India Loaders Market Size, Share, Trends and Forecast by Type, Engine, Fuel, and Region, 2025-2033

India Loaders Market Overview:

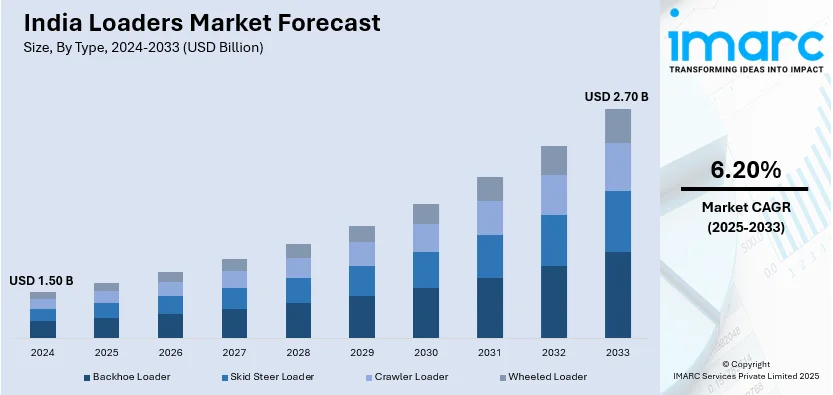

The India loaders market size reached USD 1.50 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.70 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The India loaders market is driven by rapid infrastructure development, government initiatives like Gati Shakti, and rising construction investments, supported by substantial capital expenditure, urban expansion, and industrial growth, leading to higher demand for loaders in road construction, railways, warehousing, and real estate projects across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.50 Billion |

| Market Forecast in 2033 | USD 2.70 Billion |

| Market Growth Rate (2025-2033) | 6.20% |

India Loaders Market Trends:

Robust Infrastructure Development

The infrastructure of India has seen tremendous growth over the last few years, being the backbone of economic development and had a direct bearing on the demand for loaders and other construction equipment. The emphasis of the government on improving the transportation network, urban facilities, and digital infrastructure has resulted in significant developments across the country. India has the second-largest highway network in the world, running over 6.37 million kilometers. An impressive expansion in national highway building, with the average speed moving up from 12 kilometers daily in 2014-15 to nearly 29 kilometers a day in 2021-22, is widely noticeable. As a result, the total mileage of national highways increased from 97,830 kilometers in 2014 to 145,155 kilometers in 2021. The growth requires massive employment of loaders in activities, such as earthmoving, roadbed construction, and handling materials. In the railways industry, the Indian Railways broke a record in transporting more than 30 million passengers in November 2024, in a single day, comprising a record of 12.072 million non-suburban travelers. Such successes highlight the persistent improvement of rail infrastructure, for which loaders are a crucial and significant part when it comes to laying tracks, building stations, and maintenance tasks. Maritime infrastructure has also developed appreciably, with capacity of ports from 871.52 million tons during 2014-15 rising to 1,629.86 million tons during 2023-24. The number of ships/vessels increased from 1,250 to 1,526 between these years, that is, an improvement of 22%. Loader has an important part to play in the ports as it is instrumental in bringing cargo handling effectively and thereby lending effectiveness to sea-borne logistics as a whole.

To get more information on this market, Request Sample

Substantial Investments in the Construction Sector

India's construction industry has become a key driver of economic growth, drawing large investments and creating widespread job opportunities. The growth of this industry is directly related to the rising demand for loaders, which are crucial in most construction operations. During the financial year 2024-25, the government raised its capital spending by 11.1% to USD 133 billion, representing 3.4% of the GDP. This large investment highlights the focus on infrastructure development, such as roads, railways, and urban construction, all of which demand high utilization of loaders for functions like excavation, material hauling, and preparation of the site.The warehousing industry is expected to grow substantially, with a projected demand of 159 million square feet by 2047 at a CAGR of 4%. The e-commerce and manufacturing sectors are fueling this growth, prompting investments in logistics parks and industrial corridors. Development of these buildings requires the employment of loaders for land preparation, foundation work, and material handling. The real estate industry is estimated to grow significantly, possibly up to USD 5.8 trillion in 2047 and accounting for 15.5% of the overall economic output.This includes residential, commercial, and industrial development, all of which involve loaders for different stages of construction, ranging from land clearing to structural construction. This upward trend is strengthened by the emphasis of the government on infrastructure development and relaxation in foreign investment policies, making India poised to rank as the third-largest construction industry globally by 2025. The growing construction activities naturally augment the demand for loaders, which is necessary for effective project implementation.

India Loaders Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, engine, and fuel.

Type Insights:

- Backhoe Loader

- Skid Steer Loader

- Crawler Loader

- Wheeled Loader

The report has provided a detailed breakup and analysis of the market based on the type. This includes backhoe loader, skid steer loader, crawler loader, and wheeled loader.

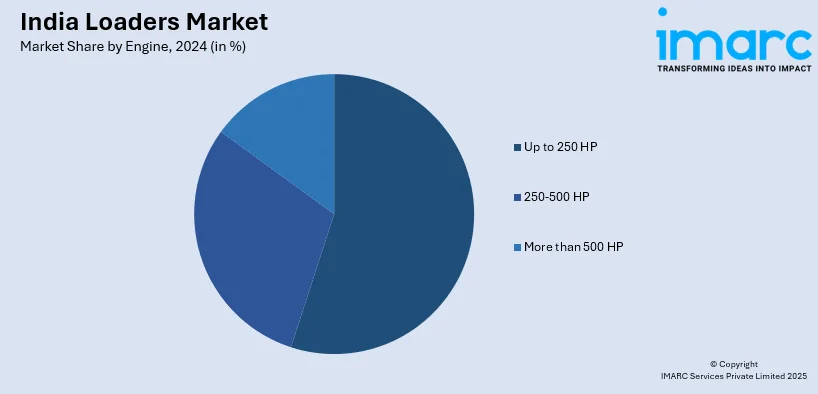

Engine Insights:

- Up to 250 HP

- 250-500 HP

- More than 500 HP

A detailed breakup and analysis of the market based on the engine have also been provided in the report. This includes up to 250 HP, 250-500 HP, and more than 500 HP.

Fuel Insights:

- Electric

- ICE

A detailed breakup and analysis of the market based on the fuel have also been provided in the report. This includes electric and ICE.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Loaders Market News:

- June 2024: CASE India introduced its first skid-steer loader specifically for the Indian market, improving local manufacturing capacity and meeting rising demand. The release of this machine promotes infrastructure development by offering multi-purpose and effective equipment for construction work. This move consolidates India's loaders market by improving product availability and supporting domestic manufacturing.

- April 2024: SDLG, a member of the Volvo Group, opened a new factory in Bengaluru to produce wheel loaders, escalating local production capacity. The move is to address the growing demand for construction equipment in India, fueled by infrastructure development projects. It reinforces the India loaders market by increasing availability and lowering dependence on imports.

India Loaders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Backhoe Loader, Skid Steer Loader, Crawler Loader, Wheeled Loader |

| Engine Covered | Up to 250 HP, 250-500 HP, More than 500 HP |

| Fuels Covered | Electric, ICE |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India loaders market performed so far and how will it perform in the coming years?

- What is the breakup of the India loaders market on the basis of type?

- What is the breakup of the India loaders market on the basis of engine?

- What is the breakup of the India loaders market on the basis of fuel?

- What are the various stages in the value chain of the India loaders market?

- What are the key driving factors and challenges in the India loaders market?

- What is the structure of the India loaders market and who are the key players?

- What is the degree of competition in the India loaders market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India loaders market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India loaders market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India loaders industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)