India Maternal Healthcare Products Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

India Maternal Healthcare Products Market Overview:

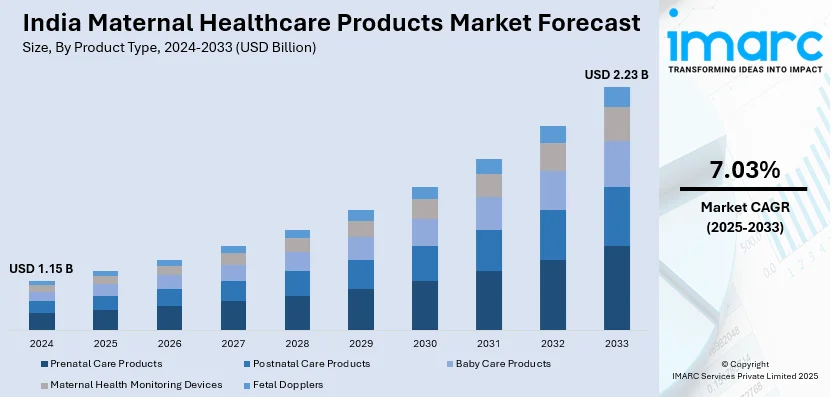

The India maternal healthcare products market size reached USD 1.15 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.23 Billion by 2033, exhibiting a growth rate (CAGR) of 7.03% during 2025-2033. The market is witnessing significant growth, driven by the rising preference for prenatal nutritional supplements and functional foods and the rapid digitalization of maternal health monitoring and product access.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.15 Billion |

| Market Forecast in 2033 | USD 2.23 Billion |

| Market Growth Rate 2025-2033 | 7.03% |

India Maternal Healthcare Products Market Trends:

Rising Preference for Prenatal Nutritional Supplements and Functional Foods

The India maternal healthcare products market is witnessing a notable shift toward prenatal nutritional supplements and functional foods, driven by growing awareness of maternal health needs and the role of targeted nutrition during pregnancy. Increasing educational outreach by healthcare professionals, coupled with government-supported antenatal care programs, is encouraging expecting mothers to adopt dietary supplements that address common deficiencies such as iron, calcium, folic acid, and vitamin D. For instance, in February 2024, the Indian government launched Pradhan Mantri Surakshit Matritva Abhiyan (PMSMA) to offer free, quality antenatal care on the 9th of every month, with an extended strategy for tracking high-risk pregnancies through incentives and additional ASHA visits. Functional foods fortified with essential micronutrients are gaining traction in both urban and semi-urban areas, supported by improved access to pharmacies and online healthcare platforms. Private healthcare providers and maternity hospitals are actively recommending personalized supplement plans, while domestic and international brands are expanding their product lines to include chewable tablets, gummies, protein powders, and ready-to-drink formulations. The trend is further reinforced by the rise in nuclear families and late pregnancies, where nutritional supplementation becomes critical. Manufacturers are also introducing clean-label, plant-based, and allergen-free variants to cater to evolving consumer preferences. This shift is not only enhancing health outcomes for both mother and child but is also reshaping product innovation strategies across the maternal healthcare ecosystem in India, making nutrition-centric interventions a key growth segment within the broader market.

To get more information on this market, Request Sample

Digitalization of Maternal Health Monitoring and Product Access

The increasing integration of digital technologies in maternal healthcare is transforming how expectant mothers in India access products, services, and real-time health information. Mobile health applications, teleconsultations, and remote monitoring devices are enabling continuous engagement between healthcare providers and patients, facilitating early intervention and informed decision-making. For instance, in July 2024, the Indian Ministry of Health launched ‘U-WIN’, a digital portal to track vaccinations for pregnant women and children under 6, covering 12 VPDs under UIP, part of NHM’s RCH program. These digital tools are particularly effective in improving outreach in tier II and tier III cities, where traditional healthcare infrastructure may be limited. Online platforms and e-commerce marketplaces are also playing a pivotal role in streamlining the purchase of maternal healthcare products such as supplements, personal care items, and diagnostic kits. Leading brands are leveraging these platforms to offer subscription-based services, customized product bundles, and doorstep delivery, enhancing convenience and user retention. Furthermore, the proliferation of wearable devices with pregnancy-specific features—such as fetal monitoring, sleep tracking, and nutrition logging is empowering women to take a proactive role in managing their health. Digital campaigns run by healthcare brands and government agencies are raising awareness around the availability and usage of these solutions. As digital health ecosystems continue to expand in India, they are not only improving access and compliance but are also setting new benchmarks in personalized maternal care delivery.

India Maternal Healthcare Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Prenatal Care Products

- Prenatal Vitamins and Supplements

- Pregnancy Tests

- Maternity Belts and Support Products

- Postnatal Care Products

- Postnatal Recovery Kits

- Breastfeeding

- Postnatal Supplements

- Baby Care Products

- Baby Skincare Products

- Baby Feeding Products

- Baby Hygiene Products

- Maternal Health Monitoring Devices

- Blood Pressure Monitors

- Glucose Monitors

- Fetal Dopplers

The report has provided a detailed breakup and analysis of the market based on the product type. This includes prenatal care products (prenatal vitamins and supplements, pregnancy tests, maternity belts and support products), postnatal care products (postnatal recovery kits, breastfeeding, postnatal supplements), baby care products (baby skincare products, baby feeding products, baby hygiene products), and maternal health monitoring devices (blood pressure monitors, glucose monitors, and fetal dopplers).

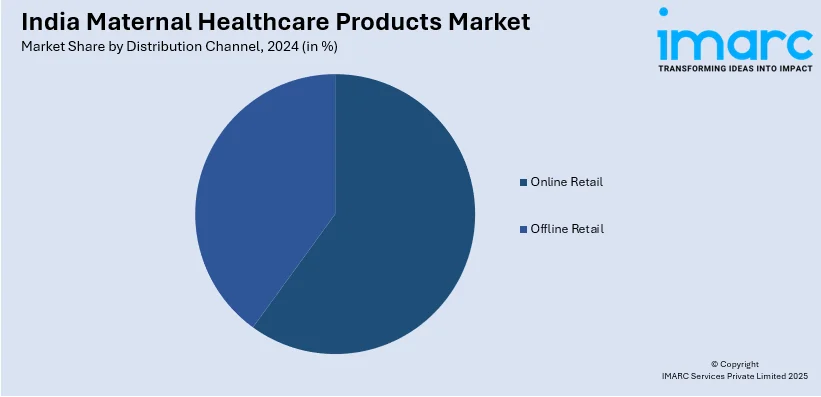

Distribution Channel Insights:

- Online Retail

- Offline Retail

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online retail and offline retail.

End User Insights:

- Hospitals and Clinics

- Homecare Settings

- Maternity Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, homecare settings, and maternity centers

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Maternal healthcare products Market News:

- In May 2024, Janitri, a MedTech startup featured in Shark Tank India Season 3, secured ₹1 crore from Namita Thapar. With innovations in maternal and fetal monitoring, Janitri has supported over 1 lakh pregnancies, saved 8,000+ lives, and continues to combat maternal mortality through impactful, tech-driven healthcare solutions across India.

India Maternal healthcare products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Online Retail, Offline Retail |

| End Users Covered | Hospitals and Clinics, Homecare Settings, Maternity Centers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India maternal healthcare products market performed so far and how will it perform in the coming years?

- What is the breakup of the India maternal healthcare products market on the basis of product type?

- What is the breakup of the India maternal healthcare products market on the basis of distribution channel?

- What is the breakup of the India maternal healthcare products market on the basis of end user?

- What is the breakup of the India maternal healthcare products market on the basis of region?

- What are the various stages in the value chain of the India maternal healthcare products market?

- What are the key driving factors and challenges in the India maternal healthcare products?

- What is the structure of the India maternal healthcare products market and who are the key players?

- What is the degree of competition in the India maternal healthcare products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India maternal healthcare products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India maternal healthcare products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India maternal healthcare products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)