India Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2026-2034

India Meat Market 2025, Size and Share:

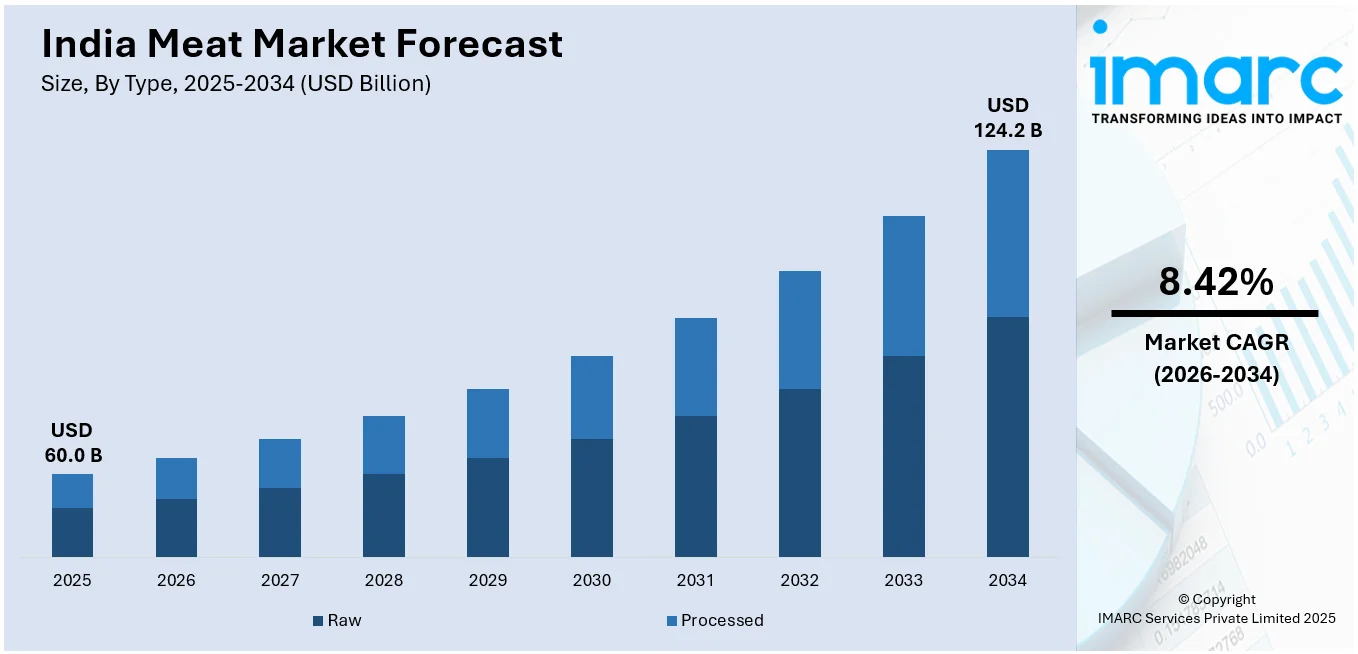

The India meat market size was valued at USD 60.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 124.2 Billion by 2034, exhibiting a CAGR of 8.42% from 2026-2034. The market is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, growing health-conscious consumers seeking protein-rich diets, advancements in meat processing and packaging, heightened export demand, and technological improvements in sustainable meat production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 60.0 Billion |

| Market Forecast in 2034 | USD 124.2 Billion |

| Market Growth Rate (2026-2034) | 8.42% |

Urbanization is one of the biggest factors driving the meat market share in India. Over time, more and more individuals have been moving to urban areas in pursuit of improved employment prospects, education, and overall quality of life. Urban population in the country was reported at 36.36% in the year 2023. The swift growth of cities has brought about major transformations in the way people live. In cities, people have access to a wider range of food options, including different types of meats. Moreover, the convenience of buying ready-to-eat (RTE) or processed meat products, like chicken nuggets, sausages, and cold cuts, fits into the busy schedules of urban dwellers, thus boosting the India meat market growth.

To get more information on this market Request Sample

India’s economy has been growing steadily, and with that, the average disposable income of the population has also increased. The country’s per capita disposable income was recorded at ₹2.14 lakh in 2023-24. As people earn more, their propensity to spend on food and other luxuries also rises. The growing income levels is encouraging people to spend on higher-quality or premium meat products, like organic chicken or grass-fed beef. As a result, meat consumption has expanded in the country as it has become a regular part of daily meals for many households. Additionally, India’s expanding middle class is contributing to the demand for meat products. In rural areas, as well, there is a noticeable increase in purchasing power, and people are now consuming more meat, both in traditional forms like mutton or chicken and in processed forms.

India Meat Market Trends:

Health and Nutritional Benefits of Meat

Health-consciousness is another driving force behind the increasing popularity of meat in India. As awareness grows about the nutritional advantages of meat, such as its rich protein, essential vitamins, and minerals, the demand for meat products has increased. People, especially younger generations, are opting for protein-rich diets to support fitness goals, muscle growth, and overall health. Various companies are also introducing initiatives to help consumers gain awareness about the type of meat they consume. For instance, In April 2023, Delfrez made significant efforts and adopted the voluntary ‘Soy Fed Product’ label across all its range of ready-to-cook (RTC) and ready-to-eat (RTE) meat products. This label is designed to help consumers make informed choices about food and identify packaged poultry, meat, and fish that are fed soy-based meals. Soy’s superior amino acid profile and digestibility play a significant role in the growth and development of the meat, providing benefits to the final consumer.

Improved Meat Processing and Availability of Packaged Meats

The meat industry in India has undergone significant improvements in terms of processing technology and packaging. The introduction of advanced processing techniques, like vacuum packing and freezing, has made it easier to store and transport meat products safely. These improvements in meat preservation have extended the shelf life of products, making them more accessible to customers all over the country, even in remote areas. Moreover, ready-to-cook and ready-to-eat packaged meats are becoming highly popular due to their convenience and time-saving aspects. It offers convenience for individuals with hectic schedules who don't have the time to cook meals with fresh meat from scratch. Alongside this, the availability of a variety of options like frozen chicken breasts, marinated mutton, fish fillets, and even meat snacks in supermarkets and grocery stores are playing a key role in making meat products more mainstream and accessible to a larger audience.

Increase in Meat Export and Global Demand

As per the India meat market outlook, the country has become one of the largest exporters of meat, especially buffalo meat, to international markets. Countries like the United Arab Emirates (UAE), Saudi Arabia, and other parts of the Middle East, along with countries in Southeast Asia, have a huge demand for Indian meat products. As such, the exports of meat products reached 1093.30 USD million in 2023. This international demand not only boosts the local meat industry but also increases awareness of India’s meat quality standards. This rise in meat exports is also helping the industry grow by providing higher incomes for farmers and meat producers. As the industry flourishes due to export, it also strengthens the domestic market, prompting producers to adopt better farming techniques, improve meat quality, and invest in more efficient meat production processes. The global presence of Indian meat is adding to its reputation and further encouraging the local consumption of meat products.

India Meat Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India meat market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type, product, and distribution channel.

Analysis by Type:

- Raw

- Processed

The raw meat segment in India includes fresh, unprocessed meat products such as chicken, mutton, pork, and beef, which are typically sold in butcher shops, supermarkets, and local markets. This segment caters to consumers who prefer to purchase fresh meat for home cooking, where they can customize cuts and preparation methods. Raw meat is popular among those who value traditional cooking methods and those seeking specific types of meat for regional dishes. The demand for raw meat is particularly high in areas where fresh and local sourcing is emphasized, and it appeals to consumers who prioritize freshness and quality over convenience.

According to the India meat market outlook, the processed meat segment in India includes products like sausages, cold cuts, ready-to-eat meals, frozen meat products, and marinated meat. This segment is expanding quickly, fueled by the rising demand for convenience, particularly among busy urban dwellers. Processed meats offer ready-to-cook or ready-to-eat options, which save time and effort for individuals and families. As urbanization increases and working professionals adopt faster-paced lifestyles, processed meat products like frozen chicken nuggets, ham, and bacon are becoming increasingly popular. The segment is also benefiting from innovations in packaging, longer shelf life, and improved flavors, making it an attractive choice for a broader range of consumers.

Analysis by Product:

- Chicken

- Beef

- Pork

- Mutton

- Others

Chicken emerges as one of the most sought-after meat items in the Indian market, mainly because of its affordability, adaptability in cooking and, above all, its widespread demand among consumers. It is consumed in different forms, usually comprising whole chickens, chicken breasts, legs, wings, and processed products such as nuggets, sausages, and patties. It is highly appreciated for its mild flavor, quicker cooking time, and nutritious benefits, especially high protein levels and lower fat content than red meats. Both urban and rural consumers favor chicken in its fresh and frozen options. Moreover, the current trend of eating healthy has further widened the demand spectrum for chicken as a source of lean protein.

Beef has a significant but smaller segment in India’s meat market share. While beef consumption is not as widespread due to cultural and religious sensitivities in many parts of the country, it remains a staple for certain communities. The beef segment has seen growth in areas with a high demand for premium cuts and products like minced beef, steaks, and beef burgers. Additionally, the rising export demand for Indian buffalo meat has provided a boost to this segment, positioning India as a key player in the global beef trade.

Pork in the Indian meat industry is a niche but growing segment as it is popular in regions where pork food items and dishes form a major part of the local cuisine. Most regions in India do not consume pork mainly owing to cultural and dietary restrictions; however, it has a steady demand in specific areas based on local preferences. The segment includes fresh cuts such as pork ribs, chops, and sausages, as well as processed products like bacon and ham. With changing food habits, urban eaters are majorly showing interest in pork-based products, especially in supermarkets and online grocery stores, which provide ease and variety for the urban consumer.

Mutton, particularly goat meat, is a primary protein source in India and has cultural and gastronomic importance in many locations. In regions where it is utilized in traditional stews, curries, and celebratory foods, mutton is in great demand. Goat meat is a popular option for special events and family gatherings because of its unique flavor and succulent texture. Given its perceived richness in flavor and its cultural significance in many Indian dishes, mutton is still popular even though it is more expensive than chicken.

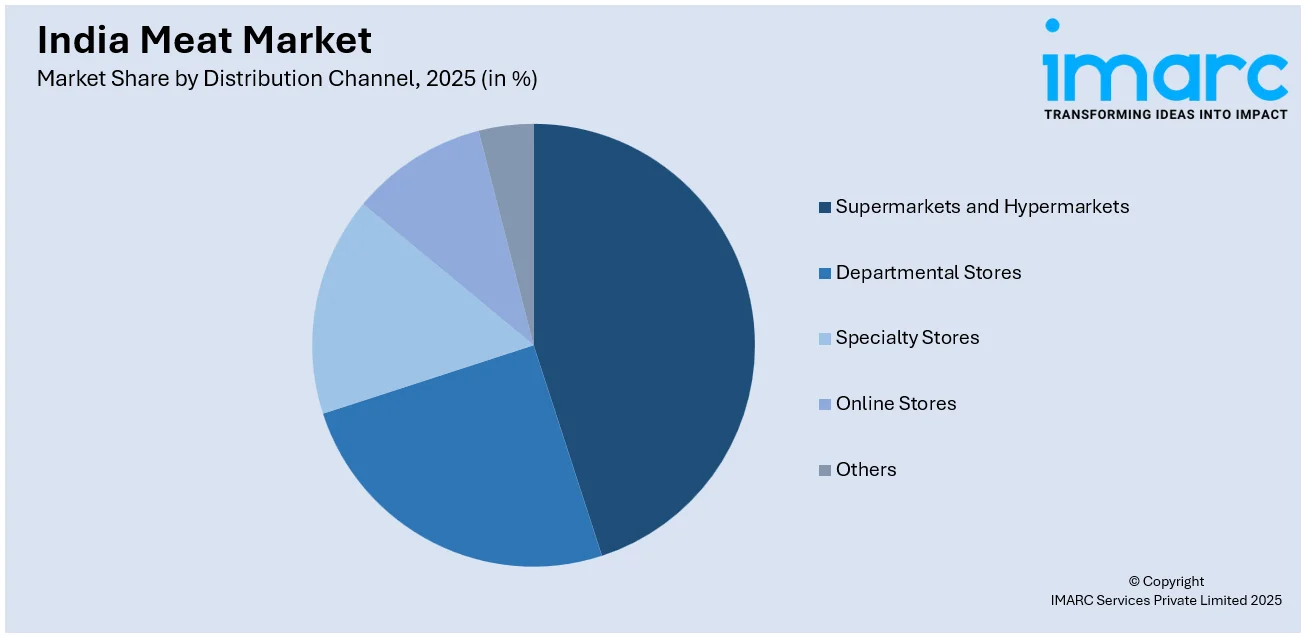

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets are key retail channels driving the meat market growth in India. These large-scale stores provide a diverse selection of fresh and packaged meat products, such as chicken, mutton, beef, and processed meat items. The convenience of purchasing meat along with groceries in one location, coupled with the assurance of product quality and hygiene, has made supermarkets and hypermarkets a popular choice for consumers. Additionally, these stores often have dedicated meat sections with trained staff to cut and prepare meat to customers' preferences, enhancing the shopping experience. With the growth of large retail chains, this segment has become an essential part of India's evolving meat market.

Departmental stores in India are becoming a popular choice for meat purchase, especially for the urban population since it offers various kinds of fresh and frozen meats. These stores offer superior quality bench meat with a well-organized section in comparison to supermarket chains, thus catering to the middle to high- end clients who need convenience. In addition to fresh meats, departmental stores also exhibit a whole range of processed meats like sausages, frozen meals, marinated cuts. With the changing tastes and demands of people, coupled with the ever-increasing strong need for good quality and user-friendly offerings, department stores are becoming a trusted meat destination for shoppers.

Meat specialty stores are retailers that specialize in selling meat and its wide variety of products. Typically, these stores sell fresh and often high-quality or specialty meats. From prime cuts of beef to more exotic meats or even organic and hormone-free poultry, specialty stores sell products geared toward health-conscious as well as distinguishing customers. More so, it is preferred by those consumers who are searching for specific types of meat or products that do not get into the regular supermarket. Many specialty stores also have customer-handling service features, like home delivery, custom meat cutting, and sustainable business practices that attract a growing section of individuals who seek better quality meat and a more personalized shopping experience.

As per the India meat market outlook, the online segment is one of the highest growing segments in the country as they make it easy and convenient for people to buy meat through e-commerce channels. With this, consumers can purchase fresh and frozen meats from different online stores which directly deliver meat products to their homes. This segment mainly attracts city experts who generally prefer simple and fast ways of buying meat. Various meats, fresh to frozen to ready-to-cook prepared dishes, are often sold at discounted price or under promotional offers with time-specific guaranteed deliveries. Availability of offering online grocery platforms has turned out to be a remarkable transformation for the India meat market growth.

Regional Analysis:

- South India

- North India

- West and Central India

- East India

The meat market in South India is among the most diversified and hugely influenced market by regional variations in cuisines, with chicken, mutton, and fish as the most treasured forms of meat consumption. States such as Kerala, Tamil Nadu, Andhra Pradesh, and Karnataka are richly connected to the cultural aspects of non-vegetarian food where meat forms an integral part in numerous local dishes such as biryanis, curries, and preparations of seafood. Fish, especially of coastal origin, is held highly alongside chicken and goat meat and is used during traditional feasts and festivals. Demand for processed meats such as sausages and ready-to-cook items has additionally been increasing, principally in urban areas. The upsurge in demand for processed meat is also due to the fast-growing middle class, increasing disposable incomes, and the need for convenience. As a result, the region is gradually witnessing the growth of the supermarket and the online segment that cater to meat customers.

Mutton and chicken are highly preferred in North India, where kebabs, curries, and tandoori preparations are common food items. Mutton is a staple in the area because of its cultural significance, particularly during festivals and other special events. It is seen as more of a delicacy, whereas chicken is consumed year-round. Urban markets have also experienced an increase in demand for processed meats including marinated chops, sausages, and ready-to-cook kebabs. The urbanization of the area and shifting eating preferences, especially among younger customers who value variety and convenience, are fueling the rise of contemporary retail formats like supermarkets and internet retailers, which in turn is helping the expansion of the India meat market growth.

West and Central India are a mixed meat market. In Maharashtra, meat consumption is very prominent, especially in urban centers like Mumbai and Pune, but in Gujarat and Rajasthan, the culture is vegetarian which limits the demand for meat. Despite this, chicken and mutton hold a significant place in the diet of non-vegetarian consumers in these regions. Processed meat is also in demand due to the impact of Western food culture and the convenience of RTE meat items. Furthermore, in cities like Mumbai, ready-to-eat products such as sandwiches, burgers, and frozen meats are on the rise. The growth of supermarkets and online grocery platforms in these regions also supports the meat market demand, as consumers seek quality products and shopping options.

The distinctive meat market in East India, which consists of states like West Bengal, Odisha, Bihar, and Assam, is influenced by local tastes for a variety of meats, such as chicken, mutton, and hog, as well as freshwater fish. West Bengal is especially well-known for its love of fish, with rohu, hilsa, and catla being important dietary mainstays. Chicken and mutton are also well-liked, particularly when making rich curries and biryanis. The region's ethnic variety and culinary customs are reflected in the widespread consumption of pork in states like Assam and portions of Bihar. Alongside this, sausage and marinated meats are among some of the processed meat items that are becoming progressively popular, especially in cities where consumers are particular about quality and convenience.

Competitive Landscape:

To meet the rising consumer demand and increase their market share, major companies in the industry are implementing a variety of strategies. Prominent businesses are using technology to optimize their supply chains and raise the caliber and freshness of their goods. In order to satisfy the convenience-seeking urban customer, they are also concentrating on offering home delivery services for fresh, processed, and ready-to-cook meat products. As consumers' health consciousness grows, they are also diversifying their product lines to include organic, hormone-free, and antibiotic-free meats. Larger supermarket chains and traditional merchants are further expanding their meat departments, offering an extensive variety of both fresh and processed meat to satisfy all kinds of consumer tastes. Many companies are adding value to the customer experience by offering subscription-based models of meat, custom offers, and traceability to ensure transparency in both sourcing and product quality.

The report provides a comprehensive analysis of the competitive landscape in the India meat market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Biokraft Foods organized India’s inaugural formal tasting event for a cultivated meat product in Mumbai. The event saw participation from 30 representatives of prominent organizations, including PETA India, GFI India, the Chamber for Advancement of Small and Medium Businesses (CASMB), YODA India, and India Animal Fund, who sampled cultivated chili chicken and chicken burgers.

- In November 2024, Vezlay, a leading plant-based meat company, took part in the India International Trade Fair (IITF) at Pragati Maidan, New Delhi. During the event, they unveiled two new products: Crispy Veg Chicken and Tofu Fries, both of which closely mimic the taste of their animal-based equivalents.

- In November 2024, the Allana Group launched the Indian Poultry Alliance which marked the group’s entry into the Indian poultry sector. The company announced an investment of $120 million and is planning to achieve a revenue of $300 million by 2026.

- In October 2024, meat and seafood delivery service Licious' parent company, Delightful Gourmet, acquired “My Chicken and More” which has 23 stores spread across Bengaluru to increase its offline presence.

India Meat Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India meat market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India meat market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India meat market was valued at USD 60.0 Billion in 2025.

Key factors driving the India meat market include rising urbanization, increased disposable incomes, growing health awareness, and demand for protein-rich diets. Additionally, the expansion of modern retail formats, convenience-driven processed meat products, cultural shifts towards non-vegetarian diets, and technological advancements in meat production are fueling the market growth.

IMARC estimates the India meat market to exhibit a CAGR of 8.42% during 2026-2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)