India Material Testing Equipment Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

India Material Testing Equipment Market Size and Share:

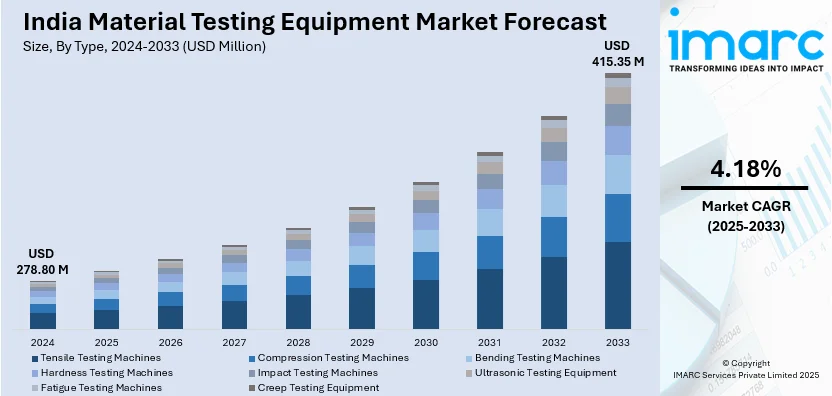

The India material testing equipment market size reached USD 278.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 415.35 Million by 2033, exhibiting a growth rate (CAGR) of 4.18% during 2025-2033. The market is witnessing significant growth, driven by the rising adoption of automated and digital testing solutions and the expansion of infrastructure and construction activities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 278.80 Million |

| Market Forecast in 2033 | USD 415.35 Million |

| Market Growth Rate 2025-2033 | 4.18% |

India Material Testing Equipment Market Trends:

Rising Adoption of Automated and Digital Testing Solutions

Material testing equipment market in India is witnessing a notable shift towards automated and digitally integrated testing systems. Industries such as automotive, aerospace, defense and construction are advancing their manufacturing practices; hence, the need for fast, accurate, and repeatable material test methods has become compelling. Automated testing machines using real-time data acquisition, remote monitoring, and software analytics are increasingly getting deployed so as to minimize human error and improve operational efficiency. For instance, in August 2024, ABB’s AquaMaster, deployed across 15 Indian cities, revolutionized water flow measurement by enhancing water flow measurement with 4G connectivity, aiding leak detection, reducing non-revenue water, and enabling remote utility management with high precision. These systems enable faster testing cycles, streamlined documentation, and seamless integration with quality management platforms, which are essential in highly regulated environments. Indian manufacturers are also aligning with global testing standards, driving demand for sophisticated equipment capable of complying with ISO, ASTM, and BIS protocols. In addition, digital transformation initiatives, supported by government programs like “Digital India” and “Make in India,” are further accelerating the adoption of intelligent testing infrastructure. With growing R&D activities and quality assurance becoming central to competitiveness, industries are investing in next-generation material testing solutions that offer enhanced accuracy, lifecycle testing, and multi-material capabilities. This trend is expected to drive long-term modernization across India's testing laboratories, academic institutions, and production facilities.

To get more information on this market, Request Sample

Expansion of Infrastructure and Construction Activities

India’s robust infrastructure growth is a key driver fueling demand for advanced material testing equipment across the construction and civil engineering sectors. With large-scale investments in highways, metro rail, smart cities, and renewable energy projects, there is a growing need to ensure the structural integrity and durability of building materials such as concrete, steel, asphalt, and composites. Government initiatives such as the National Infrastructure Pipeline (NIP), Bharatmala, and PM Gati Shakti are contributing to a significant increase in construction activity, requiring stringent material quality assessments at every stage. Construction firms and quality control laboratories are investing in compression testing machines, universal testing machines (UTMs), non-destructive testing (NDT) devices, and other field-specific equipment to meet regulatory and performance standards. For instance, in October 2024, TUV India Pvt. Ltd. launched an NABL-accredited Advanced Chemical and Material Testing Lab in Noida, enhancing testing services for automotive, electronics, industrial, and consumer sectors to meet global standards. Moreover, the emphasis on sustainability and environmental compliance is prompting the use of recycled and alternative materials, which also require comprehensive testing before deployment. The increasing involvement of international contractors and consultants in Indian infrastructure projects is introducing global best practices in material testing, further driving equipment upgrades. As infrastructure continues to form the backbone of India’s economic development, the material testing equipment market is expected to grow in parallel, driven by safety, quality, and compliance imperatives.

India Material Testing Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Tensile Testing Machines

- Compression Testing Machines

- Bending Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Ultrasonic Testing Equipment

- Fatigue Testing Machines

- Creep Testing Equipment

The report has provided a detailed breakup and analysis of the market based on the type. This includes tensile testing machines, compression testing machines, bending testing machines, hardness testing machines, impact testing machines, ultrasonic testing equipment, fatigue testing machines, and creep testing equipment.

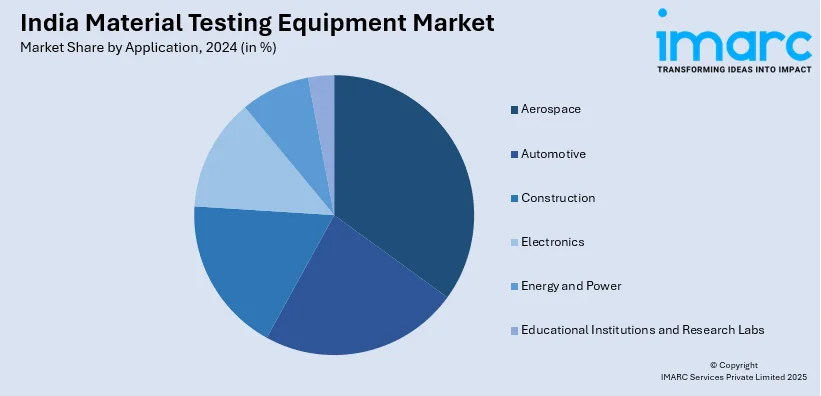

Application Insights:

- Aerospace

- Automotive

- Construction

- Electronics

- Energy and Power

- Educational Institutions and Research Labs

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes aerospace, automotive, construction, electronics, energy and power, and educational institutions and research labs.

End User Insights:

- Manufacturers

- Research and Development Laboratories

- Quality Control and Assurance Departments

- Academic Institutions

- Govemental Regulatory Bodies

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes manufacturers, research and development laboratories, quality control and assurance departments, academic institutions, and governmental regulatory bodies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Material Testing Equipment Market News:

- In February 2025, Paramount, a leading Indian textile testing instrument manufacturer, is showcasing its advanced quality control equipment at GTE 2025, co-located with Bharat Tex 2025. Textiles Minister Giriraj Singh visited their stall, where CEO Manjit Singh Saini highlighted the rising demand for quality textiles and the importance of indigenous testing solutions.

India Material Testing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tensile Testing Machines, Compression Testing Machines, Bending Testing Machines, Hardness Testing Machines, Impact Testing Machines, Ultrasonic Testing Equipment, Fatigue Testing Machines, Creep Testing Equipment |

| Applications Covered | Aerospace, Automotive, Construction, Electronics, Energy and Power, Educational Institutions and Research Labs |

| End Users Covered | Manufacturers, Research and Development Laboratories, Quality Control and Assurance Departments, Academic Institutions, Governmental Regulatory Bodies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India material testing equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India material testing equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India material testing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The material testing equipment market in India was valued at USD 278.80 Million in 2024.

The India material testing equipment market is projected to exhibit a CAGR of 4.18% during 2025-2033, reaching a value of USD 415.35 Million by 2033.

Key factors driving the India material testing equipment market include rapid industrialization, growth in construction and manufacturing sectors, increasing demand for quality assurance, and strict regulatory standards. Advancements in testing technologies and rising infrastructure projects also contribute to market expansion, along with the need for reliable materials in aerospace, automotive, and defense applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)