India Medical Oxygen Market Size, Share, Trends and Forecast by Form, Application, Delivery Mode, End User, and Region, 2025-2033

India Medical Oxygen Market Overview:

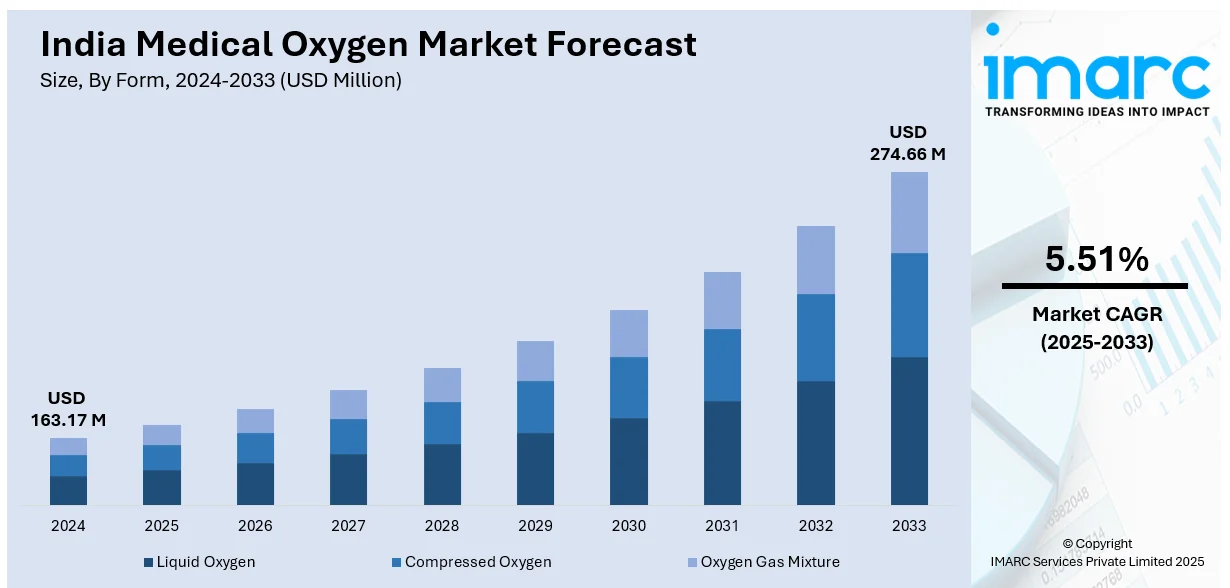

The India medical oxygen market size reached USD 163.17 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 274.66 Million by 2033, exhibiting a growth rate (CAGR) of 5.51% during 2025-2033. The India medical oxygen market share is driven by the mounting incidence of respiratory diseases, continued effects of the COVID-19 pandemic, and growing demand for home-based oxygen therapy. Moreover, advancements in oxygen production, distribution infrastructure, and oxygen concentrator technologies are also driving market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 163.17 Million |

| Market Forecast in 2033 | USD 274.66 Million |

| Market Growth Rate 2025-2033 | 5.51% |

India Medical Oxygen Market Trends:

Increasing Demand for Home-Based Medical Oxygen

One of the major trends influencing the India medical oxygen market outlook is increased demand for home-based medical oxygen solutions. Due to the COVID-19 pandemic, the shift towards home healthcare gained momentum with patients suffering from respiratory conditions such as those of COVID-19 being treated at home with oxygen therapy. The demand for home oxygen cylinders and portable oxygen concentrators has risen because of the convenience, cost-effectiveness, and provision of continuous oxygen therapy for patients in a home setting. As per industry publications, in the pre-COVID-19 period, India produced 6900 MT of oxygen, with merely 1000 MT designated for medical use. This amount rose to 19940 MT due to improved in-house oxygen production, affordable innovations, and better storage capabilities. As the chronic respiratory illnesses like COPD and asthma have increased, the demand for home oxygen therapy is likely to continue. Also, improvements in technology have resulted in the creation of smaller, more efficient, and convenient oxygen devices that are more accessible and convenient for home use, increasing this trend in India's medical oxygen market.

To get more information on this market, Request Sample

Growth of Oxygen Production and Distribution Infrastructure

With the ongoing increase in demand for medical oxygen, India is experiencing large-scale investments in the increase and upgrade of oxygen manufacturing and supply facilities. Due to the COVID-19 pandemic and the growing rate of respiratory ailments, efforts have been made towards greater availability of medical-grade oxygen in the country. Oxygen production facilities are being modernized with latest technologies in order to increase production capacities and address the growing demand. Additionally, the Indian government is making efforts to streamline oxygen's logistical distribution, particularly to rural and remote locations where access to healthcare centers is scarce. In April 2020, there were only 62,458 beds that supported oxygen. However, as the surge in Covid cases during the three waves highlighted the demand for additional beds, hospitals appear to have raised the total to 5,15,345 by February 2024, marking a growth of 725%. Apart from this, the creation of decentralized oxygen generation plants, coupled with better supply chain management and transportation facilities, is assisting in bridging shortages and providing a continuous supply of medical oxygen to clinics and hospitals. These advancements are likely to further propel the India medical oxygen market growth.

India Medical Oxygen Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on form, application, delivery mode, and end user.

Form Insights:

- Liquid Oxygen

- Compressed Oxygen

- Oxygen Gas Mixture

The report has provided a detailed breakup and analysis of the market based on the form. This includes liquid oxygen, compressed oxygen, and oxygen gas mixture.

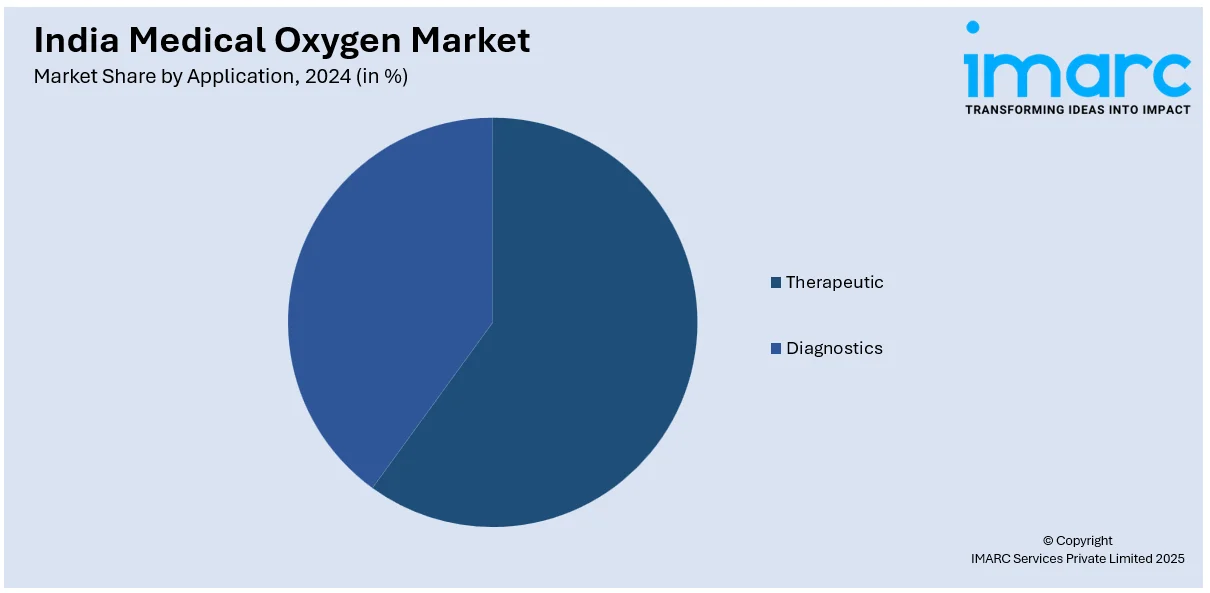

Application Insights:

- Therapeutic

- Diagnostics

The report has provided a detailed breakup and analysis of the market based on the application. This includes therapeutic and diagnostics.

Delivery Mode Insights:

- Tanks/Pipeline

- Cylinder

- Others

The report has provided a detailed breakup and analysis of the market based on the delivery mode. This includes tanks/pipeline, cylinder, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Care Centers

- Homecare

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and clinics, ambulatory care centers, homecare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medical Oxygen Market News:

- In July 2024, Air Liquide India, an industrial gases company, announced the establishment of a manufacturing facility in Mathura, Uttar Pradesh, with an investment of Rs 350 crore aimed at expanding its operations. This air separation unit, it was stated, is aimed at healthcare and industrial merchant operations in Kosi, Mathura.

- In January 2024, Linde revealed that it had extended its current long-term contract for the provision of industrial gases with Steel Authority of India Limited (SAIL), a major steelmaker in India. Linde currently provides oxygen, nitrogen, and argon to SAIL’s Rourkela steel facility in Odisha, eastern India, utilizing two on-site air separation units (ASUs) that are functioning at maximum capacity. According to the conditions of the new deal, Linde will construct, possess, and manage an extra 1,000 tons per day ASU, almost doubling Linde’s on-site output at Rourkela. Linde's investment is anticipated to be around USD 60 million.

India Medical Oxygen Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Liquid Oxygen, Compressed Oxygen, Oxygen Gas Mixture |

| Applications Covered | Therapeutic, Diagnostics |

| Delivery Modes Covered | Tanks/Pipeline, Cylinder, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Care Centers, Homecare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medical oxygen market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medical oxygen market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medical oxygen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medical oxygen market in India was valued at USD 163.17 Million in 2024.

The India medical oxygen market is projected to exhibit a (CAGR) of 5.51% during 2025-2033, reaching a value of USD 274.66 Million by 2033.

Increasing prevalence of respiratory diseases, rising investments in healthcare infrastructure, and emergency and critical care service demand are propelling the India medical oxygen market. Advances in oxygen concentrators and PSA plants, as well as government efforts to provide oxygen across rural and urban hospitals, are also boosting the market growth in both the public and private sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)