India Liquid Nitrogen Market Size, Share, Trends and Forecast by Technology, Function, Storage Type, End User, and Region, 2025-2033

India Liquid Nitrogen Market Overview:

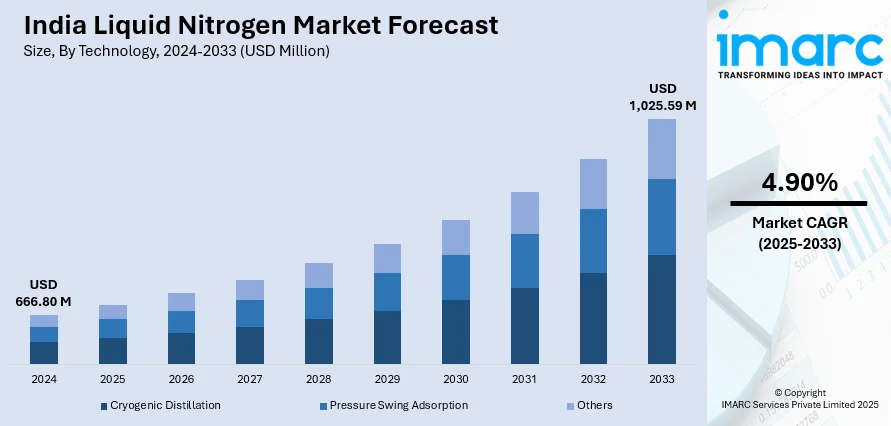

The India liquid nitrogen market size reached USD 666.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,025.59 Million by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The expansion of industrial gas infrastructure and rising investments in cryogenic systems are enhancing liquid nitrogen production, storage, and distribution in India. These developments boost local production, reduce reliance on imports, and improve supply chain efficiency, benefiting industries like manufacturing, healthcare, and energy through increased accessibility and cost-effectiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 666.80 Million |

| Market Forecast in 2033 | USD 1,025.59 Million |

| Market Growth Rate (2025-2033) | 4.90% |

India Liquid Nitrogen Market Trends:

Expansion of Industrial Gas Infrastructure

Companies are making significant investments in sophisticated cryogenic facilities, pipelines, and storage systems, which are essential for maintaining a steady and effective supply of gases such as liquid nitrogen. These investments are crucial for boosting local production capability, which subsequently increases availability and lessens reliance on imported gases. Furthermore, sectors like manufacturing, food production, pharmaceuticals, and healthcare are gaining better access to liquid nitrogen at more competitive rates, positioning it as a favored choice for numerous applications. The increasing capacity for domestic production is enhancing cost-effectiveness, enabling industries to incorporate liquid nitrogen into their operations with greater financial feasibility. Moreover, strategic alliances between industrial gas providers and end-user sectors are strengthening the supply chain, guaranteeing that liquid nitrogen is accessible at the most critical times and locations. A prime illustration of this trend is the opening of a new ₹145 crore gas production facility by Sol India Pvt Ltd in 2023at SIPCOT, Ranipet, which greatly enhanced production capacity from 80 to 200 tons per day, catering to the rising demand in both the industrial and healthcare markets.

To get more information on this market, Request Sample

Rising Investment in Cryogenic Infrastructure

The growing focus on developing cryogenic infrastructure to enhance production, storage, and distribution efficiencies is offering a favorable market outlook. Rising investments in the production of advanced cryogenic equipment are improving the accessibility and effectiveness of liquid nitrogen in various sectors. The local manufacturing of large-capacity storage tanks, transport containers, and related cryogenic systems is diminishing dependence on imports, decreasing expenses, and guaranteeing a consistent supply. This is especially vital for sectors like healthcare, energy, and manufacturing, where liquid nitrogen is essential for uses such as medical gas storage, green fuel creation, and industrial cooling. Furthermore, improvements in cryogenic insulation and energy-efficient storage technologies are enhancing the performance and safety of liquid nitrogen management systems. As India enhances its cryogenic infrastructure via extensive manufacturing and technological advancements, the liquid nitrogen market is witnessing growth, fueled by broadening industrial uses and improved supply chain efficiency. In line with this trend, in 2023, INOXCVA began construction of India's largest cryogenic equipment manufacturing facility in Savli, Gujarat, covering 30 acres. The facility, with an investment of ₹200 crore, aimed to enhance cryogenic storage solutions for liquid nitrogen, green fuels, medical gases, and industrial gases.

India Liquid Nitrogen Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology, function, storage type, and end user.

Technology Insights:

- Cryogenic Distillation

- Pressure Swing Adsorption

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes cryogenic distillation, pressure swing adsorption, and others.

Function Insights:

- Coolant

- Refrigerant

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes coolant and refrigerant.

Storage Type Insights:

- Cylinders and Packaged Gas

- Merchant Liquid/Bulk

- Tonnage

- Others

The report has provided a detailed breakup and analysis of the market based on the storage type. This includes cylinders and packaged gas, merchant liquid/bulk, tonnage, and others.

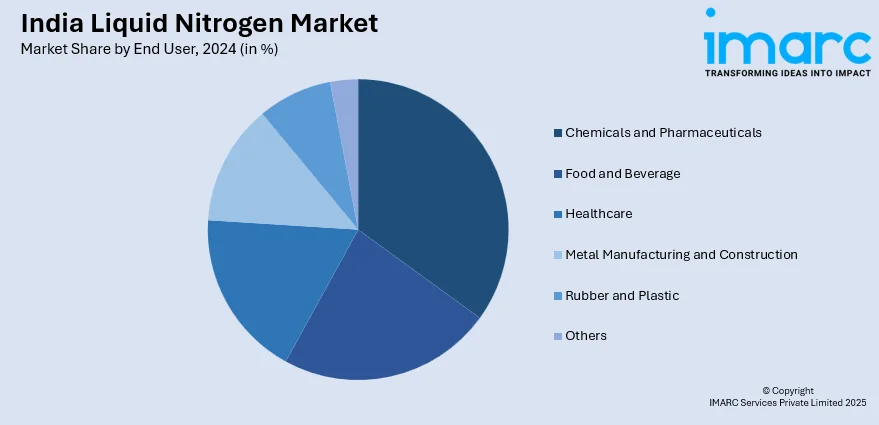

End User Insights:

- Chemicals and Pharmaceuticals

- Food and Beverage

- Healthcare

- Metal Manufacturing and Construction

- Rubber and Plastic

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes chemicals and pharmaceuticals, food and beverage, healthcare, metal manufacturing and construction, rubber and plastic, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Liquid Nitrogen Market News:

- In July 2024, Air Liquide India opened a Rs 350 crore manufacturing facility in Mathura, Uttar Pradesh, producing medical-grade oxygen, liquid nitrogen, and other gases. The plant supplied hospitals and industries across Delhi, Western Uttar Pradesh, Rajasthan, and Madhya Pradesh. By 2030, it aimed to run entirely on renewable energy.

- In April 2024, INOX India Ltd received a patent for a novel technique to suspend inner vessels in Dewar-type containers designed for the storage of cryogenic fluids like liquid nitrogen, oxygen, and argon. This new design enhanced the stability, safety, and efficiency of these containers. The patent was expected to benefit industries such as healthcare, food processing, and manufacturing.

India Liquid Nitrogen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Cryogenic Distillation, Pressure Swing Adsorption, Others |

| Functions Covered | Coolant, Refrigerant |

| Storage Types Covered | Cylinders and Packaged Gas, Merchant Liquid/Bulk, Tonnage, Others |

| End Users Covered | Chemicals and Pharmaceuticals, Food and Beverage, Healthcare, Metal Manufacturing and Construction, Rubber and Plastic, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India liquid nitrogen market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India liquid nitrogen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India liquid nitrogen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India liquid nitrogen market was valued at USD 666.80 Million in 2024.

The India liquid nitrogen market is projected to exhibit a CAGR of 4.90% during 2025-2033, reaching a value of USD 1,025.59 Million by 2033.

India's liquid nitrogen market is primarily driven by expanding industrial gas infrastructure, increased adoption in cryogenic medical applications, and growing food processing needs. Investments in local production and storage capacity reduce reliance on imports, enhancing supply efficiency. Its non-toxic, inert nature also fuels demand in pharmaceuticals, chemicals, and metal fabrication.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)