India Maritime Logistics Market Size, Share, Trends and Forecast by Service Type, Application, Mode of Transport, End User, and Region, 2025-2033

India Maritime Logistics Market Size and Share:

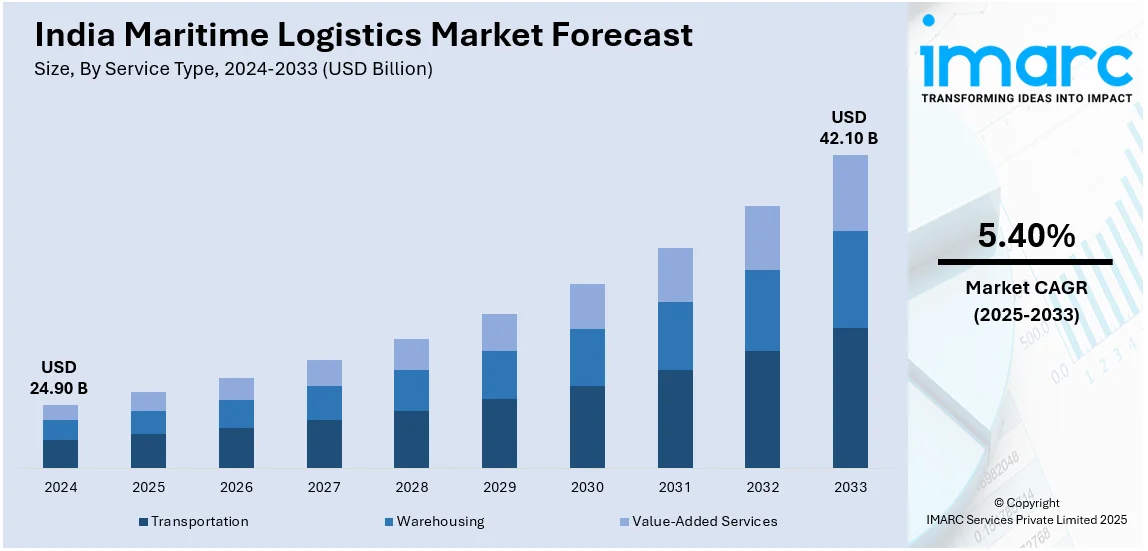

The India maritime logistics market size reached USD 24.90 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 42.10 Billion by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The India maritime logistics market is driven by massive infrastructure investments under the Sagarmala Programme, enhanced port connectivity through multimodal transport networks, rising trade volumes, increasing adoption of digital port operations, and strategic initiatives like the "One Nation-One Port" policy, which collectively boost efficiency, reduce costs, and strengthen global trade competitiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.90 Billion |

| Market Forecast in 2033 | USD 42.10 Billion |

| Market Growth Rate (2025-2033) | 5.40% |

India Maritime Logistics Market Trends:

Implementation of the Sagarmala Programme

Initiated in 2015, the Sagarmala Programme seeks to drive port-led development from India's long 7,500 km coastline. Its key goals are to modernize port infrastructure, improve connectivity, and drive industrialization to lower logistic costs and enhance trade competitiveness. By 2024, the program had made significant headway, with many of its projects completed or underway. One of the high points under Sagarmala has been the establishment of new ports and upgradation of old ones to facilitate higher volumes of cargo. For example, Adani Ports and Special Economic Zone (APSEZ), the largest private port operator in India, has seen its business grow immensely. During the year 2023-24, APSEZ handled 420 million metric tons (MMT) of cargo, an upsurge of 24%. Moreover, APSEZ accounts for 44% of India's containerized seaborne trade, which makes it a critical player in the seaborne economy. The Sagarmala Programme also focuses on enhancing connectivity between the ports and the hinterland. This involves the creation of multimodal logistics parks and improved road and rail connectivity, which have played a crucial role in lowering transportation costs and time. The programme's integrated approach has resulted in an integrated and efficient logistics network, which benefits industries and consumers.

To get more information on this market, Request Sample

East Coast Economic Corridor (ECEC): Catalyzing Regional Integration

East Coast Economic Corridor (ECEC) is another key project to expand the maritime logistics sector. The ECEC spans from West Bengal to Tamil Nadu and aims to promote port-led industrialization, infrastructure improvement, regulatory overhaul, and regional connectivity. It takes advantage of the strategic position on the eastern coastline as a link between India and global value chains, especially those in East and Southeast Asia. One of the major features of the ECEC is the focus on building world-class infrastructure to facilitate industrial development. This involves the development of road and rail connectivity, improvement in power supply, and setting up logistics and distribution centers. These upgrades have lowered business costs of transactions, making Indian goods more competitive globally. The corridor also fits into the Sagarmala program, generating synergies that further enhance the maritime logistics ecosystem. The ECEC's emphasis on regulatory reforms has improved the region's ease of doing business. Streamlined processes and a facilitative policy environment have attracted both local and international investments, triggering the growth of new industries as well as the expansion of the existing ones. This growth in industries has further boosted volumes of cargo handled by ports along the corridor, resulting in the general development of the maritime logistics sector. Moreover, the collective efforts under the Sagarmala Programme and the East Coast Economic Corridor have played a pivotal role in propelling the development of India's maritime logistics sector. Through the emphasis on infrastructure growth, connectivity development, and regulatory enhancement, these efforts have further entrenched India in global trade and laid the groundwork for long-term economic growth.

India Maritime Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service type, application, mode of transport, end-user, and region.

Service Type Insights:

- Transportation

- Warehousing

- Value-Added Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, warehousing, and value-added services.

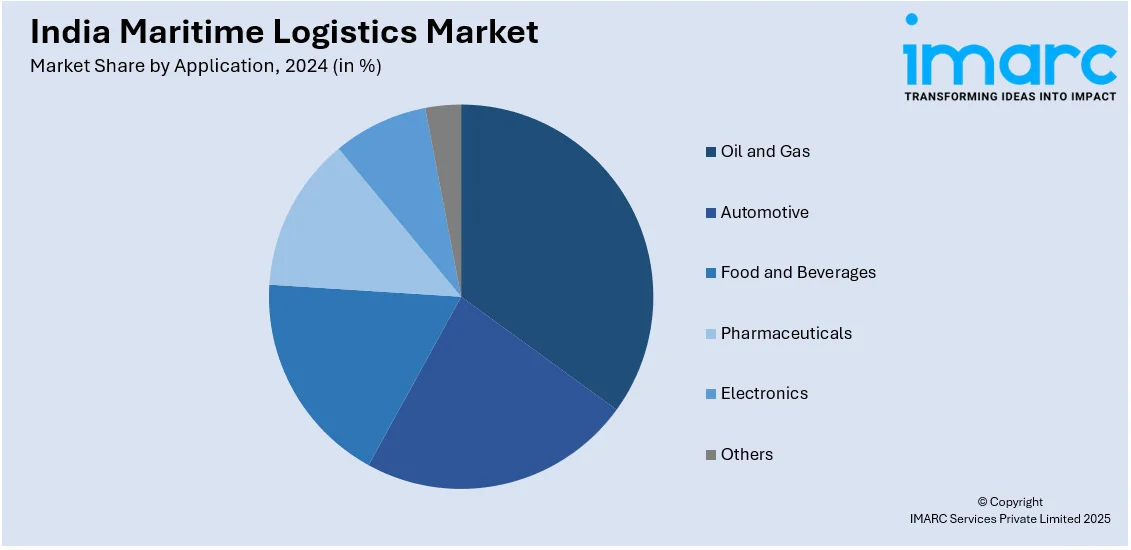

Application Insights:

- Oil and Gas

- Automotive

- Food and Beverages

- Pharmaceuticals

- Electronics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes oil and gas, automotive, food and beverages, pharmaceuticals, electronics, and others.

Mode of Transport Insights:

- Sea

- Inland Waterways

A detailed breakup and analysis of the market based on the mode of transport have also been provided in the report. This includes sea and inland waterways.

End-User Insights:

- Commercial

- Industrial

- Government

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes commercial, industrial, and government.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Maritime Logistics Market News:

- March 2025: The Government of Andhra Pradesh launched the Maritime Policy 2024–29, with the vision of making the state India's maritime gateway by 2030. With its 1,053 km coastline, the policy aims to develop port infrastructure, lower logistics costs, and attract foreign investments. These efforts are expected to enhance the state's maritime logistics strength, making Andhra Pradesh a key hub in India's maritime economy.

- February 2025: The "One Nation-One Port" policy seeks to consolidate and rationalize port operations in India, making them more efficient and easier to do business. The policy is centered on digitalization, infrastructure upgradation, and regulatory ease to lower logistics costs and turnaround time. These efficiencies enhance India's maritime logistics sector by improving cargo handling capacity, drawing global trade, and building supply chain efficiency.

India Maritime Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Warehousing, Value-Added Services |

| Applications Covered | Oil and Gas, Automotive, Food and Beverages, Pharmaceuticals, Electronics, Others |

| Mode of Transports Covered | Sea, Inland Waterways |

| End Users Covered | Commercial, Industrial, Government |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India maritime logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the India maritime logistics market on the basis of service type?

- What is the breakup of the India maritime logistics market on the basis of application?

- What is the breakup of the India maritime logistics market on the basis of mode of transport?

- What is the breakup of the India maritime logistics market on the basis of end user?

- What are the various stages in the value chain of the India maritime logistics market?

- What are the key driving factors and challenges in the India maritime logistics market?

- What is the structure of the India maritime logistics market and who are the key players?

- What is the degree of competition in the India maritime logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India maritime logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India maritime logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India maritime logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)