India Metal Recycling Market Size, Share, Trends and Forecast by Metal, Sector, and Region, 2025-2033

India Metal Recycling Market Overview:

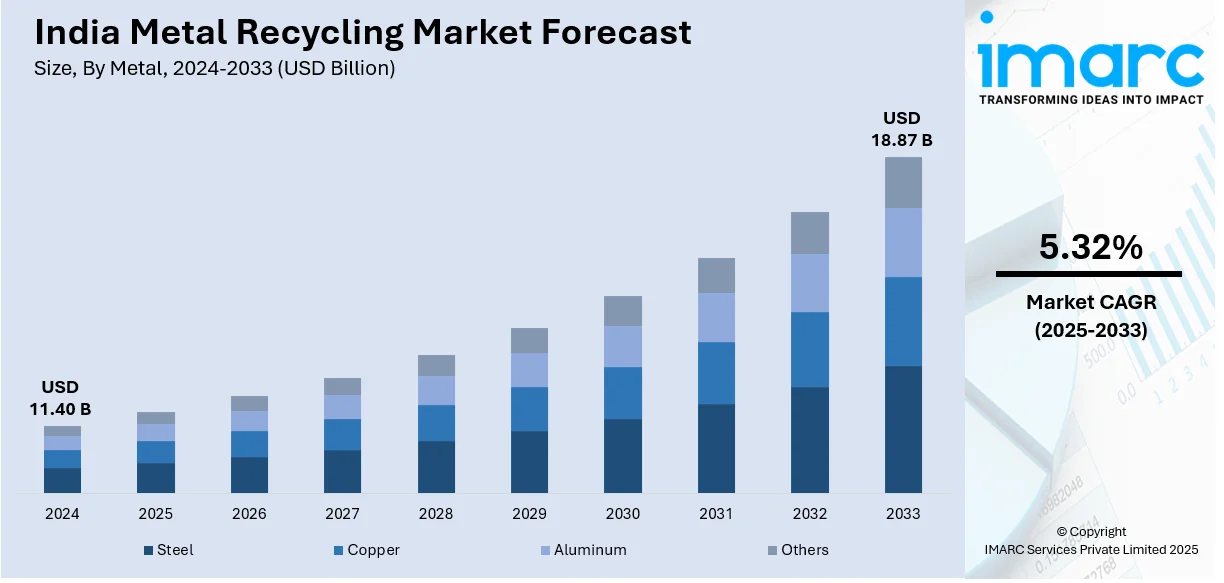

The India metal recycling market size reached USD 11.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.87 Billion by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The increasing steel production demand, government initiatives promoting sustainable waste management, the growing adoption of circular economy practices, and heightened environmental awareness are contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.40 Billion |

| Market Forecast in 2033 | USD 18.87 Billion |

| Market Growth Rate (2025-2033) | 5.32% |

India Metal Recycling Market Trends:

Rise of Electric Vehicles (EVs)

The burgeoning adoption of electric vehicles in India is a pivotal factor driving the metal recycling market. EVs require substantial quantities of metals such as steel, aluminum, and copper for components like batteries, motors, and structural elements. By 2024, India has surpassed 5.6 million electric vehicles (EVs) on its roads. This year witnessed a significant milestone, with EV sales exceeding two million units for the first time. Compared to approximately 1.6 million units sold in 2023, this marks a 24% growth. As the demand for EVs escalates, the need for these metals intensifies, underscoring the importance of recycling to sustainably meet this demand. Moreover, India's Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme is driving EV adoption, subsequently boosting demand for recyclable metals. In line with this, the automotive industry's focus on sustainability further strengthens this trend. Manufacturers are increasingly using recycled materials in car manufacturing to save resources and minimize greenhouse gas emissions. Utilizing recycled metals not only saves energy but also reduces the environmental effect of mining and processing virgin resources. This dedication to sustainability encourages innovations in recycling technology and processes, boosting the efficiency and efficacy of metal recycling operations.

To get more information on this market, Request Sample

Government Initiatives Promoting Sustainable Practices

The Government of India implemented various programs to encourage sustainable practices, which had a substantial influence on the metal recycling business. In February 2025, the finance minister announced the abolition of customs charges on twelve essential minerals, including antimony, cobalt, tungsten, and copper. This strategy intends to ensure the availability of key minerals for domestic industries while reducing dependency on imported raw resources. This initiative is part of a larger effort to boost the key minerals industry, with the government sanctioning a 163 billion rupee investment to strengthen indigenous capabilities. Such investments are expected to bolster the metal recycling infrastructure, making recycling processes more efficient and cost-effective. Additionally, the government plans to introduce a policy for recovering critical minerals from tailings or mining by-products. This initiative aims to maximize resource utilization and minimize environmental degradation associated with mining activities. By encouraging the recovery of precious minerals from trash, the strategy promotes circular economic ideas and sustainable industrial practices. These government activities are intended to boost the metal recycling industry by providing a consistent supply of raw materials for local sectors, lowering environmental impact, and encouraging sustainable resource management. As a result, the metal recycling business in India is expected to expand significantly in the future years.

India Metal Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on metal and sector.

Metal Insights:

- Steel

- Copper

- Aluminum

- Others

The report has provided a detailed breakup and analysis of the market based on the metal. This includes steel, copper, aluminum, and others.

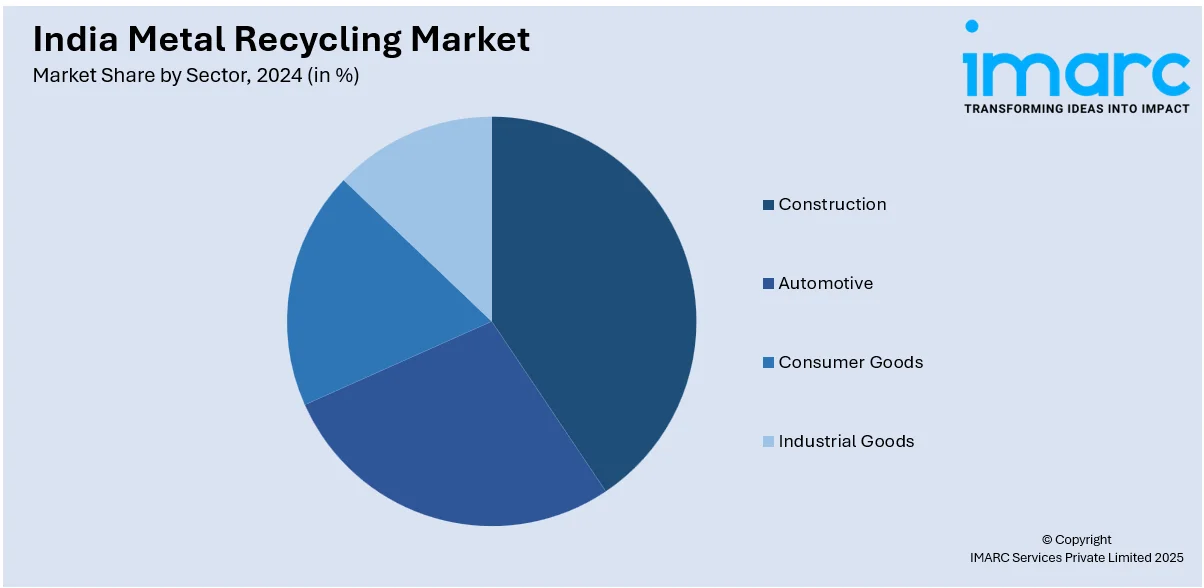

Sector Insights:

- Construction

- Automotive

- Consumer Goods

- Industrial Goods

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes construction, automotive, consumer goods, and industrial goods.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Metal Recycling Market News:

- November 2024: Nupur Recyclers Limited, a key player in non-ferrous metal recycling, unveiled plans to expand its operations by 2027 to include metal scrap processing and lithium-ion battery recycling. The company aims to set up a cutting-edge facility dedicated to these initiatives, enhancing production capacity and improving revenue growth.

- June 2024: Mitsui & Co., Ltd. invested in MTC Business Private Ltd., a prominent metal recycling company in India. MTC aims to expand its operations by entering the end-of-life vehicle recycling sector and evolving into a comprehensive recycling company capable of handling various waste materials, including used batteries.

India Metal Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Metals Covered | Steel, Copper, Aluminum, Others |

| Sectors Covered | Construction, Automotive, Consumer Goods, Industrial Goods |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India metal recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India metal recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India metal recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The metal recycling market in India was valued at USD 11.40 Billion in 2024.

Recycling metals like aluminum, steel, and copper is significantly reducing energy use and emissions compared to primary production. Increasing investments in the manufacturing sector are further catalyzing the demand for cost-effective and sustainable raw materials. Apart from this, environmental concerns and the need to minimize landfill waste are driving the shift towards recycling.

The India metal recycling market is projected to exhibit a CAGR of 5.32% during 2025-2033, reaching a value of USD 18.87 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)