India Luxury Travel Market Size, Share, Trends and Forecast by Type of Tour, Age Group, Type of Traveller, and Region, 2025-2033

India Luxury Travel Market Size and Share:

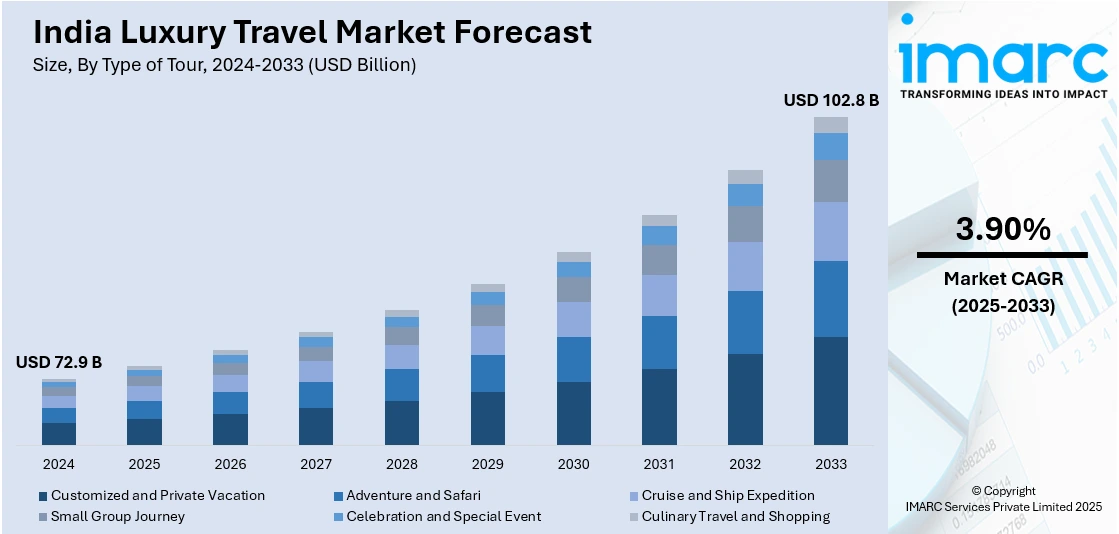

The India luxury travel market size reached USD 72.9 Billion in 2024. The market is projected to reach USD 102.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market growth is attributed to the rising disposable incomes, a growing affluent middle class, increasing demand for personalized experiences, improved air connectivity, expansion of high-end hotels and resorts, government initiatives to boost tourism, rising interest in wellness and adventure tourism, and a growing global desire for unique destinations.

Market Insights:

- Based on region, the market is divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of type of tour, the market is divided into customized and private vacation, adventure and safari, cruise and ship expedition, small group journey, celebration and special event, and culinary travel and shopping.

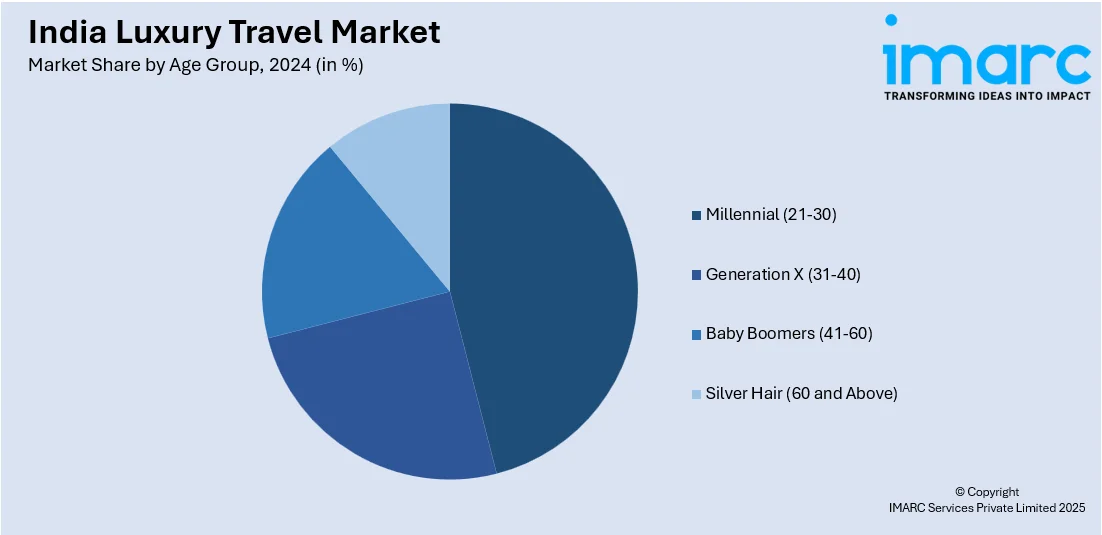

- Based on the age group, the market is categorized as millennial (21-30), generation x (31-40), baby boomers (41-60), and silver hair (60 and above).

- On the basis of type of traveller, the market is segmented into absolute luxury, aspiring luxury, and accessible luxury.

Market Size and Forecast:

- 2024 Market Size: USD 72.9 Billion

- 2033 Projected Market Size: USD 102.8 Billion

- CAGR (2025-2033): 3.90%

Luxury travel epitomizes a premium and exclusive sector within the tourism industry, designed for discerning travelers in search of extraordinary and lavish experiences. It transcends basic amenities and comfort, providing bespoke services, exquisite accommodations, gourmet dining, and distinctive, immersive activities. Typically, luxury travel involves stays in opulent hotels, private villas, or upscale resorts located in picturesque destinations. Travelers partake in indulgent experiences such as spa treatments, fine dining at Michelin-starred restaurants, private yacht charters, and culturally enriching excursions tailored to their preferences. Luxury travel lies in its emphasis on exclusivity, meticulous attention to detail, and a steadfast commitment to ensuring the highest levels of comfort and satisfaction.

To get more information on this market, Request Sample

The luxury travel market in India has emerged as a dynamic and thriving segment within the country's tourism industry, responding to the increasing affluence and evolving preferences of discerning travelers. Catering to those who seek extraordinary and opulent experiences, the India luxury travel market goes beyond conventional tourism by providing exclusive services, lavish accommodations, gourmet dining, and personalized, immersive activities. Moreover, these establishments prioritize exclusivity, offering travelers a heightened level of comfort and sophistication. Besides this, luxury travelers in India indulge in a range of unparalleled experiences, including spa treatments, fine dining at Michelin-starred restaurants, private yacht charters, and tailor-made cultural excursions. Additionally, the demand driven by the country's growing middle and upper classes, with an increasing number of travelers seeking not just a vacation but a curated and exceptional journey is propelling the India luxury travel market growth. As India continues to position itself as a popular travel destination, the luxury travel market is poised for continued expansion, setting new standards for opulence, exclusivity, and redefining the benchmarks for unparalleled travel experiences in the region. The combination of diverse cultural offerings, scenic landscapes, and a commitment to luxury services will bolster the market growth over the forecasted period.

India Luxury Travel Market Trends:

Rise in Experiential and Personalized Travel

The market is witnessing a distinct shift from traditional sightseeing packages to experiential and highly personalized journeys. According to an industry survey, Indian travelers are poised to embark on more frequent and significantly costlier vacations in 2025, with 75% preferring experience‑first travel. Discerning travelers are increasingly seeking immersive experiences that align with their individual preferences, values, and lifestyle choices. This trend includes wellness retreats in the Himalayas, heritage walks in Rajasthan, culinary trails in Kerala, and wildlife safaris in Madhya Pradesh curated to offer exclusivity and depth. Moreover, luxury consumers are demanding tailor-made itineraries with private guides, off-the-beaten-path destinations, and meaningful cultural interactions. Besides this, the rise of boutique travel agencies and concierge services that craft bespoke travel experiences further underline this trend. Technology also plays a significant role, enabling customization through AI-driven travel planning tools and mobile concierge services. Additionally, affluent millennials and Gen Z travelers are fuelling demand for purpose-driven travel, such as eco-tourism and philanthropic vacations, where impact and exclusivity go hand in hand.

Increasing Government Support in the Sector

Government-led initiatives are significantly impacting the India luxury travel market outlook, primarily through the enhancement of infrastructure and regional connectivity. Schemes such as Swadesh Darshan aim to promote theme-based tourist circuits by developing destinations with high-end amenities, focusing on heritage, culture, and spirituality. This aligns with luxury travelers' growing interest in exclusive cultural and historical experiences. Meanwhile, the UDAN (Ude Desh ka Aam Nagrik) scheme enhances regional air connectivity by making remote and underexplored destinations accessible via commercial flights. This not only increases tourist inflow to luxury resorts in less crowded locales but also stimulates investment in upscale hospitality in tier-2 and tier-3 cities. Additionally, policies related to visa liberalization, including e-visa expansion, have eased access for international high-net-worth travelers. Heritage hotel development, wildlife circuit enhancement, and cruise tourism promotion are also part of the government’s broader efforts to attract affluent global and domestic tourists, driving steady momentum in the luxury travel industry.

Growth Drivers of India Luxury Travel Market:

The market is experiencing robust growth driven by a convergence of digital influence, demographic shifts, and evolving consumer preferences. The increasing penetration of social media platforms has emerged as a powerful catalyst, with influencers and curated travel content shaping aspirational lifestyles and driving demand for exclusive, high-end experiences. Digital transformation has further augmented the India luxury travel market share by streamlining planning and booking through Online Travel Agencies (OTAs), which offer curated itineraries, AI-driven personalization, and virtual previews of luxury destinations. Additionally, the growing base of affluent millennials and Gen Z travelers—characterized by higher disposable incomes and a desire for unique, culturally rich experiences- has propelled demand for personalized and immersive travel. These younger demographics value luxury that is meaningful and socially conscious, expanding segments such as sustainable tourism and wellness retreats. Furthermore, improved connectivity, expanding luxury hospitality infrastructure, and India's global positioning as a culturally diverse destination also contribute to sustained growth in this sector.

Opportunities in India Luxury Travel Market:

The market presents vast opportunities fueled by rising domestic affluence, increasing global interest in Indian culture, and growing infrastructural developments. Moreover, the surge in high-net-worth individuals (HNIs) and aspirational middle-class consumers is expanding the target audience for bespoke travel experiences. As per the India luxury travel market forecast, there is significant potential in niche luxury segments such as heritage tourism, adventure travel, and wellness retreats, which can be tailored to both domestic and international audiences. Additionally, the underexploited potential of tier-2 and tier-3 cities as destinations and source markets offers scope for decentralized luxury tourism. Cruise tourism, luxury trains, and eco-resorts represent promising avenues for investment and innovation. Government schemes like Swadesh Darshan and PRASAD open opportunities for public-private partnerships to develop theme-based, high-end tourism circuits. Besides this, collaborations between luxury brands, hospitality players, and tech-driven platforms can also lead to differentiated offerings. The increasing demand for exclusive and sustainable travel experiences further creates room for curated, conscious luxury tourism products.

Challenges in the India Luxury Travel Market:

Despite its strong potential, according to the India luxury travel market analysis, the market faces several structural and operational challenges that hinder its full-scale expansion. A primary concern is the inconsistency in infrastructure quality, especially in remote or emerging luxury destinations, where inadequate transportation, connectivity, and amenities can affect traveler satisfaction. Additionally, a lack of standardization in service quality across luxury properties impacts the overall brand perception. Another issue lies in the limited availability of skilled hospitality professionals trained in delivering high-end, personalized experiences. Regulatory complexities, including bureaucratic hurdles in approvals and clearances, also act as a deterrent for investment in new luxury travel projects. Furthermore, while the affluent domestic base is growing, India still lacks the global brand positioning enjoyed by traditional luxury destinations such as France or Italy, which can impact international tourist inflow. Lastly, balancing luxury with sustainability remains a challenge, as many high-end services still rely on resource-intensive operations that conflict with emerging eco-conscious traveler expectations.

India Luxury Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type of tour, age group, and type of traveller.

Type of Tour Insights:

- Customized and Private Vacation

- Adventure and Safari

- Cruise and Ship Expedition

- Small Group Journey

- Celebration and Special Event

- Culinary Travel and Shopping

The report has provided a detailed breakup and analysis of the market based on the type of tour. This includes customized and private vacation, adventure and safari, cruise and ship expedition, small group journey, celebration and special event, and culinary travel and shopping.

Age Group Insights:

- Millennial (21-30)

- Generation X (31-40)

- Baby Boomers (41-60)

- Silver Hair (60 and Above)

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes millennial (21-30), generation x (31-40), baby boomers (41-60), and silver hair (60 and above).

Type of Traveller Insights:

- Absolute Luxury

- Aspiring Luxury

- Accessible Luxury

The report has provided a detailed breakup and analysis of the market based on the type of traveller. This includes absolute luxury, aspiring luxury, and accessible luxury.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In July 2025, Miros Hotels & Resorts launched its inaugural luxury property in Central Goa, offering a distinctive blend of wellness, cultural immersion, and plant-based (all‑vegetarian, largely vegan) dining aimed at the modern, health‑conscious traveler. The brand underscores its vision of providing not just accommodation but an emotionally resonant, indulgent lifestyle experience, characterized by exceptional service and a strong emphasis on sustainability.

- In July 2025, Travelogy India Pvt. Ltd. officially launched its new luxury train booking portal, offering travelers a seamless, user-friendly platform to book iconic royal train journeys with real‑time availability and streamlined booking processes. The portal features an intuitive interface, dynamic filtering by fare, route, and departure, and supports multiple secure payment options. This initiative significantly enhances the premium rail travel experience for both domestic and international tourists.

- In July 2025, Viking announced plans to introduce its first-ever river cruise in India with the custom-built Viking Brahmaputra, designed to navigate the Brahmaputra River and accommodate 80 guests across 40 outside staterooms featuring floor‑to‑ceiling sliding glass doors and verandas, along with upscale amenities. Scheduled to debut in late 2027, the vessel will operate the “Wonders of India” 15‑day itinerary, combining an eight‑day river cruise between Guwahati and Nimati Ghat in Assam with a fully guided land program that includes overnight stays in Delhi, Agra, and Jaipur, featuring 13 included tours and visits to up to 10 UNESCO World Heritage Sites.

- In April 2025, THRS (Travel and Hospitality Representation Services) announced its strategic expansion into Japan and Azerbaijan, reinforcing its commitment to offering exceptional outbound luxury travel experiences for Indian clientele. This expansion underscores THRS’s dedication to redefining luxury travel through curated partnerships that cater to evolving preferences for immersive, culturally‑rich journeys.

India Luxury Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Tour Covered | Customized and Private Vacation, Adventure and Safari, Cruise and Ship Expedition, Small Group Journey, Celebration and Special Event, Culinary Travel and Shopping |

| Age Groups Covered | Millennial (21-30), Generation X (31-40), Baby Boomers (41-60), Silver Hair (60 and Above) |

| Types of Traveller Covered | Absolute Luxury, Aspiring Luxury, Accessible Luxury |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India luxury travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India luxury travel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India luxury travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury travel market in India was valued at USD 72.9 Billion in 2024.

The India luxury travel market is projected to exhibit a CAGR of 3.90% during 2025-2033, reaching a value of USD 102.8 Billion by 2033.

The India luxury travel market is driven by rising disposable incomes, growing preference for personalized and immersive experiences, and a surge in high-net-worth individuals. Improved air connectivity, digital booking platforms, and the expansion of premium hospitality brands further support growth. Younger, affluent travelers are increasingly seeking curated, exclusive, and wellness-focused journeys.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)