India Leather Chemicals Market Size, Share, Trends and Forecast by Product, Process, Application, and Region, 2025-2033

India Leather Chemicals Market Overview:

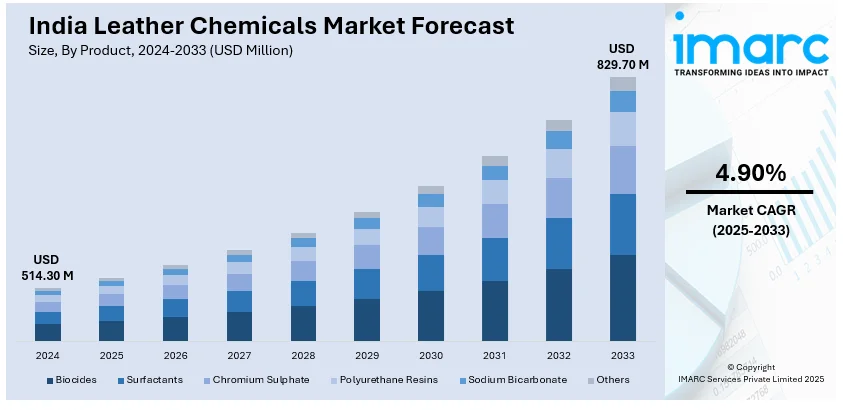

The India leather chemicals market size reached USD 514.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 829.70 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The market is propelled by rising demand for eco-friendly formulations, stringent environmental regulations, and growing preference for high-performance finishing chemicals. Expanding domestic leather production, government initiatives, like Make in India, and increasing exports further boost market growth. Advancements in tanning and finishing technologies also drive innovation and adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 514.30 Million |

| Market Forecast in 2033 | USD 829.70 Million |

| Market Growth Rate (2025-2033) | 4.90% |

India Leather Chemicals Market Trends:

Rising Demand for Eco-Friendly Leather Chemicals

The India leather chemicals industry is shifting toward sustainable practices, driving demand for eco-friendly leather chemicals. Strict environmental regulations and consumer preferences for sustainable products are encouraging tanneries to adopt bio-based and water-based alternatives. Chrome-free tanning agents, biodegradable surfactants, and plant-derived dyes are gaining traction, reducing environmental impact without compromising leather quality. The push for zero-liquid discharge (ZLD) policies in industrial clusters further accelerates the transition. Chemical manufacturers are investing in research to develop low-volatile organic compound (VOC) and non-toxic formulations to meet compliance standards. International buyers’ preference for sustainably processed leather is also encouraging Indian exporters to integrate green chemistry, fostering long-term growth in this segment.

To get more information on this market, Request Sample

Increasing Adoption of High-Performance Finishing Chemicals

With increasing demand for premium leather in automotive, footwear, and luxury applications, high-performance finishing chemicals are increasingly becoming popular in India. Advanced coatings, water-repellent chemicals, and nano-based products improve durability, appearance, and stain resistance, addressing industry-specific needs. The automotive industry, in specific, is fueling demand for ultra violet (UV) resistant and anti-scratch coatings to enhance leather life. In fashion and footwear, the market for matte, glossy, and textured finishes is increasing, giving rise to innovative polymer-based and silicone-based technologies. In addition, the introduction of synthetic and composite leathers as substitutes for traditional leather has driven the need for chemical treatments to replicate natural leather characteristics with higher product performance improvement.

Expansion of Domestic Leather Chemical Manufacturing

India leather chemical industry is expanding domestic production, driven by government incentives and efforts to reduce import dependence. Initiatives like the “Make in India” campaign and leather clusters are enhancing local manufacturing capabilities. The country’s abundant raw material supply, with 20% of the world’s cattle and buffalo population and 11% of the goat and sheep population, ensures a steady flow of leather inputs. Chemical producers are investing in advanced research and development (R&D) facilities to develop cost-effective solutions suited to Indian processing needs. Strategic collaborations between domestic and global firms foster technology transfers, improving product quality and competitiveness. A growing network of chemical suppliers further strengthens the supply chain, reducing manufacturing costs and solidifying India’s position as a global leather hub.

India Leather Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, process and application.

Product Insights:

- Biocides

- Surfactants

- Chromium Sulphate

- Polyurethane Resins

- Sodium Bicarbonate

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes biocides, surfactants, chromium sulphate, polyurethane resins, sodium bicarbonate, and others.

Process Insights:

- Tanning and Dyeing

- Beamhouse Chemicals

- Finishing Chemicals

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes tanning and dyeing, beamhouse chemicals, and finishing chemicals.

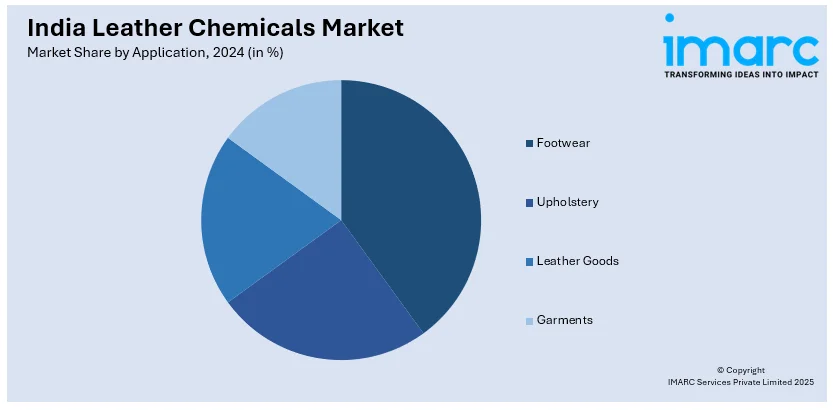

Application Insights:

- Footwear

- Upholstery

- Leather Goods

- Garments

The report has provided a detailed breakup and analysis of the market based on the application. This includes footwear, upholstery, leather goods, and garments.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Leather Chemicals Market News:

- In November 2024, Stahl sold its wet-end leather chemicals business to Syntagma Capital, marking its transition to a specialty coatings company. The deal includes 428 employees, manufacturing sites in Italy and India, and the full wet-end portfolio. Stahl aims to focus on coatings innovation and sustainability. CEO Maarten Heijbroek stated this shift enhances consumer experiences. The transaction is set to close in early 2025, pending regulatory approvals.

India Leather Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Biocides, Surfactants, Chromium Sulphate, Polyurethane Resins, Sodium Bicarbonate, Others |

| Processes Covered | Tanning and Dyeing, Beamhouse Chemicals, Finishing Chemicals |

| Applications Covered | Footwear, Upholstery, Leather Goods, Garments |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India leather chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India leather chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India leather chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The leather chemicals market in India was valued at USD 514.30 Million in 2024.

The India leather chemicals market is projected to exhibit a CAGR of 4.90% during 2025-2033, reaching a value of USD 829.70 Million by 2033.

The growth of the India leather chemicals market is driven by increasing demand for high-quality leather products in automotive, fashion, and footwear industries. The shift towards eco-friendly and sustainable leather processing methods, including chrome-free tanning, is a significant factor. Additionally, growing export opportunities, government support for the leather sector, and advancements in chemical formulations to improve leather durability and finish further propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)