India LNG Bunkering Market Size, Share, Trends and Forecast by Ship Type, End-User, and Region, 2026-2034

India LNG Bunkering Market Overview:

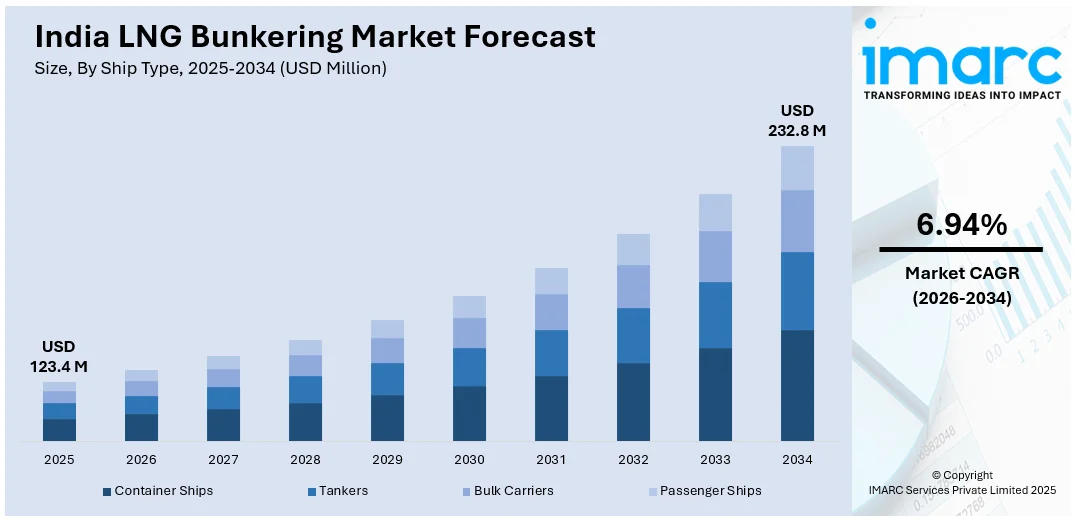

The India LNG bunkering market size reached USD 123.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 232.8 Million by 2034, exhibiting a growth rate (CAGR) of 6.94% during 2026-2034. The market is gaining traction with rising regulatory focus on cleaner marine fuels, infrastructure development at key ports, and growing interest from coastal and inland shipping operators adopting LNG to reduce emissions and ensure long-term operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 123.4 Million |

| Market Forecast in 2034 | USD 232.8 Million |

| Market Growth Rate 2026-2034 | 6.94% |

India LNG Bunkering Market Trends:

Growing Regulatory Push for Cleaner Marine Fuel

India’s LNG bunkering market is gaining momentum as environmental regulations push for cleaner alternatives to traditional marine fuels. The International Maritime Organization’s (IMO) sulphur cap, combined with India’s own commitments to reduce emissions under the Maritime India Vision 2030, is encouraging ports and shipping companies to shift toward LNG as a marine fuel. Additionally, LNG significantly reduces sulphur oxides, nitrogen oxides, and particulate matter as compared to heavy fuel oil, making it a viable compliance solution. Indian shipping operators are beginning to explore dual-fuel vessel options to align with global decarbonization trends. The Indian government is also laying the groundwork by developing policies to support LNG infrastructure in key coastal areas. This includes the development of storage terminals, refueling facilities, and safety protocols. Moreover, as awareness grows about LNG’s long-term cost advantages and environmental compliance benefits, more port authorities and logistics operators are expected to invest in LNG-compatible infrastructure, positioning India as a potential LNG bunkering hub for South Asia in the coming years. For instance, in March 2024, GAIL announced the commissioning of India’s first small-scale LNG unit at its Vijaipur LPG plant in Madhya Pradesh. The facility aims to serve remote consumers not connected to pipelines, supporting India's natural gas-based economy transition.

To get more information on this market Request Sample

Port Infrastructure Development Supporting LNG Bunkering Expansion

Expansion of port infrastructure is playing a central role in driving India’s LNG bunkering market growth. Public-private partnerships are being formed to build the required storage tanks, loading arms, pipelines, and mobile bunkering solutions. The goal is to create a viable network of LNG-ready ports that can support coastal shipping and international marine traffic. Moreover, key players are investing in LNG terminals and collaborating with shipping companies to enable fuel-switching. For instance, in November 2023, Indian Oil Corporation announced plans to expand its LNG terminal at Kamarajar Port, Chennai, aiming to meet the rising LNG demand by 2025–26. The ₹3,400 crore project will double capacity from 5 MMTPA to 10 MMTPA, with completion in 54 months. Additionally, integration with India’s existing gas grid and LNG import terminals allows for efficient supply chain development. As infrastructure scales up, costs are expected to decrease, improving the commercial viability of LNG bunkering. These infrastructure efforts reflect a long-term view toward establishing India as a competitive LNG fueling destination for regional and global maritime routes.

India LNG Bunkering Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on ship type and end-user.

Ship Type Insights:

- Container Ships

- Tankers

- Bulk Carriers

- Passenger Ships

The report has provided a detailed breakup and analysis of the market based on the ship type. This includes container ships, tankers, bulk carriers, and passenger ships.

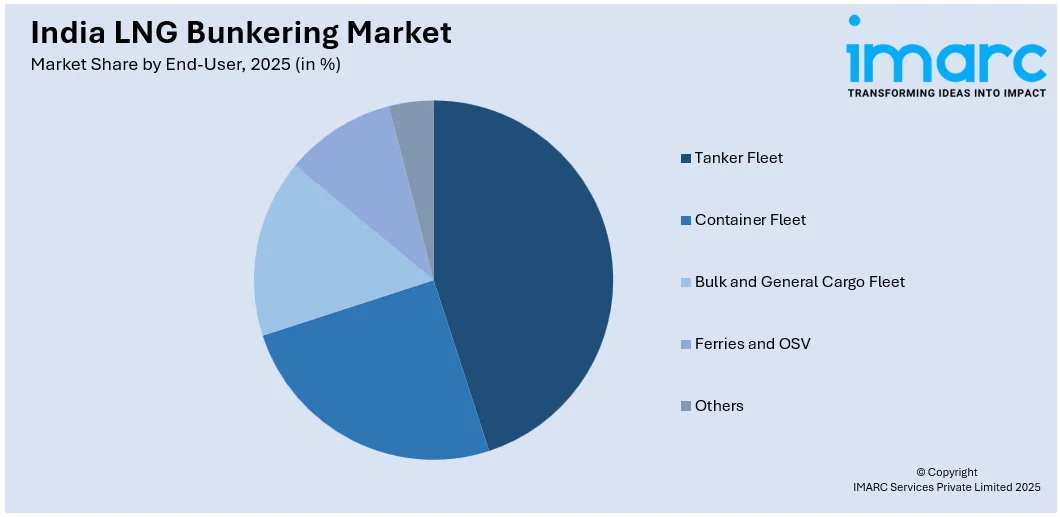

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Tanker Fleet

- Container Fleet

- Bulk and General Cargo Fleet

- Ferries and OSV

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes tanker fleet, container fleet, bulk and general cargo fleet, ferries and OSV, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India LNG Bunkering Market News:

- In December 2024, Government of India (GOI) announced plans to supply LNG to Sri Lanka's power plants and to connect the power grids of both countries. Indian state-run firm Petronet LNG signed a five-year agreement to supply LNG to LTL Holdings' power plants in Colombo through Petronet's Kochi terminal. This initiative underscores India's role in enhancing regional energy connectivity.

- In January 2025, HPCL announced the commissioning of its 5 MTPA LNG terminal at Chhara, Gujarat, with the first cargo delivered on January 6, 2025. The terminal aims to support India’s goal of increasing natural gas usage and will operate on a tolling model, allowing third-party access through long-term and spot agreements.

India LNG Bunkering Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Ship Types Covered | Container Ships, Tankers, Bulk Carriers, Passenger Ships |

| End-Users Covered | Tanker Fleet, Container Fleet, Bulk and General Cargo Fleet, Ferries and OSV, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India LNG bunkering market performed so far and how will it perform in the coming years?

- What is the breakup of the India LNG bunkering market on the basis of ship type?

- What is the breakup of the India LNG bunkering market on the basis of end-user?

- What is the breakup of the India LNG bunkering market on the basis of region?

- What are the various stages in the value chain of the India LNG bunkering market?

- What are the key driving factors and challenges in the India LNG bunkering market?

- What is the structure of the India LNG bunkering market and who are the key players?

- What is the degree of competition in the India LNG bunkering market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India LNG bunkering market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India LNG bunkering market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India LNG bunkering industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)