India Luxury Goods Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User and Region, 2026-2034

India Luxury Goods Market Size and Share:

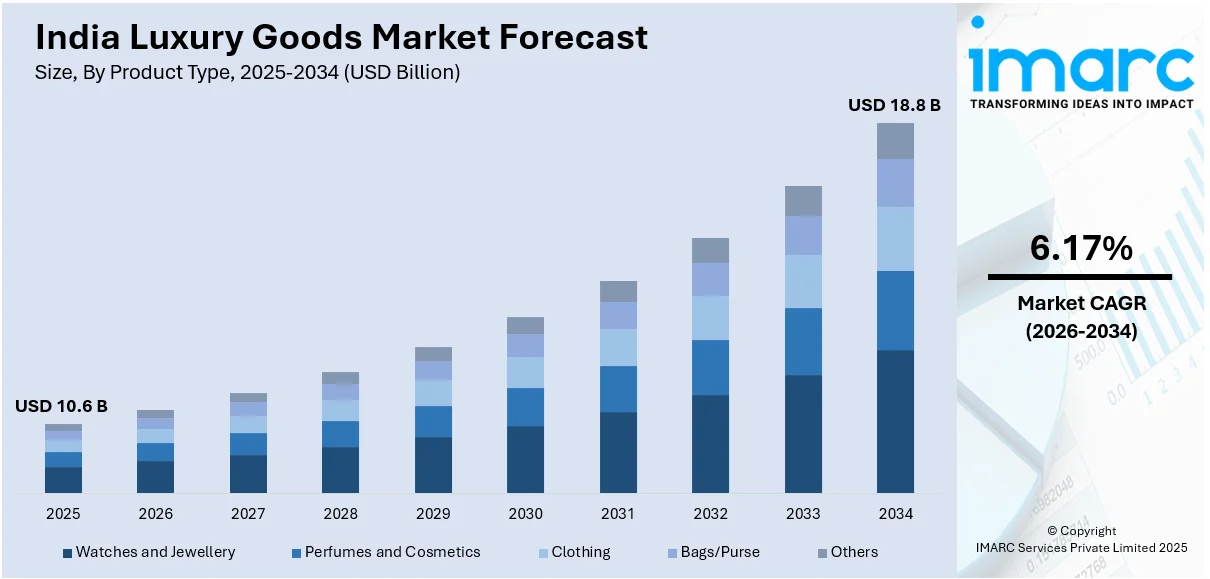

The India luxury goods market size was valued at USD 10.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 18.8 Billion by 2034, exhibiting a CAGR of 6.17% during 2026-2034. North India currently dominates the market, holding a significant market share of around 35.45% in 2024. The market is driven by increasing disposable incomes, expanding middle and upper classes, and growing consumer interest in premium experiences. In addition to this, the rise in demand for personalized luxury, coupled with changing consumer preferences toward exclusivity and customization, is also fueling the market’s expansion, making luxury goods more accessible and desirable across India. Moreover, the rapid growth of e-commerce platforms has created new opportunities for luxury brands to engage with tech-savvy, urban consumers, further augmenting the India luxury goods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 10.6 Billion |

|

Market Forecast in 2034

|

USD 18.8 Billion |

| Market Growth Rate 2026-2034 | 6.17% |

The market is majorly influenced by the increasing number of high-net-worth individuals (HNWIs) and affluent consumers, who are fueling the demand for premium products. According to an industry report, the urban population of India is expected to increase to nearly 600 million by 2036, representing 40% of the nation's total population, up from 31% in 2011. This rapid urbanization plays a crucial role, with rising income levels and changing lifestyles in metropolitan cities leading to a higher consumption of luxury items. Another significant driver is the growing demand for distinctive and customized experiences, which luxury brands are uniquely positioned to provide. In line with this, the development in infrastructure and the expansion of luxury malls and online retail websites have helped make luxury products more accessible to more people.

To get more information on this market Request Sample

In addition to this, an increasing number of young, aspirational consumers are looking to buy luxury products, as they consider them status symbols and markers of success. Apart from this, the effect of social media and digital channels has increased awareness and reach, allowing brands to connect with potential customers more effectively. According to industry reports, as of January 2025, India had 491 million social media users, which represented 33.7% of the country's population. The massive online presence offers luxury brands an unparalleled platform to interact with a large and varied fan base, which in turn supports market growth. Also, increased affinity for high-fashion, timepieces, jewelry, and cars is enabling more people to spend on these high-end products.

India Luxury Goods Market Trends:

Increasing Disposable Incomes

The steady rise in disposable incomes among Indian consumers is a significant factor positively impacting the market. With a growing Indian economy and rising wages, consumers have more disposable income to spend on discretionary products. Indian private consumption has almost doubled to USD 2.1 Trillion in 2024, as per an industry report, registering strong growth in consumer buying power. This is resulting in higher demand for higher-value goods and services, especially in urban areas. Moreover, increases in income levels are fueled by the growth of major sectors like information technology, finance, and manufacturing, where pay scales and career prospects continue to improve. Also, government policies supporting economic growth, and the rapidly growing middle class are key factors that fuel the rise in disposable income. The outcome of inflating disposable income is an emerging consumer class that is now financially able to indulge in luxury goods like designer clothing, upscale dining, premium cars, and high-end travel.

Expanding Middle and Upper Classes in India

The rapid growth of India's middle and upper classes is a key driver contributing to the India luxury goods market growth. With the nation's ongoing economic rise, several people are entering the middle-income segment, thus increasing the overall market for luxury items. Improved access to education, career prospects, and well-paying jobs has given these consumers the purchasing power to afford luxury goods like high-end fashion, luxury cars, and designer accessories. Moreover, the rise of the "upper middle class", individuals with greater incomes and assets, also strengthens this trend. An industry study forecasts that the proportion of India's middle class will almost double to 61% of the population by 2047, reflecting a long-term structural change in consumer bases that benefits luxury spending. The growth in the middle and upper classes is also prompting luxury brands to introduce more affordable yet premium offerings, aimed at attracting this growing demographic.

Expansion of E-Commerce Platforms

The rapid growth of e-commerce platforms is transforming the way luxury goods are marketed and purchased in India, which is creating a positive India luxury goods market outlook. Online shopping offers Indian buyers unmatched access to a vast array of luxury products, bypassing geographic barriers and convenience at their fingertips. As consumers in urban and semi-urban regions increasingly adopt online shopping, luxury brands are using digital platforms to connect directly with a technologically savvy audience. It is particularly effective for the younger generations, who find it convenient and flexible to buy luxury products online. As per industry reports, the e-commerce market in India is projected to reach USD 163 billion by 2026, with a CAGR of 27%. This strong growth presents luxury brands with a great chance to increase their market coverage through e-commerce, leveraging an increasing base of digitally connected consumers. As Indian consumers increasingly adopt e-tailing, it is likely to keep reshaping the luxury goods market, offering brands a powerful means of addressing changing consumer desires.

India Luxury Goods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India luxury goods market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, distribution channel, and end user.

Analysis by Product Type:

- Watches and Jewellery

- Perfumes and Cosmetics

- Clothing

- Bags/Purse

- Others

Watches and jewellery lead the market with around 38.5% of market share in 2024, fueled by a deep cultural attachment to luxury ornaments and expanding wealthier segments. Luxury timepieces, characterized by precision, craftsmanship, and status, are highly sought after among India's elite class. Jewellery, particularly gold, diamonds, and traditional pieces, is also a critical element in festivals, weddings, and social status. This sector is also supported by growing globalization and exposure to high-value international brands. The growth of this segment is also driven by the increase in disposable income and changing consumer attitudes towards luxury brands. Consumers are increasingly seeking products that have both aesthetic appeal and investment worth, indicating a growing preference for branded watches and high-end jewellery.

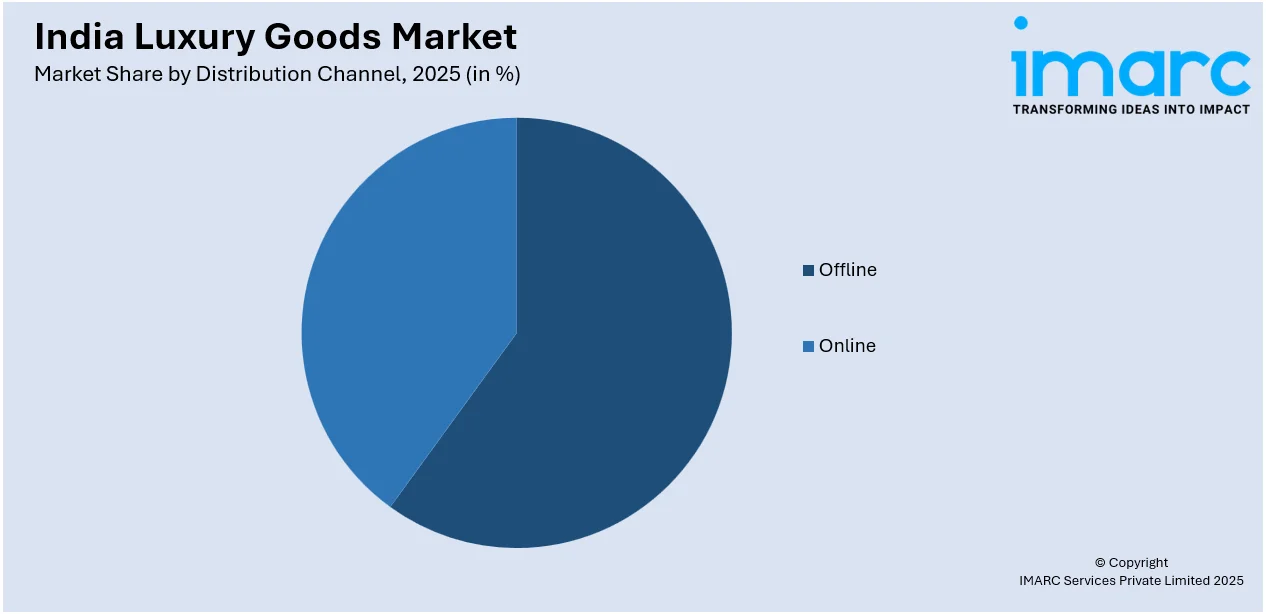

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

Offline leads the market with around 74.3% of market share in 2024. The segment is important particularly for premium products like watches, jewelry, and apparel. Brick-and-mortar shops, such as standalone boutiques and upscale department stores, offer a sensory experience that is central to luxury purchases. These shops provide individualized services, such as bespoke collections, tailored clothing, and expert advice, that India's high-income consumers value. In addition, offline retailers enable consumers to touch and feel the quality of the product themselves, instill confidence, and build emotional affinity with the brand. Offline stores also convey a feeling of exclusivity and distinction, making them more appealing to consumers who equate luxury with tangible experiences and exceptional customer service. Hence, even with the development of e-commerce, offline retail remains a key and powerful channel in the market.

Analysis by End User:

- Women

- Men

Women leads the market with around 53.9% of market share in 2024. Women are major consumers in the market, driving exceptional demand for merchandise in various categories such as fashion, jewelry, fragrances, and cosmetics. The shift in social and economic environment, along with increased disposable income, has allowed women to indulge in high-end products that go well with their lifestyle and reflect status. Luxury jewelry, branded clothing, and high-end beauty products are leading segments where women's purchasing power is strongly experienced. This trend is further reinforced by an increase in female-led enterprise, as well as a focus on personal branding and luxury purchases. The increasing awareness of global fashion styles, coupled with a higher awareness of individualism and personal expression, has turned women into top consumers of luxury products in India.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

In 2024, North India accounted for the largest market share of over 35.45%. Cities like Delhi, Chandigarh, and Lucknow are known for their luxury spending, where the demand for high-end watches, jewellery, designer apparel, and luxury automobiles is particularly strong. The region is a home to high-income groups, working professionals, and entrepreneurs. Luxury products such as jewelry, watches, clothes, and upscale cosmetics are in demand due to the increasing requirement to reflect status and achievements. North India also has a large offline retail presence, with luxury boutiques and high-end malls providing tailored experiences for affluent clients. Delhi, with its buzzing retail and availability of global brands, remains the hub of luxury shopping. North India's growing urbanization and rising disposable incomes, especially in cities like Gurgaon, also contribute to North India's central role in the market.

Competitive Landscape:

The market is characterized by an intensely competitive environment, spurred by both international and domestic players. The industry is controlled by international brands, which enjoy high brand recall and consumer loyalty. Also, the market witnesses the rise of domestic luxury brands that cater to the changing tastes of Indian customers, providing region-specific designs coupled with international standards of quality. Competition is also amplified by the rise in online luxury shopping, which has transformed the customer buying experience, facilitating easy access to high-end products. Increased disposable incomes and a desire for luxury products have led companies to emphasize innovative marketing, exclusivity, and customer experience through personalized services. Moreover, the key drivers of competition are product diversification, premium pricing strategies, and strategic retail network partnerships. Consequently, brands are constantly upgrading their portfolios to match changing consumer preferences and overall luxury market dynamics. According to the India luxury goods market forecast, the industry is anticipated to see sustained growth fueled by an expanding high-end consumer base and growing demand for premium products across categories such as fashion, accessories, and automobiles.

The report provides a comprehensive analysis of the competitive landscape in the India luxury goods market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Scentzania debuted in India with six flagship studios, introducing a tech-driven, personalized fragrance experience inspired by Singapore’s Scentopia. It offers zero-royalty franchise models and plans 50+ outlets eventually, positioning fragrance as a lifestyle experience through robot-powered perfume creation stations.

- April 2025: Hindustan Unilever's Nexxus New York debuted in India with a luxury-focused launch event in Mumbai. The PROMEND range, highlighted by the Resurrection Hair Oil-in-Serum, combines salon-grade proteomic science with opulent design, including an 18k gold bottle display.

- April 2025: Tudor unveiled new Black Bay editions, including the Pro, Chrono, 58, and 68 models. The Pro features a satin-brushed stainless steel case, Snowflake hands, and the Tudor MT5262 Caliber with a GMT function.

- March 2025: Kilian Paris launched in India, bringing its luxury fragrance collection known for storytelling, refillable bottles, and artisanal quality. Signature scents like Love Don't Be Shy and Angels’ Share became available, targeting high-end consumers seeking opulence, sustainability, and exclusivity in personal scent experiences.

- February 2025: Karmic Beauty launched its luxury skincare and haircare range. The brand focuses on natural, ethically sourced ingredients like USDA-approved Moroccan argan oil and hydrolyzed keratin. It aims to bridge the gap between affordability and quality by offering premium, performance-driven self-care products.

India Luxury Goods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Watches and Jewellery, Perfumes and Cosmetics, Clothing, Bags/Purse, Others |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | Women, Men |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India luxury goods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India luxury goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury goods market in India was valued at USD 10.6 Billion in 2025.

The growth of the India luxury goods market is driven by increasing disposable incomes, a growing affluent middle class, and a shift in consumer preferences towards premium products. Additionally, rising brand awareness, an expanding online retail sector, and a booming tourism industry further contribute to the market’s expansion. Moreover, changing lifestyles and a younger, aspirational population also play a major part in market development.

The luxury goods market in India is projected to exhibit a CAGR of 6.17% during 2026-2034, reaching a value of USD 18.8 Billion by 2034.

Watches and jewellery account for the largest share of the India luxury goods market product type. This segment's dominance is driven by increasing disposable incomes, a growing preference for luxury brands, and the cultural significance of gold and diamond jewellery in India. Additionally, the rise of affluent consumers and an expanding middle class bolster demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)