India Medical Disposables Market Size, Share, Trends and Forecast by Product, Raw Material, End Use, and Region, 2025-2033

India Medical Disposables Market Overview:

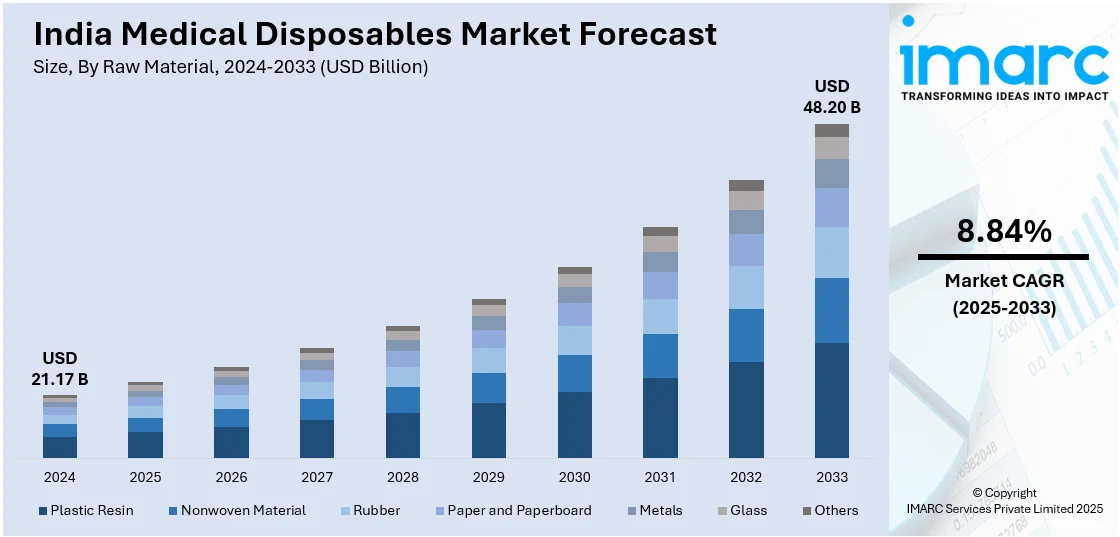

The India medical disposables market size reached USD 21.17 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.20 Billion by 2033, exhibiting a growth rate (CAGR) of 8.84% during 2025-2033. The increasing prevalence of hospital-acquired infections (HAIs) is driving the market, along with growing awareness of infection control, stricter healthcare regulations, and rising hospital admissions which are boosting the demand for disposable products like gloves, syringes, and masks to enhance patient safety and minimize cross-contamination risks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.17 Billion |

| Market Forecast in 2033 | USD 48.20 Billion |

| Market Growth Rate 2025-2033 | 8.84% |

India Medical Disposables Market Trends:

Growing Demand for Infection Control and Safety Products

Hospital-acquired infections (HAIs) remain a critical concern, as studies show that patients with HAIs experience hospital stays nearly 12 days longer than those without infections. This has heightened the focus on infection prevention, driving demand for medical disposables such as gloves, masks, syringes, and surgical drapes. Strict hygiene protocols and regulations have been implemented to mitigate HAIs, further boosting disposable medical product usage. The COVID-19 pandemic reinforced the necessity of single-use medical items in routine healthcare, accelerating their adoption. Additionally, the rising number of surgeries, diagnostic procedures, and outpatient visits has increased disposable medical supply consumption. Government initiatives and private investments continue to promote infection control, leading to sustained demand across hospitals, diagnostic centers, and home healthcare settings.

To get more information on this market, Request Sample

Expansion of Domestic Manufacturing and Government Support

India's local production of medical disposables is seeing huge growth under government schemes such as the Production Linked Incentive (PLI) scheme and the "Make in India" initiative. These encourage domestic production, which reduces dependence on imports and ensures a steady supply of key medical products. The pandemic exposed the vulnerabilities in supply chains, and hence, there was investment in self-reliance for key healthcare products. Some of the local players are increasing production capacity, embracing cutting-edge manufacturing technologies, and emphasizing cost-effective disposable medical supplies to serve both domestic and overseas markets. In addition, regulatory systems are being reinforced to promote product quality and safety, making India a competitive global center for medical disposable manufacturing.

Rising Adoption of Home Healthcare and Telemedicine

Growing demand for home-based healthcare services is fueling demand for medical disposables like catheters, blood glucose testing strips, wound care items, and disposable medical gloves. All these are influenced by demographic and disease trends, such as population aging, rising cases of chronic diseases, and the affordability of home treatment. Telemedicine has also facilitated remote monitoring of patients, which further adds to demand for disposable diagnostic kits and home-use medical devices. The development of online portals has also made easier the availability of medical disposables, and patients can now readily obtain the supplies they need from home. As patient-centered care continues to be the catchword for healthcare professionals, the shift to home healthcare solutions will also mean a perpetuation of the need for disposable medical products in India.

India Medical Disposables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, raw material, and end use.

Product Insights:

- Wound Management Products

- Drug Delivery Products

- Diagnostic and Laboratory Disposables

- Dialysis Disposables

- Incontinence Products

- Respiratory Supplies

- Sterilization Supplies

- Non-woven Disposables

- Disposable Masks

- Disposable Eye Gear

- Disposable Gloves

- Hand Sanitizers

- Gel

- Form

- Liquid

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes wound management products, drug delivery products, diagnostic and laboratory disposables, dialysis disposables, incontinence products, respiratory supplies, sterilization supplies, non-woven disposables, disposable masks, disposable eye gear, disposable gloves, hand sanitizers (gel, form, liquid, others), and others.

Raw Material Insights:

- Plastic Resin

- Nonwoven Material

- Rubber

- Paper and Paperboard

- Metals

- Glass

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes plastic resin, nonwoven material, rubber, paper and paperboard, metals, glass, and others.

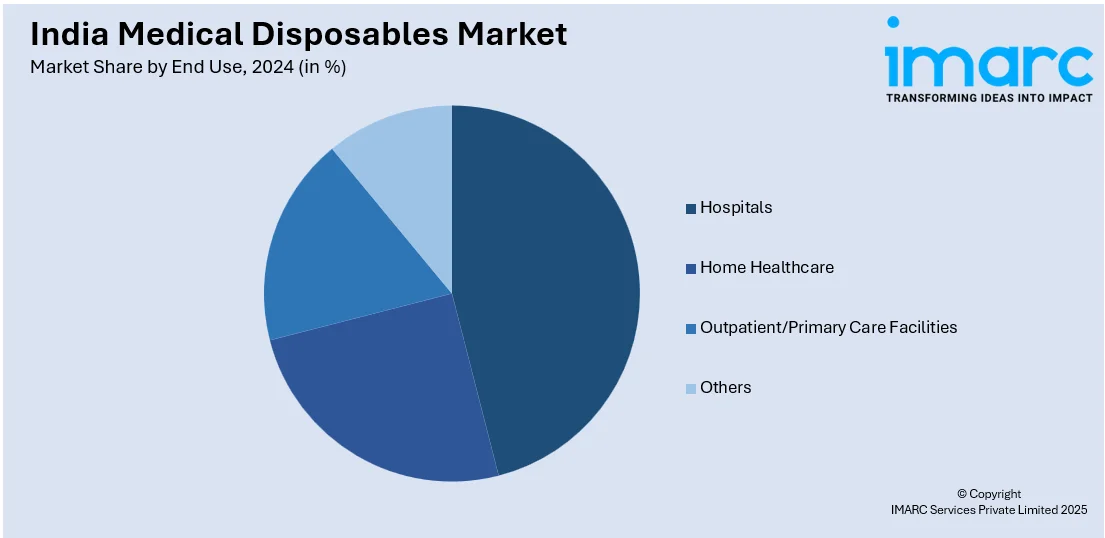

End Use Insights:

- Hospitals

- Home Healthcare

- Outpatient/Primary Care Facilities

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes hospitals, home healthcare, outpatient/primary care facilities, and others

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medical Disposables Market News:

- In March 2024, HMD introduced Dispojekt, a single-use syringe with a safety needle designed to prevent needlestick injuries (NSIs). The adoption of safety needles in healthcare settings offers significant cost benefits by reducing healthcare worker injuries, minimizing expenses for disease treatment, and lowering long-term health risks. By preventing NSIs, these syringes also cut costs associated with post-exposure prophylaxis and other healthcare expenditures, enhancing overall workplace safety and efficiency.

- In January 2024, India launched the National Single Window System (NSWS) to streamline approvals for medical devices, including imports, clinical investigations, and testing. Developed by Tata Consultancy Services (TCS), NSWS serves as a one-stop portal for registrations, licences, and clearances, replacing existing platforms by January 15. This initiative enhances ease of doing business, eliminating the need for multiple approvals across different authorities, as per the Central Drugs Standard Control Organisation (CDSCO).

India Medical Disposables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Raw Materials Covered | Plastic Resin, Nonwoven Material, Rubber, Paper and Paperboard, Metals, Glass, Others |

| End Uses Covered | Hospitals, Home Healthcare, Outpatient/Primary Care Facilities, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medical disposables market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medical disposables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medical disposables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical disposables market in India was valued at USD 21.17 Billion in 2024.

The India medical disposables market is projected to exhibit a (CAGR) of 8.84% during 2025-2033, reaching a value of USD 48.20 Billion by 2033.

The market is expanding with increasing healthcare facilities, growth in surgical procedures, and awareness on infection control. Growth in public and private healthcare spending, single-use device demand, and regulatory focus on safety standards are driving adoption in hospitals, clinics, and homecare. Domestic production under "Make in India" additionally ensures accessibility and affordability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)