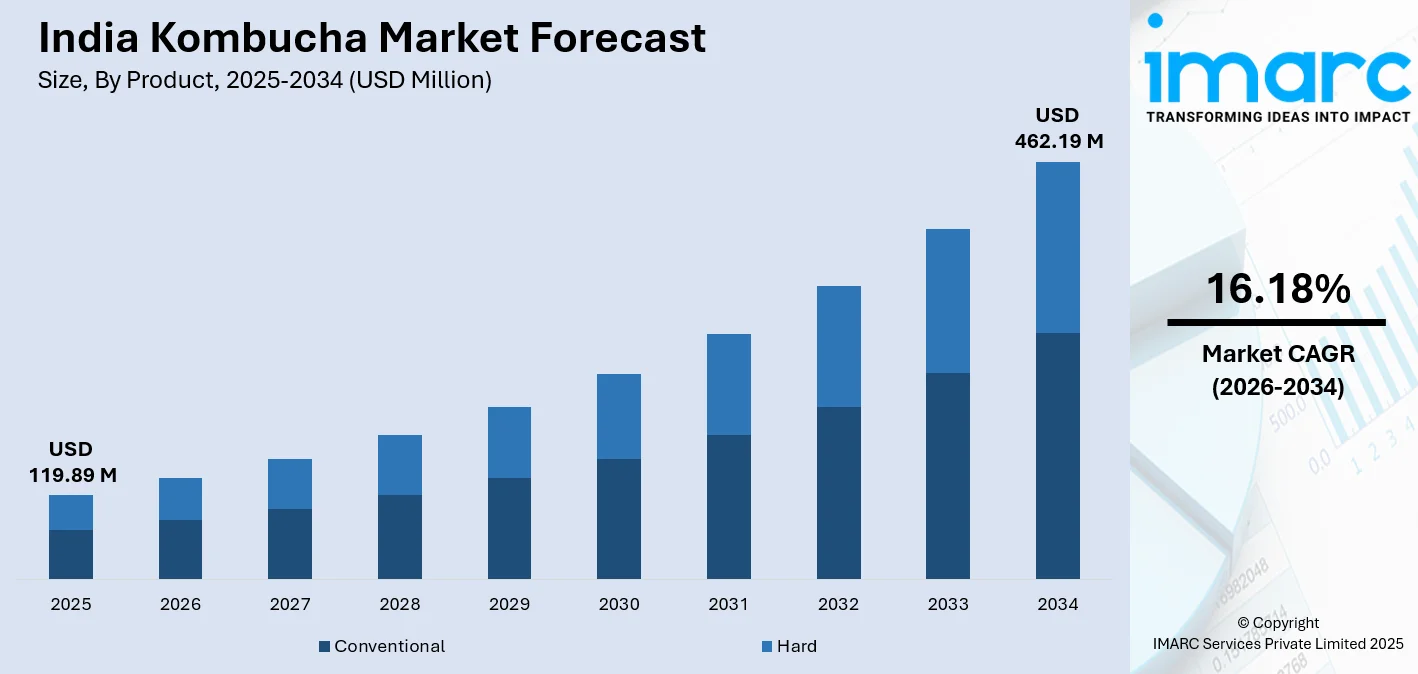

The India kombucha market size was valued at USD 119.89 Million in 2025 and is projected to reach USD 462.19 Million by 2034, growing at a compound annual growth rate of 16.18% from 2026-2034.

The India kombucha market is experiencing robust expansion, driven by rising health consciousness among consumers prioritizing gut health and immunity. Increasing urbanization and growing disposable incomes are creating a premium consumer base seeking functional probiotic beverages. The shift from sugary carbonated drinks towards natural fermentation-based alternatives, combined with expanding retail and e-commerce distribution channels, is accelerating market penetration across metropolitan and tier-one cities throughout the country.

Key Takeaways and Insights:

- By Product: Conventional dominates the market with a share of 76% in 2025, owing to its widespread consumer acceptance, established brewing processes, and alignment with health-conscious preferences for natural fermented beverages offering probiotic benefits without alcohol content.

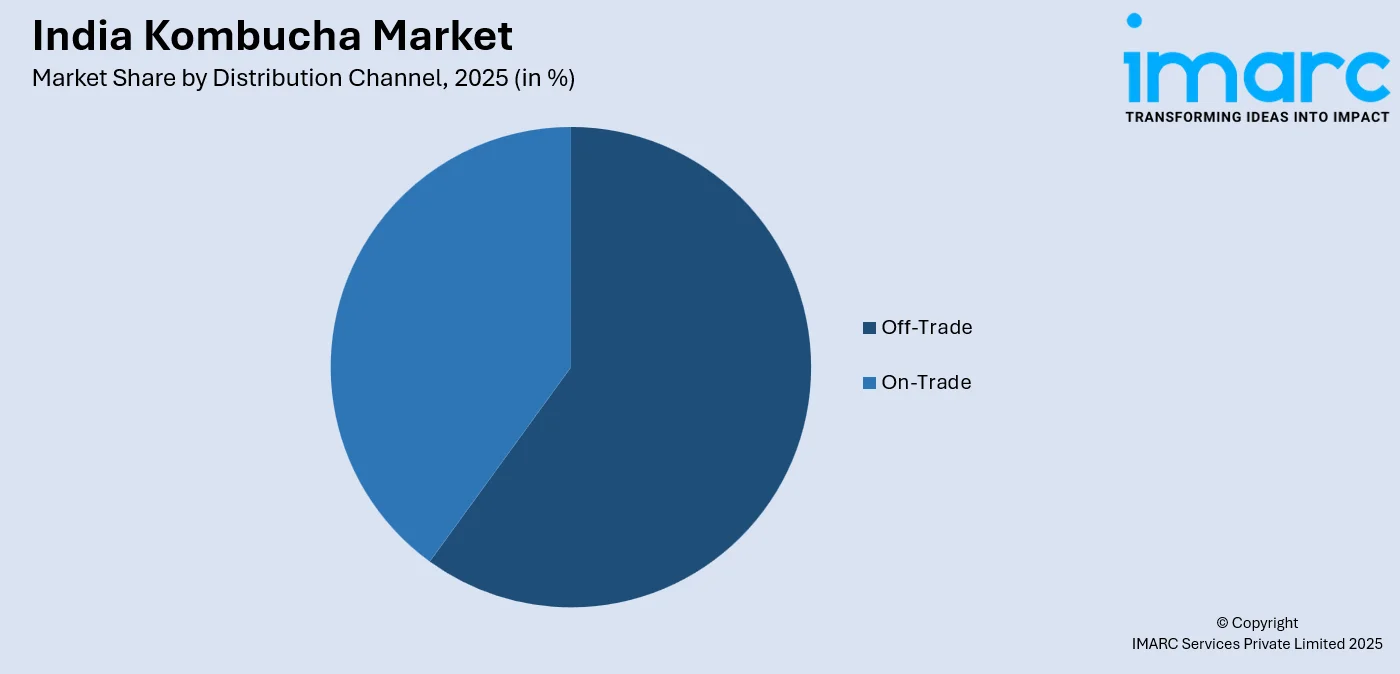

- By Distribution Channel: Off-trade leads the market with a share of 41% in 2025. This dominance is driven by expanding supermarket and hypermarket networks, growing specialty health store presence, and rising e-commerce penetration enabling convenient home delivery of functional beverages.

- By Region: North India comprises the largest region with 31% share in 2025, driven by the concentration of health-conscious urban population in Delhi-NCR and surrounding metropolitan areas, higher disposable incomes enabling premium beverage purchases.

- Key Players: Key players drive the India kombucha market by expanding product portfolios with innovative regional flavors, improving fermentation technologies, and strengthening nationwide distribution. Their investments in consumer education, strategic partnerships with wellness retailers, and celebrity endorsements boost awareness and accelerate adoption across diverse consumer segments.

To get more information on this market Request Sample

The India kombucha market is witnessing accelerated growth, as consumers increasingly prioritize digestive wellness and natural immunity support. The fermented tea beverage has transitioned from niche wellness circles to mainstream retail shelves across urban centers, driven by rising awareness about probiotic benefits and the cultural familiarity with traditional fermented foods like buttermilk, kanji, and dahi. The market benefits from innovations in flavor development, with brands incorporating indigenous ingredients, such as turmeric, tulsi, and regional spices, to appeal to local palates. Millennial and Generation Z consumers, representing the primary adoption demographic, are driving demand through their preference for clean-label, low-sugar alternatives to conventional carbonated beverages. As of October 2024, India's extensive Gen Z demographic was estimated at 377 Million. Strategic brand positioning emphasizing authenticity, traditional brewing methods, and transparent ingredient sourcing continues to resonate with health-conscious urban populations seeking quality functional beverages.

India Kombucha Market Trends:

Integration of Ayurvedic and Traditional Indian Ingredients

The India kombucha market is experiencing significant innovation through the incorporation of traditional Ayurvedic ingredients, such as turmeric, tulsi, ashwagandha, and amla, into fermentation formulations. This trend reflects growing consumer preference for beverages that combine modern wellness concepts with ancient Indian medicinal wisdom. These ingredient integrations enhance functional benefits, positioning kombucha as a holistic health beverage rather than a lifestyle drink. Local brands are differentiating products by highlighting immunity support, stress relief, and digestive wellness attributes linked to Ayurveda.

Rise of Artisanal and Locally Brewed Kombucha Brands

In India, the market is witnessing proliferation of artisanal kombucha brands emphasizing small-batch production, organic ingredients, and unique regional flavor profiles. These brands leverage extended fermentation periods to develop deeper, more complex taste characteristics that differentiate them from mass-produced alternatives. Direct-to-consumer (D2C) models, farmers market presence, and experiential marketing through brewery tours enable these brands to build authentic connections with health and wellness conscious consumers seeking premium, handcrafted beverages with transparent production processes. As per IMARC Group, the India health and wellness market is set to attain USD 256.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033.

Innovations in Shelf-Stable Formulations and Packaging

Technological advancements in filtration and fermentation processes are enabling brands to achieve extended shelf life at ambient temperature without preservatives. This innovation addresses critical cold chain infrastructure limitations in the Indian market, significantly expanding distribution potential beyond metropolitan areas with established refrigerated logistics. Eco-friendly packaging solutions, including recyclable glass bottles and refill programs, are gaining traction among environmentally conscious consumers, further enhancing brand positioning in the premium functional beverage segment.

Market Outlook 2026-2034:

The India kombucha market is positioned for sustained expansion, as consumer preferences continue to shift towards functional beverages that support digestive health and overall wellness. The market generated a revenue of USD 119.89 Million in 2025 and is projected to reach a revenue of USD 462.19 Million by 2034, growing at a compound annual growth rate of 16.18% from 2026-2034. The proliferation of quick commerce platforms and health-focused retail channels will enhance product accessibility, while continued innovations in regional flavor development and shelf-stable formulations will address distribution challenges. Rising investments from established beverage conglomerates and strategic celebrity endorsements will accelerate mainstream market penetration and consumer education initiatives.

India Kombucha Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Conventional |

76% |

|

Distribution Channel |

Off-Trade |

41% |

|

Region |

North India |

31% |

Product Insights:

- Conventional

- Hard

Conventional dominates with a market share of 76% of the total India kombucha market in 2025.

Conventional maintains dominant position through widespread consumer acceptance of traditional fermentation methods that deliver natural probiotic benefits without alcohol content. Health-conscious consumers prefer conventional formulations for daily consumption as functional alternatives to sugary carbonated beverages, driving consistent demand growth across urban retail channels. The segment benefits from established production processes that ensure consistent quality and flavor profiles while meeting regulatory requirements. Additionally, wider availability across supermarkets, health stores, and cafés improves accessibility, supporting higher consumption frequency and broader consumer penetration.

The conventional segment's dominance is reinforced by strategic product innovations targeting diverse consumer preferences through indigenous flavor development. Companies are utilizing traditional Indian components, such as turmeric, ginger, tulsi, and local spices, to develop culturally significant products that appeal to local palates while preserving genuine fermentation traits. In August 2024, Tata Consumer Products, based in India, launched Tetley Kombucha featuring prebiotic fiber in Ginger Lemon and Peach variants, demonstrating major corporate investment in conventional kombucha innovation. This entry of established beverage conglomerates validates market potential and accelerates mainstream consumer adoption through trusted brand positioning.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- On-Trade

- Off-Trade

Off-trade leads with a share of 41% of the total India kombucha market in 2025.

Off-trade maintains market leadership through expanding organized retail infrastructure and growing e-commerce penetration, enabling convenient consumer access to functional beverages. Supermarkets, hypermarkets, and specialty health stores are dedicating increased shelf space to kombucha products, reflecting mainstream retail acceptance of the category. The segment also benefits from controlled pricing, product visibility, and standardized cold-chain storage that preserves kombucha quality. Retail promotions, in-store sampling, and health-focused product placement further improve consumer awareness and trial rates.

E-commerce platforms are emerging as significant growth drivers within the off-trade segment, enabling D2C brand engagement and nationwide distribution reach. Online marketplaces offer subscription-based models and bundling options that attract health-conscious buyers seeking convenient replenishment. The q-commerce industry in India is thriving, with projections indicating market value reaching USD 106.2 Billion by 2033, supporting the segment’s expansion. Shopping platforms enable targeted distribution of premium kombucha brands to health-focused consumer segments across metropolitan areas.

Regional Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 31% share of the total India kombucha market in 2025.

North India's market leadership reflects the concentration of health-conscious urban population in Delhi-NCR, Chandigarh, and Punjab metropolitan areas with higher disposable incomes enabling premium functional beverage purchases. The region benefits from robust retail and e-commerce networks facilitating product accessibility. Leasing of retail spaces in shopping malls and high streets throughout Delhi-NCR increased by 25% during January-June 2025, due to improved demand and greater new supply, as reported by CBRE. Cafés, organic food stores, gyms, and yoga studios across Delhi-NCR and Chandigarh actively promote kombucha as a healthier refreshment option, supporting trial and repeat consumption.

Regional distributors and cold-chain logistics providers ensure product freshness and wider availability across Tier I and emerging Tier II cities. Additionally, higher media exposure and influencer-driven marketing campaigns accelerate consumer education around fermented beverages. North India also hosts several domestic kombucha startups, encouraging innovations, competitive pricing, and localized flavor development. These combined factors create a mature consumption ecosystem that continues to attract new brands and investments, reinforcing the region’s sustained dominance in the market.

Market Dynamics:

Growth Drivers:

Why is the India Kombucha Market Growing?

Rising Health Consciousness and Gut Health Awareness

The India kombucha market is experiencing robust expansion, driven by increasing consumer awareness about digestive health benefits and probiotic functionality. Health-conscious consumers are actively seeking natural alternatives to sugary carbonated beverages, with kombucha gaining traction as a functional drink supporting gut microbiome balance and immune system strengthening. The broader shift towards preventive healthcare and wellness-oriented consumption patterns is accelerating demand for fermented beverages across urban populations. Millennials and Generation Z consumers demonstrate particular affinity for clean-label products with transparent ingredient sourcing and authentic production methods. The rising prevalence of lifestyle diseases, including obesity and diabetes, is pushing consumers towards healthier beverage options that align with proactive wellness strategies, thus fueling the market expansion. In 2024, India held the second position with 90 Million adults diagnosed with diabetes, as reported by a study in the Lancet Diabetes and Endocrinology journal.

Rapid Urbanization and Growing Disposable Incomes

Urban population growth and rising disposable income levels are creating a substantial premium consumer base with purchasing power for functional beverages priced above conventional soft drinks. As per government data, India's per capita disposable income was projected to reach INR 2.14 Lakh in 2023-24. Metropolitan consumers, particularly in tier-one cities, demonstrate strong willingness to pay premiums for health-enhancing products that align with aspirational lifestyle positioning. The concentration of health-focused retail infrastructure in urban centers provides essential distribution access for kombucha brands seeking mainstream market penetration. Young professionals and dual-income households represent primary consumer segments driving demand for convenient, health-oriented beverage alternatives that fit modern lifestyle patterns. Additionally, increasing exposure to wellness trends is accelerating acceptance of kombucha. Increasing awareness about gut health and preventive nutrition further supports sustained demand growth.

Expansion of Retail and E-Commerce Distribution Channels

The development of well-organized retailing distribution channels and broadening of online e-commerce platforms are improving the availability of kombucha as well as its appeal to a larger customer base. Grocery stores and supermarkets are increasing the allocation of product space in the functional beverages category. E-commerce sites act as critical distribution channels in reaching health-minded consumers in various areas where store presence is limited. D2C business models, along with subscription-based delivery services, foster long-term buying engagements while also promoting brand interaction through online platforms. The inclusion of kombucha in q-commerce platforms allows it to be delivered promptly, in line with the convenience expectations of urban health-focused consumers. Increased cold chain distribution capabilities enable product quality across wider geographies. Digital promotions and influencer marketing further hasten online consumption in the country.

Market Restraints:

What Challenges the India Kombucha Market is Facing?

Limited Consumer Awareness in Rural and Semi-Urban Markets

Consumer awareness about kombucha remains concentrated in metropolitan and tier-one urban centers, with significant knowledge gaps persisting across rural and semi-urban populations. Many potential consumers are unfamiliar with fermentation processes, probiotic benefits, and appropriate consumption occasions for kombucha beverages. Educational marketing initiatives require substantial investment to build category understanding beyond established wellness-oriented consumer segments. The unfamiliar tangy flavor profile presents additional adoption barriers for consumers accustomed to sweeter conventional beverages.

Premium Pricing Relative to Conventional Beverages

Kombucha products command significant price premiums compared to traditional carbonated soft drinks and conventional fruit beverages, limiting accessibility for price-sensitive consumer segments. Production costs, including organic ingredients, specialized fermentation equipment, and cold chain logistics, increase manufacturing expenses by substantial margins compared to conventional beverage production. This pricing differential constrains market penetration beyond affluent urban demographics with discretionary spending capacity for premium functional beverages, impacting volume growth potential.

Regulatory Ambiguity and Compliance Challenges

Kombucha manufacturers face regulatory uncertainty related to classification, labeling requirements, and permissible alcohol thresholds resulting from fermentation. Variations in interpretation across states create compliance complexities and increase operational risk for brands expanding nationally. Frequent testing, documentation, and reformulation requirements add to costs and slow product launches. Smaller startups often struggle to navigate evolving food safety regulations, limiting innovation speed and market scalability in the broader Indian beverage landscape.

Competitive Landscape:

The India kombucha market exhibits a fragmented competitive structure, comprising established domestic brands, emerging artisanal producers, and new entrants from major beverage conglomerates. Key players are pursuing differentiation strategies through indigenous flavor innovation, premium positioning, and strategic distribution partnerships. The market is witnessing increased investment activities, as both domestic startups and multinational corporations recognize the category's growth potential. Competition centers on product quality, shelf-life innovations, and consumer education initiatives to build category awareness. Brands are leveraging D2C models, experiential marketing through brewery tours, and strategic celebrity endorsements to establish market presence. The entry of large consumer products companies brings substantial resources for nationwide distribution expansion and mainstream marketing campaigns, while artisanal producers maintain loyal customer bases through authenticity positioning and craft production methods.

India Kombucha Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Conventional, Hard |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India kombucha market size was valued at USD 119.89 Million in 2025.

The India kombucha market is expected to grow at a compound annual growth rate of 16.18% from 2026-2034 to reach USD 462.19 Million by 2034.

Conventional dominated the market with a share of 76%, driven by broadening of retail channels and widespread consumer preferences for traditional non-alcoholic fermented beverages delivering natural probiotic benefits and functional wellness support.

Key factors driving the India kombucha market include rising health consciousness and gut health awareness, rapid urbanization with growing disposable incomes, expanding retail and e-commerce distribution channels, and increasing demand for functional probiotic beverages.

Major challenges include limited consumer awareness in rural and semi-urban markets, premium pricing relative to conventional beverages, regulatory compliance requirements, and competition from traditional fermented beverages and emerging functional drink alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)