India Laundry Service Market Size, Share, Trends and Forecast by Sector, Business Type, Service Type, End User, and Region, 2025-2033

India Laundry Service Market Overview:

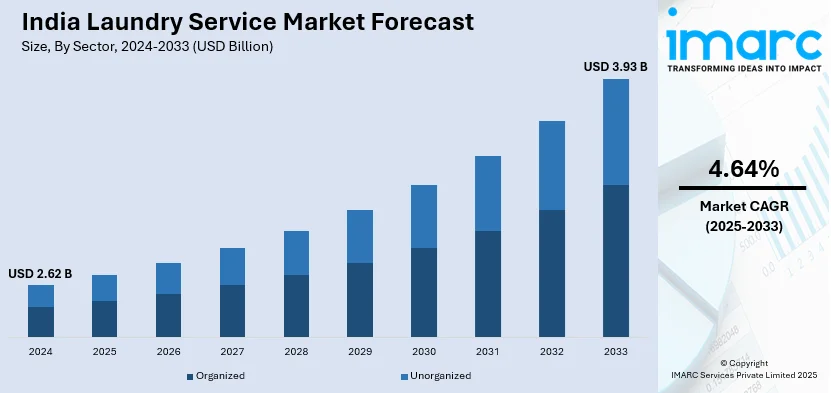

The India laundry service market size reached USD 2.62 Billion in 2024. The market is expected to reach USD 3.93 Billion by 2033, exhibiting a growth rate (CAGR) of 4.64% during 2025-2033. The market growth is attributed to rapid urbanization, changing consumer lifestyles, expanding disposable income levels, escalating demand from the hospitality and healthcare sectors, technological advancements in online booking and automation, rising awareness of hygiene, expansion of organized laundromats, and the convenience of doorstep pickup and delivery services.

Market Insights:

- Based on region, the market is divided into North India, South India, East India, and West India.

- On the basis of sector, the market is categorized as organized and unorganized.

- Based on the business type, the market is segmented into online and offline.

- On the basis of service type, the market is categorized as laundry care, dry cleaning, duvet cleaning, steam/electric pressing, and others.

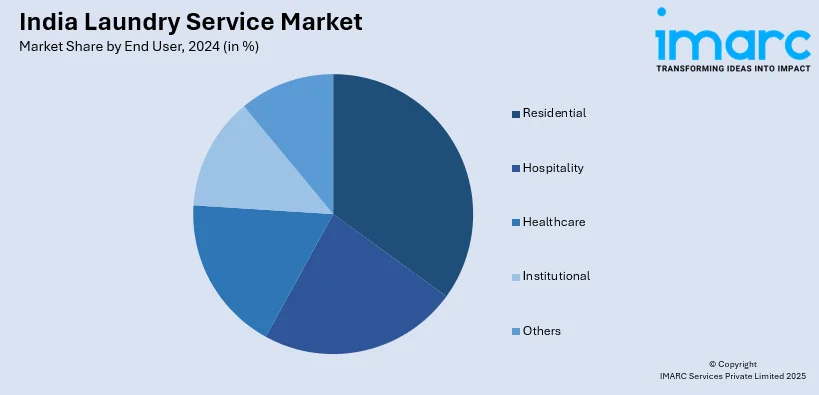

- Based on the end user, the market is segmented into residential, hospitality, healthcare, institutional, and others.

Market Size and Forecast:

- 2024 Market Size: USD 2.62 Billion

- 2033 Projected Market Size: USD 3.93 Billion

- CAGR (2025-2033): 4.64%

India Laundry Service Market Trends:

Rapid Urbanization and Evolving Lifestyles

Urbanization in India has been on the rise steadily, and this has brought about major lifestyle changes. Urban residents tend to have long working hours and long commutes, leaving them with little time for domestic chores like laundry. This promotes a greater dependence on professional laundry services, which are convenient and efficient. Additionally, the development of the hospitality industry, including hotels, resorts, and restaurants, contributes to the higher demand for professional laundry services as well. They need regular and high-quality laundry solutions to preserve their standards and customer satisfaction. According to the India laundry service market analysis, the transition to nuclear families and solo households in Indian cities also drives the need for professional laundry services. In contrast to joint family arrangements where domestic work was communally shared, smaller family sizes tend to imply greater dependence on outside services to take care of household tasks. Working professionals, students, and young businesspersons residing in metros and tier-1 cities consider outsourcing laundry to professional services as an efficient option that suits their hectic lifestyles.

To get more information on this market, Request Sample

Technological Advancements and Digital Integration

The incorporation of technology into the laundry service sector transformed the conventional systems of operations for better accessibility and engagement from customers. This trend is significantly contributing in augmenting the India laundry service market share. The penetration of smartphones and internet connectivity created room for the innovations of online sites and mobile applications that help people in scheduling pickup times, tracking orders, and paying for orders without hassle, thereby elevating the experience for users. In addition, embracing sophisticated machinery and green practices has enhanced service standards and operational efficiency. Technologies like automated washing equipment and environmentally friendly detergents not only provide superior cleaning results but also align with the increased consumer consciousness for environmental responsibility. The focus on technological integration and sustainability is evidence of the sector's dedication to addressing modern-day consumer demands and driving long-term development. Moreover, the Indian laundry service market is being driven by rapid urbanization, changing lifestyles, and advancements in technology. All of these are contributing to the dynamic progress of the industry in tandem with the changing preferences and demands of the multicultural population of India.

Rising Demand for Eco-Friendly and Hygienic Cleaning Solutions

Hygiene consciousness among Indian consumers has intensified, influencing laundry preferences. Additionally, there's growing demand for services that use non-toxic detergents, hypoallergenic solvents, and water-efficient processes. Many customers now actively seek out providers who advertise antimicrobial treatment, ozone cleaning, or steam sanitization. This trend is especially visible in metros and affluent urban neighborhoods, where disposable income supports higher pricing for health-oriented services. Apart from this, eco-conscious laundry operators are promoting sustainability by adopting biodegradable packaging, energy-efficient machines, and chemical-free softeners. Some brands are also offering waterless dry-cleaning technologies and recycling programs, which is further enhancing the India laundry service market outlook. While these measures increase operational costs, many service providers are positioning them as value-added features to attract premium segments, such as boutique hotels, spas, gyms, and high-income residential societies. In addition to this, regulatory nudges toward sustainable water and chemical use, especially in industrial laundry operations, are also pushing the market in this direction. Service differentiation based on green practices is becoming a viable branding strategy, especially among younger and health-aware customers.

India Laundry Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on sector, business type, service type, and end user.

Sector Insights:

- Organized

- Unorganized

The report has provided a detailed breakup and analysis of the market based on the sector. This includes organized and unorganized.

Business Type Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the business type have also been provided in the report. This includes online and offline.

Service Type Insights:

- Laundry Care

- Dry Cleaning

- Duvet Cleaning

- Steam/Electric Pressing

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes laundry care, dry cleaning, duvet cleaning, steam/electric pressing, and others.

End User Insights:

- Residential

- Hospitality

- Healthcare

- Institutional

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, hospitality, healthcare, institutional, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Laundry Service Market News:

- July 2025: Laundrywala announced its continued expansion in India’s organized laundry sector, driven by technology integration and a scalable franchise model. With over 30 outlets across 20 cities, the brand offers digital-enabled services such as doorstep delivery, cashless payments, and order tracking. Emphasizing hygiene, sustainability, and post-pandemic safety, Laundrywala aims to meet the growing demand in Tier 2 and Tier 3 markets. This expansion is contributing in extending the laundry service market size in India.

- February 2025: Quick Clean raised INR 500 Million in fu.nding led by Alkemi Growth Capital and Blue Ashva Capital, along with an INR 100 Million credit line, to expand its presence in the healthcare and hospitality sectors. Founded in 2010, the company has grown from India’s first coin-operated laundromat to a national leader in professional linen management, operating across 36 cities with over 3,000 machines. The investment reinforces Quick Clean’s sustainability mission and its role in delivering advanced, hygienic laundry solutions to top-tier hotels and hospitals.

- October 2024: Hindustan Unilever Limited (HUL), in collaboration with the Brihanmumbai Municipal Corporation (BMC) and JSW Foundation, inaugurated the first jointly set-up Suvidha Centre at Jagruti Nagar, Ghatkopar, marking the 18th facility in Mumbai under the Suvidha initiative. The Suvidha Centres are comprehensive urban hygiene and sanitation hubs offering 24×7 safe toilets, purified drinking water, showers, laundry services, and inclusive design features such as separate facilities for women, children, persons with disabilities, along with emergency panic buttons and solar-powered infrastructure.

- May 2024: Dhobi House, a high-end dry-cleaning and laundry facility, was opened at Kohima, Nagaland. The facility brings advanced laundry services to the region, catering to the changing requirements of the local populace. Such ventures expand India's laundry service industry by filling the growing needs for professional and easy laundry services within developing urban hubs.

- February 2024: LG Electronics India made a USD 4 million investment to open 200 self-laundry service centers in 2024, beginning with a center in a Greater Noida university for 1,500 students. The move brings easy laundry solutions to educational institutions, making professional laundry facilities more accessible.

India Laundry Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Organized, Unorganized |

| Business Types Covered | Online, Offline |

| Service Types Covered | Laundry Care, Dry Cleaning, Duvet Cleaning, Steam/Electric Pressing, Others |

| End Users Covered | Residential, Hospitality, Healthcare, Institutional, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India laundry service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India laundry service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India laundry service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The laundry service market in India was valued at USD 2.62 Billion in 2024.

The India laundry service market is projected to exhibit a CAGR of 4.64% during 2025-2033, reaching a value of USD 3.93 Billion by 2033.

The India laundry service market is expanding due to increasing urban populations, time constraints among working professionals, and growing awareness of hygiene. Rising disposable incomes, demand for convenient doorstep services, and the emergence of app-based platforms are encouraging organized laundry providers across both metro and smaller cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)