India LED Bulb Market Size, Share, Trends and Forecast by Application, and Region, 2025-2033

India LED Bulb Market Overview:

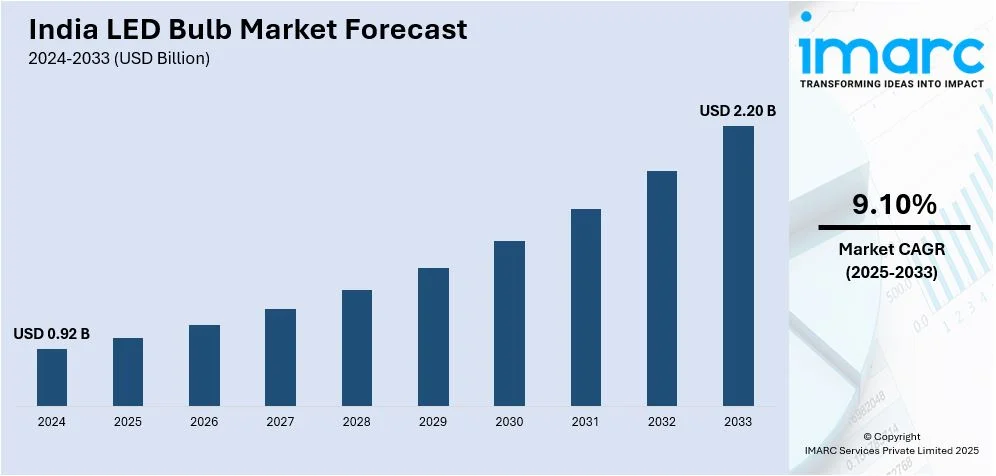

The India LED bulb market size reached USD 0.92 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.20 Billion by 2033, exhibiting a growth rate (CAGR) of 9.10% during 2025-2033. The market is driven by rising urbanization, increasing electricity access in rural areas, and growing consumer preference for energy-efficient lighting solutions. The implementation of government initiatives, declining light-emitting diode (LED) prices, and advancements in smart lighting technology further boost demand, while rapid infrastructure development fuels market expansion across residential and commercial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.92 Billion |

| Market Forecast in 2033 | USD 2.20 Billion |

| Market Growth Rate (2025-2033) | 9.10% |

India LED Bulb Market Trends:

Shift Towards LED and Energy-Efficient Lighting

The India LED bulb market is experiencing a major transition from traditional incandescent and Compact Fluorescent Lamp (CFL) bulbs to LED lighting solutions. This shift is driven by government initiatives, such as the Unnat Jyoti by Affordable LEDs for All (UJALA) program, which promotes LED adoption to reduce energy consumption. Falling LED prices, improved luminous efficiency, and increased awareness of long-term cost savings encourage consumers to switch to energy-efficient alternatives. Additionally, manufacturers are focusing on advanced technologies like tunable lighting and smart LED bulbs with remote control and automation features. With a growing emphasis on sustainability and carbon footprint reduction, both residential and commercial sectors are rapidly replacing conventional bulbs with LEDs, boosting demand across urban and rural markets.

To get more information on this market, Request Sample

Government Regulations and Sustainability Initiatives

Regulatory measures and sustainability initiatives are key drivers in shaping the India LED bulb market. The government has enforced stringent energy efficiency standards, phasing out high-energy-consuming bulbs and promoting eco-friendly alternatives. The Energy Conservation Building Code (ECBC), designed to enhance energy efficiency in buildings, is expected to prevent 1,065 metric tons of carbon dioxide emissions between 2019 and 2030. Additionally, schemes like UJALA have significantly influenced consumer preferences by making LED lighting more accessible and affordable. Manufacturers are increasingly adopting circular economy practices, focusing on recyclable materials and mercury-free lighting solutions. The push for sustainability has also accelerated innovations in solar-powered LED bulbs, particularly for rural electrification. With growing emphasis on carbon emission reductions and energy conservation, the India LED bulb market continues to transition toward sustainable, durable, and cost-efficient solutions.

Expansion of Smart Lighting and IoT Integration

The integration of smart lighting solutions with the Internet of Things (IoT) is transforming the India LED bulb market. Consumers are increasingly adopting smart bulbs that offer features, such as remote operation via smartphone apps, voice control compatibility with AI assistants like Alexa and Google Assistant, and customizable lighting settings. The rising penetration of smart home ecosystems, combined with the affordability of IoT-enabled lighting solutions, is driving demand in both residential and commercial sectors. Additionally, businesses and government entities are investing in connected lighting infrastructure to enhance energy efficiency in public spaces, offices, and industrial facilities. As digital transformation accelerates, the demand for intelligent, automated lighting solutions continues to grow, reshaping the future of the Indian lighting industry.

India LED Bulb Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application.

Application Insights:

.webp)

- Retrofit

- Retail and Hospitality

- Outdoor

- Offices

- Architectural

- Residential

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes retrofit, retail and hospitality, outdoor, offices, architectural, residential, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India LED Bulb Market News:

- In February 2025, Uno Minda launched the Ultimo Pro+ LED bulbs for two-wheelers in India, priced between Rs 660 and Rs 995. Designed for enhanced road safety and style, these bulbs offer advanced technology for brighter and more focused illumination. Available in three power output variants, the Ultimo Pro+ range prioritizes performance and durability, catering to the growing need for improved visibility on Indian roads as two-wheeler usage continues to rise.

India LED Bulb Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Retrofit, Retail and Hospitality, Outdoor, Offices, Architectural, Residential, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India LED bulb market performed so far and how will it perform in the coming years?

- What is the breakup of the India LED bulb market on the basis of application?

- What is the breakup of the India LED bulb market on the basis of region?

- What are the various stages in the value chain of the India LED bulb market?

- What are the key driving factors and challenges in the India LED bulb market?

- What is the structure of the India LED bulb market and who are the key players?

- What is the degree of competition in the India LED bulb market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India LED bulb market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India LED bulb market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India LED bulb industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)