India Laptop Market Size, Share, Trends and Forecast by Type, Design, Screen Size, Price, End Use, and Region, 2025-2033

India Laptop Market Size and Share:

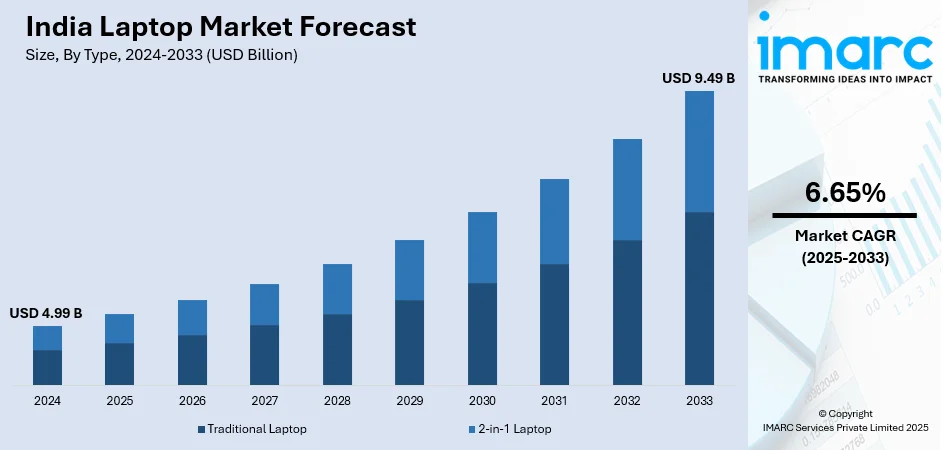

The India laptop market size was valued at USD 4.99 Billion in 2024. Looking forward, the market is expected to reach USD 9.49 Billion by 2033, exhibiting a CAGR of 6.65% during 2025-2033. The market is fueled by increasing demand for remote work and online learning and increasing internet connectivity in urban as well as rural markets. Digital literacy growth and government policies supporting access to affordable technology are also spurring adoption. Greater interest in gaming and content creation, and affordable financing options and incentives toward local manufacturing also enable laptops to become easily accessible and affordable, which further contributes to the consistent growth of India laptop market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.99 Billion |

| Market Forecast in 2033 | USD 9.49 Billion |

| Market Growth Rate (2025-2033) | 6.65% |

One of the significant drivers of the Indian laptop market is increasing emphasis on digital education and technology access initiatives backed by the government. As digitization in schools and colleges has increased, particularly after online learning shifted, laptops have emerged as integral tools for students of all economic segments. The Indian government has launched various initiatives to enhance access to digital infrastructure, such as schemes that subsidize or distribute laptops to rural and underprivileged students. State governments have also initiated laptop distribution schemes in states such as Uttar Pradesh, Tamil Nadu, and Karnataka to enable youth empowerment and enhance digital literacy. The growth of internet access in smaller towns and villages has also contributed significantly. There are more students from tier-2 and tier-3 cities now taking online courses and skill development programs, generating a steady demand for low-cost, long-lasting laptops. This broader regional inclusiveness has greatly expanded the base for the development of the India laptop market outlook.

To get more information on this market, Request Sample

India's dynamic startup culture and changing hybrid work pattern are among the prime drivers of laptop usage, especially in urban and semi-urban regions. With increasing startups and small enterprises growing in urban cities such as Bengaluru, Hyderabad, and Gurugram, there is a rising demand for stable computing devices capable of handling high-performance tasks such as coding, designing, and video conferencing. Startups tend to prefer bulk buying and seek value-for-money machines that provide business-level productivity without the cost of a corporate label. At the same time, the increase in freelancing, remote consulting, and online business has driven demand for laptops that can handle multitasking and digital collaboration. Laptops have also become affordable due to financing facilities. Indian consumers, particularly students or new buyers, often use EMI offerings, cashbacks, and festive promotions offered through online and offline stores. These finance options are necessary in a price-conscious market like India, where the flexibility to change costs often drives the decision to buy. Laptops are therefore becoming crucial household investments.

India Laptop Market Trends:

Increasing Demand for Remote Working and Digital Connectivity

The growing use of remote working arrangements and the drive for digital connectivity have become key drivers transforming the laptop market in India. With bigger companies, startups, and government offices adopting hybrid working models, there's a growing demand for devices that balance portability, performance, and longevity. A recent report indicates that around 82% of Indian employees prefer remote working conditions, prompting professionals to invest in high-performance, portable devices that support flexibility and productivity. Hence, Indian professionals now expect laptops capable of handling long video calls, multiple browser tabs, and heavy productivity applications without frequent charging breaks. Moreover, improved broadband penetration—especially via fiber networks and 4G/5G expansion—is fueling demand for devices that support seamless digital communication even in smaller towns and rural areas. Manufacturers are responding by positioning mid-range ultra books and lightweight notebooks as ideal work companions for India’s digitally mobile workforce. These devices tend to feature locally optimized aspects: spill-resistant keyboards, dual-language keyboards, and region-specific keyboard stickers for Hindi or other local scripts. Strong after-sales networks and service points in Tier 2 and Tier 3 cities also soothe consumer worries about having connected devices, thereby making sure that the market increasingly focuses on work-at-home feasibility for a geographically dispersed workforce. These factors collectively propel the India laptop market growth and development as well.

Increased Phenomenon of Online Education and Digital Content Consumption

India's laptop market is also driven by the phenomenal rise in online learning and a hunger for consuming digital content. With students using virtual classrooms, test preparation websites, and interactive learning modules, the demand for personal laptops has increased exponentially. These gadgets serve as learning aids, entertainment centers, and content-generating devices, meeting the demands of students looking for efficiency as well as affordability. According to the India Brand Equity Foundation (IBEF), digital channels now drive 62% of student enrolments in India, illustrating the growing reliance on laptops among students for educational purposes and digital engagement. This phenomenon is not limited to city areas, as parents in smaller cities are buying entry-level laptops specifically designed for academic purposes and multimedia access. Several brands are offering bundled partnered tools, including education app subscription and e‑library access, to appeal to family shoppers. Meanwhile, content consumption patterns—ranging from streaming sites, YouTube, e‑reading, and social media—have made laptops mere study tools turn into multimedia hubs. Hence, there is an increase in devices boasting colorful IPS screens, dual speakers, and battery life that lasts to support video watching, reading, and casual gaming during downtime. Localization initiatives—such as pre-installed native keyboards and UI support—make it possible for both students and content consumers to engage with their native languages, making digital adoption inclusive across India's diverse multilingual environment.

Growth of the Gaming Industry

One of the prominent India laptop market trends include the growing gaming industry, which has fueled interest in affordable yet high-performance gaming laptops. With a surge in mobile and PC gaming, driven by mass popularity of online multiplayer games and esports competitions, India's youth segment looks for devices that offer competitive frame rates, good keyboards, and effective thermal solutions. As per IBEF, it is anticipated that India's online gaming market would more than double in size, from USD 3.7 billion in 2024 to USD 9.1 billion by 2029, indicating a strong demand for powerful gaming laptops designed for engaging gameplay. Foreign and local manufacturers are introducing gaming laptops with enhanced cooling solutions designed to suit India's environment, such as dual-fan and metal-chassis models to spread heat in warmer climates. Pre-loaded gaming platforms, driver utility software, and weekend gaming event sponsorships are turning into selling points, creating communities of gamers hungry for hassle-free experiences. In addition, brands are also tying up with Indian streamers and content creators to promote benchmarks of gaming laptops and emphasize compatibility with local game chats, highlighting both performance and connectivity. Entry-level models with graphics cards priced for price-performance balance are being widely promoted to first-time users as well. This trend has made gaming laptops a fast-growing segment contributing to the overall India laptop market forecast, and further leading to changing digital leisure habits.

India Laptop Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India laptop market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, design, screen size, price, and end use.

Analysis by Type:

- Traditional Laptop

- 2-in-1 Laptop

Traditional Laptops are popular due to their affordability, ruggedness, and broad recognition among users. They remain favorite among students, professionals, and small business operators who value performance and price above portability or design flexibility. They generally provide bigger screens, improved heat dissipation, and upgradable parts, which make them ideal for general usage, office tasks, and educational use across urban and rural India.

At the same time, 2-in-1 Laptops are also preferred, particularly by consumers of tech-savvy nature and creative professionals. These multipurpose gadgets combine the portability of a tablet with the capability of a standard laptop, increasing their versatility. They are suited for users who do presentations, design, digital notetaking, or working on the go. Their compact size and touchscreen feature attract young shoppers in urban areas who value multifunctional gadgets. The increasing trend of online education and mobile employment is driving increased usage of this flexible laptop segment in India.

Analysis by Design:

- Ultrabook

- Notebook

- Others

In India's laptop industry, ultrabooks have established a niche among professionals and high-end users demanding sleek, slim design along with impeccable performance. With their thin designs, long battery life, and rapid SSD storage, ultrabooks are popular with heavy travelers, corporate executives, and urban professionals. They usually come with high-quality materials, edge-to-edge screens, and high-performance processors, making them suitable for multitasking, content creation, and office work. They appeal to the balance of form and function, appealing to those that are willing to spend for long-term efficiency and portability.

Notebooks also remain the staple in the mainstream segment as they are affordable and pragmatic in their design. Perfect for students, regular users, and home-based workers, notebooks have fundamental computing capabilities at a price lower than ultrabooks. They are available in different configurations, display sizes, and price segments to cater to the masses in metro cities as well as tier 2 and 3 markets in India.

Analysis by Screen Size:

- Up to 10.9"

- 11" to 12.9"

- 13" to 14.9"

- 15.0" to 16.9"

- More than 17"

Screen size is a major determining factor in the India laptop market demand, based on usage requirements and portability. Up to 10.9" laptops are generally preferred for extreme portability, used in tablets or small 2-in-1s. They are favored by students and occasional users who seek mobility at the cost of screen space.

11" to 12.9" laptops cater to the same user base but provide slightly improved visibility, seen in affordable education devices.

13" to 14.9" laptops are the balanced category, desired by working professionals and students alike for their combination of portability and productivity. These laptop models are particularly in demand in urban locations for everyday use.

15.0" to 16.9" laptops are the most popular, providing a full keyboard and larger screen appropriate for multitasking, gaming, and content viewing, while also being preferred for household and office application.

Over 17" laptops are specialized, serving gamers, designers, and professionals who need large screens for visually intensive tasks or entertainment.

Analysis by Price:

- Less than INR 40,000

- INR 40,000 to INR 80,000

- More than INR 80,000

Less than INR 40,000 price category is attractive to price-sensitive consumers like students, first-time buyers, and occasional home users. Laptops in this category provide standard functionality such as web surfing, document editing, and video streaming. Brands usually promote tier 2 and 3 cities with these models, offering basic features at low prices to enhance digital literacy and penetration.

The INR 40,000 to INR 80,000 segment is the most competitive, drawing working professionals, students, and small business users. Laptops in this segment find a balance between performance and features, frequently featuring improved processors, SSD storage, and full HD screens. This segment can multitask, enable online education, and remote work, and it is the top choice in urban centers where durability and average power are top purchasing drivers.

Premium laptops above INR 80,000 cater to professionals, gamers, and creatives who demand high performance, advanced graphics, and sleek designs. These devices feature superior build quality, extended battery life, and cutting-edge specifications. Buyers in metro cities often choose this segment for high-end tasks like video editing, programming, or gaming, valuing both performance and brand prestige.

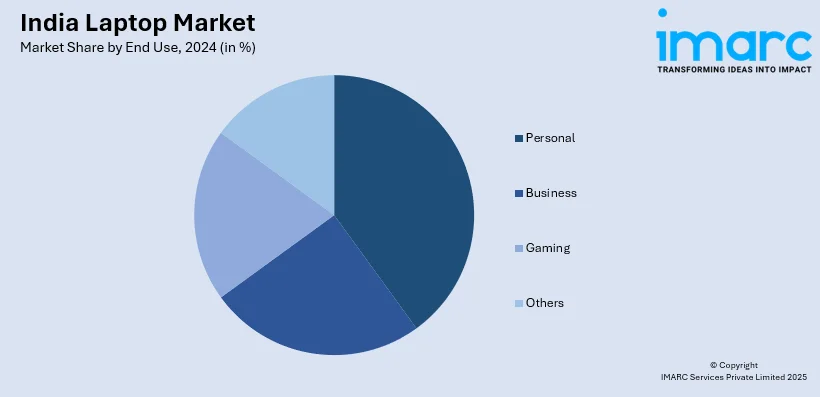

Analysis by End Use:

- Personal

- Business

- Gaming

- Others

The personal consumer segment consists of laptops for general usage such as browsing, streaming, social networking, and light productivity. It is extremely popular among homemakers, students, and general users. Ease of use, portability, and price are central drivers of demand in this space, particularly in homes of urban and semi-urban India where the laptop is regarded as a necessary digital device.

Business laptops are designed for professionals and businesses demanding robust performance, secure data management, and extended battery life. They tend to be light, rugged, and come with features such as fingerprint readers and encrypted drives. Startups, corporate establishments, and remote professionals in large Indian cities value this segment for facilitating hybrid work environments and productivity-oriented computing demands.

The gaming segment is rapidly growing in India on the back of the increasing popularity of esports, livestreaming, and high-speed gaming. These laptops boast dedicated graphics cards, state-of-the-art cooling facilities, and high-refresh-rate displays. Gamers, content creators, and tech enthusiasts—particularly among the youth—are driving demand, with buying fueled by metro cities and online channels that are providing attractive deals.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

North India displays high demand from cities such as Delhi and Chandigarh, led by students, IT professionals, and government offices. The region enjoys strong infrastructure and rising digital penetration across both metropolitans and smaller towns.

West and Central India, particularly Mumbai and Pune, have high corporate user demand, startups, and creative professionals. The states are technology-oriented with rich retail and e-commerce networks facilitating laptop availability in urban and semi-urban areas.

South India is at the forefront of laptop adoption because of its booming IT centers such as Bengaluru, Hyderabad, and Chennai. High digital literacy, solid educational institutions, and a huge working population drive personal and business laptop demand in the region.

East and Northeast India exhibit rising demand for laptops, particularly in urban areas such as Kolkata and Guwahati. Initiatives by the government, investments in education, and enhancing internet infrastructure are slowly expanding digital access and market potential in this formerly underpenetrated region.

Competitive Landscape:

Key players in the Indian laptop market are aggressively fueling growth through a range of strategic initiatives designed to meet the nation's heterogeneous consumer base. Top international and local brands are broadening their product offerings to include low-priced, mid-segment, and high-end models targeting students, professionals, and gamers in equal measure. They are prioritizing the provision of laptops that carry specifications suited to Indian consumers' requirements, including multilingual keyboards, extended battery life for power-starved areas, and strong after-sales service networks reaching tier 2 and tier 3 towns. Most brands are investing in domestic manufacturing and assembly plants in reaction to initiatives such as "Make in India" by governments, which assists in lowering costs and resonating with the increasing sense of favoring local production. To make them more accessible, manufacturers are integrating with online shopping platforms and retail chains to provide interesting financing plans, such as no-cost EMIs and exchange schemes, to make laptops cheaper for a cost-conscious market. Moreover, firms are focusing on innovation by incorporating the newest technologies like SSD storage, quick charging, and light weight to cater to current usage requirements. Marketing campaigns make use of social media influencers and online campaigns to inform consumers regarding product advantages and the significance of digital connectivity. These efforts by the major players are useful in increasing the laptop market in urban and rural India.

The report provides a comprehensive analysis of the competitive landscape in the India laptop market with detailed profiles of all major companies, including:

- Acer Inc.

- Apple Inc.

- ASUSTeK Computer Inc.

- Dell Inc.

- HP Development Company L.P.

- Lenovo Group Limited

- Samsung Electronics Co. Ltd.

Latest News and Developments:

- May 2025: Asus India launched its 2025 ROG laptop lineup, including Strix Scar 16/18, Zephyrus G14/G16, Strix G16, and Flow Z13. These models featured advanced hardware, immersive displays, and AI-accelerated performance. Pre-orders opened with benefits worth up to ₹34,498, targeting gamers and creators seeking innovation, power, and portability.

- May 2025: MSI launched the VenturePro 15 AI A1VEG-008IN gaming laptop in India. It features an Intel Core Ultra 7 155H processor, RTX 4050 GPU, 144Hz FHD display, 16GB DDR5 RAM, and 1TB SSD. Priced at ₹1,15,424, it supports AI workloads, comes with Windows 11 and Office 2021, and weighs 1.9 kg.

- April 2025: Lenovo launched the 2025 IdeaPad Slim 3 series in India with multiple screen sizes, metal chassis, and MIL-STD 810H certification. Powered by Intel Raptor Lake H and AMD HawkPoint processors, it featured up to 60Wh battery, Rapid Charge Boost, FHD+IR cameras, and started at ₹63,790 with a one-year warranty.

- April 2025: Motorola entered the Indian laptop segment with the Moto Book 60, launched at ₹69,999. Featuring a 2.8K OLED display, Intel Core 5/7 processors, up to 32GB RAM, and 1TB SSD, it offered military-grade durability, AI features, Dolby Atmos speakers, and Wi-Fi 7, targeting productivity and media-savvy users.

- February 2025: With an AMD Ryzen 9 Hawkpoint processor, an NVIDIA GeForce RTX 4060 GPU, and AI improvements for more fluid gameplay, HP introduced the Victus 15 gaming laptop in India. At ₹1,12,990, it included with a 3-month Xbox Game Pass subscription, a 15-inch 144Hz display, Tempest cooling, and 16GB DDR5 RAM.

India Laptop Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Traditional Laptop, 2-in-1 Laptop |

| Designs Covered | Ultrabook, Notebook, Others |

| Screen Sizes Covered | Up to 10.9", 11" to 12.9", 13" to 14.9", 15.0" to 16.9", More than 17" |

| Prices Covered | Less than INR 40,000, INR 40,000 to INR 80,000, More than INR 80,000 |

| End Uses Covered | Personal, Business, Gaming, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Companies Covered | Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell Inc., HP Development Company L.P., Lenovo Group Limited, Samsung Electronics Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India laptop market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India laptop market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India laptop industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India laptop market was valued at USD 4.99 Billion in 2024.

The India laptop market is projected to exhibit a CAGR of 6.65% during 2025-2033, reaching a value of USD 9.49 Billion by 2033.

The India laptop market is driven by rising digital literacy, growing demand for remote work and online education, and increasing internet penetration across urban and rural areas. Government initiatives, local manufacturing incentives, and flexible financing options further support market growth, making laptops more accessible to a wider range of consumers nationwide.

Some of the major players in the India laptop market include Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell Inc., HP Development Company L.P., Lenovo Group Limited, Samsung Electronics Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)