India Menthol Market Size, Share, Trends and Forecast by Product Type, Form, Application, and Region, 2025-2033

India Menthol Market Overview:

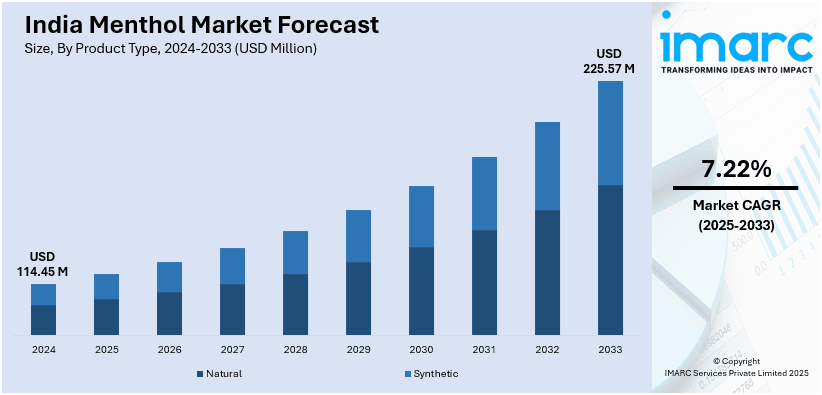

The India menthol market size reached USD 114.45 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 225.57 Million by 2033, exhibiting a growth rate (CAGR) of 7.22% during 2025-2033. The market is experiencing steady growth due to rising demand from the pharmaceutical, food, and personal care industries. Furthermore, the rising health consciousness along with the growing food and beverages sector are positively impacting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 114.45 Million |

| Market Forecast in 2033 | USD 225.57 Million |

| Market Growth Rate 2025-2033 | 7.22% |

India Menthol Market Trends:

Rising Demand for Menthol in Pharmaceuticals

The use of menthol in drugs like pain-relieving ointments, cough syrups, and throat lozenges has gone up substantially in India. In addition, the demand for menthol products is growing because of their calming effect, with awareness of health and wellness on the rise. Moreover, the growth in the incidence of respiratory and arthritis-related ailments has also accelerated the demand for menthol in topical analgesics and medicated creams. Further, menthol is used extensively in dental care and personal care products, boosting its use in the market. The constant rise in the growth of the Indian pharmaceutical industry, supported by local as well as global players, has provided new opportunities for menthol manufacturers. Consequently, market growth is expected to continue increasing through the increased application of menthol-based products for prophylactic and therapeutic purposes. In turn, producers are concentrating more on enhancing the process of extracting menthol, which increases the efficiency of manufacturing and reduces production costs. Besides, partnerships between menthol suppliers and pharmaceutical firms are improving product innovations within the industry, thereby offering industry players a competitive advantage.

To get more information on this market, Request Sample

Expanding Role of Menthol in Food and Beverages

Menthol is finding wider applications in the food and beverage industry, mainly for flavor product manufacture, such as gums, candies, and soft drinks. In India, with a rise in demand for flavored food and beverages, menthol has emerged as a major ingredient to give an agreeable taste and cooling effect. In addition, rising disposable income and shifting consumers' preferences towards novelties and new flavor sensations are fueling the increase in the use of menthol in food and beverages. Apart from this, the increasing popularity of menthol in mint-flavored beverages, such as energy drinks and health drinks, is due to consumers looking for products that provide refreshments as well as health. The growth of the food processing sector, along with rising exports, is also driving demand for menthol. Along with this, the application of menthol in the improvement of sensory experiences will remain at the forefront of the industry's growth, with firms venturing into new segments. Besides that, the need for organic and natural ingredients in food has led to the use of natural sources of menthol by manufacturers due to pressure from market demands for purity and product sustainability.

India Menthol Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, form, and application.

Product Type Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the product type. This includes natural and synthetic.

Form Insights:

- Crystalline Solid

- Powder

- Liquid

The report has provided a detailed breakup and analysis of the market based on the form. This includes crystalline solid, powder, and liquid.

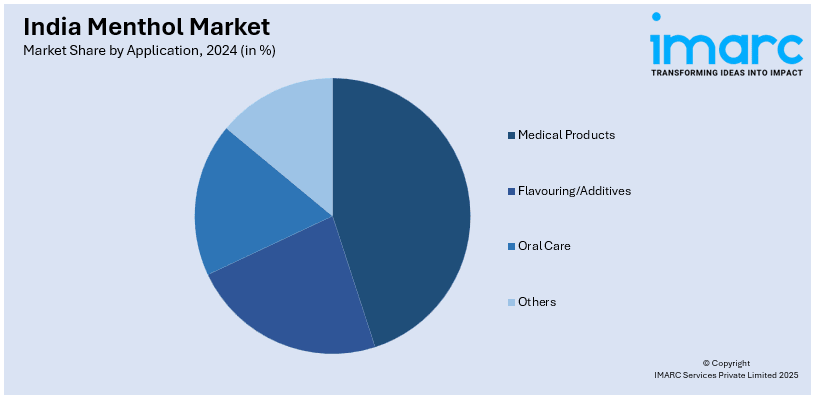

Application Insights:

- Medical Products

- Flavouring/Additives

- Oral Care

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes medical products, flavouring/additives, oral care, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Menthol Market News:

- June 2024, Vicks unveiled a double-powered transformation of its iconic triangular cough drops, marking the first change in two decades. This new version, enhanced with menthol, aimed to provide stronger relief. The innovation positively impacted the menthol industry in India by driving increased demand and consumer interest.

- June 2024, Dabur India launched Cool King Icy Perfume Talc, infused with menthol cooling crystals. The product provided a double-burst cooling effect, offering 12 hours of freshness. This innovation contributed to the growing demand for menthol in the personal care segment, enhancing its market presence.

India Menthol Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Natural, Synthetic |

| Forms Covered | Crystalline Solid, Powder, Liquid |

| Applications Covered | Medical Products, Flavouring/Additives, Oral Care, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India menthol market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India menthol market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India menthol industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The menthol market in India was valued at USD 114.45 Million in 2024.

The India menthol market is projected to exhibit a CAGR of 7.22% during 2025-2033, reaching a value of USD 225.57 Million by 2033.

The India menthol market is fueled by rising demand from the pharmaceutical, cosmetics, and personal care industries. The rising demand for organic and natural products, along with the growing use of such ingredients across the food and beverage industry, continues to accelerate this upward market trend.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)