India Mayonnaise Market Size, Share, Trends and Forecast by Type, End Use, Distribution Channel, and Region, 2025-2033

Market Overview:

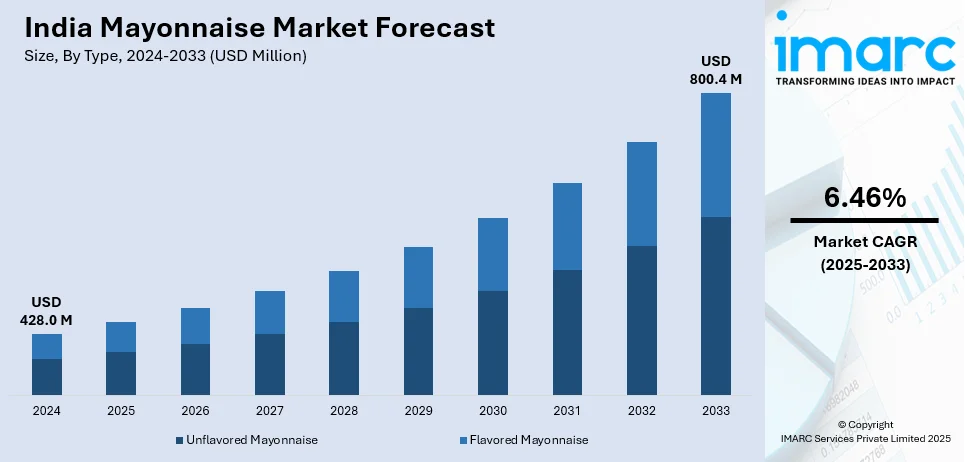

The India mayonnaise market size reached USD 428.0 Million in 2024. The market is expected to reach USD 800.4 Million by 2033, exhibiting a growth rate (CAGR) of 6.46% during 2025-2033. The market growth is attributed to the growing international culinary influences, the inflating popularity of diverse flavors, increasing adoption of Western culinary influences, growing popularity of fast-food culture, versatility of mayonnaise extending beyond traditional uses, convenience and flavor-enhancing qualities making it a staple in households, and diverse range of products catering to different taste preferences.

Market Insights:

- On the basis of region, the market has been divided into North India, West and Central India, South India, and East and Northeast India.

- On the basis of type, the market has been divided into unflavored mayonnaise and flavored mayonnaise.

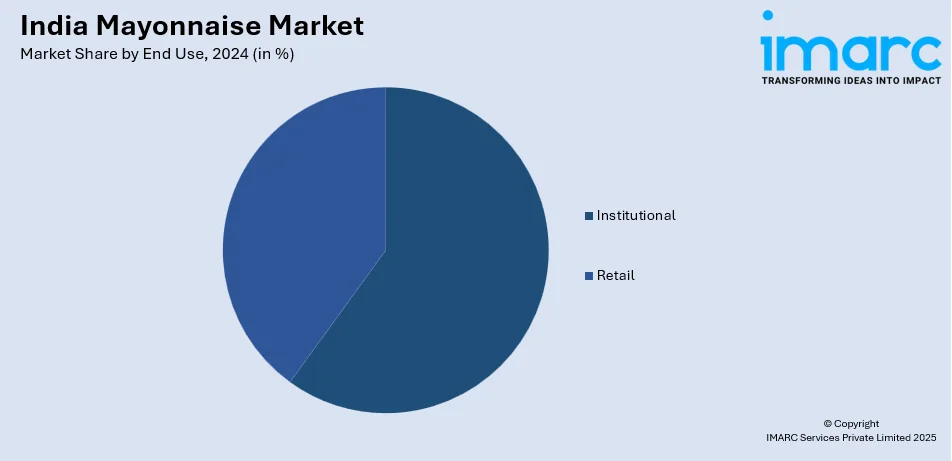

- On the basis of end use, the market has been divided into institutional and retail.

- On the basis of distribution channel, the market has been divided into supermarkets and hypermarkets, convenience stores, online retailers, specialty stores, and others.

Market Size and Forecast:

- 2024 Market Size: USD 428.0 Million

- 2033 Projected Market Size: USD 800.4 Million

- CAGR (2025-2033): 6.46%

Mayonnaise is a well-liked condiment celebrated for its smooth consistency and zesty taste. Typically crafted from a combination of oil, vinegar or lemon juice, egg yolks, and seasonings, this mixture is carefully emulsified to yield a velvety and enduring sauce. Its widespread application includes being used as a spread for sandwiches, burgers, and wraps, while also serving as a fundamental ingredient for various dressings and sauces. With its adaptability, it has become a fundamental element in both household kitchens and the commercial food sector. Beyond its role as a spread, mayonnaise is acknowledged for its capacity to enrich the flavor and texture of dishes, introducing a decadent and gratifying component. In contemporary culinary practices, it has found its way into dips and marinades, owing to its luscious consistency, making it a versatile and cherished addition in kitchens nationwide.

To get more information on this market, Request Sample

The mayonnaise market in India has experienced substantial growth, mirrored the evolving culinary preferences and expanding urbanization in the country. One of the driving factors behind the burgeoning mayonnaise market in India is the increasing adoption of Western culinary influences and the growing popularity of fast-food culture. Additionally, domestic and international brands have recognized the burgeoning demand for mayonnaise in India, leading to a diverse range of products catering to different taste preferences. Besides this, the market has seen the introduction of variations, such as garlic mayonnaise, spicy mayo, and low-fat options, appealing to a broad spectrum of consumers. The versatility of mayonnaise extends beyond its traditional uses, with its incorporation into various regional and fusion dishes gaining popularity. As the culinary landscape in India continues to evolve, and with an increasing number of consumers experimenting with diverse flavors, the mayonnaise market is poised for sustained growth. Moreover, the convenience and flavor-enhancing qualities of mayonnaise have made it a staple in many households, contributing to its integral role in the contemporary Indian kitchen. This, in turn, will continue to bolster the market growth across the country over the forecasted period.

India Mayonnaise Market Trends:

Health-Focused Formulations and Clean Label Trend

The industry is experiencing a huge transition towards health-oriented formulations propelled by the increasing realization of nutrition and well-being among end-users. Companies are launching more low-fat, low-calorie, and organic variants to address health-oriented segments. This has spurred the creation of mayonnaise products using avocado oil, olive oil, and other healthier options versus the conventional soybean oil. Moreover, the clean label trend has picked up a lot of momentum, with consumers looking for products containing few and identifiable ingredients. Companies are taking note by removing artificial flavors, colors, and preservatives from their products and featuring natural ingredients on labels. This trend is especially high among urban millennials and Gen Z, who pay a premium price for products that support their wellness and health objectives. The diabetes and obesity epidemic has further sped up the popularity of sugar-free and low-sodium versions, forcing companies to innovate and re-formulate products at the same time while preserving taste and texture levels.

Regional Flavor Innovation and Fusion Cuisine Integration

The India mayonnaise market demand is being dynamically influenced by regional flavor innovation and the fusion cuisine incorporation trend. Indian consumers are increasingly adopting mayonnaise products that use local spices and flavors, developing a novel fusion of Western condiment with indigenous Indian flavors. Companies are introducing products with flavors such as mint-coriander, tandoori, schezwan, and curry, which are appealing to the Indian taste buds without sacrificing the creamy feel of original mayonnaise. This approach to localization has worked strongly in reaching tier-2 and tier-3 cities where heritage flavors carry deep cultural connotations. The trend goes beyond flavor extension to embrace texture change and sourcing of ingredients from local sources. Food service outlets, especially quick-service restaurants and cafes, are leading demand for these new-age variants as they try to differentiate their offerings and come up with signature products that reflect local tastes but retain universal appeal.

Premium Positioning and Handcrafted Product Creation

Consumer shift towards premium and artisanal food items has helped create a niche within the market. The trend is identified by the launch of small-batch, handcrafted mayonnaise products that highlight better-quality ingredients, distinct flavor profiles, and premium packaging. Premium brands are emphasizing narratives on their manufacturing processes, ethics of sourcing, and chef approvals to support premium price points. The artisanal category consists of flavors like truffle, herb crust, and imported ingredient-based mayonnaise that appeal to upscale urban customers who wish to experience gourmet. This category is strongest among metro cities, where consumers are more open to experimental food and are willing to spend on a high-end food experience. Expansion of mayonnaise market size in India in the premium segment is being fueled by growth in organized retail channels, specialty food stores, and e-commerce platforms that enable greater visibility and convenience to these niche offerings.

Some of the other trends in the market include,

- Packaging Innovations: Packaging innovation is also contributing significantly towards increasing the convenience aspect for the consumption of mayonnaise. Squeezy bottles enhance the ease of use of mayonnaise without mess for consumers, and single-serve packs are fast gaining popularity in QSRs and food delivery chains. All these innovations are responding to the increasing demand for eating on the move and convenience, particularly in the fast-moving urban lifestyle.

- D2C and E-commerce Growth: Shopping websites like Amazon, Blinkit, and BigBasket have witnessed an increase in mayonnaise sales, echoing the trend of direct-to-consumer (D2C) sales. With home delivery at their fingertips, consumers are increasingly interested in trying out new brands and versions of mayonnaise. India's e-commerce revolution is opening up mayonnaise to more people, even in tier-2 and tier-3 cities.

- Foodservice Demand: Demand for mayonnaise from the foodservice industry, specifically cafes, quick-service restaurants (QSRs), and cloud kitchens, has witnessed a sharp increase. Mayonnaise is a prominent ingredient in many dishes at these places, ranging from sandwiches and wraps to burgers and salads. With increasing numbers of cloud kitchens and QSR chains opening up, demand for bulk mayonnaise supply continues to go up.

- Social media and Influencer Recipes: social media and influencers are leading the charge in making new uses for mayonnaise go viral, with recipes for dips, spreads, and snacks made using mayonnaise spreading like wildfire. Social media highlights innovative and different uses of mayonnaise, fueling consumer interest in trying out the product. Consequently, mayonnaise is becoming a staple in home cooking as an ingredient, rather than merely serving as a condiment.

Growth Drivers of the India Mayonnaise Market:

The primary growth drivers of the market include the rapid urbanization and changing lifestyle patterns of Indian consumers, leading to increased consumption of convenience foods and Western cuisine. The expanding food service industry, particularly the growth of quick-service restaurants, cafes, and cloud kitchens, has created substantial demand for mayonnaise as a key ingredient and condiment. One of the important factors driving the India mayonnaise market growth is the rising disposable incomes, especially among the middle-class population, have enabled consumers to experiment with international flavors and premium food products. The proliferation of organized retail channels and e-commerce platforms has improved product accessibility and visibility, facilitating market penetration across tier-2 and tier-3 cities.

Opportunities in the India Mayonnaise Market:

The India mayonnaise market presents significant opportunities through product innovation and flavor localization strategies that cater to regional taste preferences and dietary requirements. The untapped potential in rural and semi-urban markets offers substantial growth opportunities for manufacturers willing to invest in distribution network expansion and price-sensitive product variants. The growing health consciousness trend presents opportunities for developing organic, vegan, and functional mayonnaise products enriched with vitamins, probiotics, and other health-beneficial ingredients. The expanding food service sector, including the emergence of cloud kitchens and food delivery platforms, creates opportunities for bulk packaging and specialized institutional products.

Challenges in the India Mayonnaise Market:

The India mayonnaise market analysis indicates that the market faces several challenges, including intense price competition from both domestic and international players, which puts pressure on profit margins and requires continuous cost optimization. The perishable nature of mayonnaise and the need for cold chain infrastructure present logistical challenges, particularly for smaller manufacturers and in regions with inadequate refrigeration facilities. Consumer perception of mayonnaise as an unhealthy, high-calorie product poses challenges in a market increasingly focused on health and wellness. Regulatory compliance regarding food safety standards, labeling requirements, and import/export regulations adds complexity and costs for manufacturers. The seasonal nature of demand, with higher consumption during summer months and festivals, creates challenges in inventory management and production planning.

India Mayonnaise Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country levels for 2025-2033. Our report has categorized the market based on type, end use, and distribution channel.

Type Insights:

- Unflavored Mayonnaise

- Flavored Mayonnaise

The report has provided a detailed breakup and analysis of the market based on the type. This includes unflavored mayonnaise and flavored mayonnaise.

End Use Insights:

- Institutional

- Retail

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes institutional and retail.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online retailers, specialty stores, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In January 2025, Reliance Consumer Products Ltd (RCPL) acquired the SIL Food India brands from Food Service India, marking a strategic move into the packaged foods space to compete more directly with established FMCG. SIL, known for products such as cooking pastes, jams, mayonnaise, baked beans, and Chinese sauces, operates manufacturing units in Pune and Bengaluru; RCPL plans to expand SIL’s market reach nationally, leveraging its distribution and consumer-engagement capabilities.

India Mayonnaise Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Unflavored Mayonnaise, Flavored Mayonnaise |

| End Uses Covered | Institutional, Retail |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retailers, Specialty Stores, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India mayonnaise market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India mayonnaise market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mayonnaise industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mayonnaise market in India was valued at USD 428.0 Million in 2024.

The India mayonnaise market is projected to exhibit a CAGR of 6.46% during 2025-2033, reaching a value of USD 800.4 Million by 2033.

The India mayonnaise market is driven by several key factors, such as a rising inclination toward Western fast food, increased demand for convenience items, and urbanization. The growth of quick-service restaurants, introduction of new flavors, and improved retail accessibility are further enhancing the market's development across diverse consumer groups.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)