India Medical Coding Market Size, Share, Trends and Forecast by Component, Classification System, End User, and Region, 2025-2033

India Medical Coding Market Overview:

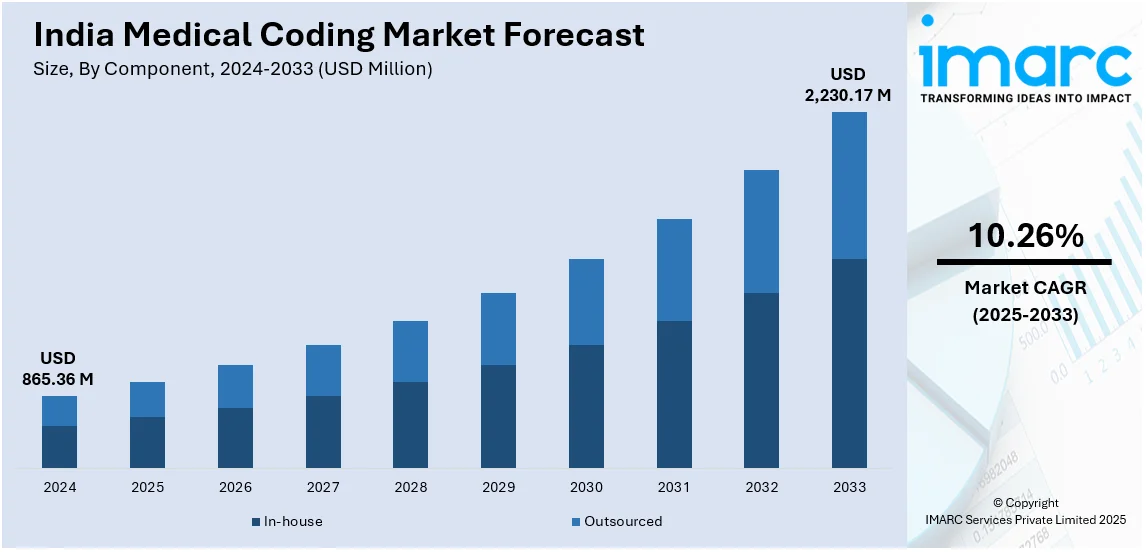

The India medical coding market size reached USD 865.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,230.17 Million by 2033, exhibiting a growth rate (CAGR) of 10.26% during 2025-2033. The increasing healthcare digitalization, rising demand for accurate billing, regulatory compliance requirements, growing medical tourism, expanding insurance penetration, and outsourcing trends are the factors propelling the growth of the market. The adoption of AI-powered coding solutions and government initiatives further accelerate market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 865.36 Million |

| Market Forecast in 2033 | USD 2,230.17 Million |

| Market Growth Rate (2025-2033) | 10.26% |

India Medical Coding Market Trends:

AI-Driven Skill Enhancement in Medical Coding

The integration of artificial intelligence into medical coding education is reshaping professional training in India. With increasing demand for accuracy in healthcare documentation, institutions are adopting AI-powered learning methods to improve coding precision and workflow efficiency. Advanced training programs are aligning with industry standards, ensuring professionals gain relevant expertise for evolving healthcare requirements. This shift enhances employment opportunities, as AI-assisted coding reduces errors and improves compliance with global healthcare regulations. Educational institutions are focusing on equipping coders with automation-driven skills, strengthening India’s position in the global medical coding landscape. As AI adoption grows, medical coders trained in advanced technologies are becoming indispensable for maintaining high documentation standards and optimizing revenue cycle management in healthcare institutions. For example, in June 2024, Medi Infotech, a medical coding training provider in Hyderabad, Bangalore, and Pune, integrated AI into its curriculum to enhance coding accuracy and efficiency. As an AAPC-approved institute, it aimed to equip professionals with advanced skills aligned with India’s evolving healthcare sector. This initiative helped streamline documentation and improve coding standards, addressing the growing demand for skilled medical coders in the country.

To get more information on this market, Request Sample

Expanding Medical Coding Education for Workforce Development

The demand for skilled medical coders in India is driving a shift toward structured training programs and industry-recognized certifications. Educational initiatives are focusing on equipping healthcare professionals with essential coding expertise to meet accuracy and compliance standards in documentation. Comprehensive learning resources and certification pathways are enhancing employability, creating a well-trained workforce for hospitals, insurance firms, and billing service providers. This focus on skill development is addressing workforce shortages while improving healthcare revenue cycle management. As healthcare digitalization expands, professionals with specialized coding knowledge are becoming integral to maintaining data integrity and operational efficiency. Strengthening medical coding education is setting the stage for higher industry standards, ensuring better patient record management and streamlined billing processes across healthcare institutions. For instance, in August 2023, 369Hub Ventures Private Limited and AAPC established a partnership in Delhi to transform India's medical coding industry. This collaboration offers comprehensive training, resources, and certification programs, aiming to equip healthcare professionals with essential coding skills. The initiative addresses the growing demand for qualified medical coders, enhancing accuracy in healthcare documentation and improving employment opportunities within India's healthcare sector.

India Medical Coding Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, classification system, and end user.

Component Insights:

- In-house

- Outsourced

The report has provided a detailed breakup and analysis of the market based on the component. This includes in-house and outsourced.

Classification System Insights:

- International Classification of Diseases (ICD)

- Healthcare Common Procedure Code System (HCPCS)

The report has provided a detailed breakup and analysis of the market based on the classification system. This includes International Classification of Diseases (ICD) and Healthcare Common Procedure Code System (HCPCS).

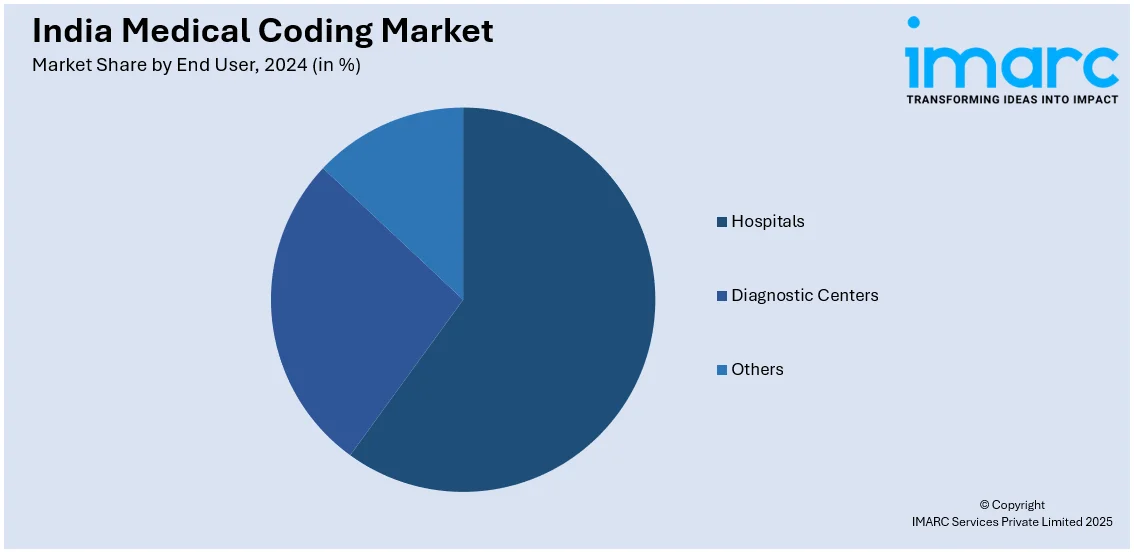

End User Insights:

- Hospitals

- Diagnostic Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, diagnostic centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medical Coding Market News:

- In January 2025, the World Health Organization (WHO) observed the first-ever "Ayush Medical Coding and Records Day" on the 10th of January. Announced during the 10th World Ayurveda Congress in Dehradun, this initiative aims to standardize Ayurveda, Unani, Siddha, and Homeopathy coding, integrating traditional Indian medicine into global healthcare frameworks for improved recognition and credibility.

- In January 2025, Telangana's Skills University partnered with AIG Hospitals and KIMS Hospitals to introduce specialized courses. This collaboration aims to equip students with essential skills in medical coding, addressing the increasing demand for accurate healthcare documentation in India. By aligning educational programs with industry needs, the initiative seeks to improve employment opportunities and the quality of medical records management nationwide.

India Medical Coding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | In-house, Outsourced |

| Classification Systems Covered | International Classification of Diseases (ICD) , Healthcare Common Procedure Code System (HCPCS) |

| End Users Covered | Hospitals, Diagnostic Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medical coding market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medical coding market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medical coding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical coding market in India was valued at USD 865.36 Million in 2024.

The India medical coding market is projected to exhibit a CAGR of 10.26% during 2025-2033, reaching a value of USD 2,230.17 Million by 2033.

The India medical coding market is driven by the growing healthcare sector, rising demand for accurate patient data management, and increasing adoption of digital health records. Expansion of medical insurance coverage, regulatory compliance requirements, and the outsourcing of medical coding services to India further accelerate market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)