India Medical Equipment Market Size, Share, Trends and Forecast by Product Type, Application, End User, and Region, 2025-2033

India Medical Equipment Market Overview:

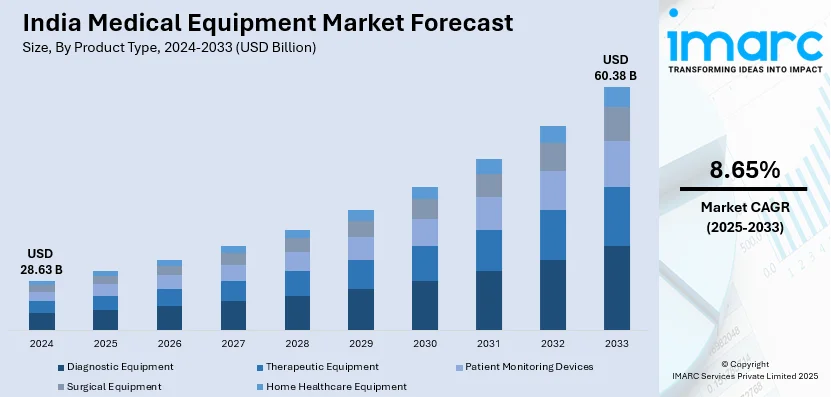

The India medical equipment market size reached USD 28.63 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 60.38 Billion by 2033, exhibiting a growth rate (CAGR) of 8.65% during 2025-2033. The market is driven by rising healthcare demand, increasing prevalence of chronic diseases, and government initiatives to improve healthcare infrastructure. Technological advancements, such as AI and IoT, along with growing awareness of early diagnosis and treatment, are further propelling the India medical equipment market share, especially in portable and home-based medical devices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.63 Billion |

| Market Forecast in 2033 | USD 60.38 Billion |

| Market Growth Rate 2025-2033 | 8.65% |

India Medical Equipment Market Trends:

Rising Demand for Portable and Home-Based Medical Devices

The rise in demand for portable and home-based medical devices is majorly driving the India medical equipment market growth. This trend is driven by the growing preference for personalized healthcare and the need for cost-effective solutions, especially in rural and semi-urban areas. Devices such as portable glucose monitors, blood pressure cuffs, and nebulizers are becoming increasingly popular as they enable patients to manage chronic conditions from the comfort of their homes. On World Diabetes Day 2024, India reiterated the urgent need to further strengthen diabetes prevention, management, and equitable access to healthcare services, with this chronic non-communicable disease (NCD) affecting 10.1 crore (approximately 101 million) individuals, as revealed by the ICMR-INDAIB study. Government initiatives under the NP-NCD program include 6,237 community clinics and free essential medicines for the promotion of care for diabetes. Due to a rise in diabetes-related kidney complications, the demand for portable medical equipment in India is witnessing a significant increase. The COVID-19 pandemic further accelerated this trend, as patients sought to minimize hospital visits and reduce exposure to infections. Additionally, advancements in technology, such as IoT-enabled devices, are enhancing the functionality and connectivity of these portable tools, allowing for real-time health monitoring and data sharing with healthcare providers. This shift is not only improving patient outcomes but also reducing the burden on India’s healthcare infrastructure.

To get more information on this market, Request Sample

Increasing Adoption of AI and Robotics in Medical Equipment

The integration of artificial intelligence (AI) and robotics into medical equipment is transforming the India medical equipment market outlook. AI-powered diagnostic tools, such as imaging systems and pathology analyzers, are gaining traction due to their ability to deliver faster and more accurate results. Robotics is also being increasingly utilized in surgical procedures, offering precision and minimizing human error. This trend is fueled by the growing need for advanced healthcare solutions in a country with a high patient-to-doctor ratio. A research report released by the IMARC Group indicates that the digital health market in India is expected to demonstrate a compound annual growth rate (CAGR) of 19.80% from 2025 to 2033. Government initiatives, such as the promotion of digital health under the National Digital Health Mission, are further supporting the adoption of these technologies. Moreover, private sector investments in AI-driven startups and collaborations with global tech companies are accelerating innovation. As a result, AI and robotics are not only enhancing the efficiency of medical equipment but also paving the way for more accessible and affordable healthcare in India.

India Medical Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, application, and end user.

Product Type Insights:

- Diagnostic Equipment

- Therapeutic Equipment

- Patient Monitoring Devices

- Surgical Equipment

- Home Healthcare Equipment

The report has provided a detailed breakup and analysis of the market based on the product type. This includes diagnostic equipment, therapeutic equipment, patient monitoring devices, surgical equipment, and home healthcare equipment.

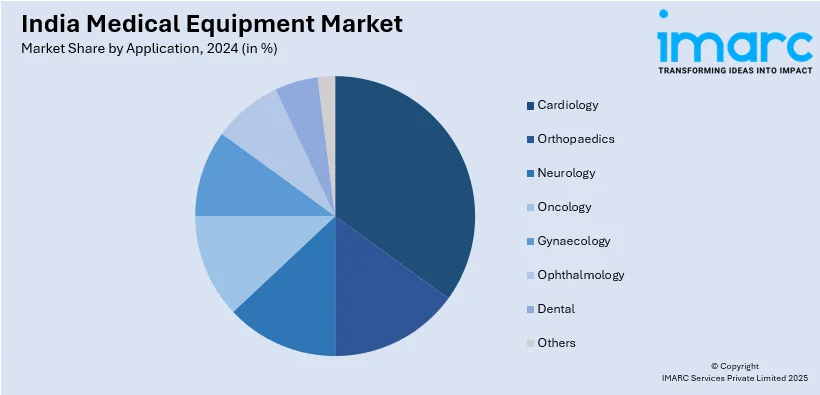

Application Insights:

- Cardiology

- Orthopaedics

- Neurology

- Oncology

- Gynaecology

- Ophthalmology

- Dental

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cardiology, orthopaedics, neurology, oncology, gynaecology, ophthalmology, dental, and others.

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Home Healthcare Settings

- Diagnostic Laboratories

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, ambulatory surgical centers, clinics, home healthcare settings, and diagnostic laboratories.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medical Equipment Market News:

- October 24, 2024: Konoike Transport announced launching a service in India for the cleaning and sterilization of used medical equipment in hospitals in major Indian cities such as Delhi, Mumbai and Bengaluru by 2030. The company plans to spend several hundred million yen and is aiming for an annual revenue of USD 3.9 Million in 2030. As several hospitals lack the required resources to execute this process, this initiative aims to address the rising need for specialized medical equipment sterilization in India.

- July 6, 2024: Horiba India inaugurated a state-of-the-art manufacturing facility of medical equipment in Butibori, Nagpur, with an investment of INR 200 Crore (approximately USD 24 Million). Spread over 50,000 square meters, this plant will cater to over 30,000 diagnostic laboratories and hospitals across India, creating numerous job opportunities and skill development opportunities. This marks HORIBA's third large investment in India and is in line with Prime Minister Narendra Modi's vision of Atmanirbhar Bharat and Make in India.

- May 13, 2024: OMRON Healthcare India partnered with AliveCor India to launch portable artificial intelligence (AI) based ECG monitoring devices in India aimed at the management of cardiovascular health. This collaboration introduces OMRON COMPLETE, an FDA-cleared device that combines blood pressure and ECG monitoring, as well as KardiaMobile and KardiaMobile 6L, which supply comprehensive heart data.

India Medical Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Diagnostic Equipment, Therapeutic Equipment, Patient Monitoring Devices, Surgical Equipment, Home Healthcare Equipment |

| Applications Covered | Cardiology, Orthopaedics, Neurology, Oncology, Gynaecology, Ophthalmology, Dental, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Clinics, Home Healthcare Settings, Diagnostic Laboratories |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medical equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medical equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medical equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical equipment market in India was valued at USD 28.63 Billion in 2024.

An increasing population, combined with longer life spans, is driving a higher demand for diagnostic, monitoring, and therapeutic devices in India. The growing prevalence of chronic conditions like diabetes, heart diseases, and lung disorders is creating the need for sophisticated medical devices. Additionally, the broadening of hospitals, clinics, and diagnostic facilities in urban and rural regions is encouraging the adoption of contemporary tools and technologies.

The India medical equipment market is projected to exhibit a CAGR of 8.65% during 2025-2033, reaching a value of USD 60.38 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)