India LED Display Market Size, Share, Trends and Forecast by Technology, Colour, Application, End Use, and Region, 2026-2034

India LED Display Market Overview:

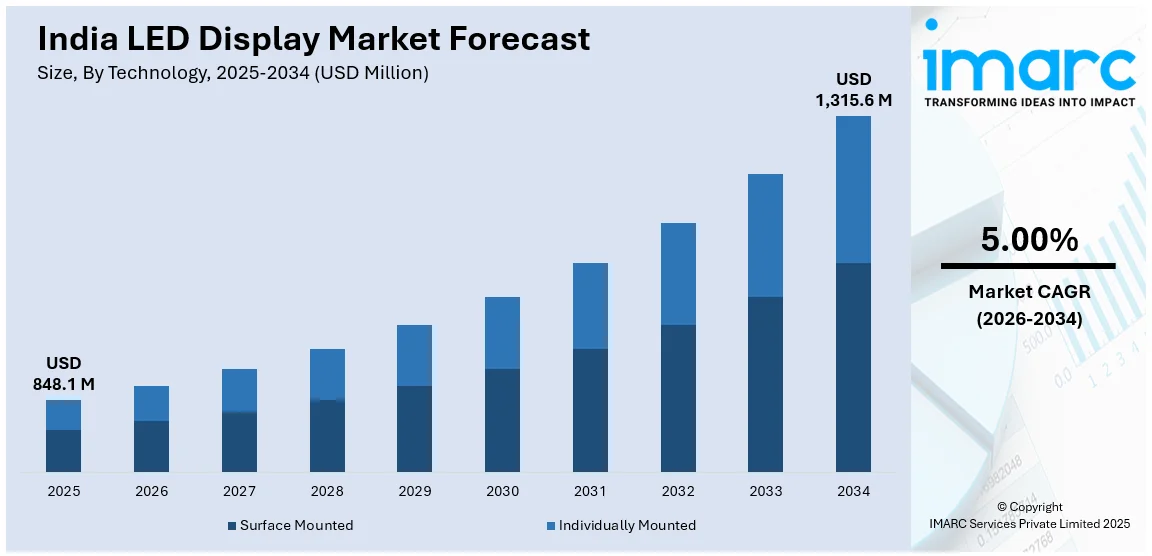

The India LED display market size reached USD 848.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,315.6 Million by 2034, exhibiting a growth rate (CAGR) of 5.00% during 2026-2034. The market is influenced by the growing demand for digital signage, expanding use in retail and entertainment industries, and government policies that support smart city initiatives. Innovation in energy-saving display technologies and increasing use of high-resolution screens in commercial segments also contribute to the growth of the market throughout the nation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 848.1 Million |

| Market Forecast in 2034 | USD 1,315.6 Million |

| Market Growth Rate (2026-2034) | 5.00% |

India LED Display Market Trends:

Rising Demand for Outdoor Digital Signage

The growing use of LED displays for outdoor digital signage is a prominent trend in India. Companies are moving towards digital advertising solutions to maximize brand visibility, utilizing LED displays at high-traffic locations like shopping malls, airports, railway stations, and highways. The retail industry, especially, is seeing large-format LED screens being invested in to create engaging customer experiences. Additionally, the entertainment and hospitality sectors are embedding dynamic digital signage to better involve consumers. Innovations in weather-resistant and high-brightness LED displays are also fuelling adoption. Increasing Digital Out-of-Home (DOOH) ad penetration, driven by declining LED display technology costs, is fueling market growth, with outdoor digital signage becoming a prominent application segment.

To get more information on this market Request Sample

Expansion of Smart City and Infrastructure Projects

Government-led smart city initiatives are driving the demand for LED displays across India. Under the Smart Cities Mission, launched in 2015, over 8,000 projects worth ₹1.64 lakh crore (USD 22 billion) have been planned, with 91% already tendered. Municipal bodies and urban planners are deploying LED display panels for real-time traffic updates, public information dissemination, and security surveillance. The growth of metro rail lines, upgraded airports, and intelligent transportation hubs is driving the integration of LED display systems for better passenger communication. Large-scale sports events and public events also heavily rely on LED video walls for crowd control and live streaming more and more. The demand for energy-efficient technology, along with increasing investments in digitalization and urban modernization, is further cementing the position of LED displays in India's developing smart city infrastructure.

Increasing Adoption in Retail and Entertainment Sectors

The entertainment and retail sectors are adopting LED displays to boost customer interaction and brand narratives. Retail stores, shopping malls, and experience centers are investing in high-definition LED video walls to lure consumers and present interactive promotions. The entertainment industry, such as cinemas, concert halls, and theme parks, is using large-format LED screens to enhance audience interaction. Further, increasing interest in esports and live event streaming is driving demand for ultra-HD and curved LED displays. Developments like transparent LED screens and flexible panels are opening up new areas of application. As companies invest in digital transformation and immersive consumer experience, the use of LED displays in these markets will pick up speed.

India LED Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on technology, colour, application and end use.

Technology Insights:

- Surface Mounted

- Individually Mounted

The report has provided a detailed breakup and analysis of the market based on the technology. This includes surface mounted, and individually mounted.

Colour Insights:

- Full Color Display

- Monochrome Display

- Tri-Color Display

A detailed breakup and analysis of the market based on the colour have also been provided in the report. This includes full color display, monochrome display, and tri-color display.

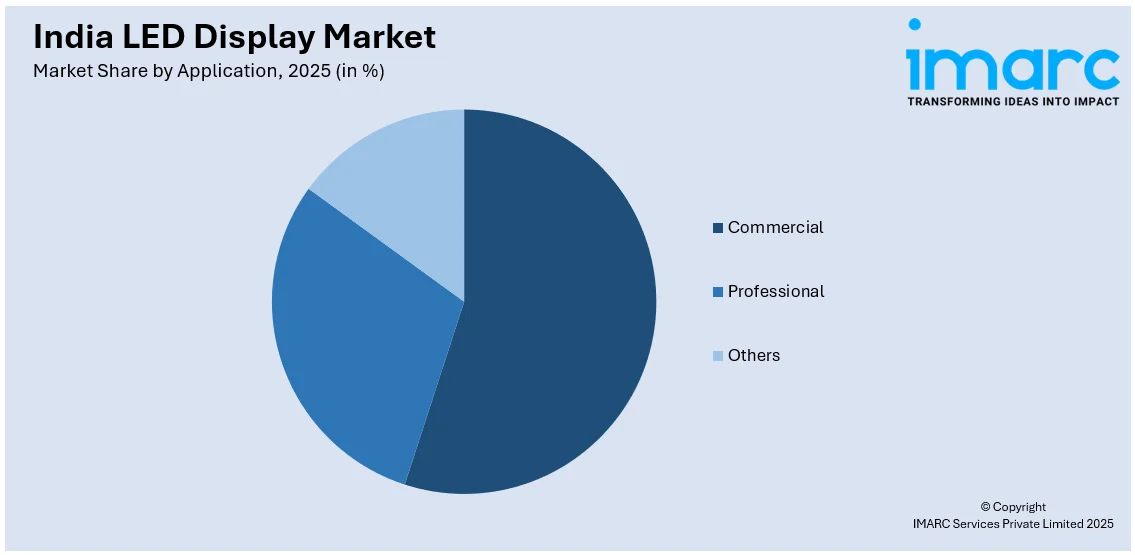

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Professional

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, professional, and others.

End Use Insights:

- Indoor

- Outdoor

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes indoor, and outdoor.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India LED Display Market News:

- In October 2024, AET Displays is set to unveil its latest advanced LED display solutions at A.B.I.S. 2024, held from October 17-19 at Mumbai’s Jio World Convention Centre. It will showcase the QUANTUM Series with MIP Technology for superior clarity and the INVISILITE Series, a transparent LED display. With India’s media sector growing rapidly, AET Displays aims to meet market demand with cutting-edge innovations, enhancing visual performance and durability in the broadcasting industry.

- In September 2024, ViewSonic Corp. launched the LDC series, the world's first customizable All-in-One mega LED displays, at InfoComm India 2024. Designed for flexible configurations up to 760 inches, these displays offer seamless installation and easy operation. Targeting business, commercial, and public spaces, the LDC series enhances digital signage solutions. ViewSonic aims to drive innovation in India's LED display market with adaptable, ultra-large-format technology that simplifies deployment while maintaining high visual performance.

- In February 2024, Vedanta, in partnership with Taiwan’s Innolux, plans to start mass production of LCD displays in India within 18-24 months, pending government approval. The project, estimated at USD 3-4 billion, aims to strengthen India’s display manufacturing sector. Vedanta has submitted its proposal under the semiconductor and display fab incentive program, marking a significant step toward domestic production. Other key industry proposals include those from Tower Semiconductors and Tata Group.

India LED Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Surface Mounted, Individually Mounted |

| Colours Covered | Full Color Display, Monochrome Display, Tri-Color Display |

| Applications Covered | Commercial, Professional, Others |

| End Uses Covered | Indoor, Outdoor |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India LED display market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India LED display market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India LED display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India LED display market was valued at USD 848.1 Million in 2025.

The India LED display market is projected to exhibit a CAGR of 5.00% during 2026-2034, reaching a value of USD 1,315.6 Million by 2034.

The key factors include the rising demand for digital advertising and signage, government initiatives like Smart Cities Mission, decreasing LED technology costs, and increasing product adoption across retail, entertainment, and corporate sectors for high-resolution displays.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)