India Leak Detection Market Size, Share, Trends and Forecast by Technology, End User, and Region, 2025-2033

India Leak Detection Market Overview:

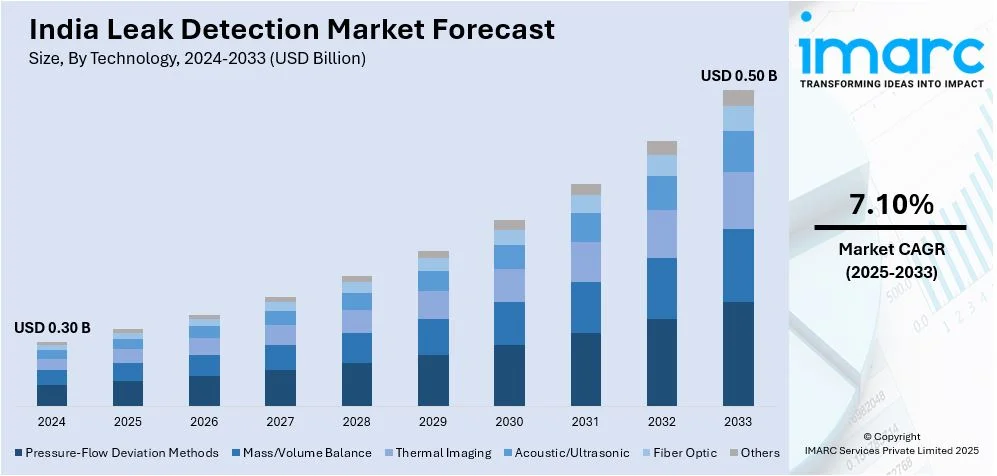

The India leak detection market size reached USD 0.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.50 Billion by 2033, exhibiting a growth rate (CAGR) of 7.10% during 2025-2033. The market is driven by stringent government regulations mandating pipeline safety, increasing investments in oil and gas infrastructure, and the rising adoption of advanced monitoring technologies. Growing concerns over water conservation, industrial safety, and environmental protection further accelerate demand for real-time leak detection solutions across multiple industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.30 Billion |

| Market Forecast in 2033 | USD 0.50 Billion |

| Market Growth Rate (2025-2033) | 7.10% |

India Leak Detection Market Trends:

Rising Adoption of IoT and AI-Based Leak Detection Solutions

The leak detection market of India is aggressively transforming with IoT and AI-enabled monitoring systems being adopted. Segments like the oil and gas, water infrastructure, and manufacturing sectors are installing smart sensors, cloud-based computing, and machine learning (ML) algorithms in order to ensure more accurate leaks detection and reduce response times. These technologies offer real-time information gathering, pre-emptive maintenance, as well as off-site monitoring with reduced operational expense and environmental dangers. AI-based pattern identification and automated notice also enhance premature leak detection and avoid extensive destruction. Government initiatives, including the approval of 12 new industrial smart cities under the National Industrial Corridor Development Programme with an investment of INR 286.02 billion (US$3.41 billion), are accelerating the adoption of these advanced leak detection solutions. This trend is improving efficiency, safety, and sustainability across key industrial sectors.

To get more information on this market, Request Sample

Increasing Investments in Pipeline Infrastructure and Safety Regulations

India’s expanding pipeline infrastructure for oil, gas, and water distribution is fueling the demand for advanced leak detection systems. The government aims to extend the gas pipeline network by 10,000 kilometers, reaching 33,000 kilometers within the next four to five years, aligning with the projected 60% rise in natural gas demand by 2030. Stricter safety regulations and increased investments in monitoring technologies are reinforcing this growth. Regulatory authorities require real-time leak detection systems to avert dangerous incidents and ensure compliance with the environment. Pipeline companies are incorporating ultrasonic, fiber-optic, and acoustic sensing technologies to achieve better detection levels. Large-scale infrastructure projects such as city gas distribution networks and water supply pipeline networks are embracing smart leak detection systems to enhance operations. Such advancements are hugely influencing India's leak detection market dynamics.

Increasing Focus on Water Conservation and Non-Revenue Water (NRW) Reduction

With rising concerns over water scarcity, India’s leak detection market is being driven by a heightened focus on water conservation. Municipal corporations and water utility providers are implementing advanced leak detection technologies to curb non-revenue water (NRW) losses caused by pipeline leakages and inefficiencies in distribution networks. Solutions such as acoustic sensors, satellite-based leak detection, and GIS mapping are gaining traction for efficient leak identification. Government initiatives like the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) and the Smart Cities Mission are fostering the adoption of smart water management systems, including automated leak detection. Notably, over 17,026 kilometers of water supply infrastructure are now monitored through Supervisory Control and Data Acquisition (SCADA) systems, significantly improving leak prevention and reducing water losses. As urbanization accelerates, the demand for sustainable water resource management continues to propel the adoption of advanced leak detection technologies across the country.

India Leak Detection Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on technology, and end users.

Technology Insights:

- Pressure-Flow Deviation Methods

- Mass/Volume Balance

- Thermal Imaging

- Acoustic/Ultrasonic

- Fiber Optic

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes pressure-flow deviation methods, mass/volume balance, thermal imaging, acoustic/ultrasonic, fiber optic, and others.

End User Insights:

.webp)

- Oil and Gas

- Chemical Plants

- Water Treatment Plants

- Thermal Power Plants

- Mining and Slurry

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes oil and gas, chemical plants, water treatment plants, thermal power plants, mining and slurry, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Leak Detection Market News:

- In November 2024, Diehl Metering, a global leader in smart metering solutions, acquired PREVENTIO GmbH, a German startup specializing in leakage management and predictive maintenance. This acquisition strengthens Diehl Metering’s real-time leak detection capabilities, enhancing its Analytics & Services portfolio. PREVENTIO’s AI-driven technology will integrate with Diehl’s Water Loss Management and Energy Forecast Management solutions, offering advanced tools for efficient resource management in water and heat supply networks.

- In October 2024, Marposs acquired Leak B-TRACER, a semi-automatic station for leak testing lithium-ion battery cells, to enhance safety and performance in e-mobility. With flammable electrolytes posing risks, this solution ensures battery integrity during assembly. The acquisition aligns with growing demand for reliable leak detection in next-generation electric vehicle batteries.

India Leak Detection Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Pressure-Flow Deviation Methods, Mass/Volume Balance, Thermal Imaging, Acoustic/Ultrasonic, Fiber Optic, Others |

| End Users Covered | Oil and Gas, Chemical Plants, Water Treatment Plants, Thermal Power Plants, Mining and Slurry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India leak detection market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India leak detection market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India leak detection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The leak detection market in India was valued at USD 0.30 Billion in 2024.

The India leak detection market is projected to exhibit a CAGR of 7.10% during 2025-2033, reaching a value of USD 0.50 Billion by 2033.

The India leak detection market is driven by rapid expansion of oil and gas infrastructure, increasing adoption of CNG vehicles, and growing industrialization. Rising safety concerns, strict environmental regulations, and the need to prevent resource loss and environmental damage further accelerate the demand for advanced leak detection systems nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)