India Medical Tubing Market Size, Share, Trends and Forecast by Product, Structure, Application, End User, and Region, 2025-2033

Market Overview:

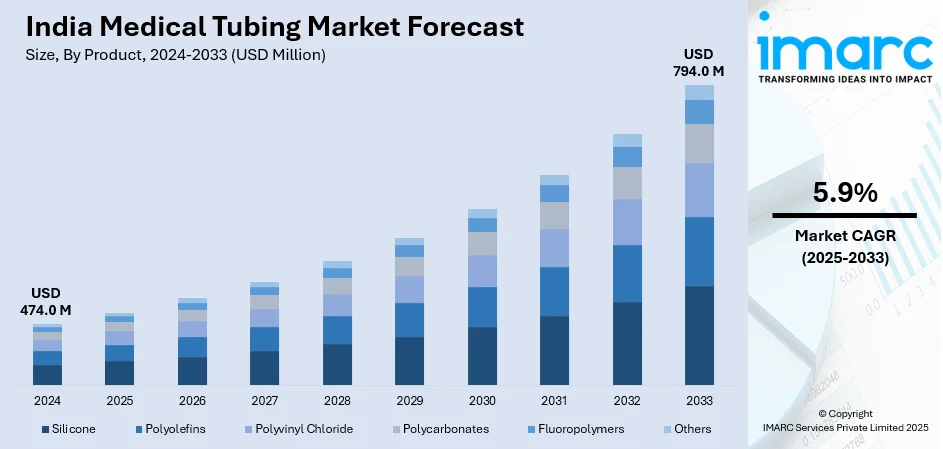

India medical tubing market size reached USD 474.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 794.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.9% during 2025-2033. The increasing number of diverse healthcare settings, encompassing clinics, hospitals, ambulatory surgical centers, and medical laboratories, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 474.0 Million |

| Market Forecast in 2033 | USD 794.0 Million |

| Market Growth Rate 2025-2033 | 5.9% |

Medical tubing refers to a cylindrical, hollow pipe designed for the administration of fluids and the transfer of gases and liquids in various medical applications. It is crafted from materials such as polyethylene, thermoplastic elastomers (TPE), nylon, polyvinyl chloride (PVC), and silicone. The utilization of medical tubing extends to diverse medical scenarios, including fluid management, catheters, drainage systems, peristaltic pumps, intravenous (IV) setups, bio-pharmaceutical laboratory equipment, anesthesiology, and respiratory devices. The properties of medical tubing, including hardness, flexibility, durability, and resistance to temperature, pressure, and abrasion, make it a versatile solution for medical applications. Manufactured from recyclable plastics, medical tubing is known for its biocompatibility, devoid of allergic or adverse reactions when in direct contact with the human body. Notably, medical tubing possesses the ability to withstand rigorous mechanical requirements owing to its high level of purity.

To get more information on this market, Request Sample

India Medical Tubing Market Trends:

The medical tubing market in India is witnessing substantial growth, propelled by the increasing demand for advanced and reliable medical devices and equipment across the healthcare sector. Moreover, its versatility and wide-ranging applications make it an integral part of modern medical practices. Besides this, medical tubing in India is characterized by essential properties such as hardness, flexibility, durability, and resistance to temperature, pressure, and abrasion. It ensures its suitability for a diverse range of medical scenarios while meeting stringent quality and safety standards. Additionally, the use of recyclable plastics in medical tubing aligns with environmental considerations and regulatory guidelines. Apart from this, the market for medical tubing in India is driven by the growth of healthcare infrastructure, increased focus on patient care, and advancements in medical technology. Furthermore, as clinics, hospitals, ambulatory surgical centers, and medical laboratories continue to expand and modernize, the demand for high-quality medical tubing is poised to rise, contributing to the overall efficiency and safety of healthcare practices in the country. In addition, with a strong emphasis on biocompatibility and adherence to international quality standards, the medical tubing market in India is expected to fuel bolster over the forecasted period.

India Medical Tubing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, structure, application, and end user.

Product Insights:

- Silicone

- Polyolefins

- Polyvinyl Chloride

- Polycarbonates

- Fluoropolymers

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes silicone, polyolefins, polyvinyl chloride, polycarbonates, fluoropolymers, and others.

Structure Insights:

- Single-Lumen

- Co-Extruded

- Multi-Lumen

- Tapered or Bump Tubing

- Braided Tubing

A detailed breakup and analysis of the market based on the structure have also been provided in the report. This includes single-lumen, co-extruded, multi-lumen, tapered or bump tubing, and braided tubing.

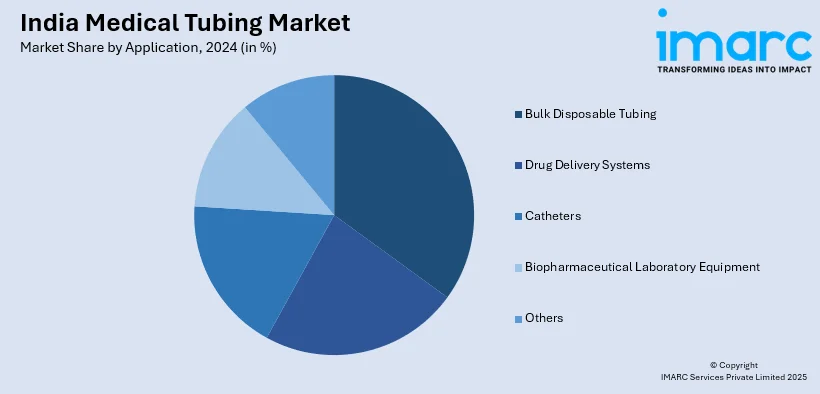

Application Insights:

- Bulk Disposable Tubing

- Drug Delivery Systems

- Catheters

- Biopharmaceutical Laboratory Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes bulk disposable tubing, drug delivery systems, catheters, biopharmaceutical laboratory equipment, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Medical Labs

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, medical labs, and others.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medical Tubing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Silicone, Polyolefins, Polyvinyl Chloride, Polycarbonates, Fluoropolymers, Others |

| Structures Covered | Single-Lumen, Co-Extruded, Multi-Lumen, Tapered or Bump Tubing, Braided Tubing |

| Applications Covered | Bulk Disposable Tubing, Drug Delivery Systems, Catheters, Biopharmaceutical Laboratory Equipment, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Medical Labs, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India medical tubing market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the India medical tubing market?

- What is the breakup of the India medical tubing market on the basis of product?

- what is the breakup of the India medical tubing market on the basis of structure?

- What is the breakup of the India medical tubing market on the basis of application?

- What is the breakup of the India medical tubing market on the basis of end user?

- What are the various stages in the value chain of the India medical tubing market?

- What are the key driving factors and challenges in the India medical tubing?

- What is the structure of the India medical tubing market and who are the key players?

- What is the degree of competition in the India medical tubing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medical tubing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medical tubing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medical tubing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)