India Medical Gloves Market Size, Share, Trends and Forecast by Type, Product Type, Material Type, Form, End User, and Region, 2025-2033

India Medical Gloves Market Overview:

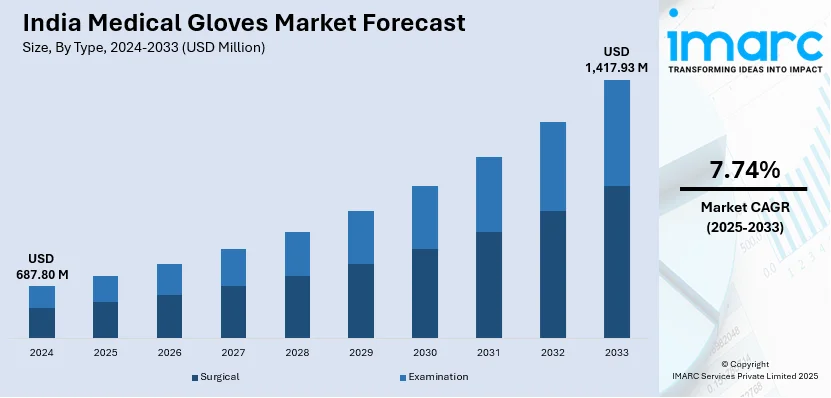

The India medical gloves market size reached USD 687.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,417.93 Million by 2033, exhibiting a growth rate (CAGR) of 7.74% during 2025-2033. The market is driven by rising healthcare awareness, increased demand due to infection control protocols, and growth in hospital and diagnostic infrastructure. Moreover, government initiatives supporting hygiene and safety, and onset of COVID-19 pandemic also significantly boosted the demand for disposable and examination gloves.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 687.80 Million |

| Market Forecast in 2033 | USD 1,417.93 Million |

| Market Growth Rate 2025-2033 | 7.74% |

India Medical Gloves Market Trends:

Expansion of Healthcare Infrastructure

India’s rapidly expanding healthcare infrastructure, including hospitals, nursing homes, clinics, and diagnostic centers, has contributed to the India medical gloves market growth. According to the India Brand Equity Foundation (IBEF), the Government of India is set to launch a credit incentive scheme valued at Rs. 50,000 crore (US$ 6.8 billion) to enhance the nation’s healthcare infrastructure. The Indian healthcare industry is experiencing unparalleled expansion, as private equity and venture capital funding exceeded US$ 1 billion in the initial five months of 2024, representing a 220% rise compared to the prior year. Government initiatives such as Ayushman Bharat and private investments have led to the establishment of more healthcare facilities, especially in semi-urban and rural areas. With the rise in surgeries, outpatient visits, and diagnostic procedures, the need for examination and surgical gloves has grown substantially, creating a positive India medical gloves market outlook. In addition, the booming telemedicine and home healthcare segments have widened the use of gloves beyond conventional settings, creating a more diversified and sustained demand across the healthcare system.

To get more information on this market, Request Sample

Infection Control and Regulatory Compliance

Stringent infection control protocols and regulations from health authorities like the Ministry of Health and Family Welfare, along with international standards from WHO and CDC, have made glove usage mandatory in most medical procedures. Hospitals and labs are required to follow safety guidelines to prevent cross-contamination, especially in high-risk environments like ICUs and operation theatres. Regular audits and inspections ensure compliance, further boosting the India medical gloves market share. The pandemic further reinforced these norms, embedding gloves as a non-negotiable part of personal protective equipment (PPE) kits in both government and private healthcare setups. For instance, in March 2024, the government is expected to include surgical gloves and disposable medical examination gloves in the Quality Control Order (QCO) to regulate the import of substandard products and improve the standards for domestic manufacturing. The action aligns with requests from local glove manufacturers who stated that insufficient regulation is causing the import of inferior gloves, rejected elsewhere, into India.

India Medical Gloves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, product type, material type, form, and end user.

Type Insights:

- Surgical

- Examination

The report has provided a detailed breakup and analysis of the market based on the type. This includes surgical and examination.

Product Type Insights:

- Reusable

- Disposable

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes reusable and disposable.

Material Type Insights:

- Natural Rubber

- Nitrile

- Viny

- Neoprene

- Polyethylene

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes natural rubber, nitrile, viny, neoprene, polyethylene, and others.

Form Insights:

- Powdered

- Non-Powdered

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes powdered and non-powdered.

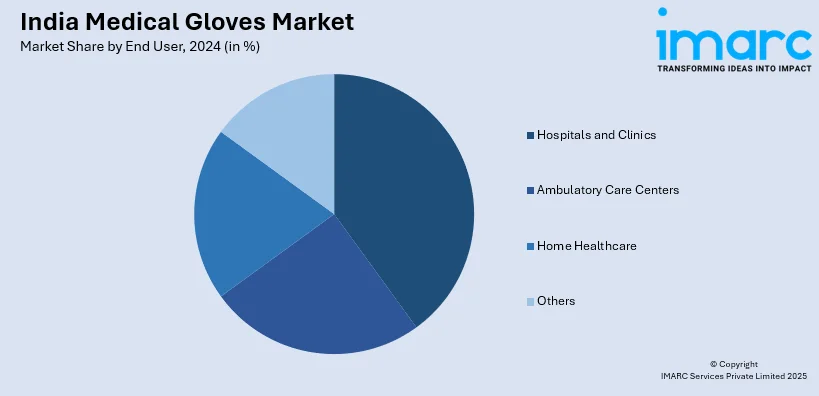

End User Insights:

- Hospitals and Clinics

- Ambulatory Care Centers

- Home Healthcare

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory care centers, home healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medical Gloves Market News:

- In February 2024, the Indian Rubber Gloves Manufacturers Association (IRGMA) strengthened its ongoing battle against banned medical gloves that enter India via extensive illegal import routes and distribution practices.

- In October 2024, KluraLabs, a pioneer in antimicrobial solutions, and Unigloves, a leading expert in hand protection, collaborated to introduce the CrossGuard antimicrobial nitrile glove, the first of its type to eradicate 99.99% of specific bacteria in 60 seconds. Third-party testing supports this innovation, which is devoid of active components.

India Medical Gloves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Surgical, Examination |

| Product Types Covered | Reusable, Disposable |

| Material Types Covered | Natural Rubber, Nitrile, Viny, Neoprene, Polyethylene, Others |

| Forms Covered | Powdered, Non-Powdered |

| End Users Covered | Hospitals And Clinics, Ambulatory Care Centers, Home Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medical gloves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medical gloves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medical gloves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical gloves market in India was valued at USD 687.80 Million in 2024.

India medical gloves market is projected to exhibit a (CAGR) of 7.74% during 2025-2033, reaching a value of USD 1,417.93 Million by 2033.

India's medical gloves market is supported by growing healthcare awareness, rigorous hygiene practices, and rising demand from hospitals, diagnostic laboratories, and clinics. Government spending on healthcare infrastructure, pandemic readiness, and infection control drives consumption. Surge in surgical activities and personal protective equipment (PPE) adoption also underpin steady demand across both public and private healthcare sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)