India Linear Alkyl Benzene Market Size, Share, Trends and Forecast by Application, End User, and Region, 2025-2033

India Linear Alkyl Benzene Market Overview:

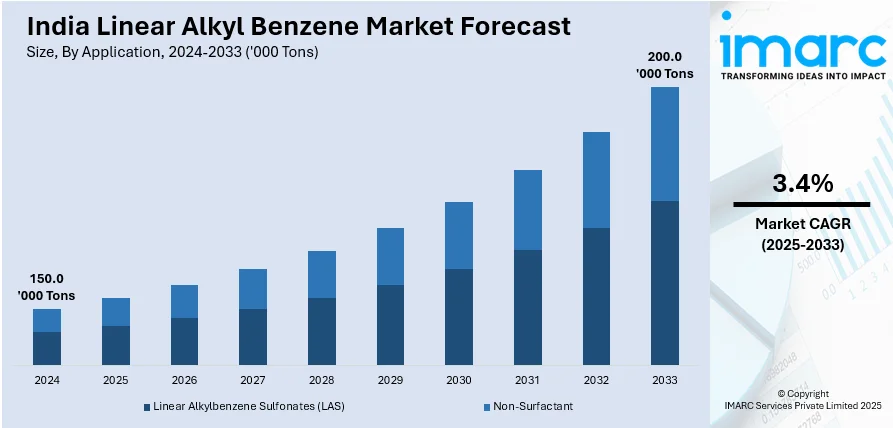

The India linear alkyl benzene market size reached 150.0 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 200.0 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 3.4% during 2025-2033. The rising demand for biodegradable surfactants, increasing household and industrial detergent consumption, rapid urbanization, growing disposable income, and stringent environmental regulations promoting sustainable alternatives are some of the major factors augmenting the India linear alkyl benzene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 150.0 Thousand Tons |

| Market Forecast in 2033 | 200.0 Thousand Tons |

| Market Growth Rate 2025-2033 | 3.4% |

India Linear Alkyl Benzene Market Trends:

Expanding Industrial Applications and Specialty Chemicals Demand

The usage of linear alkyl benzene in industrial applications, lubricant additives, emulsifiers, and agricultural chemicals is expanding. The increasing demand for industrial lubricants, driven by expanding manufacturing, automotive, and infrastructure sectors, is creating lucrative opportunities for LAB-based additives. Lubricants formulated with LAB-derived sulfonates offer superior thermal stability and oxidation resistance, which makes them suitable for high-performance applications. Additionally, the agrochemical sector in India is incorporating LAB-based surfactants in pesticide formulations to enhance dispersion and efficacy. Furthermore, the rising need for emulsifiers in textile processing and oil recovery is also contributing to India linear alkyl benzene market growth. Also, specialty chemical manufacturers are exploring LAB derivatives to develop cost-effective, performance-enhancing surfactants tailored to industrial requirements. Besides this, major petrochemical companies are investing in LAB production. For instance, on September 6, 2024, Tamilnadu Petroproducts Ltd. (TPL) announced plans to commission expanded capacities for its Linear Alkyl Benzene (LAB) and Caustic Soda plants by 2026, with a total investment of INR 405 Crore. The increased investments and expansion of production facilities are strengthening domestic supply chains, reducing dependence on imports, and stabilizing pricing. The trend toward high-value applications is prompting refiners and chemical producers to optimize process efficiencies and diversify their LAB portfolios to cater to evolving industry needs.

To get more information on this market, Request Sample

Rising Household Detergent Consumption Driving Linear Alkyl Benzene Demand

The increasing penetration of washing machines, rising urbanization, and changing consumer lifestyles are fueling the demand for household detergents in India, directly impacting the consumption of Linear Alkyl Benzene (LAB). According to IBEF, The Indian washing appliance market, which is presently worth USD 3.76 Billion, is projected to increase at a CAGR of 7.65% to reach USD 5.43 Billion by 2029. This expansion is fueling higher detergent consumption, particularly liquid and powder formulations that rely on LAB-based surfactants for effective cleaning and biodegradability. Moreover, leading FMCG companies are expanding their detergent portfolios to cater to shifting consumer preferences, emphasizing premium, high-performance, and eco-friendly formulations. In addition to this, consumers are opting for premium detergents offering enhanced stain removal and fragrance retention, leading to increased demand for high-performance surfactants like Linear Alkyl Benzene Sulfonate (LAS). Also, e-commerce and modern retail channels are further increasing detergent sales, making advanced formulations more accessible to consumers across different price segments. Rural markets are also witnessing a surge in detergent adoption, driven by improved electricity access and growing awareness of hygiene and sanitation. Apart from this, the implementation of government initiatives such as the Swachh Bharat Abhiyan and pandemic-induced hygiene awareness further reinforces the importance of effective cleaning solutions, accelerating detergent consumption, which is positively impacting the India linear alkyl benzene market outlook.

India Linear Alkyl Benzene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on application and end user.

Application Insights:

- Linear Alkylbenzene Sulfonates (LAS)

- Non-Surfactant

The report has provided a detailed breakup and analysis of the market based on the application. This includes linear alkylbenzene sulfonates (LAS) and non-surfactant.

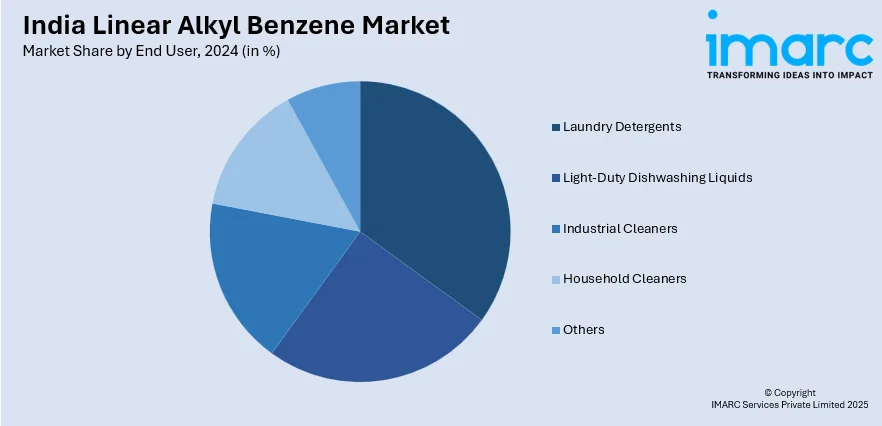

End User Insights:

- Laundry Detergents

- Light-Duty Dishwashing Liquids

- Industrial Cleaners

- Household Cleaners

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes laundry detergents, light-duty dishwashing liquids, industrial cleaners, household cleaners, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Linear Alkyl Benzene Market News:

- On April 24, 2024, Tamilnadu Petroproducts Limited (TPL), a prominent producer of industrial intermediate chemicals, especially linear alkyl benzene, announced a partnership with consulting firm EY-Parthenon to develop an integrated carbon-neutral roadmap consistent with its long-term sustainability goals. With an emphasis on Scope 1 and 2 emissions, this partnership seeks to set internal reduction goals along with the Science-Based Targets initiative (SBTi). To attain carbon-neutral manufacturing, TPL intends to apply interventions including digital automation, circularity, process efficiency enhancements, and sustainable energy substitution.

India Linear Alkyl Benzene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Linear Alkylbenzene Sulfonates (LAS), Non-Surfactant |

| End Users Covered | Laundry Detergents, Light-Duty Dishwashing Liquids, Industrial Cleaners, Household Cleaners, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India linear alkyl benzene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India linear alkyl benzene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India linear alkyl benzene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The linear alkyl benzene market in India reached 150.0 Thousand Tons in 2024.

The India linear alkyl benzene market is projected to exhibit a CAGR of 3.4% during 2025-2033, reaching a volume of 200.0 Thousand Tons by 2033.

Surging demand for household detergents and industrial cleaners drives growth. Rapid urbanization, rising hygiene awareness, and expanding manufacturing activities support consumption. Domestic production incentives and availability of raw materials such as kerosene and benzene also aid the market’s steady development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)