India Load Break Switch Market Size, Share, Trends and Forecast by Type, Voltage, Installation, End Use, and Region, 2025-2033

India Load Break Switch Market Overview:

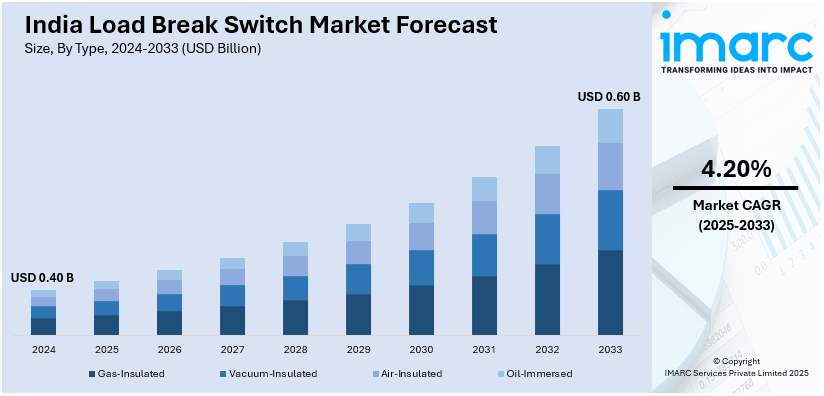

The India load break switch market size reached USD 0.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.60 Billion by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The India load break switch market is driven by government initiatives like the Revamped Distribution Sector Scheme (RDSS) for power grid modernization, increasing renewable energy integration, rising smart grid adoption, and growing industrial infrastructure development, all requiring reliable switching solutions to ensure efficient power distribution, grid stability, and operational safety across diverse applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.40 Billion |

| Market Forecast in 2033 | USD 0.60 Billion |

| Market Growth Rate (2025-2033) | 4.20% |

India Load Break Switch Market Trends:

Government Initiatives to Modernize Power Distribution Infrastructure

The Government of India has initiated a number of initiatives to modernize the power distribution infrastructure of the country, thereby directly influencing the demand for Load Break Switches (LBS). One of the prominent schemes is the Revamped Distribution Sector Scheme (RDSS), approved in June 2021, with a major outlay of INR 3,03,758 crore and Gross Budgetary Support of INR 97,631 crore from the Government of India spread over five years, i.e., FY 2021-22 to FY 2025-26. The main targets of the RDSS are to bring down Aggregate Technical & Commercial (AT&C) losses to pan-India levels of 12-15% and close the Average Cost of Supply (ACS)-Average Revenue Realized (ARR) gap by 2024-25. The scheme focuses on the modernization and improvement of distribution infrastructure to enhance the quality and reliability of power supply to consumers. Under the RDSS, the government offers financial support to Distribution Companies (DISCOMs) for the implementation of different projects, such as the installation of Supervisory Control and Data Acquisition (SCADA) systems, Advanced Metering Infrastructure (AMI), and the use of advanced technologies. These technologies require the integration of dependable switching equipment, including LBS, to facilitate effective and safe operation of the power distribution network. The emphasis on minimizing AT&C losses and enhancing operational efficiency has prompted higher investments in the development of existing infrastructure. This entails replacing old switchgear with advanced LBS that provide better performance and safety features. The stress of the government in attaining a financially viable and operationally efficient distribution sector provides a favorable platform for the development of the LBS market in India.

To get more information on this market, Request Sample

Integration of Renewable Energy into the Power Grid

India has established aggressive goals for renewable energy penetration with a vision to reach 450 GW of renewable energy capacity by 2030, compared to the earlier goal of 175 GW by 2022. As of October 2024, the overall electricity generation capacity of India was 452.69 GW, out of which renewable energy-based capacity stood at 201.45 GW, which is 46.3% of the total installed capacity of the nation. The blending of renewable power sources, i.e., solar and wind energy, into the conventional power grid poses special problems because of their variable and intermittent nature. In order to tackle these problems, there is a pressing requirement for sophisticated grid infrastructure, including secure switching devices like Load Break Switches (LBS), in order to cope with fluctuations and ensure grid stability. The government's pledge to expand renewable energy capacity has resulted in huge investments in transmission and distribution infrastructure to take in the rising flow of renewable power. This growth involves new substation development and upgrading of existing ones, where LBS are used to isolate faults and provide safety and reliability of supply.

India Load Break Switch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, voltage, installation, and end use.

Type Insights:

- Gas-Insulated

- Vacuum-Insulated

- Air-Insulated

- Oil-Immersed

The report has provided a detailed breakup and analysis of the market based on the type. This includes gas-insulated, vacuum-insulated, air-insulated, and oil-immersed.

Voltage Insights:

- Below 11 kV

- 11-33 kV

- 33-60 kV

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes below 11kV, 11-33 kV, and 33-60 kV.

Installation Insights:

- Outdoor

- Indoor

A detailed breakup and analysis of the market based on the installation have also been provided in the report. This includes below outdoor and indoor.

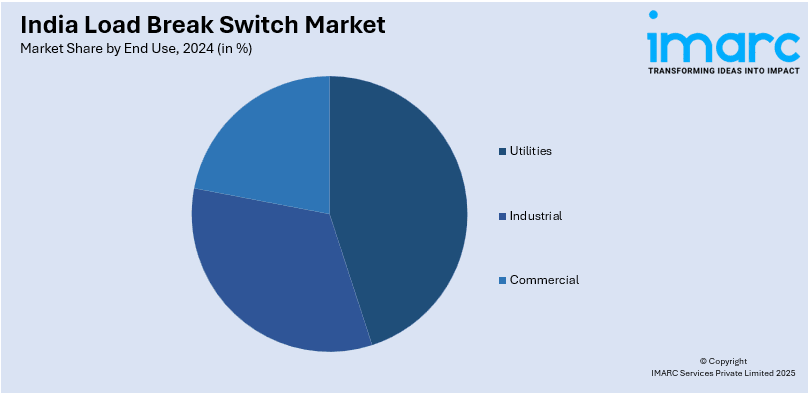

End Use Insights:

- Utilities

- Industrial

- Commercial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes utilities, industrial, and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Load Break Switch Market News:

- February 2025: Socomec introduced new solutions for power management, such as advanced UPS products, power quality meters, and energy storage fuses, to ELECRAMA 2025. Socomec further displayed its modular UPS, auto transfer switches, ATS controllers, manual transfer switches, load break switches, and DC switch disconnectors for the PV segment. The increasing necessity for advanced infrastructure of power is propelling the use of load break switches to improve the safety and operation of the grid.

- August 2024: The 2nd Safe City and Intelligent Mobility India 2024 conference was organized in New Delhi, centering on intelligent grid integration and urbanization. The conference promoted the contribution of state-of-the-art power infrastructure in city resilience, demanding solid electrical devices such as load break switches (LBS). LBS performs secure and reliable distribution of power by disconnecting malfunctioning portions, hence providing it with significance for smart grid dependability and uninterrupted power delivery.

India Load Break Switch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gas-Insulated, Vacuum-Insulated, Air-Insulated, Oil-Immersed |

| Voltages Covered | Below 11 kV, 11-33 kV, 33-60kV |

| Installations Covered | Outdoor, Indoor |

| End Uses Covered | Utilities, Industrial, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India load break switch market performed so far and how will it perform in the coming years?

- What is the breakup of the India load break switch market on the basis of type?

- What is the breakup of the India load break switch market on the basis of voltage?

- What is the breakup of the India load break switch market on the basis of installation?

- What is the breakup of the India load break switch market on the basis of end use?

- What are the various stages in the value chain of the India load break switch market?

- What are the key driving factors and challenges in the India load break switch market?

- What is the structure of the India load break switch market and who are the key players?

- What is the degree of competition in the India load break switch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India load break switch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India load break switch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India load break switch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)