India Leisure Travel Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Expenditure Type, Sales Channel, and Region, 2025-2033

India Leisure Travel Market Overview:

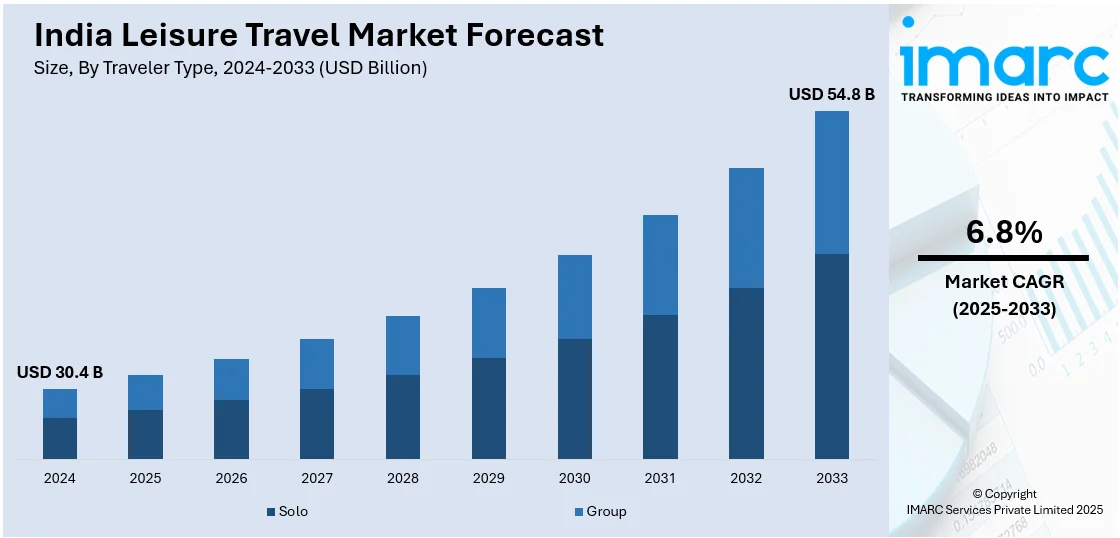

The India leisure travel market size reached USD 30.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 54.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.8% during 2025-2033. Government initiatives promoting domestic tourism, rising disposable income, enhanced connectivity through new flight routes, expansion of digital travel platforms, increasing demand for experiential travel, escalation in pilgrimage tourism, improved infrastructure, and seasonal travel trends collectively contribute to the strong momentum in India's leisure travel market, attracting diverse traveler segments nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.4 Billion |

| Market Forecast in 2033 | USD 54.8 Billion |

| Market Growth Rate 2025-2033 | 6.8% |

India Leisure Travel Market Trends:

Government Initiatives Promoting Domestic Tourism

The Government of India has introduced numerous programs to enhance domestic travel, appreciating its ability to fuel economic growth and cultural interaction. Among them is the "Dekho Apna Desh" campaign, which calls on Indians to discover the country's varied destinations. Through increased awareness of India's rich heritage and natural scenery, the campaign has promoted domestic travel, especially to off-the-beaten-path destinations. This has aided in dispersing the benefits of tourism more equally, stimulating regional growth and increasing local economies. Another notable initiative is the PRASHAD (Pilgrimage Rejuvenation and Spiritual Augmentation Drive) plan, which concentrates on the development of pilgrimage centers. By enhancing infrastructure and visitor facilities, the scheme aims to make religious tourism easier and more attractive to domestic tourists. This not only serves the religious interests of visitors but also enhances local economies by boosting tourist arrivals in these places. Collectively, these efforts are dramatically transforming India's leisure travel sector, making domestic tourism livelier and more sustainable.

To get more information on this market, Request Sample

Rising Disposable Incomes

India's vibrant vacation travel market is being strongly influenced by the rise in disposable individual income. As Indian families are increasingly becoming financially more secure, discretionary expenditure on tourism has jumped, and vacations and leisure vacations are becoming available to a larger segment of society. Statistics from the Ministry of Statistics and Programme Implementation indicate that India's Disposable Personal Income rose to 296,383,300 INR million in 2023, compared to 273,364,818.90 INR million in 2022. The rise in purchasing power has led to a robust demand for local and foreign travel, with more Indians looking to visit new places. The growing middle class is the driving force behind this revolution. Improved economic conditions have led to this segment increasingly desiring leisure experiences, and the consequent swift growth of the tourism sector. The possibility of a wide range of travel segments priced for various pockets has also made travel cheaper than before. From affordable domestic escapes to high-end global holidays, India's tourism sector is transforming to suit the requirements of its growing consumer base.

India Leisure Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on traveler type, age group, expenditure type, and sales channel.

Traveler Type Insights:

- Solo

- Group

The report has provided a detailed breakup and analysis of the market based on the traveler type. This includes solo and group.

Age Group Insights:

- Baby Boomers

- Generation X

- Millennial

- Generation Z

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes baby boomers, generation X, millennial, and generation Z.

Expenditure Type Insights:

- Lodging

- Transportation

- Food and Beverages

- Events and Entertainment

- Others

A detailed breakup and analysis of the market based on the expenditure type have also been provided in the report. This includes lodging, transportation, food and beverages, events and entertainment, and others.

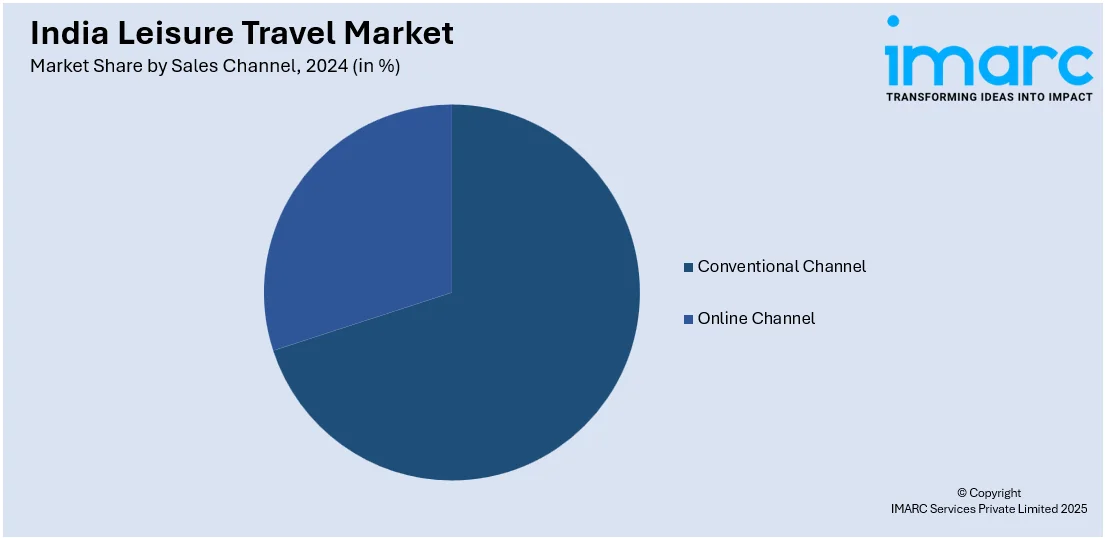

Sales Channel Insights:

- Conventional Channel

- Online Channel

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes conventional channel and online channel.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Leisure Travel Market News:

- March 2025: Air India introduced the resumption of its non-stop services from Mumbai to Melbourne from September 2025, operating three times a week using Boeing 787-8 Dreamliner planes.The reinstatement is expected to enhance connectivity between Australia and India, driving both business as well as leisure travel. The enhanced accessibility is expected to drive outbound tourism from India, positively impacting the leisure travel sector of the country.

- March 2025: Vietnam Airlines is scheduled to introduce direct flights from Bengaluru and Hyderabad to Hanoi in May 2025, with four flights a week from Bengaluru and three from Hyderabad on Airbus A321 aircraft. The move will increase connectivity between southern India and Vietnam, with more leisure travel and cultural exchange. By facilitating easier travel, the move is likely to drive tourism and boost relations between the two regions.

- November 2024: Hilton Worldwide is going to double its number of hotel rooms in India within the next five years as it seeks to bridge the gap with rivals in a booming local travel market. The expansion comprises a licensing deal with India's Embassy Group to develop 150 Spark brand hotels, Hilton's India-first brand launch in the Asia-Pacific region. These happenings add to the accommodation facilities, trigger competition, and satisfy the propelling demand from middle-income tourists, thus accelerating India's leisure travel industry growth.

India Leisure Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Baby Boomers, Generation X, Millennial, Generation Z |

| Expenditure Types Covered | Lodging, Transportation, Food, Beverages, Events, Entertainment, Others |

| Sales Channels Covered | Conventional Channel, Online Channel |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India leisure travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India leisure travel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India leisure travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India leisure travel market was valued at USD 30.4 Billion in 2024.

The India leisure travel market is projected to grow at a CAGR of 6.8% during 2025-2033, reaching USD 54.8 Billion by 2033.

Key drivers of the market include the rising disposable income levels, introduction of government initiatives such as the "Dekho Apna Desh" campaign, expansion of pilgrimage and cultural tourism, enhanced digital travel infrastructure, and growing consumer demand for diverse travel experiences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)