India Machine Tool Accessories Market Size, Share, Trends and Forecast by Product, Machine Type, End-User Industry, and Region, 2025-2033

India Machine Tool Accessories Market Overview:

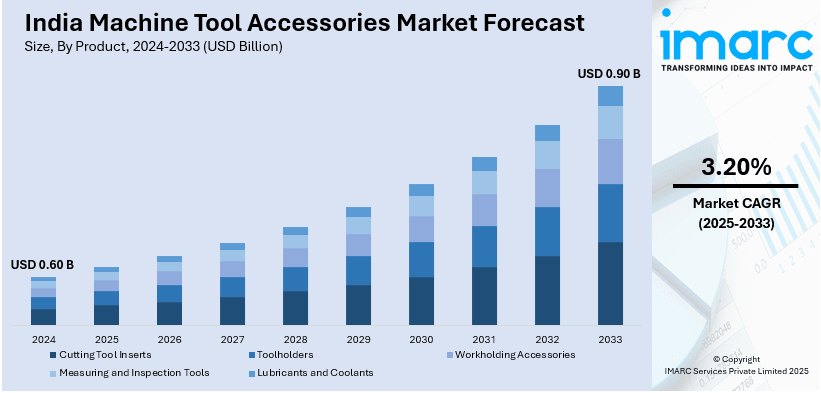

The India machine tool accessories market size reached USD 0.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.90 Billion by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The India machine tool accessories market is driven by government initiatives like 'Make in India' and PLI schemes, rising domestic manufacturing, and the expansion of key end-user industries such as automotive, aerospace, and electronics, leading to increasing demand for precision tools, automation, and advanced manufacturing solutions across various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.60 Billion |

| Market Forecast in 2033 | USD 0.90 Billion |

| Market Growth Rate 2025-2033 | 3.20% |

India Machine Tool Accessories Market Trends:

Government Initiatives Promoting Domestic Manufacturing

The forward-looking policies of the Indian government have played a key role in boosting the machine tool accessories industry. The 'Make in India' program, initiated in September 2014, is an endeavor to shift India's focus from being a manufacturing-focused country to being a global manufacturing hub through the promotion of both multinational and indigenous companies to produce within India. The program emphasizes the development of innovation, skill building, and the creation of best-in-class infrastructure. In addition to further enhance manufacturing strength, the Production Linked Incentive (PLI) schemes were launched by the government with an outlay of INR 1.97 lakh crore (more than USD 26 billion) in 14 sectors of high priority from the financial year 2021-22. These schemes are formulated to enhance domestic production and exports by way of giving fiscal support as incentives in the form of incremental production. The effect of these efforts can be seen in the performance of the manufacturing industry. As per the results of the Annual Survey of Industries (ASI), the Gross Value Added (GVA) in the manufacturing industry surged by 8.8% in current prices during 2020-21 and by a staggering 26.6% during 2021-22 compared to the corresponding previous years. Further, industrial production experienced a whopping growth of more than 35% during 2021-22 from the previous year, and employment in the sector experienced a healthy growth of 7.0% in the same time period.

To get more information on this market, Request Sample

Growth in Key End-Use Industries

The growth in major end-use industries, namely automotive, aerospace, and electronics, has significantly pushed the use of machine tool accessories in India. The auto industry, in particular, has been a great driver of the manufacturing sector output with rising automotive production and shipments. In the same vein, the aerospace sector has also grown immensely, with the likes of Larsen & Toubro (L&T) marking its presence in aerospace manufacturing, concentrating on launching satellite buildings. L&T, in partnership with Hindustan Aeronautics Limited, is manufacturing India's first privately constructed Polar Satellite Launch Vehicle (PSLV) at its Coimbatore plant in line with India's vision to expand its commercial space industry to USD 44 billion by 2035 from the present valuation of USD 13 billion. The electronics manufacturing industry has also seen significant growth, based on rising domestic consumption and encouraging government policies. India emerged as a global hub of electronics manufacturing, especially in smartphones, with Apple iPhone exports exceeding USD 12 billion during the 2023-24 financial year. The government's emphasis on localized manufacturing covering laptops, tablets, computers, and servers further strengthened the sector. Recently, 27 IT hardware manufacturers were sanctioned with incentives, which forecast USD 42 billion in manufacturing over the next several years. Local companies, such as Dixon Technologies, hope to fulfill 15% of India's demand for laptops by FY26, which shows rising domestic manufacturing capability fueled by growing demand due to rising incomes and business activities. The expansion in such sectors has promoted investments in manufacturing technology and infrastructure, hence enhancing the demand for machine tool accessories. The necessity for automation, precision, and efficiency in the process of production has also upsurged the demand for sophisticated machine tools, thus expanding the market.

India Machine Tool Accessories Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, machine type, and end-user industry.

Product Insights:

- Cutting Tool Inserts

- Toolholders

- Workholding Accessories

- Measuring and Inspection Tools

- Lubricants and Coolants

The report has provided a detailed breakup and analysis of the market based on the product. This includes cutting tool inserts, toolholders, workholding accessories, measuring and inspection tools, and lubricants and coolants.

Machine Type Insights:

- CNC Milling Machines

- CNC Lathes

- EDM Machines

- Grinding Machines

- Others

A detailed breakup and analysis of the market based on the machine type have also been provided in the report. This includes CNC milling machines, CNC lathes, EDM machines, grinding machines, and others.

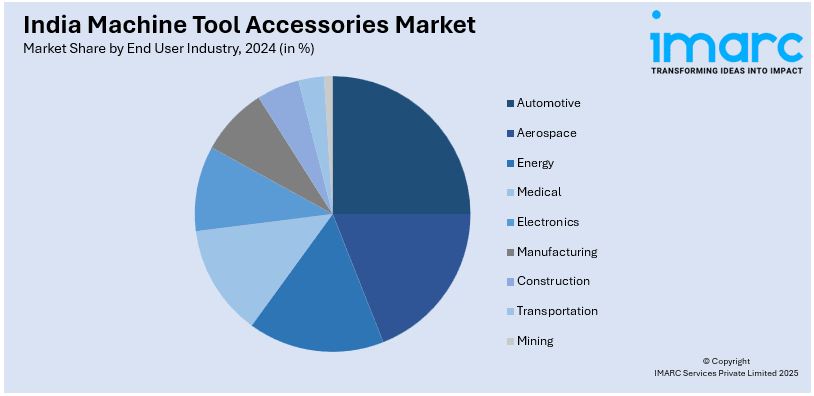

End User Industry Insights:

- Automotive

- Aerospace

- Energy

- Medical

- Electronics

- Manufacturing

- Construction

- Transportation

- Mining

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes automotive, aerospace, energy, medical, electronics, manufacturing, construction, transportation, and mining.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Machine Tool Accessories Market News:

- January 2025: IMTEX 2025 at the Bangalore International Exhibition Centre (BIEC), demonstrated the latest metal cutting and manufacturing technologies, which drew more than 1,000 exhibitors and a record number of business visitors. Live demonstrations of cutting-edge machine tools and accessories were a highlight of the event, promoting innovation and collaboration in the industry. This platform helped network and business opportunities, thus boosting India's machine tool accessories market growth.

- March 2024: The board of Birla Precision Technologies Ltd sanctioned the purchase of a 2.63% interest in Kores (India) Limited for INR15 crore as part of aligning with its growth plans. The strategic purchase is likely to boost its offerings in the machine tool accessories sector. Such mergers and acquisitions fuel market expansion through innovation and expanded product lines.

India Machine Tool Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cutting Tool Inserts, Toolholders, Workholding Accessories, Measuring and Inspection Tools, Lubricants and Coolants |

| Machine Types Covered | CNC Milling Machines, CNC Lathes, EDM Machines, Grinding Machines, Others |

| End-User Industries Covered | Automotive, Aerospace, Energy, Medical, Electronics, Manufacturing, Construction, Transportation, Mining |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India machine tool accessories market performed so far and how will it perform in the coming years?

- What is the breakup of the India machine tool accessories market on the basis of product?

- What is the breakup of the India machine tool accessories market on the basis of machine type?

- What is the breakup of the India machine tool accessories market on the basis of end user industry?

- What are the various stages in the value chain of the India machine tool accessories market?

- What are the key driving factors and challenges in the India machine tool accessories?

- What is the structure of the India machine tool accessories market and who are the key players?

- What is the degree of competition in the India machine tool accessories market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India machine tool accessories market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India machine tool accessories market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India machine tool accessories industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)