India Metal Additive Manufacturing Market Size, Share, Trends and Forecast by Type, Component, End Use Industry, and Region, 2025-2033

India Metal Additive Manufacturing Market Size and Share:

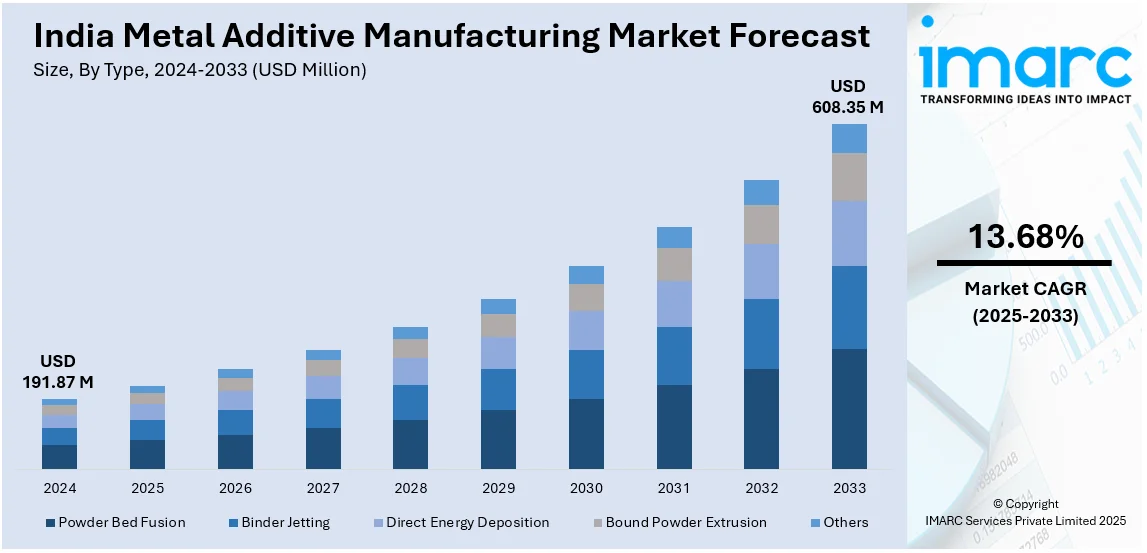

The India metal additive manufacturing market size reached USD 191.87 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 608.35 Million by 2033, exhibiting a growth rate (CAGR) of 13.68% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of metal additive manufacturing in aerospace and defense and growing adoption in medical and dental implants.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 191.87 Million |

| Market Forecast in 2033 | USD 608.35 Million |

| Market Growth Rate (2025-2033) | 13.68% |

India Metal Additive Manufacturing Market Trends:

Increasing Adoption of Metal Additive Manufacturing in Aerospace and Defense

Rapidly increasing demand for metal based additive manufacturing (AM) and cutting back of custom airplane structural requirements has been seen in India’s aero and defense systems sector. The local self-sufficient economy concept, entitled as Policy of the State "Atmanirbhar Bharat", forces the contraction of production at the place of consumption, military and aerospace sectors as well as the integrated use of technological innovations such as laser powder bed fusion (LPBF) and electron beam powder bed fusion (DED). Such companies as Halkul Aeronautics Meta Corporation (HAL), Bharat Forge and The Defence Research and Development Organization (DRDO) are developing metal am parts, for example for aircraft engines, missiles or other structures, in the manufacturing industry. Incorporation of such technologies even in traditional parts, as relative to the classical techniques enables enhancing more performance and reducing the material consumed. Furthermore, both Boeing and Airbus, leading world companies, are joining efforts with Indian manufacturers in creating composite structures for light aircrafts’ bodies and maintenance parts using AM. For instance, in February 2025, DRDO and IIT Hyderabad unveiled a Large Area Additive Manufacturing (LAAM) system, advancing India's aerospace and defense sectors by enabling large-scale metal component production through additive manufacturing. The adoption of high-performance metal powders, including titanium, aluminum, and nickel-based superalloys, is further driving innovation in the sector. As India strengthens its indigenous defense capabilities, metal additive manufacturing is expected to play a crucial role in achieving self-sufficiency in critical aerospace and defense applications.

To get more information on this market, Request Sample

Growing Adoption in Medical and Dental Implants

The Indian healthcare industry is increasingly integrating metal additive manufacturing for customized medical implants and prosthetics, driven by the demand for patient-specific solutions and advancements in biocompatible materials. Orthopedic implants, cranial plates, and dental prosthetics are among the key applications benefiting from metal AM’s precision and design flexibility. Medical device manufacturers are leveraging titanium and cobalt-chromium (Co-Cr) alloys to produce high-strength, corrosion-resistant implants tailored to individual patient anatomies. The ability of AM to manufacture porous structures that promote better osseointegration is making it a preferred choice for orthopedic applications. Leading Indian healthcare institutions and research centers are collaborating with AM technology providers like Wipro 3D and Objectify Technologies to advance metal AM-based medical devices. For instance, in June 2024, Wipro 3D and Nikon SLM Solutions announced partnership to advance additive manufacturing in India, combining Wipro 3D’s expertise with Nikon’s selective laser melting technology to enhance manufacturing across multiple industries. Furthermore, the adoption of regulatory frameworks for 3D-printed medical devices is fostering confidence in AM-produced implants. With India’s aging population and increasing healthcare expenditures, the demand for customized, high-quality implants is expected to surge. Metal additive manufacturing is set to revolutionize the medical and dental industries, offering cost-effective, patient-specific solutions that improve clinical outcomes and accessibility in the Indian healthcare ecosystem.

India Metal Additive Manufacturing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, component, and end use industry.

Type Insights:

- Powder Bed Fusion

- Binder Jetting

- Direct Energy Deposition

- Bound Powder Extrusion

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes powder bed fusion, binder jetting, direct energy deposition, bound powder extrusion, and others.

Component Insights:

- Systems

- Materials

- Service and Parts

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes systems, materials, and service and parts.

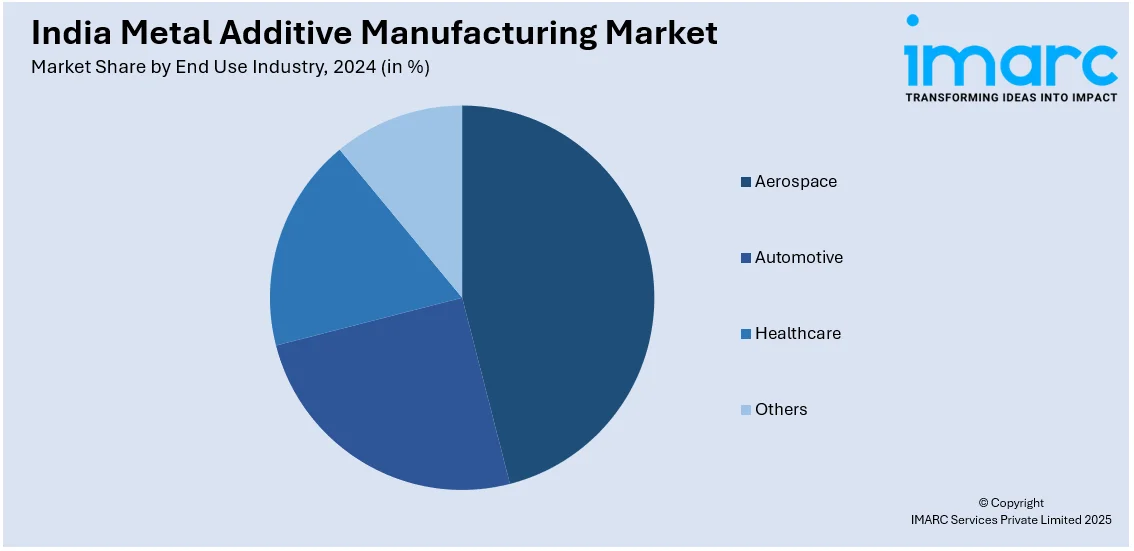

End Use Industry Insights:

- Aerospace

- Automotive

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end use indusrty have also been provided in the report. This includes aerospace, automotive, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metal Additive Manufacturing Market News:

- In June 2024, MeitY Secretary Shri S Krishnan inaugurated the first National Additive Manufacturing Symposium (NAMS) in New Delhi, highlighting India's AM ecosystem. The event included the release of the Additive Manufacturing Landscape Report and the unveiling of an indigenously developed additive manufacturing machine, showcasing India's advancements in AM technology.

India Metal Additive Manufacturing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Powder Bed Fusion, Binder Jetting, Direct Energy Deposition, Bound Powder Extrusion, Others |

| Components Covered | Systems, Materials, Service and Parts |

| End Use Industries Covered | Aerospace, Automotive, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India metal additive manufacturing market performed so far and how will it perform in the coming years?

- What is the breakup of the India metal additive manufacturing market on the basis of type?

- What is the breakup of the India metal additive manufacturing market on the basis of component?

- What is the breakup of the India metal additive manufacturing market on the basis of end use industry?

- What is the breakup of the India metal additive manufacturing market on the basis of region?

- What are the various stages in the value chain of the India metal additive manufacturing market?

- What are the key driving factors and challenges in the India metal additive manufacturing?

- What is the structure of the India metal additive manufacturing market and who are the key players?

- What is the degree of competition in the India metal additive manufacturing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metal additive manufacturing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metal additive manufacturing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metal additive manufacturing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)