India Medical Aesthetics Market Size, Share, Trends and Forecast by Type of Device, Application, End User, and Region, 2025-2033

India Medical Aesthetics Market Size, Growth and Overview:

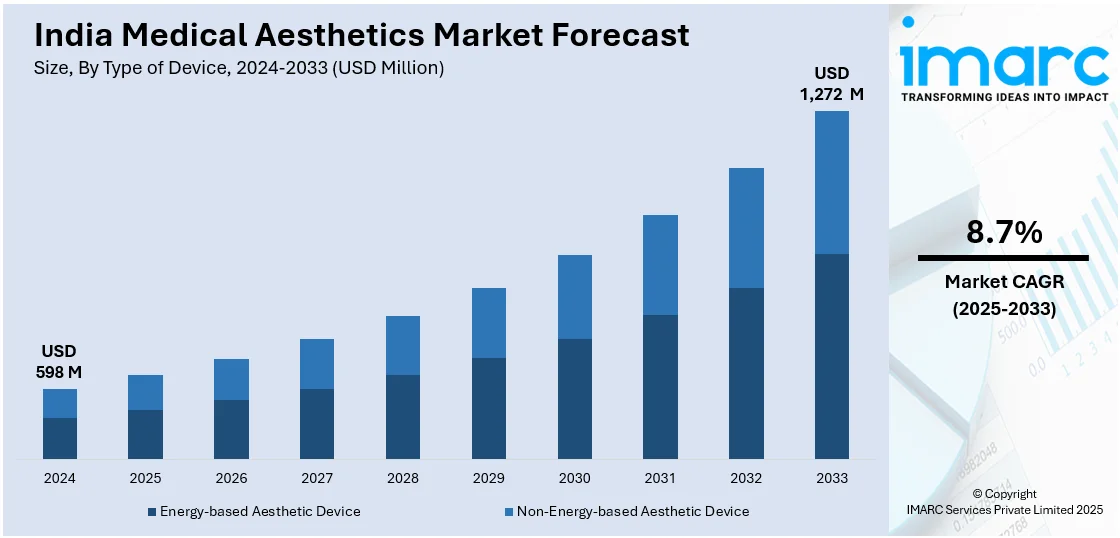

The India medical aesthetics market size was valued at USD 598 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,272 Million by 2033, exhibiting a CAGR of 8.7% from 2025-2033. The market is driven by rising disposable incomes, increasing awareness of cosmetic procedures, technological advancements, and a growing emphasis on personal appearance. Factors like social media influence, medical tourism, expanding urbanization, and shifting toward minimally invasive treatments resulting in a significant India medical aesthetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 598 Million |

| Market Forecast in 2033 | USD 1,272 Million |

| Market Growth Rate (2025-2033) | 8.7% |

The growing awareness and acceptance of cosmetic procedures due to social media and influencer-driven marketing have been important factors in normalizing aesthetic enhancement. Medical tourism in India also contributes to the growth of the market. High-quality treatments at competitive prices attract international patients in addition to the domestic demand. In addition, urbanization and lifestyle changes have increased the focus on appearance, especially among young professionals who consider aesthetic treatments a part of self-care. For example, The Esthetic Clinics® was featured by MedTalks News in December 2024 as one of the top travel destinations in India's burgeoning medical tourism sector for cosmetic surgery. The clinic chain is an affordable and reliable option for advanced cosmetic surgery procedures since over 15% of the patients it treats come from other countries. Such recognition serves as a pivotal factor in facilitating the demand for the aesthetic services, thereby creating a positive India medical aesthetics market outlook.

To get more information on this market, Request Sample

Technological advancement in medical aesthetics through the availability of safer, less invasive, and non-invasive procedures makes them accessible and more appealing to the greater public. For example, with laser-based technologies, dermal fillers, and energy-based devices, it has improved treatment outcomes, reduced recovery time, and led to more individuals to come forward for aesthetic solutions. For example, one of the leading cosmetic treatment providers in Delhi, Sculpt Clinics, launched a brand-new laser hair removal technology that significantly reduces treatment time by half, in September 2024. The brand new technology is now accessible in Sculpt Clinics so as to provide faster and painless hair removal by simply being more effective to facilitate the busy lives of the people.

India Medical Aesthetics Market Trends:

Rising Disposable Incomes and Lifestyle Changes

The increasing middle-class population in India and growing disposable incomes have led to a higher spending on self-care and cosmetic enhancements. Changing lifestyles, due to urbanization and global exposure, increase the demand for aesthetic treatments. According to industry reports, India's socioeconomic environment is changing rapidly, deemed as the "powerhouse of Indian aspirations," because over 250 million have emerged from poverty into a neo-middle class in the last few years. The neo-middle class in India has also become a great world economic force. As it stands today, 41% of the population is expected to be middle class by 2031. Brands should anticipate significant increases in consumption as this group of wealthy consumers grows. Individuals, particularly young professionals, now view medical aesthetics to boost confidence and improve social and professional interactions.

Advancements in Technology

Technological progress in minimally invasive and non-invasive procedures has revolutionized the medical aesthetics market. Innovations like laser treatments, dermal fillers, and energy-based devices offer safer, faster, and more effective results with minimal downtime. These developments have made aesthetic solutions more desirable and accessible, hence prompting wider adoption. For example, in September 2024, Kosmoderma Clinic, a trailblazer in advanced dermatological and cosmetic treatments, announced the launch of the LPG Endermologie Cellu M6 Alliance at its Bengaluru facility. This cutting-edge technology addresses resistant fat, cellulite, and skin sagging, with non-invasive treatments that help in body contouring and rejuvenation of facial skin. LPG Endermologie proprietary technique induces circulation, firmness, and natural collagen production that is observable and long-lasting for customers.

Medical Tourism and Expanding Clinics

India is increasingly becoming the destination for high-quality medical treatments at affordable prices, attracting international patients. Also, with expanding specialized clinics and partnerships with global aesthetic brands, it is ensuring that the patients get to see the skilled practitioners and advanced procedures. This makes them have trust and creates a demand in both domestic and international markets for aesthetic treatments. For example, in December 2024, industry experts debated the convergence of high-tech technology, old-age medicine, and cutting-edge healthcare in India's rapidly growing medical tourism space. In line with this, data from the Apollo Hospitals report that in 2024 alone, 7.3 million international patients were treated in India, with a 25% hike from 6 million in 2023. The medical tourism sector is set to rise from its present valuation of Rs 87,000 crores of 2024 to as high as Rs 4,25,000 crores by 2034.

India Medical Aesthetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India medical aesthetics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type of device, application, and end user.

Analysis by Type of Device:

- Energy-based Aesthetic Device

- Laser-based Aesthetic Device

- Radiofrequency (RF) Based Aesthetic Device

- Light-based Aesthetic Device

- Ultrasound Aesthetic Device

- Non-Energy-based Aesthetic Device

- Botulinum Toxin

- Dermal Fillers and Aesthetic Threads

- Microdermabrasion

- Implants

- Others

Energy-based aesthetic devices hold a significant India medical aesthetics market share due to their effectiveness in non-invasive treatments like skin tightening, hair removal, and body contouring. The growing need for rapid, secure, and effective solutions is met by cutting-edge technology including lasers, radiofrequency, and ultrasound. Because of their widespread use in clinics and beauty parlors, these devices are accessible. Energy-based devices are essential to India's expanding aesthetic market because of increased awareness, urbanization, and the impact of social media.

Non-energy-based aesthetic devices dominate India’s market due to their affordability, ease of use, and application in treatments like dermal fillers, micro-needling, and injectables. These devices are popular with a variety of demographics because they address a wide range of issues, from volume enhancement to facial rejuvenation. Their demand is increased by their non-invasive nature, short recovery period, and rising awareness of cosmetic procedures. These solutions' growing accessibility in both at-home and clinic settings contributes to their broad acceptance in India.

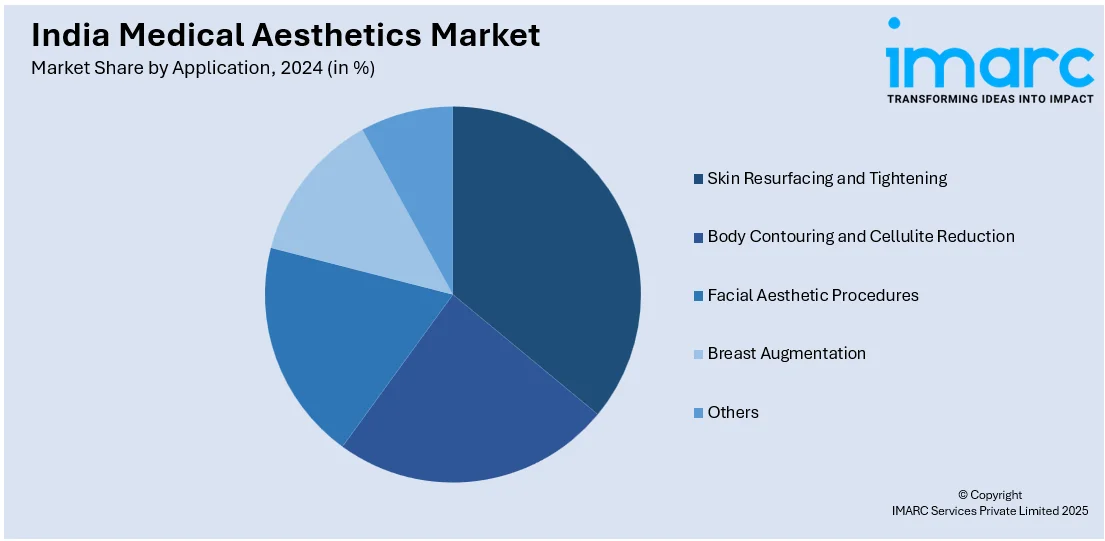

Analysis by Application:

- Skin Resurfacing and Tightening

- Body Contouring and Cellulite Reduction

- Facial Aesthetic Procedures

- Breast Augmentation

- Others

Skin resurfacing and tightening hold a significant share in India due to rising demand for anti-aging treatments and solutions for skin issues like acne scars and pigmentation. Because of their efficiency and speedy recovery, these minimally invasive procedures—which use technology like radiofrequency and lasers—are preferred. Clinics are very accessible due to rising awareness, availability, and cost. In India, the demand for skin rejuvenation procedures is also fueled by urbanization, social media impact, and an increasing emphasis on youthful appearances.

Body contouring and cellulite reduction dominate the market currently with the increasing fitness awareness and demand for shaped figures. These procedures use technologies such as cryolipolysis and ultrasound to ensure non-invasive fat reduction and skin-tightening mechanisms. The procedure services men and women, almost all demographics that desire beauty without surgery. Social media influence and post-pregnancy body restoration trends account for a huge part of India medical aesthetics market growth.

Facial aesthetic procedures, including Botox, dermal fillers, and chemical peels, are widely popular due to their ability to provide instant, visible enhancements. These minimally invasive treatments address aging concerns like wrinkles, volume loss, and dull skin, appealing to individuals seeking youthful, rejuvenated appearances. Their affordability, safety, and quick recovery time make them accessible to a broad audience, ensuring prominent India medical aesthetics market demand.

Analysis by End User:

- Hospitals

- Clinics and Beauty Centers

- Home Settings

Hospitals hold a significant share in India's medical aesthetics market due to their advanced infrastructure, highly qualified medical professionals, and trust among patients for complex procedures. In a safe, regulated setting, hospitals provide a variety of modern treatments and cosmetic operations. For invasive operations like breast augmentations and hair transplants, where post-operative care is essential, many patients prefer hospitals. The demand for aesthetic procedures in hospital settings is further increased by India's expanding medical tourism industry.

Clinics and beauty centers dominate the market because they offer specialized, minimally invasive treatments in a more accessible and personalized setting. Equipped with trained professionals and advanced technologies, these facilities focus on procedures like Botox, fillers, and skin rejuvenation. Their affordability compared to hospitals and convenience of location attract a broad customer base. Additionally, clinics and beauty centers emphasize customer experience and aftercare, enhancing their appeal for non-surgical aesthetic treatments.

Home settings are gaining traction in India’s medical aesthetics market due to rising demand for convenience and privacy. Non-invasive treatments, such as at-home devices for skin rejuvenation, hair removal, and micro-needling, are increasingly popular, especially among tech-savvy and budget-conscious consumers. Social media and e-commerce platforms are driving awareness and accessibility to these devices. Home settings appeal to those seeking affordable, DIY aesthetic solutions, particularly in smaller cities where access to advanced clinics may be limited.

Regional Analysis:

- North India

- West and Central India

- South India

- East and Northeast India

High disposable incomes, a fashion-conscious population, and a strong influence of Bollywood and social media drive the medical aesthetics market in North India. There are many upscale clinics providing cutting-edge treatments in the urban areas of the region, such as Delhi and Chandigarh. Young professionals looking for minimally invasive procedures for job advancement and personal grooming are contributing to the demand. Growing medical tourism, especially in Delhi NCR, is another important factor driving the market's expansion in this area.

Based on the India medical aesthetics market forecast, clinics and beauty centers are expected to dominate the market because they offer specialized, minimally invasive treatments in a more accessible and personalized setting. Equipped with trained professionals and advanced technologies, these facilities focus on procedures like Botox, fillers, and skin rejuvenation. Their affordability compared to hospitals and convenience of location attract a broad customer base. Additionally, clinics and beauty centers emphasize customer experience and aftercare, enhancing their appeal for non-surgical aesthetic treatments.

South India’s medical aesthetics market thrives on advancements in technology and a focus on minimally invasive treatments. Cities with tech-savvy metropolitan populations, such as Bengaluru, Chennai, and Hyderabad, act as centers. Because of its competitive pricing and developed healthcare infrastructure, the region benefits from medical tourism. Demand is further increased by a growing focus on body contouring, hair restoration, and skincare, which is bolstered by an increase in specialty clinics and alliances with international aesthetics corporations.

The market in East and Northeast India is growing steadily, driven by rising awareness and aspirations for aesthetic enhancements. Urban centers like Kolkata lead in offering advanced treatments, with an increasing number of clinics catering to local and international patients. The region's emerging middle class and the influence of social media contribute to demand. In Northeast India, unique beauty standards and a younger demographic drive interest in skin rejuvenation and minimally invasive procedures, supported by improved access to quality services.

Competitive Landscape:

The India medical aesthetics market is highly fragmented, with global leaders like Allergan, Merz Aesthetics, and Cynosure competing alongside regional players such as VLCC, Oliva Skin & Hair Clinic, and Kaya Clinic. While local competitors concentrate on accessibility and affordability, global brands use cutting-edge technologies and creative products to dominate premium segments. Market penetration is improved by growing alliances between foreign companies and Indian clinics. Medical tourism, social media influence, and the rising desire for minimally invasive procedures are the main drivers of the competitive landscape. To serve India's broad customer base, companies are increasing clinic networks, investing in localized marketing, and providing tailored solutions.

Latest News and Developments:

- In June 2024, Kosmoderma Skin, Hair & Body Clinic, a renowned dermatological clinic, opened its newest establishment in Mumbai, which intends to bring cutting-edge, expensive technologies to the Indian aesthetic dermatology market.

- In September 2024, Clinic Dermatech, India’s leading skin and hair clinic chain, announced the grand opening of CD Lush in Safdarjung, New Delhi, which is intended to elevate the standard of skin care, hair restoration, and aesthetic surgeries in the city, offering a wide range of high-end beauty, wellness, and surgical services.

India Medical Aesthetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Device Covered |

|

| Applications Covered | Skin Resurfacing and Tightening, Body Contouring and Cellulite Reduction, Facial Aesthetic Procedures, Breast Augmentation, Others |

| End Users Covered | Hospitals, Clinics and Beauty Centers, Home Settings |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medical aesthetics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India medical aesthetics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medical aesthetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Medical aesthetics involves advanced, non-surgical or minimally invasive cosmetic procedures aimed at enhancing physical appearance and addressing skin, hair, or body concerns. Treatments include Botox, dermal fillers, laser therapies, chemical peels, and body contouring, performed by qualified professionals to improve aesthetics, boost confidence, and promote a youthful, rejuvenated look.

The India medical aesthetics market was valued at USD 598 Million in 2024.

IMARC estimates the India medical aesthetics market to exhibit a CAGR of 8.7% during 2025-2033.

The demand for medical aesthetics in India is driven by rising disposable incomes, increasing awareness of aesthetic procedures, and advancements in minimally invasive technologies. The influence of social media, medical tourism, and changing beauty standards further fuel demand. Expanding clinics, skilled practitioners, and affordability also contribute to the market’s rapid growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)