India Maleic Anhydride Market Size, Share, Trends and Forecast by Raw Materials, Application, and Region, 2025-2033

India Maleic Anhydride Market Overview:

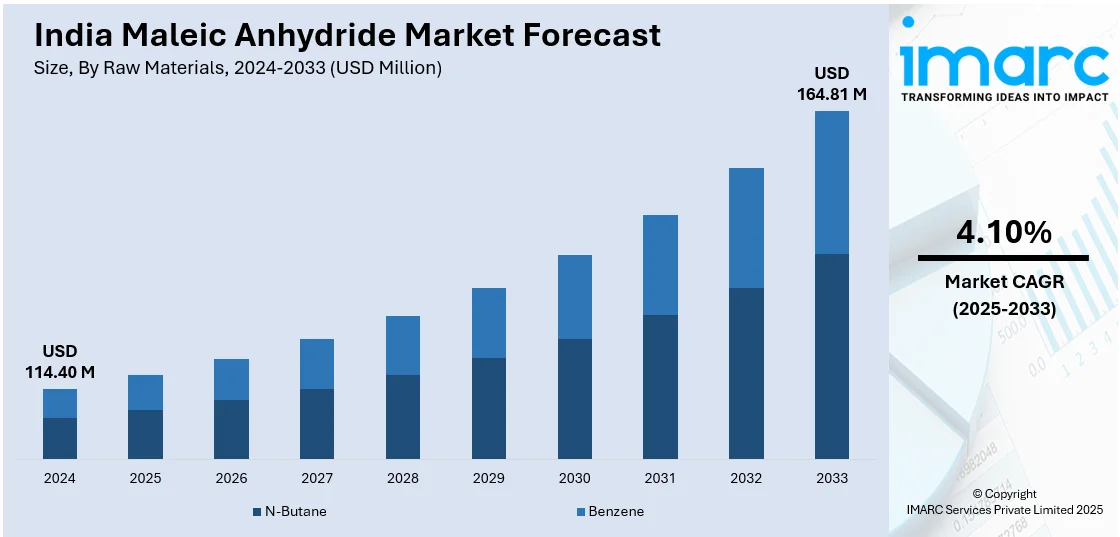

The India maleic anhydride market size reached USD 114.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 164.81 Million by 2033, exhibiting a growth rate (CAGR) of 4.10% during 2025-2033. The growing demand from the automotive, construction, and packaging industries, increasing consumption in the production of unsaturated polyester resins, rising infrastructure development, expanding use in agricultural chemicals, and the growing focus on sustainable and bio-based products are some of the major factors augmenting the India maleic anhydride market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 114.40 Million |

| Market Forecast in 2033 | USD 164.81 Million |

| Market Growth Rate 2025-2033 | 4.10% |

India Maleic Anhydride Market Trends:

Growing Demand from the Automotive and Construction Sectors

The increasing usage of maleic anhydride in the production of unsaturated polyester resins (UPR), which is essential for producing lightweight, durable materials in the automotive and construction sectors, is propelling the India maleic anhydride market growth. UPR finds extensive applications in fiberglass-reinforced plastic (FRP) for car parts such as bumpers, hoods, and structural panels to reduce car weight and ensure fuel efficiency. UPR-based products are also used in building construction in the form of roofing sheets, pipes, and tanks for their durability and resistance against corrosion. With the fast pace of urbanization, Smart City Mission, and development of infrastructure, there is growing demand for low-maintenance, high-performance materials. According to an industry report, total infrastructure investment in India is on the rise, with budget allocations reaching INR 10 Lakh Crore (about USD 120,482 Million) in 2023-24. This increased investment is driving the requirement for materials like maleic anhydride, which is widely used in the production of UPR in construction applications. Additionally, maleic anhydride-based composites are used in renewable energy applications, including wind turbine blades, which are providing a boost to market expansion. In addition to this, the automotive sector's push towards electric vehicles (EV) also increases the need for lightweight materials, further increasing the market consumption. Furthermore, increasing investments in research and development (R&D) activities to enhance material performance and develop customized resin formulations are expected to sustain market growth, fostering technological advancements and broader industrial applications.

To get more information on this market, Request Sample

Expanding Use of Agricultural Chemicals and Water Treatment

The maleic anhydride's applications in agricultural chemicals, particularly pesticides, herbicides, and plant growth regulators, are positively impacting the India maleic anhydride market outlook. According to an industry report, the country's overall food grain production for 2023–24 is projected to reach a record 3322.98 LMT, an increase of 26.11 LMT compared to the 3296.87 LMT produced in 2022–23. The higher agricultural productivity denotes the increasing demand for maleic-anhydride-based solutions, as these products enhance crop yields and protect against pests, thereby ensuring food security. Apart from this, maleic anhydride-derived chemicals find extensive applications in crop protection product formulation, and thus, they are the backbone of current agricultural practices. Maleic anhydride derivatives such as malic acid and fumaric acid play a crucial role in agrochemical formulations, which is fortifying the market demand. Moreover, maleic anhydride finds applications in water treatment chemicals that inhibit scale formation, corrosion, and microbial growth in industrial systems. In addition to this, rapid industrialization is also fueling the demand for efficient water management technologies in industries such as power generation, oil and gas, and chemical processing. Along with this, the ongoing developments in bio-based water treatment technologies and improving emphasis on water wastage minimization further add to the growth of the market. Further, strategic collaborations among chemical manufacturers and farming organizations are encouraging the creation of more efficient, environment-friendly water and agri-treatment products.

India Maleic Anhydride Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on raw materials and application.

Raw Materials Insights:

- N-Butane

- Benzene

The report has provided a detailed breakup and analysis of the market based on the raw materials. This includes N-butane and benzene.

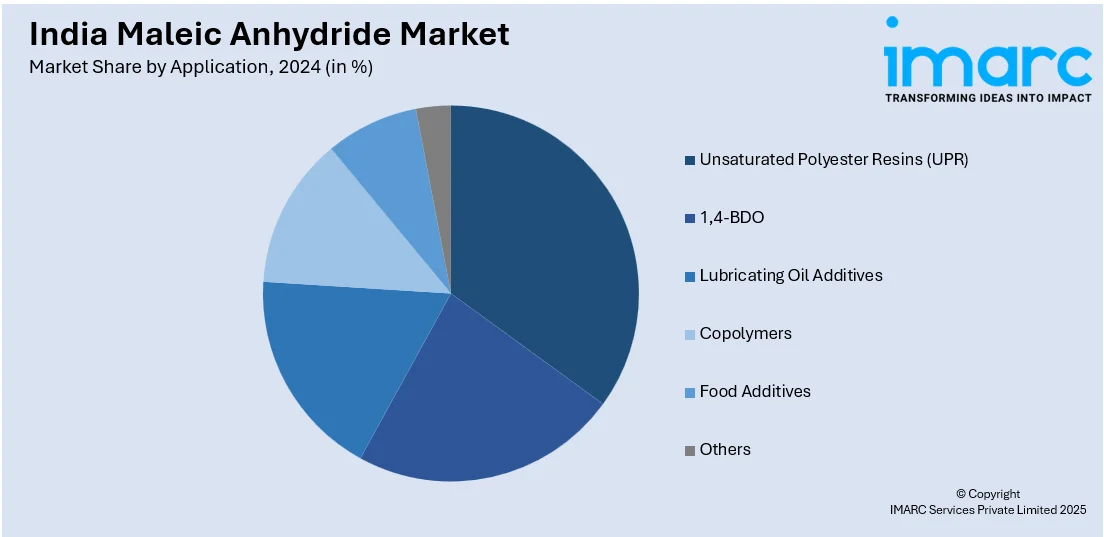

Application Insights:

- Unsaturated Polyester Resins (UPR)

- 1,4-BDO

- Lubricating Oil Additives

- Copolymers

- Food Additives

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes unsaturated polyester resins (UPR), 1,4-BDO, lubricating oil additives, copolymers, food additives, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Maleic Anhydride Market News:

- On May 24, 2023, Indian Oil Corporation (IOC) awarded a project management consultancy contract to McDermott International for the installation of a maleic anhydride (MAH) production unit at its Panipat refinery in Haryana, India. This plant, approved in November 2021 with an investment of INR 36.81 Billion (USD 491.89 Million), is designed to produce 120,000 Tonnes per year (tpy) of MAH, 20,000 tpy of 1,4-butanediol (BDO), and 16,000 tpy of tetrahydrofuran (THF). The initiative aims to reduce India's import dependence and bolster IOC's petrochemical portfolio by integrating value-added specialty products.

India Maleic Anhydride Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | N-Butane, Benzene |

| Applications Covered | Unsaturated Polyester Resins (UPR), 1,4-BDO, Lubricating Oil Additives, Copolymers, Food Additives, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India maleic anhydride market performed so far and how will it perform in the coming years?

- What is the breakup of the India maleic anhydride market on the basis of raw materials?

- What is the breakup of the India maleic anhydride market on the basis of application?

- What is the breakup of the India maleic anhydride market on the basis of region?

- What are the various stages in the value chain of the India maleic anhydride market?

- What are the key driving factors and challenges in the India maleic anhydride market?

- What is the structure of the India maleic anhydride market and who are the key players?

- What is the degree of competition in the India maleic anhydride market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India maleic anhydride market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India maleic anhydride market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India maleic anhydride industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)