India Metal Coatings Market Size, Share, Trends and Forecast by Resin Type, Process, Technology, End Use Industry, and Region, 2025-2033

India Metal Coatings Market Overview:

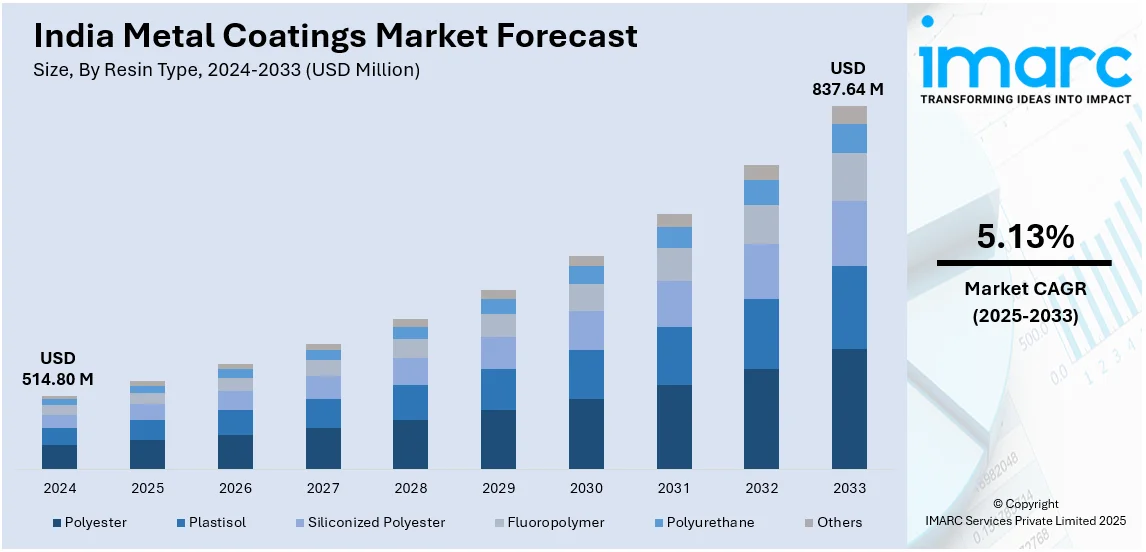

The India metal coatings market size reached USD 514.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 837.64 Million by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033. The rising automotive production, increasing demand for corrosion-resistant coatings in construction and manufacturing, government initiatives promoting sustainable coatings, and advancements in coating technologies are fueling the industry’s growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 514.80 Million |

| Market Forecast in 2033 | USD 837.64 Million |

| Market Growth Rate (2025-2033) | 5.13% |

India Metal Coatings Market Trends:

Rising Adoption of Eco-Friendly and Sustainable Coatings

The metal coatings market in India is witnessing a significant shift toward eco-friendly and sustainable coatings, driven by environmental regulations and increasing consumer preference for green alternatives. Traditional solvent-based coatings contribute to volatile organic compound (VOC) emissions, prompting a surge in demand for water-based and powder coatings that offer reduced environmental impact without compromising performance. With 60% of Indian consumers ready to pay a premium for sustainable products and 52% of urban buyers set to boost spending on eco-friendly brands in the next three years, industries are prioritizing stricter environmental compliance to align with evolving consumer preferences and regulatory standards. In response, powder coatings are gaining popularity, as they eliminate solvents and significantly reduce hazardous waste, aligning with sustainability goals. In addition to this, government initiatives, such as the National Clean Air Programme (NCAP) and strict industrial emission guidelines, are accelerating this transition. Furthermore, major industry players are investing in bio-based coatings and low-VOC formulations to align with sustainability goals. For instance, global coatings manufacturers are expanding their footprint in India by launching advanced, non-toxic coatings suitable for diverse applications, including construction, automotive, and industrial machinery, which is strengthening the market growth.

To get more information on this market, Request Sample

Growth of Smart and Functional Coatings for Industrial Applications

The rising need for smart coatings with self-healing, anti-corrosion, and heat resistance features is transforming India's metal coatings sector. Automotive, aerospace, and infrastructure industries are using functional coatings to improve durability, efficiency, and long-term cost savings. With India's ambitious $1.4 trillion National Infrastructure Pipeline (NIP) pushing large-scale building and industrial expansion, the need for outstanding performance coatings is increasing rapidly. Smart coatings with self-healing and antimicrobial qualities are becoming popular in sectors that value longevity and low maintenance. For example, manufacturers are developing nanocoatings that can self-repair minor surface damages, significantly improving asset lifespan in harsh environmental conditions. Moreover, the burgeoning growth of the automotive sector, with its production scaling 284 million vehicles in 2023-2024, is also aiding in market expansion with its rising demand for heat-resistant and anti-scratch coatings to improve vehicle durability and aesthetics. Major global and domestic players are ramping up R&D investments in functional coatings tailored for India's climatic and industrial challenges, which is further propelling the market forward.

India Metal Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on resin type, process, technology, and end use industry.

Resin Type Insights:

- Polyester

- Plastisol

- Siliconized Polyester

- Fluoropolymer

- Polyurethane

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes polyester, plastisol, siliconized polyester, fluoropolymer, polyurethane, and others.

Process Insights:

- Coil Coating

- Extrusion Coating

- Hot-Dip Galvanizing

A detailed breakup and analysis of the market based on the process have also been provided in the report. This includes coil coating, extrusion coating, and hot dip galvanizing.

Technology Insights:

- Liquid Coating

- Powder Coating

The report has provided a detailed breakup and analysis of the market based on the technology. This includes liquid and powder coatings.

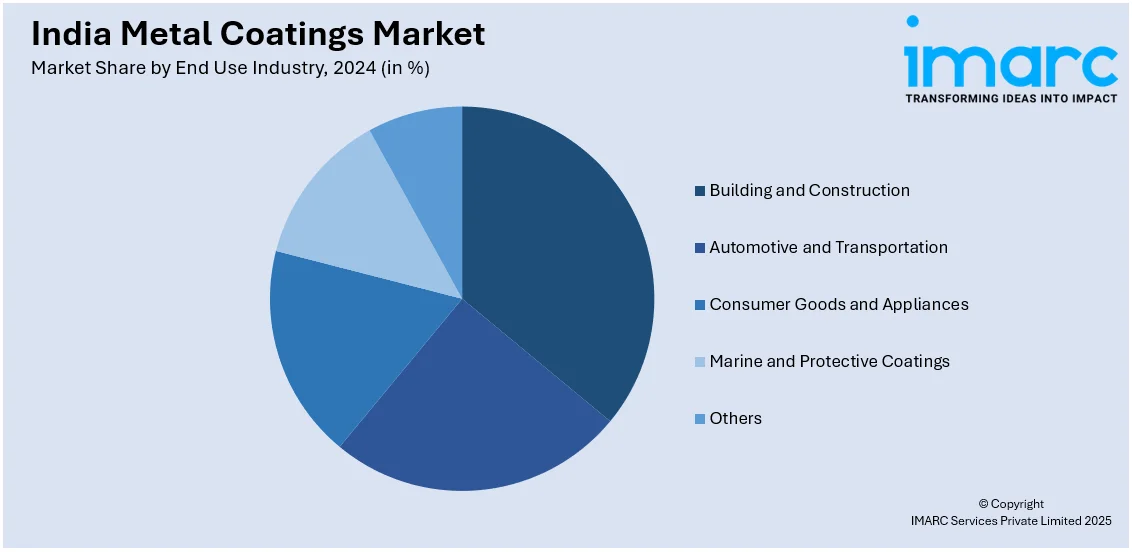

End Use Industry Insights:

- Building and Construction

- Automotive and Transportation

- Consumer Goods and Appliances

- Marine and Protective Coatings

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes building and construction, automotive and transportation, consumer goods and appliances, marine and protective coatings, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metal Coatings Market News:

- January 2025: Akzo Nobel India Ltd, a metal coating and painting manufacturer, proposed a strategic evaluation of its powder coatings business and R&D unit, potentially selling these assets to an indirect wholly-owned subsidiary of Akzo Nobel NV (ANNV). The proposal also includes Akzo Nobel India potentially acquiring the decorative paints' intellectual property owned by ANNV.

- August 2024: NOF Metal Coatings introduced its PFAS-free topcoat range, featuring three options: PLUS XL 2 Silver, PLUS VLh 2 Silver, and PLUS ML 2 Silver. This innovation aligns with evolving environmental regulations and sustainability goals.

India Metal Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyester, Plastisol, Siliconized Polyester, Fluoropolymer, Polyurethane, Others |

| Processes Covered | Coil Coating, Extrusion Coating, Hot Dip Galvanizing |

| Technologies Covered | Liquid Coating, Powder Coating |

| End Use Industries Covered | Building and Construction, Automotive and Transportation, Consumer Goods and Appliances, Marine and Protective Coatings, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India metal coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the India metal coatings market on the basis of resin type?

- What is the breakup of the India metal coatings market on the basis of process?

- What is the breakup of the India metal coatings market on the basis of technology?

- What is the breakup of the India metal coatings market on the basis of end use industry?

- What are the various stages in the value chain of the India metal coatings market?

- What are the key driving factors and challenges in the India metal coatings?

- What is the structure of the India metal coatings market and who are the key players?

- What is the degree of competition in the India metal coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metal coatings market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metal coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metal coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)