India Large Format Ceramic Panel Market Size, Share, Trends and Forecast by Application, Thickness, Construction Type, and Region, 2025-2033

India Large Format Ceramic Panel Market Overview:

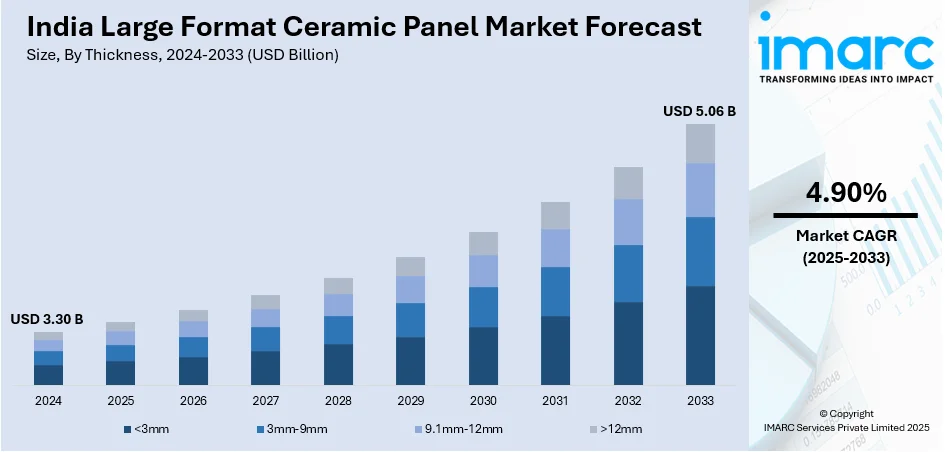

The India large format ceramic panel market size reached USD 3.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.06 Billion by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The market is driven by increasing demand for premium aesthetics in residential and commercial spaces, rapid urbanization, continuous advancements in digital printing technology, growing consumer preference for durable and low-maintenance surfaces, and rising investments in real estate and infrastructure development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.30 Billion |

| Market Forecast in 2033 | USD 5.06 Billion |

| Market Growth Rate (2025-2033) | 4.90% |

India Large Format Ceramic Panel Market Trends:

Growing Adoption in Luxury Residential and Commercial Spaces

The India large format ceramic panel market growth is experiencing rapid growth from luxury residential buildings, along with commercial projects. In line with this, homeowners and architects choose these panels because they deliver a smooth appearance together with reduced grout lines and an upscale modern decorative aesthetic. Moreover, large format ceramic panels are expanding in commercial premises including hotels, malls and corporate offices as they offer durability alongside effortless maintenance and superior moisture and stain resistance. Besides this, modern digital printing techniques encourage manufacturers to produce accurate visuals of stone, wood and concrete effects in their ceramic panels for construction purposes. For instance, in 2024, the Ministry of Textiles approved 137 research projects under the National Technical Textiles Mission (NTTM) with an outlay of ₹474.7 crore, showcasing the government's dedication to this crucial industry. Furthermore, the growing demand for large format ceramic panels in upscale interiors as well as facades based on rising disposable income and advancing urbanization blended with global design trends is boosting the India large format ceramic panels market share.

To get more information on this market, Request Sample

Technological Advancements and Sustainable Production Practices

Modern ceramic panel manufacturing technology is significantly contributing to enhance the India large format ceramic panels market outlook. For example, at Indian Ceramics 2024, SACMI introduced the Continua+ 'Hyper-Speed' configuration, elevating productivity to over 30,000 m² per day. This advancement ensures superior compaction, reduced energy consumption, and versatile thickness control (3 to 30 mm), catering to diverse design requirements. In addition to this, the application of digital inkjet printing together with sintering and lightweight panel technology extends product quality to support better design capabilities and improved durability. Concurrently, manufacturers in the market increasingly pursue sustainable production methods by using eco-friendly raw materials in addition to energy-efficient kilns and water recycling systems. Moreover, two main factors that are driving developers to choose large format ceramic panels, include using less materials and maintaining their durability better, because of expanding interest in green building certifications, Leadership in Energy and Environmental Design (LEED) and Indian Green Building Council (IGBC). Apart from this, the market adoption of thin ceramic panels results in decreased transportation expenses and installation costs and generates reduced carbon emissions. Additionally, the market is sustaining its transition toward sustainable and ongoing technologically advanced ceramic panel solutions because environmental concerns continue to rise in importance.

India Large Format Ceramic Panel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application, thickness, and construction type.

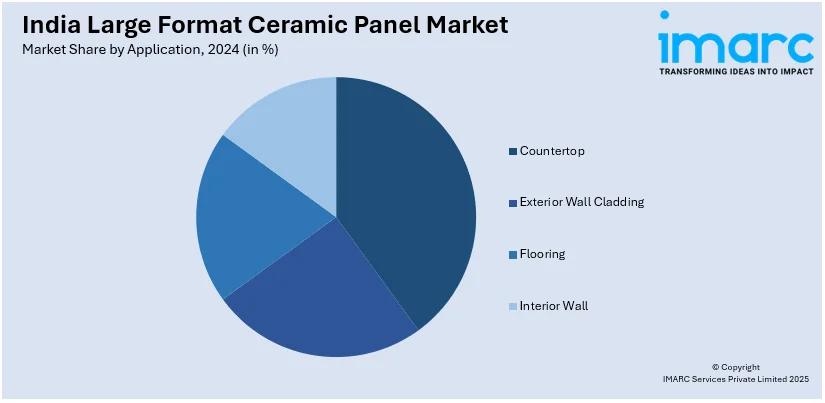

Application Insights:

- Countertop

- Exterior Wall Cladding

- Flooring

- Interior Wall

The report has provided a detailed breakup and analysis of the market based on the application. This includes countertop, exterior wall cladding, flooring, and interior wall.

Thickness Insights:

- <3mm

- 3mm-9mm

- 9.1mm-12mm

- >12mm

A detailed breakup and analysis of the market based on the thickness have also been provided in the report. This includes <3mm, 3mm-9mm, 9.1mm-12mm, and >12mm.

Construction Type Insights:

- New Construction

- Replacement and Renovation

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes new construction, and replacement and renovation.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Large Format Ceramic Panel Market News:

- In June 2024, Somany Ceramics showcased its 'Max Coverstone' large format slabs at IIID Showcase Insider 2024, highlighting innovative finishes and versatile applications. This initiative reinforces its design leadership and promotes large format ceramic panel adoption in modern architecture.

- In December 2023, Rey Cera Creation launched India's largest 60x120 cm GVT plant in Morbi, Gujarat, with a 9.3 million sqm annual capacity. It is equipped with advanced global machinery, aiming to meet rising demand and boost India's presence in the global ceramic industry.

India Large Format Ceramic Panel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Countertop, Exterior Wall Cladding, Flooring, Interior Wall |

| Thicknesses Covered | <3mm, 3mm-9mm, 9.1mm-12mm, >12mm |

| Construction Types Covered | New Construction, Replacement and Renovation |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India large format ceramic panel market performed so far and how will it perform in the coming years?

- What is the breakup of the India large format ceramic panel market on the basis of application?

- What is the breakup of the India large format ceramic panel market on the basis of thickness?

- What is the breakup of the India large format ceramic panel market on the basis of construction type?

- What is the breakup of the India large format ceramic panel market on the basis of region?

- What are the various stages in the value chain of the India large format ceramic panel market?

- What are the key driving factors and challenges in the India large format ceramic panel?

- What is the structure of the India large format ceramic panel market and who are the key players?

- What is the degree of competition in the India large format ceramic panel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India large format ceramic panel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India large format ceramic panel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India large format ceramic panel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)