India Maritime Freight Market Size, Share, Trends and Forecast by Transport Type, Application, and Region, 2025-2033

India Maritime Freight Market Overview:

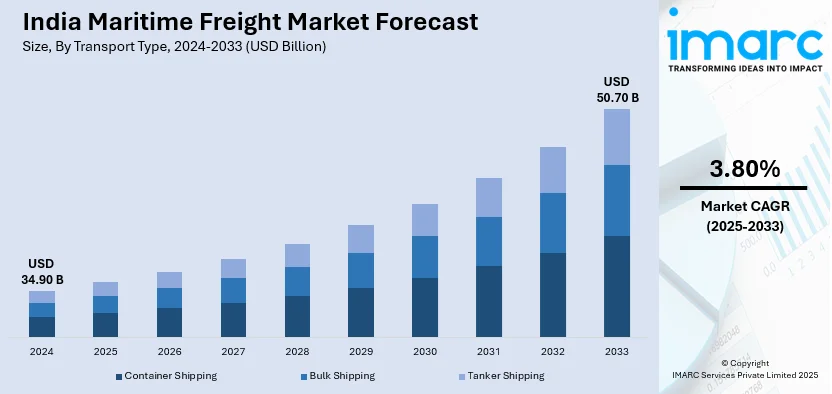

The India maritime freight market size reached USD 34.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 50.70 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is witnessing significant growth, driven by the expansion of port infrastructure and modernization initiatives and the rising containerization and shift toward value-added services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.90 Billion |

| Market Forecast in 2033 | USD 50.70 Billion |

| Market Growth Rate (2025-2033) | 3.80% |

India Maritime Freight Market Trends:

Expansion of Port Infrastructure and Modernization Initiatives

India’s maritime freight market is experiencing significant transformation driven by large-scale port infrastructure expansion and modernization projects under government-backed initiatives. The Sagarmala Programme, spearheaded by the Ministry of Ports, Shipping and Waterways, aims to reduce logistics costs by enhancing port capacity, improving hinterland connectivity, and facilitating port-led industrialization. As part of this initiative, the government is focusing on the development of new ports and the upgrading of existing major and non-major ports with advanced cargo handling systems, deep-draft berths, and digital port operations. For instance, in December 2024, The Ministry organized the first India Maritime Heritage Conclave. Major port capacity doubled to 1,630 MTPA, with 98 modernization projects adding 230+ MTPA capacity. Public-private partnerships are also playing a pivotal role in attracting investment for terminal expansion, mechanization, and the integration of smart technologies such as real-time tracking, AI-based logistics management, and blockchain-enabled documentation. These improvements are enabling faster turnaround times, greater handling capacity, and better operational efficiency, thereby enhancing India’s global trade competitiveness. The modernization of port infrastructure is further complemented by the development of multimodal logistics parks and dedicated freight corridors, which facilitate seamless movement of goods across rail, road, and inland waterways. As a result, the Indian maritime freight sector is becoming increasingly integrated and efficient, positioning itself as a strategic hub in the Indiaal and global supply chain network.

To get more information on this market, Request Sample

Rising Containerization and Shift Toward Value-Added Services

The Indian maritime freight market is witnessing a growing trend toward containerization, reflecting a structural shift in cargo handling and logistics preferences. As global trade becomes more standardized and integrated, the use of containers is increasing across a broad spectrum of cargo categories, including agricultural produce, automotive parts, electronics, textiles, and chemicals. This shift is driven by the benefits of containerized freight, such as improved cargo security, reduced handling times, enhanced intermodal transport compatibility, and lower risk of damage or loss. Major ports like Jawaharlal Nehru Port, Mundra, and Chennai are expanding their container handling capabilities through the installation of advanced cranes, automated systems, and dedicated container terminals. Additionally, the market is experiencing a rise in demand for value-added services such as warehousing, cold chain logistics, last-mile delivery, and integrated supply chain management. Logistics service providers are increasingly offering end-to-end solutions that combine ocean freight with inland transport, customs clearance, and inventory management. For instance, in February 2025, Union Minister Sarbananda Sonowal announced ₹4,800 crore investment at Advantage Assam 2.0 to modernize river transport, enhance trade connectivity, and promote eco-friendly inland waterways in Assam. Digital platforms are also enabling real-time visibility and streamlined documentation, contributing to operational efficiency. The combination of containerization and expanded value-added services is reshaping the maritime freight ecosystem in India, improving service quality and reinforcing the country’s position as a competitive maritime logistics hub.

India Maritime Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on transport type and application.

Transport Type Insights:

- Container Shipping

- Bulk Shipping

- Tanker Shipping

The report has provided a detailed breakup and analysis of the market based on the transport type. This includes container shipping, bulk shipping, and tanker shipping.

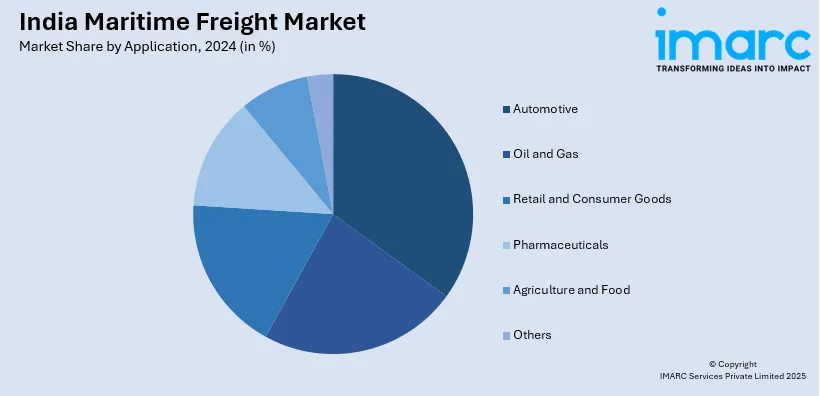

Application Insights:

- Automotive

- Oil and Gas

- Retail and Consumer Goods

- Pharmaceuticals

- Agriculture and Food

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, oil and gas, retail and consumer goods, pharmaceuticals, agriculture and food, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Maritime Freight Market News:

- In February 2025, BEML Ltd. and Goa Shipyard Limited signed an MoU to advance shipbuilding and maritime technologies, supporting India's Aatmanirbhar Bharat vision. The collaboration will boost innovation, infrastructure, and indigenous capabilities in defense and marine sectors, focusing on research, manufacturing, and reducing import dependency through advanced engineering and shipbuilding expertise.

- In February 2025, the Cruise Bharat Mission announced that it aims to double India’s cruise passenger traffic by 2029. It adopts an inter-ministerial approach, focusing on policy reforms, infrastructure growth, and coordination among Customs, Immigration, CISF, tourism bodies, maritime agencies, and local authorities to streamline cruise operations nationwide.

India Maritime Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transport Types Covered | Container Shipping, Bulk Shipping, Tanker Shipping |

| Applications Covered | Automotive, Oil and Gas, Retail and Consumer Goods, Pharmaceuticals, Agriculture and Food, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India maritime freight market performed so far and how will it perform in the coming years?

- What is the breakup of the India maritime freight market on the basis of transport type?

- What is the breakup of the India maritime freight market on the basis of application?

- What is the breakup of the India maritime freight market on the basis of region?

- What are the various stages in the value chain of the India maritime freight market?

- What are the key driving factors and challenges in the India maritime freight ?

- What is the structure of the India maritime freight market and who are the key players?

- What is the degree of competition in the India maritime freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India maritime freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India maritime freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India maritime freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)