India Laminated Flooring Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

India Laminated Flooring Market Overview:

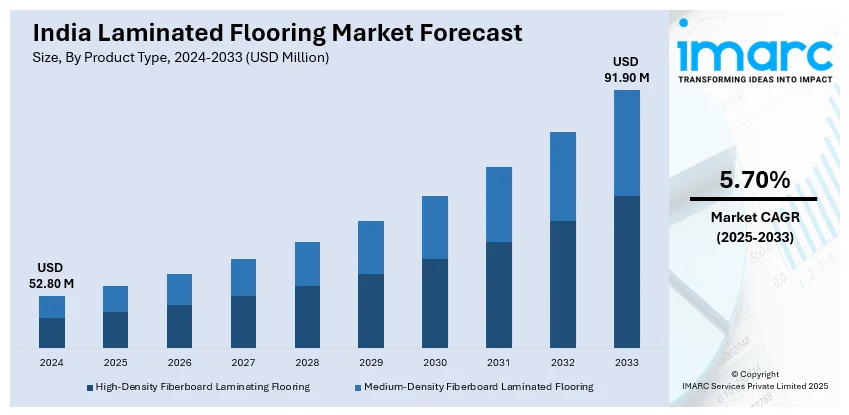

The India laminated flooring market size reached USD 52.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 91.90 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The market is driven by increasing urbanization, rising disposable incomes, increasing demand for cost-effective, durable, and aesthetically appealing flooring solutions, along with expanding residential and commercial construction activities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 52.80 Million |

| Market Forecast in 2033 | USD 91.90 Million |

| Market Growth Rate (2025-2033) | 5.70% |

India Laminated Flooring Market Trends:

Growing Demand for Affordable and Durable Flooring Solutions

The growing demand for affordable and durable flooring solutions is boosting the India laminated flooring market share. In addition to this, rapid urbanization along with expanding residential housing development is fueling the adoption of wood-like flooring which delivers affordable wood appearance. Moreover, its combination of attractive look and excellent resistance to scratching, water and general wear is encouraging consumers to opt for laminated flooring. Besides this, the middle-class expansion and increasing household spending power have created increased home renovation needs. For instance, the Bureau of Indian Standards (BIS) has undertaken studies on flexible polyvinyl chloride (PVC) floorings available in the Indian market, reflecting the industry’s focus on quality and standardization, which strengthens consumer trust and market growth. Furthermore, the process of installing laminated flooring proves simpler than hardwood or tile, as it needs less maintenance, which allows developers and homeowners to choose it over these alternatives. Apart from this, the market is becoming more attractive to cost-conscious yet quality-seeking consumers as manufacturers are adopting technological advancements to develop eco-friendly water-resistant laminated flooring products. As a result, the market growth for the coming years will be supported by this emerging trend.

To get more information on this market, Request Sample

Increasing Adoption of Sustainable and Eco-Friendly Flooring

The India laminated flooring market growth is driven by the widespread adoption of sustainable and eco-friendly flooring, as customers and companies choose construction materials that protect the environment. The rise of ecological consciousness drives customers toward sustainable laminated flooring products, which are constructed from recycled material sources. Moreover, high-density fiberboard (HDF) manufacturers are adopting wood fibers from sustainable sources along with earth-friendly adhesive materials, emitting lower volatile organic compounds (VOCs) emissions. Government regulations for sustainable development as well as green building standards also encourage developers to select environmentally friendly flooring options. For example, in November 2023, the Indian Green Building Council (IGBC) introduced the Net Zero Carbon (pilot version) rating system to reduce operational and embodied emissions in buildings. This initiative encourages the use of low-embodied carbon materials and renewable energy integration. Additionally, the importance of FloorScore and E1 emission standards has risen in India's commercial and residential sectors because they motivate the adoption of laminated flooring with low emissions. Furthermore, the growing interest in sustainable buildings is driving the demand for eco-friendly laminated flooring, affecting both new product developments and market choice patterns, thereby enhancing the India laminated flooring market outlook.

India Laminated Flooring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- High-Density Fiberboard Laminating Flooring

- Medium-Density Fiberboard Laminated Flooring

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high-density fiberboard laminating flooring and medium-density fiberboard laminated flooring.

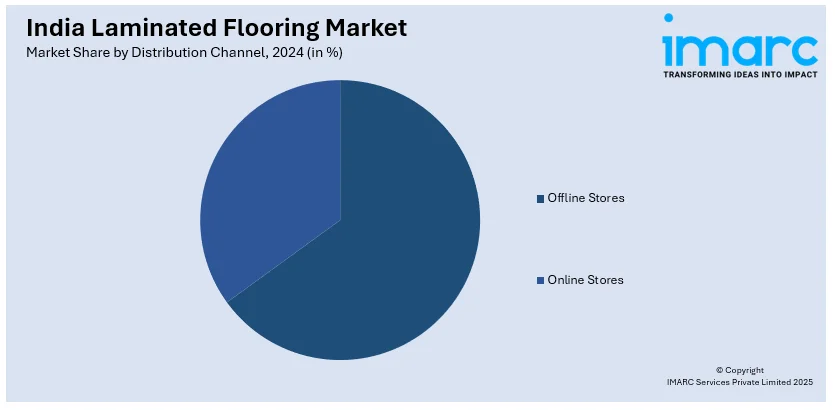

Distribution Channel Insights:

- Offline Stores

- Online Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline stores and online stores.

End User Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Laminated Flooring Market News:

- In September 2024, Vebro Polymers partnered with Thermax Chemical Solutions Private Limited to form Thermax Vebro Polymers India Private Limited. This joint venture aims to penetrate the burgeoning Indian industrial and commercial flooring market by combining Vebro's global experience in polymer flooring with Thermax's established infrastructure and project network.

- In July 2023, Century Laminates collaborated with renowned fashion designer Manish Malhotra to introduce an exclusive range of designer laminates, branded as "Fashion for your Furniture." This initiative caters to the evolving consumer demand for premium home décor products, blending high fashion with interior design and boosting the market demand.

India Laminated Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High-Density Fiberboard Laminating Flooring, Medium-Density Fiberboard Laminated Flooring |

| Distribution Channels Covered | Offline Stores, Online Stores |

| End Users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India laminated flooring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India laminated flooring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India laminated flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India laminated flooring market was valued at USD 52.80 Million in 2024.

The laminated flooring market in India is projected to exhibit a CAGR of 5.70% during 2025-2033, reaching a value of USD 91.90 Million by 2033.

The laminated flooring market in India is driven by rapid urbanization and housing boom, rising disposable incomes, and demand for affordable, durable wood-like flooring. Technological advances like water-resistant, eco-friendly laminates and easy installation (click-lock) are key. Green-building initiatives and modern commercial infrastructure also support steady growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)