India Machine Components Market Size, Share, Trends and Forecast by Component Type, Material, End Use Industry, and Region, 2025-2033

India Machine Components Market Overview:

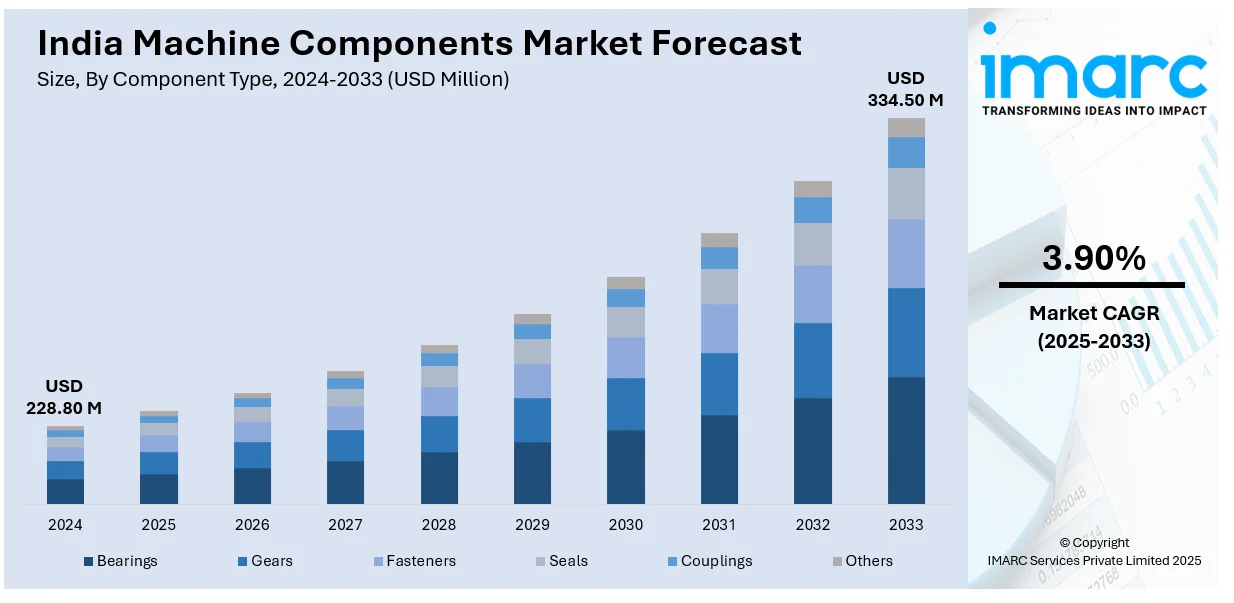

The India machine components market size reached USD 228.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 334.50 Million by 2033, exhibiting a growth rate (CAGR) of 3.90% during 2025-2033. The market is growing steadily, supported by expanding manufacturing activity, localization of supply chains, and rising demand for precision-engineered parts. Additionally, sectors such as automotive, aerospace, and industrial machinery are investing in technological upgrades, while digital adoption and improved material capabilities are reshaping production standards and supplier competitiveness across the value chain.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 228.80 Million |

| Market Forecast in 2033 | USD 334.50 Million |

| Market Growth Rate 2025-2033 | 3.90% |

India Machine Components Market Trends:

Increased Localization of Component Manufacturing

Indian manufacturers are gradually shifting towards locally sourcing machine components to reduce dependence on imports and mitigate supply chain disruptions. This trend is supported by government-led initiatives like ‘Make in India’ and the Production Linked Incentive (PLI) schemes, which encourage domestic production across engineering sectors. For instance, as of August 2024, the automobile and auto components sector in India received 95 approvals under the PLI scheme, reinforcing the push for indigenous production. However, the rising import costs, fluctuating forex rates, and geopolitical uncertainties are making localization both a cost and risk management strategy. Additionally, original equipment manufacturers (OEMs) across sectors, such as automotive, aerospace, and industrial machinery, are expanding their supplier base within India to achieve faster lead times and better control over quality. Concurrently, component suppliers are investing in advanced computer numerical control (CNC) machinery, testing infrastructure, and certifications to meet global manufacturing standards. This localized ecosystem is also facilitating greater collaboration between small component makers and large equipment manufacturers, resulting in better integration and co-development of critical parts.

To get more information on this market, Request Sample

Demand for Precision Engineering and High-Performance Alloys

The demand for precision-machined components is rising sharply, driven by the heightened requirement for machine components in sectors such as aerospace, medical devices, electric vehicles, and high-end industrial automation. These industries require components with tight tolerances, high thermal resistance, and longer fatigue life. As a result, machine component manufacturers are adopting advanced manufacturing techniques, including multi-axis CNC machining, additive manufacturing, and real-time quality control systems. Alongside, the growing use of high-performance alloys like titanium, Inconel, and duplex stainless steels, especially in applications where reliability and performance are critical. Indian suppliers are upskilling their workforce and upgrading production systems to meet these evolving technical requirements. This is also facilitating investments in CAD/CAM integration, metrology equipment, and process automation to maintain consistency at scale. For instance, in January 2025, Cimatron announced launch of its latest CAD/CAM solution, Cimatron 2025, in India at IMTEX 2025. This aims to enhance efficiency and reduce delivery times by offering integrated workflows, artificial intelligence (AI)-powered tools, and improved productivity for mold, die, and manufacturing shops. However, the focus is no longer just on mass production but on producing technically superior components tailored for specific applications. Furthermore, with global OEMs increasingly sourcing from India, precision and metallurgy capabilities are becoming key differentiators for suppliers aiming to move up the value chain.

India Machine Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component type, material, and end use industry.

Component Type Insights:

- Bearings

- Gears

- Fasteners

- Seals

- Couplings

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes bearings, gears, fasteners, seals, couplings, and others.

Material Insights:

- Metals

- Plastics

- Composites

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metals, plastics, and composites.

End Use Industry Insights:

.webp)

- Automotive

- Aerospace

- Industrial Machinery

- Electronics

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, aerospace, industrial machinery, electronics, construction, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Machine Components Market News:

- In July 2024, Shibaura Machine India announced the launch of its second factory in Chennai with an investment of ₹225 crore. The new unit will increase annual production capacity from 1,200 to 4,000 machines. This facility aims to support job creation, MSME vendor development, and strengthen the company’s commitment to the Make in India initiative.

- In September 2024, Brother Machinery India announced the completion of its new machine tool plant near Bengaluru, with operations set to begin in December 2024. The facility aims to produce standard models and support the automotive and medical sectors while reducing CO₂ emissions using solar power.

India Machine Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Bearings, Gears, Fasteners, Seals, Couplings, Others |

| Materials Covered | Metals, Plastics, Composites |

| End Use Industries Covered | Automotive, Aerospace, Industrial Machinery, Electronics, Construction, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India machine components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India machine components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India machine components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The machine components market in India was valued at USD 228.80 Million in 2024.

The India machine components market is projected to exhibit a CAGR of 3.90% during 2025-2033, reaching a value of USD 334.50 Million by 2033.

The India machine components market is driven by rapid industrialization, expansion of manufacturing sectors, and rising demand for precision engineering products. Growth in automotive, aerospace, and heavy machinery industries, along with increasing adoption of automation and advanced technologies, further boosts demand for reliable and high-performance machine components.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)