India Lentil Market Size, Share, Trends and Forecast by End Use and Region, 2025-2033

India Lentil Market Overview:

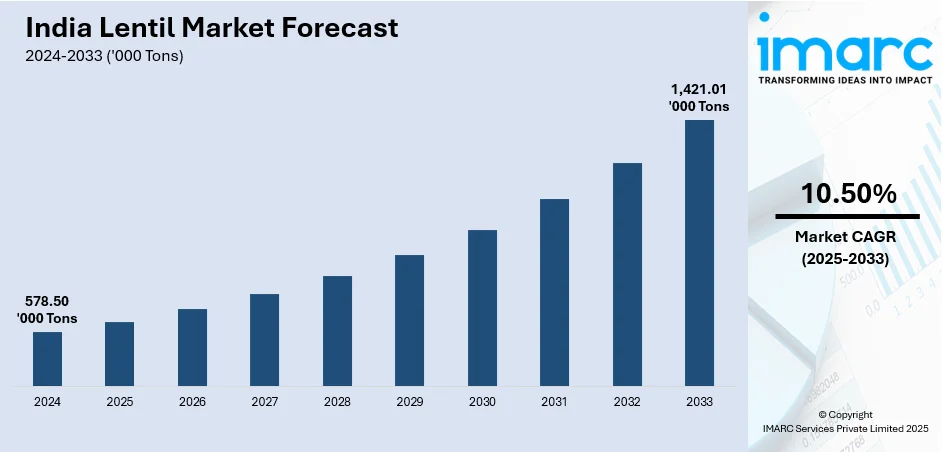

The India lentil market size reached 578.50 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 1,421.01 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 10.50% during 2025-2033. The market is expanding due to rising domestic consumption, government MSP support and growing demand in home cooking, snacks and flour industries. Urbanization, health trends and plant-based diets further drive market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 578.50 Thousand Tons |

| Market Forecast in 2033 | 1,421.01 Thousand Tons |

| Market Growth Rate (2025-2033) | 10.50% |

India Lentil Market Trends:

Rising Popularity of Plant-Based Diets

The rising popularity of plant-based diets is driving demand, as consumers increasingly seek protein-rich, sustainable alternatives to animal-based foods. According to industry reports, India leads globally with 38% of its population identifying as vegetarians, largely influenced by Buddhism and Jainism since the 6th Century BC. The predominant dietary practice is Lacto-vegetarianism. Lentils are a staple in vegetarian and vegan diets due to their high protein, fiber and micronutrient content. India lentil market share continues to grow as plant-based food consumption rises with lentils being widely used in traditional dishes, plant-based protein products and value-added processed foods. The trend is fueled by growing health awareness, ethical considerations and environmental concerns. Food manufacturers are incorporating lentils into plant-based meat substitutes, protein-rich snacks and fortified food products. The expansion of the health and wellness sector along with government initiatives promoting pulses under nutritional programs further supports market growth. Urbanization and busy lifestyles are also boosting the demand for ready-to-cook lentil-based meals. Additionally, global food chains and local startups are launching innovative lentil-based products enhancing accessibility and consumption. This shift is reshaping the Indian pulse industry with lentils playing a crucial role in the evolving dietary landscape.

To get more information on this market, Request Sample

Government Support & MSP Policies

Government support through Minimum Support Price (MSP) policies and import restrictions contributes positively to the India lentil market outlook. The Indian government revises MSP annually to ensure fair returns for farmers encouraging lentil cultivation. In recent years, MSP hikes have incentivized production reducing dependency on imports. Additionally, the government imposes import restrictions and higher tariffs on lentils from countries like Canada and Australia to protect domestic farmers and stabilize prices. According to the data published by IBEF, India is set to become the largest lentil producer in the 2023-24 crop year with an estimated production of 1.6 million tonnes according to Consumer Affairs Secretary. While Canada's output has been reduced Australia's is projected at 1.4 million tonnes as India aims for self-sufficiency by December 2027. Under initiatives like the National Food Security Mission (NFSM) and Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) farmers receive financial aid, improved seed varieties and better irrigation facilities to boost production. However, price volatility and unpredictable weather patterns continue to challenge market stability. These policies combined with growing domestic demand are driving the India lentil market growth, while gradually reducing reliance on imported pulses.

India Lentil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on end use.

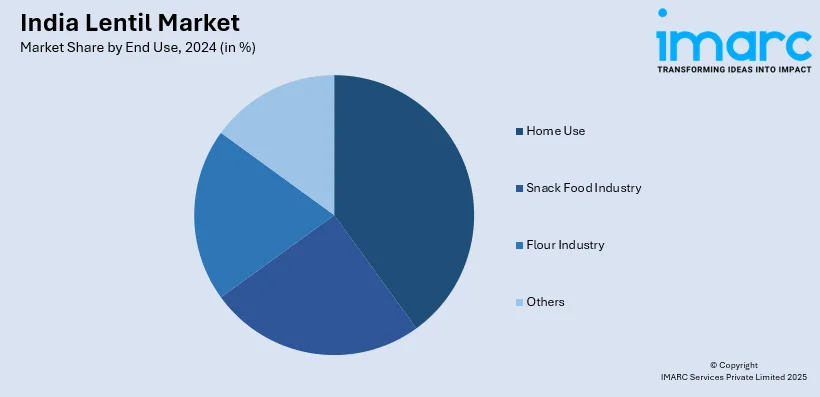

End Use Insights:

- Home Use

- Snack Food Industry

- Flour Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes home use, snack food industry, flour industry and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Lentil Market News:

- In February 2024, the Union Minister of India emphasized India's agricultural self-sufficiency, highlighting a 60% increase in pulse production over the last decade. He praised initiatives like Bharat Dal, which captured a 25% market share in four months. The minister urged further support for diversifying into pulses and lentils to bolster exports and food security.

India Lentil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Home Use, Snack Food Industry, Flour Industry, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India lentil market performed so far and how will it perform in the coming years?

- What is the breakup of the India lentil market on the basis of end use?

- What is the breakup of the India lentil market on the basis of region?

- What are the various stages in the value chain of the India lentil market?

- What are the key driving factors and challenges in the India lentil market?

- What is the structure of the India lentil market and who are the key players?

- What is the degree of competition in the India lentil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India lentil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India lentil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India lentil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)