India Laminates Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

India Laminates Market Overview:

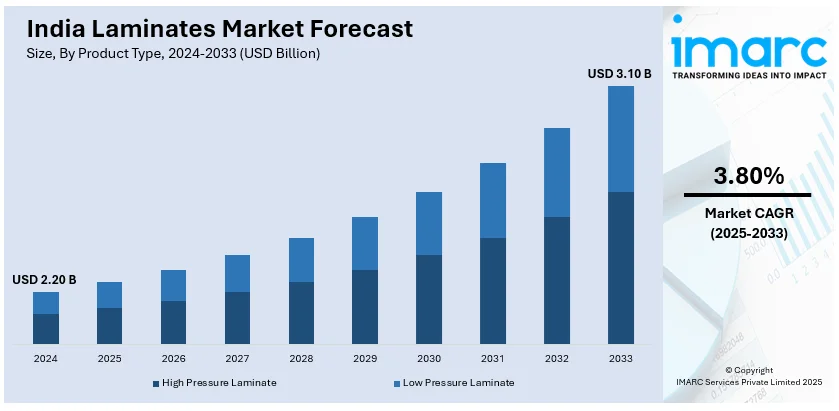

The India laminates market size reached USD 2.20 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.10 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The India laminates market is driven by rising demand for decorative and durable surfacing solutions in residential and commercial spaces, fueled by rapid urbanization and real estate expansion. Growing consumer preference for antimicrobial and fire-resistant laminates enhances safety and hygiene. Additionally, increasing adoption of eco-friendly laminates, supported by sustainability initiatives, is shaping the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.20 Billion |

| Market Forecast in 2033 | USD 3.10 Billion |

| Market Growth Rate (2025-2033) | 3.80% |

India Laminates Market Trends:

Rising Demand for Decorative Laminates

The Indian laminates industry is experiencing a boost in demand for decorative laminates, fueled by changing consumer tastes for beautiful interiors. With the development of the real estate industry and rising disposable incomes, residential and commercial spaces are all using high-quality laminates for furniture, flooring, and wall paneling. The presence of a broad variety of textures, patterns, and finishes, such as wood, marble, and metallic finishes, is also driving adoption. Additionally, technologies such as digital printing and coordinated textures are enhancing the realism and durability of laminates, positioning them as an option over traditional surface materials. The increasing popularity of modular furniture and stylish interiors is expected to carry the momentum in this category.

To get more information on this market, Request Sample

Growing Preference for Antimicrobial and Fire-Resistant Laminates

The growing focus on hygiene and safety is driving demand for antimicrobial and fire-resistant laminates in India. Rising concerns over bacterial activity in residential spaces, hospitals, and commercial establishments have led manufacturers to integrate antimicrobial properties into laminates to inhibit microbial growth. Simultaneously, stringent safety regulations in commercial and residential developments are fueling the adoption of fire-resistant laminates, particularly in hotels, office spaces, and healthcare facilities. However, the Stylam Industries has distinguished itself as the only Indian manufacturer offering fire-retardant laminates as thin as 0.8mm with a Euroclass C-s2,d0 fire classification. Known for superior flame resistance, durability, and aesthetic appeal, these laminates cater to safety-conscious interior designs. Advances in material technology further enhance fire, heat, and water resistance, making specialized laminates a preferred choice for long-term safety and performance.

Expansion of Sustainable and Eco-Friendly Laminates

The sustainability drive is changing the Indian laminates industry, with growing focus on green products. Consumers and companies are turning towards laminates produced with low-emission resins, recycled content, and green adhesives to reduce the ecological footprint. Sales of Green Label-approved and FSC-approved laminates are on the growth path as sustainability emerges as a core buying factor in building and interior design. Also, companies are spending on waterborne coatings and eco-friendly manufacturing processes to decrease their carbon footprints. The green building activities encouraged by the government policies add strength to the movement. As concerns about the environment increase, demand for low-VOC and biodegradable laminates will become the new way of the future for India's laminates market.

India Laminates Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- High Pressure Laminate

- Low Pressure Laminate

The report has provided a detailed breakup and analysis of the market based on the product type. This includes high pressure laminate, and low-pressure laminate.

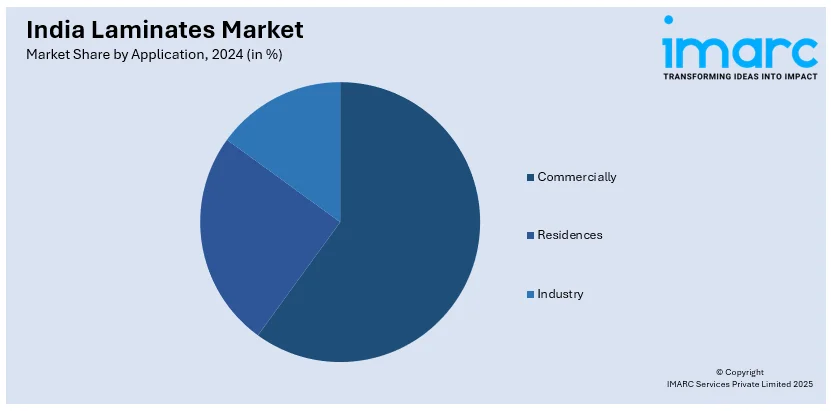

Application Insights:

- Commercially

- Residences

- Industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercially, residences, and industry.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Laminates Market News:

- In December 2024, SkyDecor Laminates Pvt. Ltd. has introduced two new laminate collections, 'Design Master 1 MM+' and 'Acrylish - Volume 2,' at a dealership event in Indore. The Design Master 1 MM+ range features over 300 unique decorative laminates, while Acrylish - Volume 2 offers high-gloss, scratch-resistant surfaces made with 100% virgin PMMA. Managing Director Manoj Bansal emphasized the company’s commitment to quality, affordability, and sustainability with these innovative product launches.

- In November 2024, Merino Laminates has launched its ‘Be Different’ campaign across India, conceptualized by Lowe Lintas. The campaign promotes the brand’s unique laminate designs, encouraging homeowners to personalize their interiors. Chief Marketing Officer Parveen Gupta emphasized Merino’s commitment to empowering customers with stylish and distinctive solutions. The campaign is now live across online and offline platforms, reinforcing Merino’s vision of helping individuals express their personality through innovative surface designs.

India Laminates Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | High Pressure Laminate, Low-Pressure Laminate |

| Applications Covered | Commercially, Residences, Industry |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India laminates market performed so far and how will it perform in the coming years?

- What is the breakup of the India laminates market on the basis of product type?

- What is the breakup of the India laminates market on the basis of application?

- What is the breakup of the India laminates market on the basis of region?

- What are the various stages in the value chain of the India laminates market?

- What are the key driving factors and challenges in the India laminates?

- What is the structure of the India laminates market and who are the key players?

- What is the degree of competition in the India laminates market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India laminates market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India laminates market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India laminates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)