India Metal Packaging Market Size, Share, Trends and Forecast by Product Type, Material, Application, and Region, 2025-2033

India Metal Packaging Market Overview:

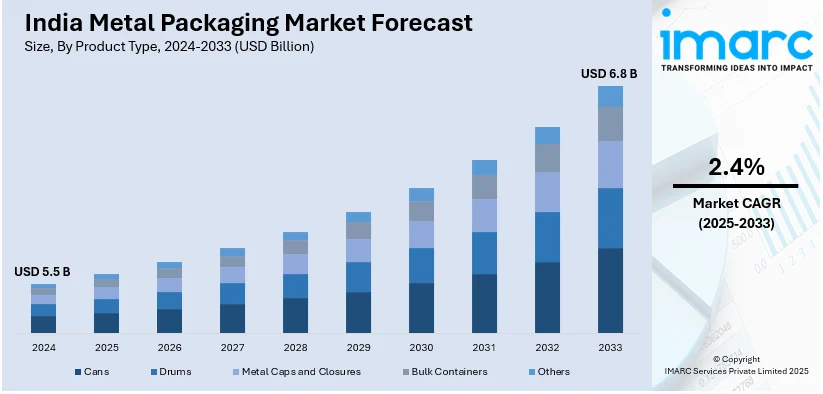

The India metal packaging market size reached USD 5.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.8 Billion by 2033, exhibiting a growth rate (CAGR) of 2.4% during 2025-2033. The growing demand for sustainable and recyclable packaging, increasing use in the food and beverage industry, rising urbanization, stricter regulations on plastic usage, advancements in packaging technology, and expanding applications in pharmaceuticals and industrial sectors are expanding the India metal packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Market Growth Rate 2025-2033 | 2.4% |

India Metal Packaging Market Trends:

Rising Demand for Sustainable Packaging Solutions

The India metal packaging market growth is driven by the increasing demand for eco-friendly and recyclable materials. With growing environmental concerns and stricter regulations on plastic usage, industries are shifting toward metal packaging options like aluminum cans, steel drums, and tin containers. For instance, as per an article published in 2024, with barely 25% of the 4 million tonnes of plastic garbage produced annually being recycled or treated, India has stepped up efforts to address the escalating plastic waste challenge. The Extended Producer Responsibility (EPR) framework was implemented by the government to address this environmental issue and hold manufacturers responsible for gathering and recycling their plastic waste. To encourage a circular economy and lessen plastic pollution, a cutting-edge online EPR trading platform has been introduced that enables recyclers to earn certificates for recovered plastic, which businesses may buy to achieve their recycling goals. The durability and recyclability of metal make it a preferred choice for food, beverage, and pharmaceutical packaging. Additionally, consumer preference for sustainable products and the rising popularity of ready-to-eat and canned food products are further propelling the market. This trend is expected to continue as brands focus on reducing carbon footprints and promoting circular economy practices.

To get more information on this market, Request Sample

Growth in the Beverage and Food Industry

The expansion of the beverage and food industry in India is fueling the demand for metal packaging. For instance, on March 16, 2025, PepsiCo revealed its intention to grow its packaged food business in India by customizing goods to suit local tastes, acknowledging the wide range of tastes across the nation. The company has made considerable investments in customer research and divided India into nine clusters in order to better understand and serve these diverse taste profiles. Furthermore, with the rising popularity of energy drinks, canned beverages, and packaged foods, metal cans and containers are becoming essential for preserving product freshness and extending shelf life. The convenience offered by metal packaging, coupled with its ability to protect against contamination and maintain product quality, is attracting major players in the industry. Additionally, the growing urban population and increasing disposable income are driving higher consumption of packaged food and beverages, which, in turn, is positively impacting the India metal packaging market outlook.

India Metal Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, material and application.

Product Type Insights:

- Cans

- Drums

- Metal Caps and Closures

- Bulk Containers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cans, drums, metal caps and closures, bulk containers, and others.

Material Insights:

- Steel

- Aluminium

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes steel, aluminium, and others.

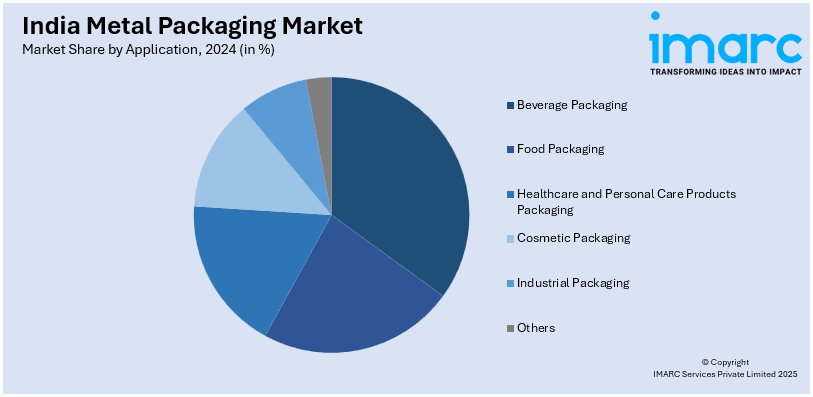

Application Insights:

- Beverage Packaging

- Food Packaging

- Healthcare and Personal Care Products Packaging

- Cosmetic Packaging

- Industrial Packaging

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes beverage packaging, food packaging, healthcare and personal care products packaging, cosmetic packaging, industrial packaging, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metal Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cans, Drums, Metal Caps and Closures, Bulk Containers, Others |

| Materials Covered | Steel, Aluminium, Others |

| Applications Covered | Beverage Packaging, Food Packaging, Healthcare and Personal Care Products Packaging, Cosmetic Packaging, Industrial Packaging, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metal packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metal packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metal packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India metal packaging market was valued at USD 5.5 Billion in 2024.

The India metal packaging market is projected to exhibit a CAGR of 2.4% during 2025-2033, reaching a value of USD 6.8 Billion by 2033.

The India metal packaging market is driven by growing demand for eco-friendly alternatives to plastic, expansion of food, beverage, and pharmaceutical sectors, rising consumer preference for safe and durable packaging, and increased focus on product shelf life. Urbanization and lifestyle changes further boost adoption across industries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)