India Medium Density Fiberboard Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2025-2033

India Medium Density Fiberboard Market Overview:

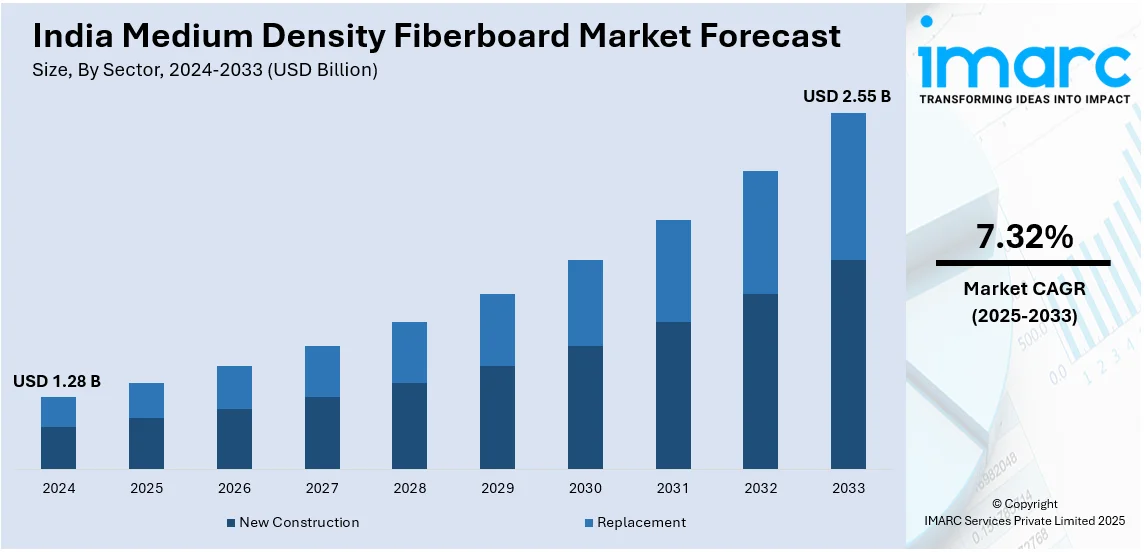

The India medium density fiberboard market size reached USD 1.28 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.55 Billion by 2033, exhibiting a growth rate (CAGR) of 7.32% during 2025-2033. The India medium density fiberboard (MDF) market is driven by the growing demand in the furniture and interior décor industry, rising urbanization, technological advancements in manufacturing, rising adoption of eco-friendly alternatives to plywood, and government initiatives promoting quality standards, boosting domestic production and expanding market opportunities for MDF manufacturers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.28 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Market Growth Rate (2025-2033) | 7.32% |

India Medium Density Fiberboard Market Trends:

Increasing Demand in the Furniture and Interior Décor Industry

The Indian interior décor and furniture sector has experienced tremendous growth over the last few years, resulting in high demand for materials like MDF. MDF is popular due to its flexibility, affordability, and ease of modification, and it is well-suited for contemporary furniture design and interior uses. Based on industry publications, the Indian MDF market size stood at around INR 4,000 crore in 2021, growing at an average annual rate of about 15%. The reason behind the growth lies in the booming furniture sector that makes widespread use of MDF in products ranging from cabinetry to shelving and decorative panels. The transition in consumer demand toward ready-to-assemble and modular furniture has further driven MDF consumption. MDF is favored by manufacturers and designers because of its flat surface, making it easy to apply veneers, laminates, and paints, meeting varied aesthetic demands. MDF's stability and uniformity also make it ideal for complex designs and machining, which has enhanced its popularity in the furniture industry.

To get more information on this market, Request Sample

Advancements in Manufacturing Technologies and Capacity Expansion

Advances in technology in MDF production have stimulated higher product quality and production efficiency, which has played a key role in driving the market growth. More efficient manufacturing processes have created MDF products that are more durable, resistant to moisture, and environmentally friendly, in accordance with changing consumer demands and regulatory requirements. In India, the production capacity of MDF has registered a significant upsurge, from 0.15 million cubic meters in 2010 to about 1.8-1.9 million cubic meters in 2021. This inflation indicates a CAGR of around 20-25% from 2021 to 2030, signifying a firm commitment from the industry players to address the escalating demand. The arrival of organized interior infrastructure firms has also been a key factor in this growth. The market leadership in the Indian MDF industry is cornered by the top four players, who together control nearly 70% of existing MDF capacity, highlighting the sector's consolidation and emphasis on quality production. These developments not only have augmented the domestic availability of MDF but also made India a viable exporter of MDF products. The enhanced quality and competitive pricing of Indian MDF offer a global market appeal, further enhancing the prospects of the industry's growth.

India Medium Density Fiberboard Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application and sector.

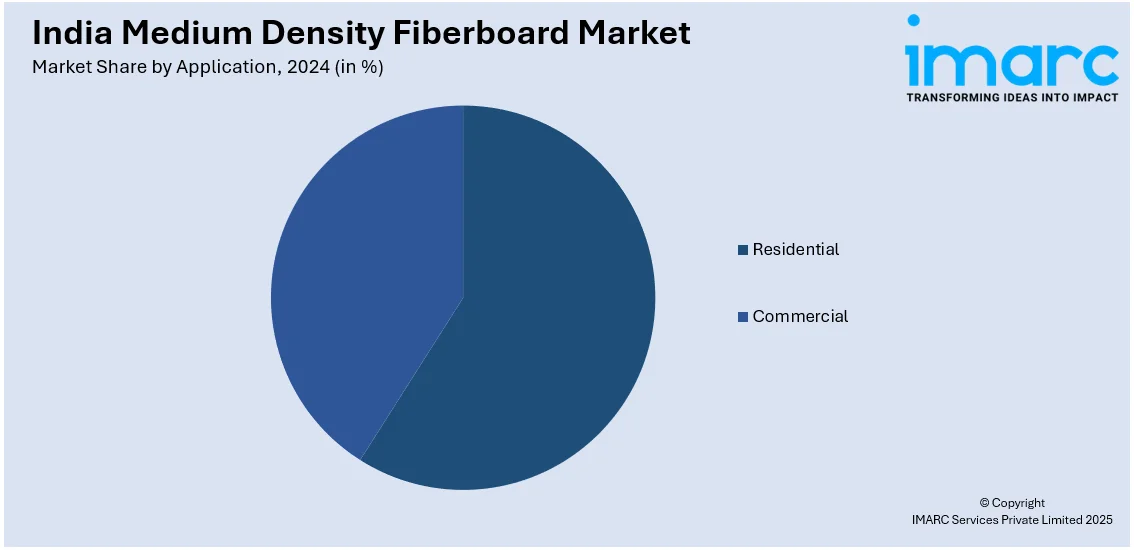

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Sector Insights:

- New Construction

- Replacement

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes new construction and replacement.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medium Density Fiberboard Market News:

- January 2025: The Indian government implemented Quality Control Orders (QCO) for plywood and MDF boards to improve standards. These regulations have been accepted by the industry for improved quality and adherence. The action is improving the India Medium Density Fiberboard market by upgrading consumer confidence, demand for compliant products, and growth in organized sectors.

- April 2024: CenturyPly expanded its MDF production by starting commercial dispatches from its new plant in Andhra Pradesh, expanding its manufacturing capacity. This expansion enhances the availability of high-quality MDF, meeting the rising demand in India's furniture and interior décor sectors. The substantial supply supports industry growth and strengthens India's MDF market competitiveness.

India Medium Density Fiberboard Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medium density fiberboard market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medium density fiberboard market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medium density fiberboard industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The medium density fiberboard market in India was valued at USD 1.28 Billion in 2024.

The India medium density fiberboard market is projected to exhibit a CAGR of 7.32% during 2025-2033, reaching a value of USD 2.55 Billion by 2033.

India’s medium-density fiberboard (MDF) market is driven by the growing demand for affordable, versatile furniture and modern interior décor, particularly in modular and ready-to-assemble formats. Expanding urbanization and construction activity support wider applications in residential and commercial spaces. Additionally, eco-friendly production practices, availability of raw materials, and advancements in manufacturing technologies make MDF a preferred alternative to traditional wood, fueling its adoption across furniture, cabinetry, and decorative applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)