India Lyocell Fiber Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

India Lyocell Fiber Market Overview:

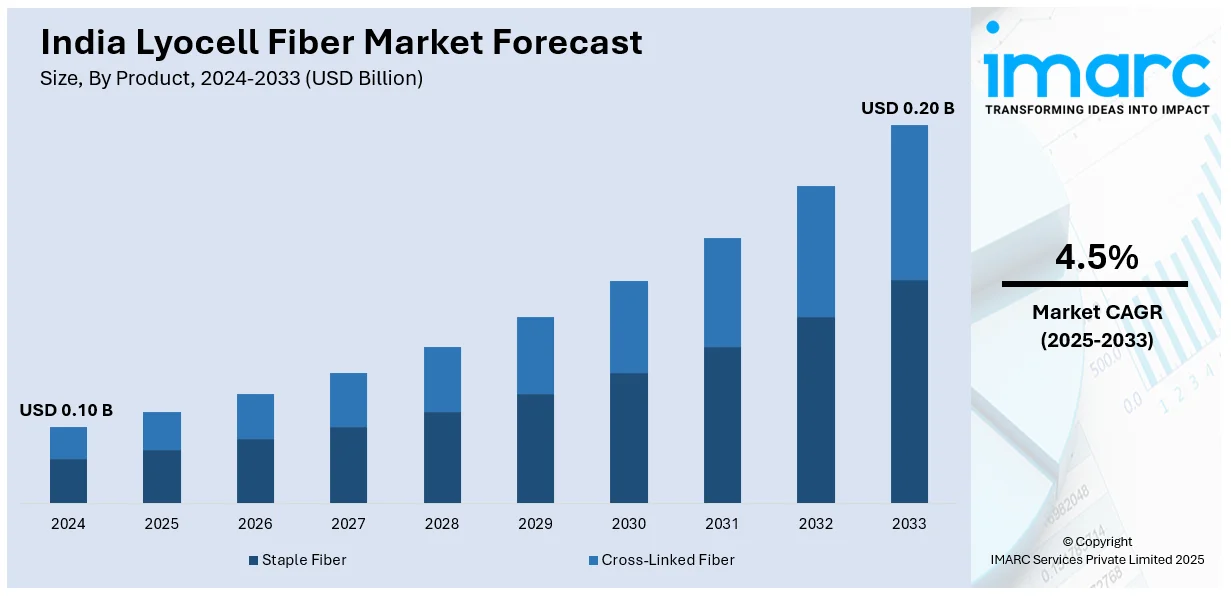

The India lyocell fiber market size reached USD 0.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.20 Billion by 2033, exhibiting a growth rate (CAGR) of 4.5% during 2025-2033. The rising demand for sustainable textiles, eco-friendly production processes, increasing disposable income, and growth in the fashion and home furnishing sectors are some of the factors propelling the growth of the market. Additionally, technological advancements, government initiatives promoting sustainable fibers, and consumer preference for biodegradable fabrics fuel market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.10 Billion |

| Market Forecast in 2033 | USD 0.20 Billion |

| Market Growth Rate (2025-2033) | 4.5% |

India Lyocell Fiber Market Trends:

Sustainable Evolution in Textile Manufacturing

The textile industry is embracing eco-friendly innovations by integrating microbial cellulose into fiber production. This approach reduces dependency on traditional wood-based sources and utilizes biomass derived from food industry waste. Such advancements enhance sustainability by promoting circular economy practices and minimizing environmental impact. As demand for greener alternatives rises, manufacturers are exploring bio-based solutions to create high-performance fibers with reduced carbon footprints. The shift toward responsible sourcing and waste repurposing aligns with global sustainability goals, paving the way for next-generation textiles. With increasing awareness and regulatory support, the industry is likely to witness more investments in biodegradable and renewable materials, offering a sustainable future for fashion and textiles while reducing the strain on natural resources. For example, in March 2022, Birla Cellulose, a division of India's Grasim Industries and part of the Aditya Birla Group, successfully completed a pilot production of eco-friendly lyocell fiber incorporating 20% microbial cellulose from Nanollose Limited. This 250 kg pilot spin represents a significant advancement in sustainable textile manufacturing, utilizing biomass derived from food industry waste to create forest-friendly fibers.

To get more information on this market, Request Sample

Eco-Friendly Materials Transforming Footwear

The footwear industry is increasingly embracing eco-conscious materials, moving away from synthetic and petroleum-based fabrics toward renewable alternatives. The adoption of lyocell fibers, derived from sustainably sourced wood, is gaining momentum as brands seek biodegradable and breathable options for shoes. This shift aligns with a broader movement in India’s fashion sector, where sustainability is becoming a key driver of innovation. Consumers are showing a growing preference for products that offer both comfort and an environmentally responsible footprint. As the demand for responsible sourcing and circular fashion practices rises, more companies are expected to integrate plant-based fibers into their designs. This evolution reflects a conscious effort to reduce the industry's environmental impact while maintaining performance and style. For instance, in July 2022, Neeman's, an emerging sustainable footwear brand in India, launched a new sneaker line made from TENCEL lyocell fibers, derived from sustainably sourced eucalyptus wood. This initiative highlights the growing trend of incorporating eco-friendly materials into footwear, reflecting a shift toward sustainability in the India lyocell fiber market.

India Lyocell Fiber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Staple Fiber

- Cross-Linked Fiber

The report has provided a detailed breakup and analysis of the market based on the product. This includes staple fiber and cross-linked fiber.

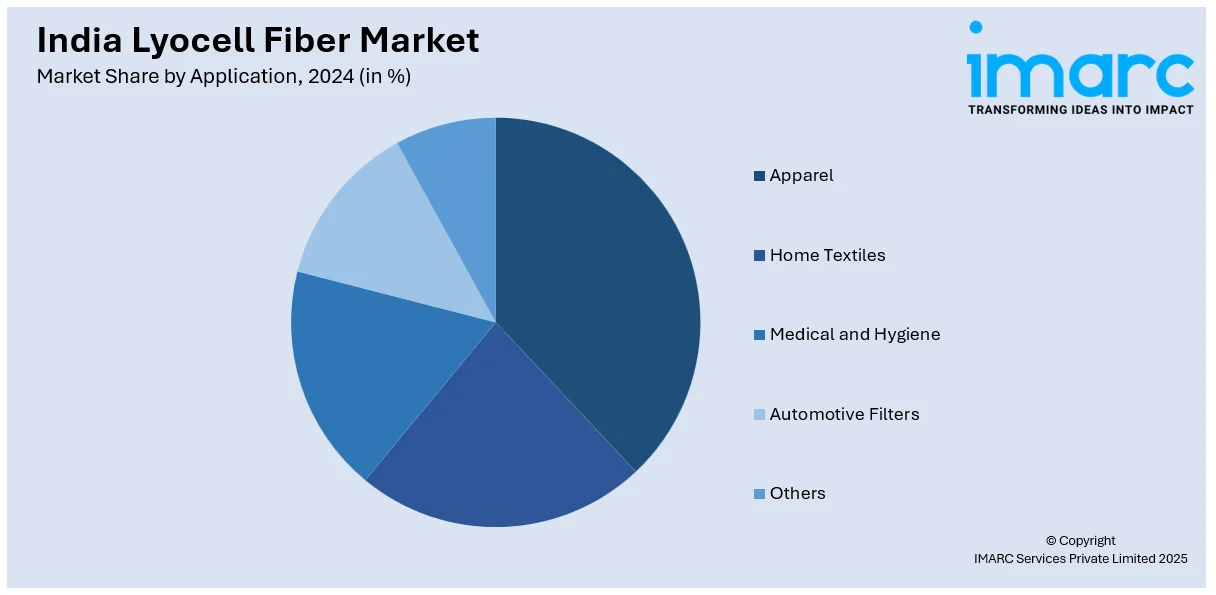

Application Insights:

- Apparel

- Home Textiles

- Medical and Hygiene

- Automotive Filters

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes apparel, home textiles, medical and hygiene, automotive filters, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Lyocell Fiber Market News:

- In January 2025, Lenzing Group expanded its LENZING Lyocell Fill portfolio, introducing finer fibers with various cut lengths for home textiles and apparel. These EU Ecolabel and ClimatePartner-certified fibers enhance thermal comfort, moisture control, and shape retention, supporting sustainable, innovative designs. Unveiled at Heimtextil 2025, they cater to diverse filling technologies and eco-conscious needs.

- In October 2024, Birla Cellulose partnered with U.S.-based Circ to enhance textile recycling efforts. The collaboration includes an annual purchase of up to 5,000 tons of Circ's recycled pulp over five years, which would be transformed into lyocell staple fiber. This initiative aims to bolster the availability of recycled materials in the India lyocell fiber market, promoting a more sustainable and circular textile industry.

India Lyocell Fiber Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Staple Fiber, Cross-Linked Fiber |

| Applications Covered | Apparel, Home Textiles, Medical and Hygiene, Automotive Filters, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India lyocell fiber market from2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India lyocell fiber market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India lyocell fiber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India lyocell fiber market was valued at USD 0.10 Billion in 2024.

The India lyocell fiber market is projected to exhibit a CAGR of 4.5% during 2025-2033, reaching a value of USD 0.20 Billion by 2033.

The India lyocell fiber market is driven by rising demand for sustainable textiles, increasing consumer awareness about eco-friendly fabrics, and the growing fashion and apparel industry. Supportive government policies promoting green manufacturing and the fiber’s biodegradable, breathable qualities further encourage adoption across clothing, home textiles, and hygiene product applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)