India Life Science Analytics Market Size, Share, Trends and Forecast by Type, Component, Deployment Mode, Application, End Use, and Region, 2025-2033

India Life Science Analytics Market Overview:

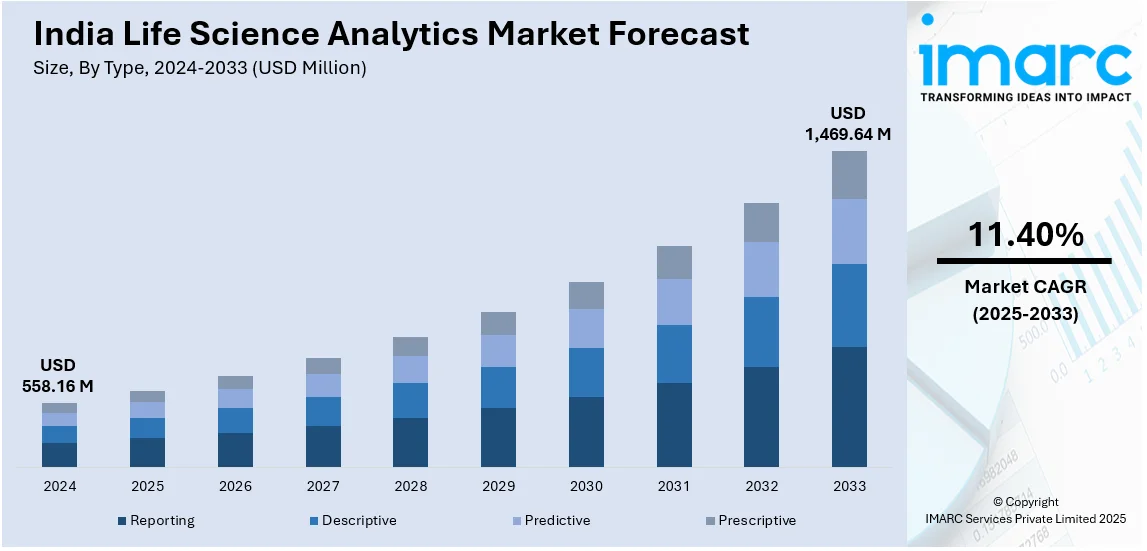

The India life science analytics market size reached USD 558.16 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,469.64 Million by 2033, exhibiting a growth rate (CAGR) of 11.40% during 2025-2033. The rising adoption of digital health technologies, such as electronic health records, telemedicine, and advanced data analytics, enhances decision-making, improves clinical outcomes, and enables personalized medicine, driving demand for life science analytics solutions in healthcare.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 558.16 Million |

| Market Forecast in 2033 | USD 1,469.64 Million |

| Market Growth Rate 2025-2033 | 11.40% |

India Life Science Analytics Market Trends:

Growing Shift Toward Predictive Analytics

India's life sciences industry is quickly adopting predictive analytics to enhance decision-making in clinical and operations processes. Life sciences and pharmaceutical companies are using AI and machine learning (ML) to predict disease progression, make clinical trial optimization decisions, and personalize medicines. With structured and unstructured health data now more readily available, predictive analytics is accelerating drug discovery by spotting high-potential molecules early in the development stage. Regulatory authorities are backing data-driven strategies, speeding up adoption in hospitals, research centers, and pharmaceutical companies. This digital revolution is a major growth driver for India's pharma sector, which is projected to almost double to $130 billion by 2030. The convergence of artificial intelligence (AI), ML, and precision medicine is transforming healthcare delivery, enhancing patient outcomes, and maximizing resource efficiency, making India a center for data-driven life sciences innovation.

To get more information on this market, Request Sample

Adoption of Real-World Evidence (RWE) and Real-World Data (RWD)

The use of real-world evidence (RWE) and real-world data (RWD) is becoming increasingly important in the life science analytics space in India. Pharmaceutical and biotechnology firms are using RWD from electronic health records, patient registries, insurance claims, and wearables to create RWE that supports drug development and market access. This trend is redefining regulatory approval procedures and post-market monitoring by facilitating a deeper understanding of drug performance in real-world environments. RWE also strengthens value-based care models and aids evidence-based pricing and reimbursement decisions. With healthcare data infrastructure expanding rapidly in India, RWE is fast emerging as a critical tool for improving patient care, making clinical trials more robust, and informing policy decisions by providing more accurate and complete assessments of patient outcomes.

Rise of Cloud-Based Analytics Platforms

Cloud analytics platforms are becoming increasingly popular in India's life science industry because of their scalability, cost-effectiveness, and accessibility. Companies are transitioning from on-premise deployments to cloud infrastructure to manage significant amounts of clinical, genomic, and patient data more effectively. This movement enables quicker deployment of analytics tools, instant data collaboration among various stakeholders, and effortless integration with sophisticated AI/ML applications. Cloud platforms facilitate regulatory compliance, too, with secure and encrypted environments where sensitive healthcare data is protected. Startups and small- and medium-sized firms enjoy reduced requirements for capital investments with access to the latest analytics capabilities. Cloud-based analytics become a focal point as digital change moves at increasingly higher speeds within India's health ecosystem, enhancing innovation, making research more productive, and making patients more involved.

India Life Science Analytics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, component, deployment mode, application and end use.

Type Insights:

- Reporting

- Descriptive

- Predictive

- Prescriptive

The report has provided a detailed breakup and analysis of the market based on the type. This includes reporting, descriptive, predictive, and prescriptive.

Component Insights:

- Software

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes software, and services.

Deployment Mode Insights:

- On-demand

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-demand, and on-premises.

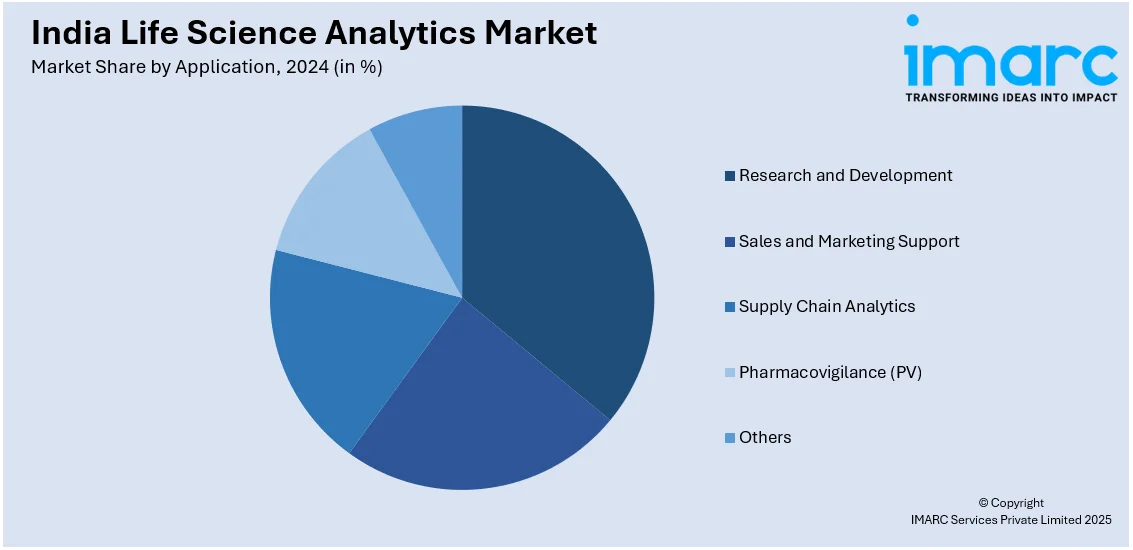

Application Insights:

- Research and Development

- Sales and Marketing Support

- Supply Chain Analytics

- Pharmacovigilance (PV)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes research and development, sales and marketing support, supply chain analytics, pharmacovigilance (PV), and others.

End Use Insights:

- Medical Devices

- Pharmaceutical

- Biotechnology

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes medical devices, pharmaceutical, biotechnology, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Life Science Analytics Market News:

- In January 2025, Clarivate Plc launched DRG Fusion, a modular analytics platform designed to support commercial teams in the life sciences sector. Powered by integrated real-world data, Fusion offers configurable dashboards for patient journey analysis, commercial targeting, and market access optimization. Tailored to biopharma and medtech needs, it simplifies data insights and enhances patient outcomes. Future updates will include AI-driven, self-service features, further strengthening its value in transforming healthcare decision-making.

- In March 2024, Axtria Inc. opened its largest India office in Hyderabad, spanning 76,000 sq. ft. at DLF Cyber City. The LEED Platinum-certified, sustainable facility supports AI-driven life sciences analytics and generative AI services. This expansion strengthens Axtria’s regional presence and talent base, with plans to hire 800 professionals globally. The move reflects Axtria’s commitment to innovation, sustainability, and enhancing healthcare outcomes through advanced data science and technology solutions.

India Life Science Analytics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Reporting, Descriptive, Predictive, Prescriptive |

| Components Covered | Software, Services |

| Deployment Modes Covered | On-demand, On-premises |

| Applications Covered | Research and Development, Sales and Marketing Support, Supply Chain Analytics, Pharmacovigilance (PV), Others |

| End Use Covered | Medical Devices, Pharmaceutical, Biotechnology, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India life science analytics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India life science analytics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India life science analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The life science analytics market in India was valued at USD 558.16 Million in 2024.

The India life science analytics market is projected to exhibit a CAGR of 11.40% during 2025-2033, reaching a value of USD 1,469.64 Million by 2033.

The India life science analytics market is driven by increasing adoption of advanced analytics in drug discovery and clinical trials, growing demand for personalized medicine, and rising prevalence of chronic diseases. Technological advancements, including AI and cloud-based platforms, further accelerate the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)