India Maintenance Repair and Operations (MRO) Market Size, Share, Trends and Forecast by Provider, MRO Type, and Region, 2025-2033

India Maintenance Repair and Operations (MRO) Market Overview:

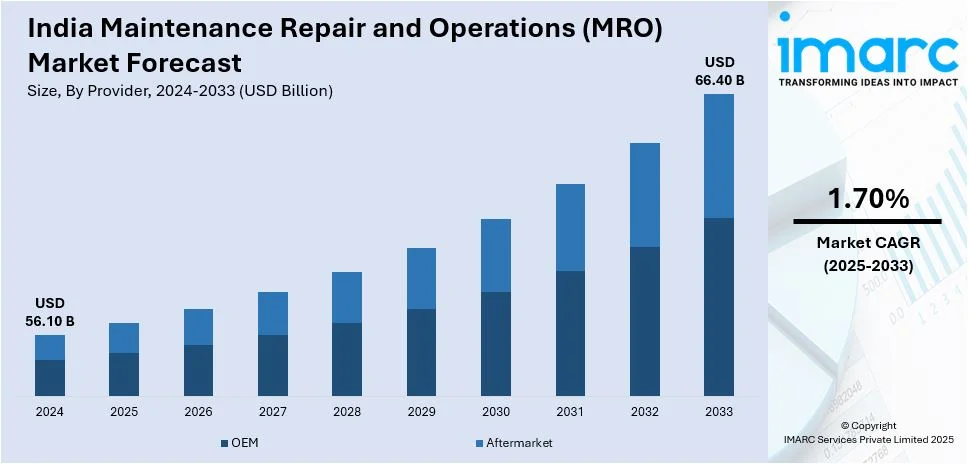

The India maintenance repair and operations (MRO) market size reached USD 56.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 66.40 Billion by 2033, exhibiting a growth rate (CAGR) of 1.70% during 2025-2033. The market is driven by rapid industrial growth, rising aviation fleet size, and increased infrastructure investments. Government initiatives like “Make in India,” policy liberalization, and demand for cost-efficient maintenance solutions are further accelerating market expansion, alongside growing adoption of digital technologies and localized supply chains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 56.10 Billion |

| Market Forecast in 2033 | USD 66.40 Billion |

| Market Growth Rate (2025-2033) | 1.70% |

India Maintenance Repair and Operations (MRO) Market Trends:

Rising Demand from Aviation and Aerospace Sector

India's thriving aviation sector is having a strong bearing on the MRO sector. With the fast-growing commercial fleet and growing air traffic within domestic as well as international routes, the airlines are focusing on maintaining aircraft on time to achieve operational efficiency and safety. Government initiatives like the UDAN scheme and free-opening of MRO policies have prompted the servicing within the country, breaking the reliance on overseas facilities. The expansion of regional airlines and low-cost carriers also requires affordable maintenance solutions. The Indian government's initiative to set up MRO hubs and give infrastructure status to the industry is also drawing foreign investment and joint ventures, making it a favorable environment for MRO expansion in aviation and aerospace uses.

To get more information on this market, Request Sample

Localization and Supply Chain Resilience Focus

India is placing increasing emphasis on localizing MRO services and strengthening domestic supply chains to reduce reliance on international vendors. Global disruptions, including pandemics and geopolitical tensions, have revealed the risks of offshore sourcing. In response, Indian industries are investing in indigenous repair capabilities and building local vendor networks to ensure operational continuity and cost control. Supporting this shift, the government has introduced targeted measures—such as reducing GST on MRO services from 18% to 5% and permitting 100% FDI via the automatic route—to bolster the sector. Initiatives under “Make in India” are accelerating the development of local component manufacturing and refurbishment units. Public-private collaboration is further enhancing skill development and regional MRO hubs, helping industries improve turnaround times and build greater self-reliance in critical maintenance operations.

Digitalization and Predictive Maintenance Adoption

Digital transformation is changing India's MRO landscape by using technologies such as IoT, AI, and data analytics. Organizations are transitioning from reactive to predictive maintenance approaches that minimize downtime and maximize asset performance. Sensors and networked systems allow equipment health to be monitored in real-time, and potential failures can be detected early. AI-powered diagnostics and digital twins are making repair and servicing more accurate. Cloud-based MRO management software is easing procurement, inventory management, and work order management. This technological revolution is not just enhancing operational efficiency and cutting costs but also facilitating better regulatory compliance. Business organizations in industries ranging from manufacturing, energy, and automotive are implementing digital MRO processes to achieve competitive advantage.

India Maintenance Repair and Operations (MRO) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on provider and MRO type.

Provider Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the provider. This includes OEM, and aftermarket.

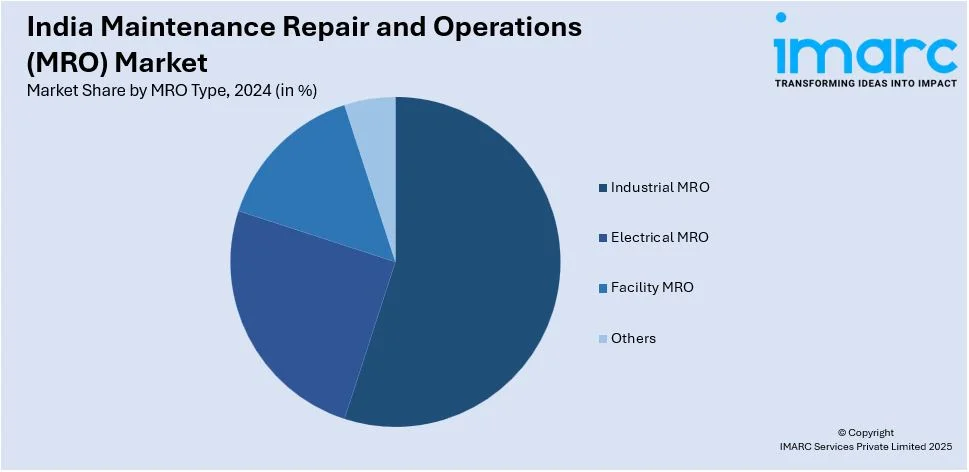

MRO Type Insights:

- Industrial MRO

- Electrical MRO

- Facility MRO

- Others

A detailed breakup and analysis of the market based on the MRO type have also been provided in the report. This includes industrial MRO, electrical MRO, facility MRO, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Maintenance Repair and Operations (MRO) Market News:

- In March 2025, French technology giant Thales inaugurated a new avionics MRO facility in Gurugram, near Delhi airport, to provide maintenance and repair services for Indian airlines including Air India and IndiGo. Certified by the DGCA, the facility was inaugurated by Civil Aviation Minister K Rammohan Naidu. This move supports the expanding Indian aviation sector and aligns with Thales’ strategy to strengthen its presence in India’s aerospace and aviation maintenance ecosystem.

- In September 2024, Dassault Aviation established a new subsidiary, Dassault Aviation MRO India (DAMROI), in Noida, Uttar Pradesh, focused solely on Maintenance, Repair, and Overhaul (MRO) for its military operations in India. This move aligns with advanced negotiations between France and the Indian Navy for 26 Rafale-M fighters, the marine variant. The Indian Air Force currently operates three Mirage-2000 squadrons and 36 Rafale jets, highlighting growing defense collaboration and localized support capabilities.

India Maintenance Repair and Operations (MRO) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | OEM, Aftermarket |

| MRO Types Covered | Industrial MRO, Electrical MRO, Facility MRO, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India maintenance repair and operations (MRO) market performed so far and how will it perform in the coming years?

- What is the breakup of the India maintenance repair and operations (MRO) market on the basis of provider?

- What is the breakup of the India maintenance repair and operations (MRO) market on the basis of MRO type?

- What is the breakup of the India maintenance repair and operations (MRO) market on the basis of region?

- What are the various stages in the value chain of the India maintenance repair and operations (MRO) market?

- What are the key driving factors and challenges in the India maintenance repair and operations (MRO) market?

- What is the structure of the India maintenance repair and operations (MRO) market and who are the key players?

- What is the degree of competition in the India maintenance repair and operations (MRO) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India maintenance repair and operations (MRO) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India maintenance repair and operations (MRO) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India maintenance repair and operations (MRO) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)