India Medium Voltage Cable Market Size, Share, Trends and Forecast by Product, Voltage, Installation, Application, and Region, 2025-2033

India Medium Voltage Cable Market Overview:

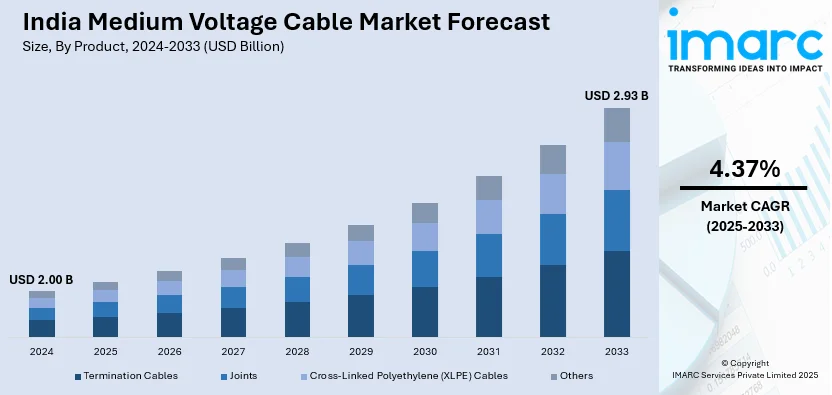

The India medium voltage cable market size reached USD 2.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.93 Billion by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2019-2024. The market is driven by increased demand for power distribution in urbanization, industrial expansion, infrastructure development, the government's push for renewable energy projects, such as wind and solar, and the rising need for reliable electricity transmission systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.00 Billion |

| Market Forecast in 2033 | USD 2.93 Billion |

| Market Growth Rate 2025-2033 | 4.37% |

India Medium Voltage Cable Market Trends:

Growth in Renewable Energy Infrastructure

The rapid expansion of renewable energy infrastructure is a key factor driving the growth of the India medium voltage cable market. With a target of achieving 500 GW of non-fossil fuel capacity by 2030, India is witnessing an accelerated transition toward renewable energy sources, increasing the demand for efficient power distribution networks. Medium voltage cables play a crucial role in transmitting electricity from wind, solar, and hydroelectric plants to urban and industrial areas. According to the International Energy Agency (IEA), India’s renewable energy capacity is expected to grow at an annual rate of over 10% throughout the next decade, necessitating reliable transmission solutions to maintain grid stability. Government initiatives such as the National Solar Mission and State-level wind power projects are further fueling the installation of solar parks and wind farms, particularly in states like Rajasthan, Gujarat, and Tamil Nadu. The Indian renewable energy market is expected to grow at a CAGR of 8.1% (2025-2033), reaching USD 52.1 billion by 2033. This expanding infrastructure underscores the increasing demand for medium voltage cables as an essential component of India’s evolving power sector.

To get more information on this market, Request Sample

Expansion of Urban and Industrial Infrastructure

The rapid expansion of urban and industrial infrastructure is a key driver of growth in the India Medium Voltage Cable market. With India’s urban population projected to reach 600 million by 2031, the demand for stable and efficient power distribution systems is surging. Government-led initiatives, such as the development of smart cities and industrial corridors like the Delhi-Mumbai Industrial Corridor (DMIC), are accelerating infrastructure projects, leading to increased installations of medium voltage cables to support expanding urban centers and industrial zones. Additionally, India's manufacturing sector, particularly in automotive, electronics, textiles, and pharmaceuticals, is witnessing significant growth, necessitating a reliable power supply for industrial operations. The India Industry 4.0 market is expected to grow at a CAGR of 12.4% (2025-2033), reaching USD 17.4 billion by 2033. Furthermore, India intends to invest INR 9.2 trillion (USD 107 billion) in new transmission lines by 2032 to accommodate a nearly threefold growth in renewable energy capacity. Medium voltage cables will continue to play an important role in India's expanding power infrastructure as urbanization, industrial growth, and improvements in electrical grid modernization continue.

India Medium Voltage Cable Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product, voltage, installation, and application.

Product Insights:

- Termination Cables

- Joints

- Cross-Linked Polyethylene (XLPE) Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes termination cables, joints, cross-linked polyethylene (XLPE) cables, and others.

Voltage Insights:

- Up to 25KV

- 26KV-50KV

- 51KV-75KV

- 76KV-100KV

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes up to 25KV, 26KV-50KV, 51KV-75KV, and 76KV-100KV.

Installation Insights:

- Underground

- Submarine

- Overhead

The report has provided a detailed breakup and analysis of the market based on the installation. This includes underground, submarine, and overhead.

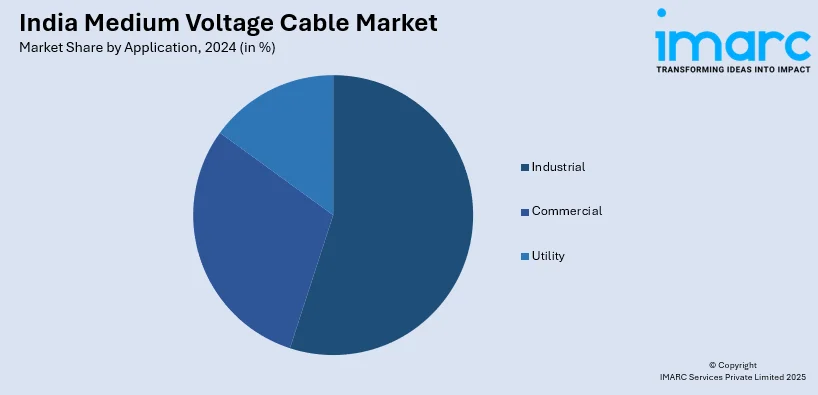

Application Insights:

- Industrial

- Commercial

- Utility

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes industrial, commercial, and utility.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Medium Voltage Cable Market News:

- January 2025: V-Marc India Limited, India's biggest maker of wires and cables, revealed its plans to expand in Kerala. The firm also announced that it would launch its latest line of sophisticated wire and cable solutions, which will have an 80% greater current carrying capacity, a service life of more than 60 years, and strong short-circuit protection.

- March 2024: Universal Cables Limited approved an additional capital expenditure of approximately INR 20 crore to augment the production capacity of XLPE Insulated Medium Voltage Power Cables at its Satna facility in Madhya Pradesh.

India Medium Voltage Cable Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Termination Cables, Joints, Cross-Linked Polyethylene (XLPE) Cables, Others |

| Voltages Covered | Up to 25KV, 26KV-50KV, 51KV-75KV, 76KV-100KV |

| Installations Covered | Underground, Submarine, Overhead |

| Applications Covered | Industrial, Commercial, Utility |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India medium voltage cable market performed so far and how will it perform in the coming years?

- What is the breakup of the India medium voltage cable market on the basis of product?

- What is the breakup of the India medium voltage cable market on the basis of voltage?

- What is the breakup of the India medium voltage cable market on the basis of installation?

- What is the breakup of the India medium voltage cable market on the basis of application?

- What are the various stages in the value chain of the India medium voltage cable market?

- What are the key driving factors and challenges in the India medium voltage cable market?

- What is the structure of the India medium voltage cable market and who are the key players?

- What is the degree of competition in the India medium voltage cable market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India medium voltage cable market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India medium voltage cable market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India medium voltage cable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)