India LLDPE Market Size, Share, Trends and Forecast by Application, End User, and Region, 2025-2033

India LLDPE Market Overview:

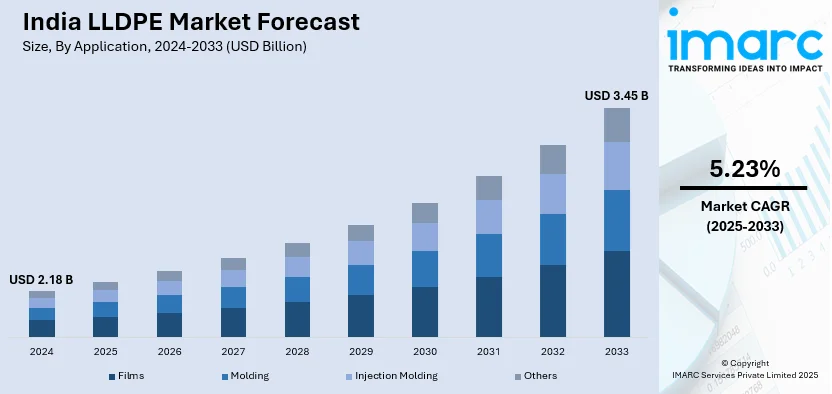

The India LLDPE market size reached USD 2.18 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.45 Billion by 2033, exhibiting a growth rate (CAGR) of 5.23% during 2025-2033. The market is driven by increasing demand for flexible packaging, rising adoption in agriculture for greenhouse films and irrigation pipes, and growth in the automotive sector for lightweight components. Additionally, expanding e-commerce, infrastructure development, and advancements in polymer processing technologies are further fueling market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.18 Billion |

| Market Forecast in 2033 | USD 3.45 Billion |

| Market Growth Rate 2025-2033 | 5.23% |

India LLDPE Market Trends:

Growing Demand for Flexible Packaging in E-Commerce and Fast-Moving Consumer Goods (FMCG)

Linear Low-Density Polyethylene (LLDPE) is a key material in flexible packaging, widely used in films, pouches, and stretch wraps due to its durability, lightweight nature, and cost efficiency. The rapid growth of e-commerce and the FMCG sector is significantly increasing demand for LLDPE-based packaging solutions. India’s flexible packaging market is projected to grow at a CAGR of 12.4% from 2025 to 2033, fueled by rapid retail expansion and rising online sales. India’s e-commerce sector recorded around $14 billion in Gross Merchandise Value (GMV) during the 2024 festive season, marking a 12% year-on-year rise and emphasizing the increasing demand for protective LLDPE films. Additionally, the FMCG sector is projected to grow at a CAGR of 27.9% from 2021 to 2027, reaching nearly $615.87 billion, further fueling LLDPE consumption in food and beverage packaging. With increasing sustainability concerns, the demand for biodegradable and recyclable LLDPE-based films is rising, prompting advancements in polymer processing. As the industry shifts towards eco-friendly alternatives, innovations in LLDPE formulations are expected to play a crucial role in shaping the future of India’s packaging sector.

To get more information on this market, Request Sample

Expansion of LLDPE in the Agricultural Sector

India’s agriculture sector is increasingly utilizing Linear Low-Density Polyethylene (LLDPE)-based solutions such as greenhouse films, irrigation pipes, and mulch films to boost productivity and improve water conservation. The government's emphasis on modern farming practices, including micro-irrigation and precision agriculture, is driving significant demand for LLDPE. India’s agricultural film market is projected to grow at a CAGR of 7.22% from 2025 to 2033, largely fueled by LLDPE-based applications. Additionally, India has the world's largest groundwater well-equipped irrigation system, covering 39 million hectares (67% of its total irrigated area), driving higher demand for LLDPE pipes. Major irrigation projects with a Cultivable Command Area (CCA) exceeding 10,000 hectares are providing an impetus to this growth. Additionally, government initiatives like the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), with an allocation of ₹50,000 crore over five years, are promoting micro-irrigation and watershed development, further boosting LLDPE adoption. As agricultural mechanization expands, LLDPE is playing a crucial role in improving efficiency, sustainability, and resource optimization, making it a key material in India’s evolving farming landscape.

India LLDPE Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application and end user.

Application Insights:

- Films

- Molding

- Injection Molding

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes films, molding, injection molding, and others.

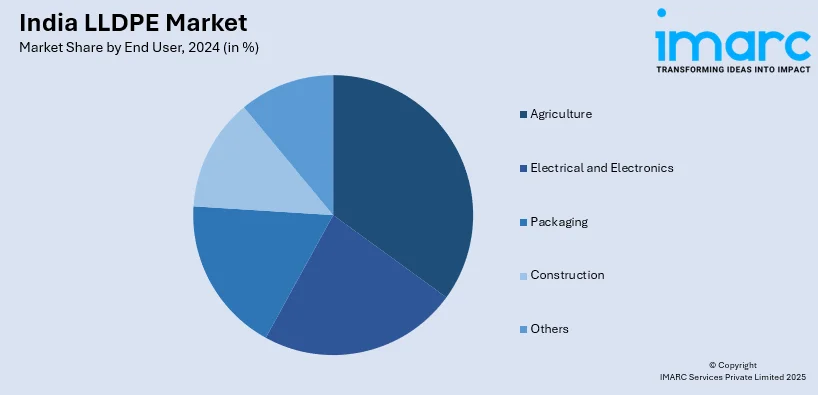

End User Insights:

- Agriculture

- Electrical and Electronics

- Packaging

- Construction

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes agriculture, electrical and electronics, packaging, construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India LLDPE Market News:

- July 2024: Hindustan Petroleum Corporation Ltd (HPCL) unveiled plans to commence two separate projects for LLDPE/High-Density Polyethylene (HDPE) production, each with a capacity of 550,000 tonnes per annum. These projects are part of HPCL's broader strategy to expand its petrochemical manufacturing capabilities to meet India's growing demand.

- June 2024: GAIL (India) Limited is planning to invest ₹60,000 crore (approximately $7.2 billion) in establishing a 1,500 kiloton per annum (KTA) ethane cracker project in Ashta, Sehore district, Madhya Pradesh. This initiative represents one of the largest investments in the region and aims to bolster India's petrochemical industry by producing key derivatives such as LLDPE, HDPE, MEG, and propylene.

India LLDPE Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Films, Molding, Injection Molding, Others |

| End Users Covered | Agriculture, Electrical and Electronics, Packaging, Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India LLDPE market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India LLDPE market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India LLDPE industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The LLDPE market in India was valued at USD 2.18 Billion in 2024.

The LLDPE market in India is projected to exhibit a CAGR of 5.23% during 2025-2033, reaching a value of USD 3.45 Billion by 2033.

India LLDPE market is spurred by increasing demand from flexible packaging, agri-films, and industrial containers. Online growth in e-commerce, FMCG, and food processing industries increases consumption. Pro-manufacturing policies of the government and growing applications in the automotive and construction industries drive market growth. Advances in LLDPE grades and the trend for lightweight, strong, and recyclable material further drive demand in different end-use sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)