India Liquid Oxygen Market Size, Share, Trends, and Forecast by Type, End User, and Region, 2025-2033

India Liquid Oxygen Market Overview:

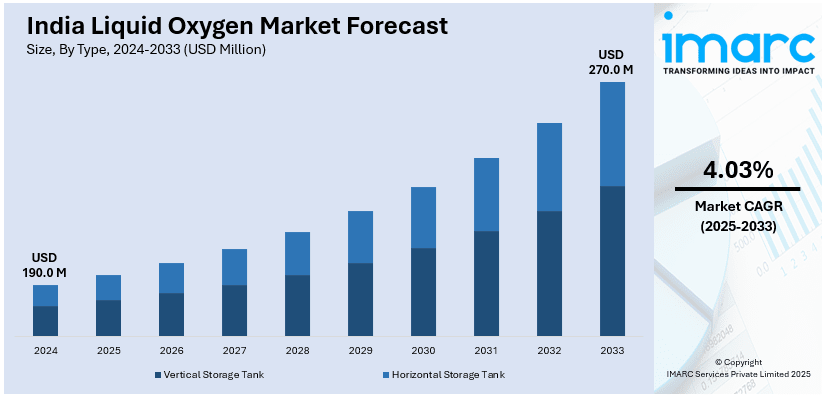

The India liquid oxygen market size reached USD 190.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 270.0 Million by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. The market is rapidly rising, propelled by hospitals, industrial manufacturing, and energy applications. Additionally, the major players in liquid oxygen are increasing production facilities and extending their distribution networks to provide a reliable and efficient supply to various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 190.0 Million |

| Market Forecast in 2033 | USD 270.0 Million |

| Market Growth Rate 2025-2033 | 4.03% |

India Liquid Oxygen Market Trends:

Rising Demand from Healthcare and Medical Applications

The demand for liquid oxygen in India is growing significantly due to its critical role in the healthcare sector. Hospitals, diagnostic centers, and emergency medical services rely on liquid oxygen for respiratory therapy, intensive care units (ICUs), and surgeries. The COVID-19 pandemic exposed supply chain vulnerabilities, leading to increased investments in medical oxygen infrastructure. Moreover, government initiatives such as the installation of Pressure Swing Adsorption (PSA) oxygen plants in hospitals have improved availability, but liquid oxygen remains essential for high-volume supply. For instance, in December 2024, the Government of India (GOI) announced plans to install 32 PSA oxygen plants in Jammu and Kashmir, part of 1,561 nationwide, to strengthen healthcare infrastructure. The initiative enhances medical oxygen availability, while broader efforts address air pollution and respiratory health risks through emission controls and clean energy programs. Additionally, regulatory focus on maintaining oxygen reserves and setting up oxygen corridors is enhancing distribution efficiency. Furthermore, the private sector is also investing in cryogenic storage and transportation solutions to meet the growing need for medical-grade oxygen. These developments are shaping a more resilient and responsive liquid oxygen supply network across India’s healthcare industry.

To get more information on this market, Request Sample

Expansion of Industrial Applications and Infrastructure

Industrial consumption of liquid oxygen in India is rising due to increased manufacturing, metal production, and chemical processing activities. Sectors such as steelmaking, welding, glass manufacturing, and petrochemicals rely on liquid oxygen for combustion enhancement, oxidation, and refining processes. Steel plants, in particular, require large quantities of liquid oxygen for blast furnace operations, and their capacity expansions are directly influencing market growth. Additionally, the aerospace and defense sectors are increasingly utilizing liquid oxygen as an oxidizer in rocket propulsion systems. In order to support this demand, suppliers are investing in cryogenic storage, transportation, and distribution infrastructure. For instance, in May 2024, ISRO announced plans to advance the development of a 2,000 kN thrust semi-cryogenic engine using Liquid Oxygen and Kerosene. This initiative aims to enhance the payload capacity of future launch vehicles, marking a significant milestone in India's space capabilities. The market is witnessing technological advancements in liquefaction plants and cryogenic tank manufacturing, ensuring efficient handling and supply. This industrial shift is reinforcing liquid oxygen’s role as a crucial input for India’s growing manufacturing and energy sectors.

India Liquid Oxygen Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Vertical Storage Tank

- Horizontal Storage Tank

The report has provided a detailed breakup and analysis of the market based on the type. This includes vertical storage tank and horizontal storage tank.

End User Insights:

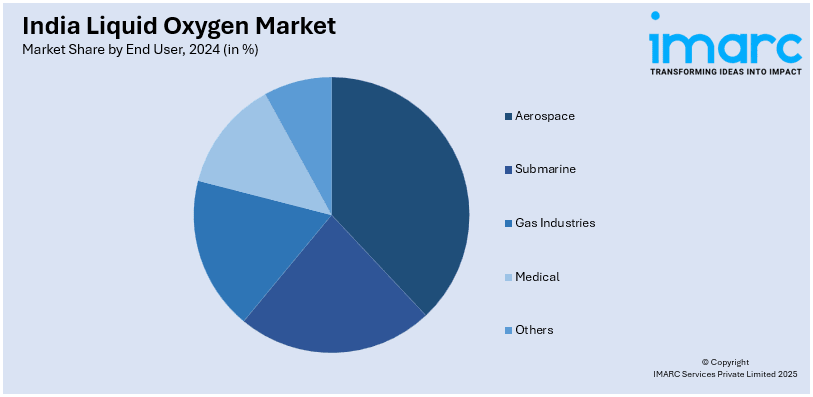

- Aerospace

- Submarine

- Gas Industries

- Medical

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes aerospace, submarine, gas industries, medical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Liquid Oxygen Market News:

- In August 2024, Air Liquide India announced the launch of a state-of-the-art Air Separation Unit (ASU) in Kosi, Mathura, Uttar Pradesh. This facility, now the largest liquid gases plant in the state, boasts a production capacity exceeding 365 tons per day. The plant supplies industrial and medical oxygen across North India with a 365 TPD capacity and aims to operate entirely on renewable energy by 2030.

India Liquid Oxygen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vertical Storage Tank, Horizontal Storage Tank |

| End Users Covered | Aerospace, Submarine, Gas Industries, Medical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India liquid oxygen market performed so far and how will it perform in the coming years?

- What is the breakup of the India liquid oxygen market on the basis of type?

- What is the breakup of the India liquid oxygen market on the basis of end user?

- What is the breakup of the India liquid oxygen market on the basis of region?

- What are the various stages in the value chain of the India liquid oxygen market?

- What are the key driving factors and challenges in the India liquid oxygen market?

- What is the structure of the India liquid oxygen market and who are the key players?

- What is the degree of competition in the India liquid oxygen market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India liquid oxygen market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India liquid oxygen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India liquid oxygen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)